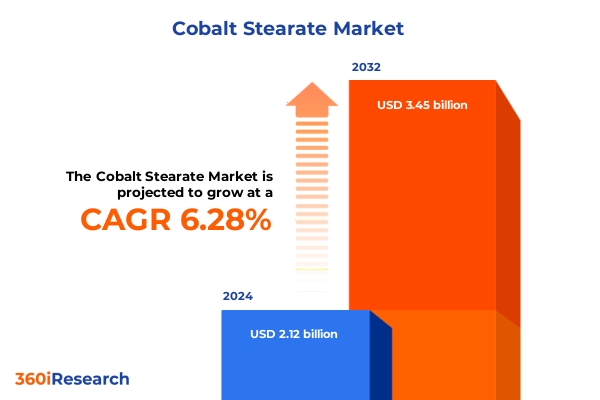

The Cobalt Stearate Market size was estimated at USD 2.25 billion in 2025 and expected to reach USD 2.39 billion in 2026, at a CAGR of 6.29% to reach USD 3.45 billion by 2032.

Uncovering the Strategic Significance and Multifaceted Applications of Cobalt Stearate in Modern Industrial and Consumer Sectors

Cobalt stearate, a metallic soap derived from the interaction of cobalt metal and stearic acid, exhibits exceptional catalytic and drying properties that make it a cornerstone additive across diverse industrial and consumer applications. As a finely tuned metal-organic compound, cobalt stearate accelerates curing processes in coatings and paints, enhances bonding in rubber formulations, and provides stable dispersion of pigments, underscoring its indispensability in high-performance materials.

In parallel with the organometallic specificity of cobalt stearate, the broader cobalt market is experiencing a critical inflection point. After a surplus in 2024, the market is projected to transition into a deficit by the early 2030s, driven primarily by surging demand in the electric vehicle sector, which is expected to account for 57% of cobalt usage by 2030 up from 43% in 2024. This structural shift in supply and demand dynamics amplifies the strategic importance of downstream additives such as cobalt stearate, as end users seek secure, high-quality sources to mitigate potential shortages.

Against this backdrop of tightening raw material availability, manufacturers and distributors of cobalt stearate are focused on leveraging the compound’s unique ability to impart rapid drying times, durable film formation, and enhanced mechanical properties. The additive’s versatility enables its application in flexible and rigid plastics, decorative and industrial coatings, and even emerging cosmetic formulations, positioning cobalt stearate as a critical enabler of innovation within performance-centric markets.

Exploring the Pivotal Technological and Sustainability-Driven Transformations Reshaping the Cobalt Stearate Market Landscape

Emerging sustainability imperatives and tightening environmental regulations are compelling formulators and end users to re-evaluate traditional additive chemistries. In the realm of paints and coatings, regulatory bodies are imposing stricter controls on heavy metal content, driving demand for eco-optimized driers and catalysts. This shift emphasizes the need for cobalt stearate manufacturers to invest in greener production methods and reformulated grades that uphold performance standards while aligning with evolving compliance frameworks.

Advancements in digital formulation tools and high-throughput screening techniques are accelerating the development of bespoke cobalt stearate variants tailored for specific end uses. By harnessing data-driven insights, R&D teams can optimize particle size distribution and surface modification, enabling finer control over curing kinetics and pigment dispersion. As a result, next-generation coatings benefit from reduced VOC emissions, faster cure schedules, and enhanced durability, underscoring the transformative power of technology-enabled innovation.

Concurrently, global supply chain realignments are reshaping the sourcing strategies for cobalt stearate. Companies are pursuing nearshoring initiatives to insulate operations from geopolitical volatility and tariff fluctuations. This trend toward localized production and strengthened partnerships with regional distributors is creating more resilient networks, capable of responding swiftly to demand spikes and raw material constraints. Such strategic realignment not only lowers logistical risks but also supports just-in-time manufacturing models critical to maintaining competitive lead times.

Assessing the Comprehensive Impact of 2025 United States Tariff Policies on the Cobalt Stearate Supply Chain and Cost Structures

In 2025, U.S. tariff policies have introduced a 25% levy on specialty chemicals and intermediates, directly affecting the import costs of additives such as cobalt stearate. These measures have led to marked increases in raw material prices, compelling formulators to reassess supplier contracts and pricing structures to safeguard margin integrity.

Trade associations such as the Society of Chemical Manufacturers & Affiliates have signaled deep concern over the resulting supply chain stress, warning that elevated import duties on critical inputs are creating uncertainty and heightening operational costs for specialty chemical makers. Many end users, reliant on carefully calibrated additive blends, now face the dual challenge of navigating tariff-induced price hikes while maintaining consistent product performance.

To avoid punitive tariffs on Chinese-origin imports, several U.S. buyers have pivoted toward cobalt sources processed in tariff-exempt jurisdictions such as Indonesia. For example, purchases of Lygend Resources’ cobalt have doubled as companies leverage Indonesia’s tariff-free status to mitigate cost increases, underscoring the critical role of strategic sourcing in preserving supply continuity amid an increasingly protectionist trade environment.

Deriving Strategic Segmentation Insights from Application, Form, End User Industry, Grade, and Sales Channel Dynamics for Cobalt Stearate

The cobalt stearate market reveals nuanced demand patterns when analyzed by application. Within the cosmetics arena, performance requirements differ sharply between color cosmetics, skin care, and hair care formulations, driving suppliers to tailor particle morphology and metal content accordingly. Decorative and industrial coatings segments similarly diverge, as decorative applications prioritize aesthetic clarity and quick tack-free times, whereas industrial coatings demand robust resistance to corrosion, abrasion, and environmental stressors. In plastics, the distinction between flexible and rigid grades calls for varied compatibility profiles to achieve targeted mechanical and thermal properties. Meanwhile, rubber applications split focus between natural and synthetic substrates, each requiring specific bonding agents to ensure optimal adhesion to metal reinforcements.

Form-based segmentation also plays a pivotal role in market dynamics. Granule grades are predominantly sought for ease of handling, automated feeding, and controlled melt dispersion in extrusion processes, whereas powder forms enable fine-tuning of cure rates and surface finish in coatings and inks. Each form factor brings distinct advantages and processing considerations, shaping purchasing decisions across manufacturing environments.

End user industries, from automotive to construction and electrical & electronics, further dictate cobalt stearate specifications. Automotive OEM and aftermarket paint lines demand rapid-dry catalysts to support high-throughput finishing, while construction coatings emphasize long-term weather resistance. In electronics, precise dielectric and insulating properties are critical, prompting suppliers to deliver ultra-pure and consistent grades. Finally, the choice between direct procurement and distributor partnerships influences supply security, lead times, and technical support availability, reflecting the diverse strategic approaches companies adopt to navigate this specialized market.

This comprehensive research report categorizes the Cobalt Stearate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Grade

- Application

- End User Industry

- Sales Channel

Unveiling Region-Specific Dynamics and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia-Pacific for Cobalt Stearate

Across the Americas, proximity to major end markets and ongoing nearshoring initiatives have strengthened the region’s position as a key hub for cobalt stearate production and distribution. Manufacturers benefit from streamlined logistics, preferential trade terms under USMCA, and targeted incentives such as the U.S. Inflation Reduction Act, which encourage domestic sourcing of critical mineral-based additives. These factors collectively support a resilient supply chain capable of meeting demand surges in automotive coatings and advanced polymer formulations.

In Europe, the Middle East, and Africa, stringent environmental regulations and sustainability mandates are shaping additive selection in paints, plastics, and rubber applications. Regulatory scrutiny around heavy metals has catalyzed the adoption of low-cobalt and alternative curing technologies, driving suppliers to innovate cobalt stearate formulations with reduced metal content or hybrid systems that blend metal soaps with organic catalysts. At the same time, robust trade relationships within the EU and GCC provide pathways for regional distribution, balancing compliance with market access considerations.

The Asia-Pacific region remains the fastest-growing market for cobalt stearate, propelled by rapid industrialization, expanding automotive production, and growth in consumer goods manufacturing across China, India, and Southeast Asia. Investments in local refining capacity, coupled with government-backed mining projects outside the DRC, are enhancing raw material availability. Furthermore, the region’s emphasis on high-performance coatings for infrastructure and electronics continues to drive sophisticated additive demand, reinforcing Asia-Pacific’s role as a dynamic growth engine for the global cobalt stearate market.

This comprehensive research report examines key regions that drive the evolution of the Cobalt Stearate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Positioning and Innovation Initiatives of Leading Cobalt Stearate Manufacturers and Distributors Globally

Leading specialty chemical distributors such as Parchem leverage extensive technical expertise and scale to supply high-purity cobalt stearate in bulk railcars and packaged formats, ensuring consistent quality for large-scale industrial applications. Their integrated supply model combines global sourcing with local inventory management to minimize lead times and streamline procurement.

CAP Chemicals has differentiated its offering by providing friable pastilles with tightly controlled metal content, catering to precision coating manufacturers seeking reproducible cure profiles. Their proprietary pelletization technology enhances powder flow and dosing accuracy, addressing key processing challenges in automated paint lines.

Evitachem’s online platform and flexible packaging options empower smaller formulators to access laboratory-grade cobalt stearate with rapid turnaround. By optimizing digital procurement channels and modular packaging, they bridge the gap between R&D quantities and production-scale requirements, supporting agile innovation cycles.

Elementis, a global specialty additives leader, integrates cobalt stearate within broader performance solutions for personal care and cosmetics, leveraging its regulatory and compliance expertise to navigate emerging ingredient safety standards. Their emphasis on regulatory stewardship and product diversification exemplifies the strategic approaches that top-tier chemical companies employ to maintain competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cobalt Stearate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Baerlocher GmbH

- Comar Chemicals

- Dura Chemicals Inc.

- FACI S.p.A.

- Hangzhou Lingrui Chemical Co., Ltd.

- Jiangxi Hongyuan Chemical Co., Ltd.

- Linghu Xinwang Chemical Co., Ltd.

- Mallinckrodt Pharmaceuticals

- Nanjing Tianshi Chemical Co., Ltd.

- Norac Additives LLC

- Peter Greven GmbH & Co. KG

- PMC Organometallix Inc.

- Shanghai Jinjinle Industrial Co., Ltd.

- Sun Ace Kakoh (Pte.) Ltd.

- Valtris Specialty Chemicals

- Zhangjiagang Huayi Chemical Co., Ltd.

Formulating Actionable Strategic Recommendations for Industry Leaders to Navigate Market Complexities and Maximize Cobalt Stearate Opportunities

To capitalize on emerging regulatory and sustainability trends, industry leaders should accelerate the development of low-cobalt or hybrid curing systems that meet stringent environmental requirements without compromising performance. Strategic partnerships with academic and research institutions can expedite R&D timelines and foster breakthroughs in green additive chemistry, positioning first movers as preferred suppliers as compliance standards evolve.

Manufacturers should diversify raw material sourcing by collaborating with suppliers in tariff-exempt jurisdictions and exploring recycled cobalt streams. Leveraging Indonesia’s tariff-free status for metal imports and engaging with battery recycling initiatives can mitigate cost volatility and supply uncertainty, ensuring continuity of supply in volatile trade environments.

Proactive monitoring of trade policy developments and active engagement with industry associations can equip companies to anticipate tariff changes and advocate for targeted exemptions. By aligning procurement strategies with national security and economic policy objectives, firms can secure favorable terms and reduce the risk of disruptive cost surges, maintaining stability in additive pricing and availability.

Detailing the Rigorous Research Methodology Employed to Deliver Comprehensive Insights into the Cobalt Stearate Market

The research underpinning this analysis combined primary data collection with extensive secondary research to ensure a holistic understanding of the cobalt stearate market. Primary inputs were gathered through structured interviews with key stakeholders, including additive formulators, coatings manufacturers, and raw material suppliers, providing firsthand perspectives on market dynamics.

Secondary research involved a thorough review of industry publications, regulatory databases, company reports, and trade association releases to triangulate data points and validate trends. This approach facilitated the identification of emerging themes in sustainability, digital innovation, and trade policy impacts.

Quantitative analysis methods, including segmentation modeling and scenario planning, were applied to assess market behavior across applications, forms, end user industries, and sales channels. Data integrity was maintained through cross verification of sources and ongoing consultations with subject matter experts, ensuring the robustness and reliability of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cobalt Stearate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cobalt Stearate Market, by Form

- Cobalt Stearate Market, by Grade

- Cobalt Stearate Market, by Application

- Cobalt Stearate Market, by End User Industry

- Cobalt Stearate Market, by Sales Channel

- Cobalt Stearate Market, by Region

- Cobalt Stearate Market, by Group

- Cobalt Stearate Market, by Country

- United States Cobalt Stearate Market

- China Cobalt Stearate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Critical Findings to Provide a Forward-Looking Perspective on Cobalt Stearate Market Evolution and Strategic Imperatives

This executive summary has distilled the multifaceted drivers shaping the cobalt stearate landscape, from macroeconomic shifts in cobalt supply and demand to nuanced segmentation patterns and regional growth differentials. As tariffs and regulatory imperatives continue to influence cost structures and formulation choices, stakeholders must adopt agile strategies to maintain competitive positioning.

By integrating sustainability-driven innovation, supply chain diversification, and proactive policy engagement, companies can navigate the complexities of the cobalt stearate market and unlock new avenues for performance enhancement. The insights presented herein offer a roadmap for informed decision making and strategic investment in a market poised for continued evolution.

Looking ahead, the convergence of environmental standards, technological advancements, and geopolitical realignments will define the next chapter of cobalt stearate’s role in high-performance applications. Organizations that leverage these insights to anticipate shifts and drive innovation will secure lasting advantages in this critical additive market.

Connect with Ketan Rohom to Secure Your Comprehensive Cobalt Stearate Market Research Report and Empower Strategic Decision Making

Are you ready to gain a decisive advantage and transform your strategic planning with unparalleled insights into the cobalt stearate market landscape? Reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive market research report tailored to address your specific needs and empower informed decision making. Embark on a journey of strategic growth and competitive differentiation today.

- How big is the Cobalt Stearate Market?

- What is the Cobalt Stearate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?