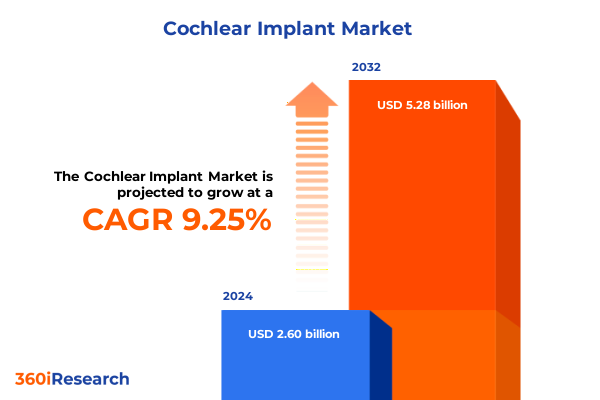

The Cochlear Implant Market size was estimated at USD 2.83 billion in 2025 and expected to reach USD 3.08 billion in 2026, at a CAGR of 9.32% to reach USD 5.28 billion by 2032.

Exploring the Evolution and Breakthroughs in Cochlear Implant Technology Driving Unprecedented Improvements in Auditory Rehabilitation and Patient Outcomes

Cochlear implants have emerged as a transformative intervention for individuals experiencing significant hearing impairment, offering the promise of restored auditory perception and enhanced communication capabilities. Over the past several decades, continuous advancements in electrode design, signal processing algorithms, and biocompatible materials have significantly improved patient outcomes, making these devices an integral component of modern hearing healthcare. As the prevalence of sensorineural hearing loss rises globally due to aging populations and environmental factors, cochlear implants stand at the forefront of technological innovation and clinical practice.

An effective strategic overview is essential for stakeholders aiming to navigate this dynamic domain. This executive summary distills the core trends, regulatory influences, market segmentation dynamics, and regional patterns that collectively shape the cochlear implant ecosystem in the United States. By synthesizing insights across component categories, patient demographics, clinical settings, distribution pathways, and key applications, this summary provides a cohesive narrative of where the market is headed and what drivers will determine success.

Moreover, by examining competitive landscapes and offering actionable recommendations tailored to stakeholder needs, this document serves as an indispensable guide for manufacturers, healthcare providers, investors, and policy-makers. Through a clear and concise presentation, readers will gain an authoritative understanding of the factors influencing adoption rates, technological diffusion, and strategic positioning within the evolving field of auditory rehabilitation.

Uncovering the Major Transformative Shifts Revolutionizing the Cochlear Implant Landscape from Digital Integration to Personalized Therapeutic Solutions

The cochlear implant sector is undergoing a paradigm shift driven by the integration of digital health ecosystems, machine learning–based signal enhancement, and remote fitting solutions. These innovations are reconfiguring how clinicians manage device programming and patient follow-up, enabling audiologists to perform real-time adjustments via cloud-enabled platforms. Consequently, patient engagement has improved, leading to higher satisfaction rates and more personalized treatment regimens.

In parallel, the development of silicon-based microelectrode arrays and injectable neuroelectrodes has reduced surgical invasiveness and expanded candidacy criteria, allowing a broader patient population to benefit from auditory prostheses. This evolution in component miniaturization has been complemented by next-generation audio processors that support advanced beamforming and adaptive noise reduction, facilitating clearer speech perception in complex listening environments.

Furthermore, strategic collaborations between device manufacturers and telehealth providers have catalyzed the emergence of hybrid care models that blend in-clinic expertise with digital monitoring. As a result, remote rehabilitation programs and virtual reality–assisted auditory training have become more prevalent, driving deeper patient engagement and improving long-term outcomes. These transformative shifts underscore the sector’s commitment to combining technological prowess with patient-centric services.

Assessing the Cumulative Impact of United States Medical Device Tariffs on Cochlear Implant Supply Chains Regulatory Costs and Market Dynamics

Since the imposition of Section 301 tariffs on medical device components, manufacturers have confronted escalating import costs for critical materials, particularly those sourced from key global suppliers. Components such as platinum-iridium contacts, microelectronic processors, and hermetic feedthrough assemblies have become more expensive to procure, prompting supply chain optimization strategies and the re-evaluation of sourcing agreements. As a result, original equipment manufacturers have prioritized regional partner networks to mitigate risks associated with tariff volatility and shipping delays.

In response to these cost pressures, several industry players have accelerated investments in local manufacturing capabilities. By establishing assembly lines within domestic facilities, manufacturers can avoid certain tariff burdens while enhancing quality control and reducing lead times. This shift has also driven regulatory engagement, as companies collaborate with the U.S. Food and Drug Administration to ensure compliance with Good Manufacturing Practices and expedite product clearances.

Additionally, service providers have explored alternative procurement pathways, such as engaging domestic subcontractors for component fabrication and leveraging bonded warehouses for tariff deferral. These tactical adjustments have preserved device affordability and safeguarded market access for patients. Overall, the cumulative effect of U.S. tariffs in 2025 has reinforced the importance of supply chain agility, proactive regulatory alignment, and diversified sourcing channels across the cochlear implant landscape.

Delving into Key Segmentation Insights to Understand Cochlear Implant Demand across Component Categories Patient Groups Clinical Settings Distribution Channels and Application Types

Detailed market segmentation reveals critical nuances that shape demand across various dimensions. Component segmentation highlights how the external audio processors and internal electrode arrays drive distinct development pathways, with research efforts focusing on wearable form factors as well as biocompatible enclosure design. Meanwhile, age-based segmentation underscores unique clinical considerations for adult versus pediatric recipients, since children often require specialized mapping protocols and rehabilitative support to optimize auditory learning trajectories.

End-user segmentation further delineates the roles of ambulatory surgical centers, hospitals, and specialty clinics in facilitating implant procedures and post-operative care. Each setting presents its own operational constraints, reimbursement frameworks, and volume thresholds, influencing how devices are marketed and supported. Distribution channel dynamics, spanning direct sales engagements with healthcare networks and emerging online sales platforms, reflect shifting procurement preferences among clinical decision-makers.

Finally, application-based segmentation underscores how cochlear implants are deployed to address moderate to severe hearing loss, severe to profound hearing loss, and single-sided deafness. This spectrum of indications not only informs device feature sets and surgical protocols but also shapes patient awareness initiatives and insurance coverage strategies. Collectively, these segmentation insights illuminate the multifaceted landscape that manufacturers and service providers must navigate to achieve targeted market penetration.

This comprehensive research report categorizes the Cochlear Implant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Patient Age Group

- End User

- Distribution Channel

- Application

Illuminating Regional Divergences and Growth Patterns in Cochlear Implant Adoption across the Americas Europe Middle East Africa and Asia-Pacific Markets

Regional analysis highlights distinct growth trajectories and strategic imperatives across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets. In the Americas, robust reimbursement frameworks and established referral networks have driven steady adoption, while emerging teleaudiology programs are expanding access in remote areas. Regulatory harmonization within North America has further streamlined product approvals and facilitated cross-border clinical trials.

Conversely, Europe, the Middle East & Africa exhibit heterogeneous regulatory landscapes, with disparate approval timelines and variable insurance coverage policies. This complexity necessitates tailored market entry strategies that account for each country’s health technology assessment processes and public funding priorities. Collaborative initiatives between manufacturers and regional health agencies have proven pivotal in aligning clinical evidence generation with reimbursement requirements.

In the Asia-Pacific region, rapid urbanization and government-led hearing health initiatives are catalyzing market growth. Innovative public–private partnerships and local manufacturing collaborations are driving down costs, thereby broadening candidacy criteria. Furthermore, digital outreach campaigns and mobile screening units have heightened awareness among underserved populations. These regional dynamics emphasize the need for adaptive go-to-market strategies that reconcile global innovation with localized execution.

This comprehensive research report examines key regions that drive the evolution of the Cochlear Implant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading and Emerging Players Shaping the Competitive Landscape of the Cochlear Implant Market through Innovation and Strategic Partnerships

Leading enterprises and pioneering start-ups alike are driving competitive intensity within the cochlear implant sector. Established players continue to leverage their extensive clinical trial data and global distribution footprints to reinforce market leadership. These organizations have prioritized R&D investments in next-generation electrode arrays and audio processing software, advancing features such as wireless streaming, artificial intelligence–powered sound enhancement, and turnkey rehabilitation platforms.

At the same time, emerging companies are challenging the status quo through modular device architectures and disruptive business models. By offering subscription-based software upgrades and remote patient monitoring services, these entrants are redefining value propositions and catalyzing customer expectations. Strategic alliances between device manufacturers and telemedicine providers have further enriched offerings, enabling seamless integration of digital health tools and audiology expertise.

Competitive benchmarking indicates that partnerships with academic research centers and cross-industry collaborations are becoming critical differentiators. Organisations that effectively synergize innovation pipelines with regulatory strategy can accelerate time to market and secure market exclusivity. This confluence of corporate agility, technological differentiation, and ecosystem integration underpins the evolving company landscape in the cochlear implant domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cochlear Implant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amplifon S.p.A.

- Cochlear Limited

- Demant A/S

- Envoy Medical Corporation

- GN Store Nord A/S

- Grace Medical

- Hemideina Pty Ltd.

- MED-EL Medical Electronics.

- Medtronic PLC

- Natus Medical Incorporated

- Neurelec SAS

- Nurotron Biotechnology Co., Ltd.

- Olympus America

- Oticon Medical A/S

- Ototronix

- Sonova Holding AG

Strategic Actionable Recommendations for Industry Leaders to Capitalize on Technological Advances and Navigate Regulatory Challenges in Cochlear Implant Sector

Industry leaders should prioritize a dual strategy that balances rapid technological adoption with proactive regulatory engagement. By closely monitoring evolving FDA guidance and harmonization efforts under international medical device directives, companies can preempt compliance risks and streamline product launches. Concurrently, investing in advanced signal processing algorithms and end-to-end digital patient management platforms will enhance therapeutic outcomes and strengthen post-market support capabilities.

Moreover, fostering collaborative research consortia with academic institutions and healthcare providers can yield valuable clinical evidence while sharing development costs. Such collaborations not only accelerate innovation but also facilitate payer acceptance through robust real-world data. In parallel, manufacturers should diversify their supplier networks and explore local manufacturing partnerships to mitigate tariff exposure and logistical bottlenecks.

Finally, building direct lines of communication with patient advocacy groups and leveraging teleaudiology channels will amplify market penetration in underserved communities. By integrating patient-reported outcome data into product refinement cycles, organizations can tailor device features to end-user needs and drive higher satisfaction rates. This customer-centric approach, coupled with agile regulatory strategies, will position industry leaders to capture emerging opportunities in the evolving cochlear implant arena.

Explaining the Rigorous Research Methodology Employed to Uncover Reliability Validity and Comprehensive Insights in Cochlear Implant Market Analysis

The research methodology underpinning this analysis combined rigorous secondary research, expert consultations, and data triangulation to ensure validity and comprehensiveness. Secondary sources included peer-reviewed medical journals, regulatory filings, and patent databases to map technological innovation pathways. This foundational research established a contextual baseline for understanding device evolution and regulatory milestones.

Complementing this, in-depth interviews were conducted with key opinion leaders, including audiologists, implant surgeons, and healthcare procurement specialists. These discussions provided real-world perspectives on clinical workflows, reimbursement strategies, and patient preferences. Further validation was achieved through a survey of device manufacturers and supply chain stakeholders, enabling quantification of strategic priorities and risk perceptions.

Finally, all inputs underwent a multi-stage quality assurance process, encompassing data consistency checks, cross-source verification, and thematic synthesis workshops. This approach assured that the resulting insights accurately reflect market realities and enable stakeholders to make informed decisions. The combined methodology thus delivers a robust framework for analyzing the cochlear implant market and anticipating future developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cochlear Implant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cochlear Implant Market, by Component Type

- Cochlear Implant Market, by Patient Age Group

- Cochlear Implant Market, by End User

- Cochlear Implant Market, by Distribution Channel

- Cochlear Implant Market, by Application

- Cochlear Implant Market, by Region

- Cochlear Implant Market, by Group

- Cochlear Implant Market, by Country

- United States Cochlear Implant Market

- China Cochlear Implant Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Perspective on How Innovations Regulatory Dynamics and Market Insights Converge to Shape the Future Trajectory of Cochlear Implant Advancements

In summary, cochlear implant technology stands at a pivotal juncture, characterized by rapid technological advancements, shifting regulatory frameworks, and evolving patient care models. Innovations in digital integration, electrode miniaturization, and cloud-based programming have elevated the standard of hearing rehabilitation and expanded candidacy criteria. Meanwhile, the cumulative impact of U.S. tariffs has underscored the need for resilient supply chains and localized manufacturing strategies.

Segmentation analyses elucidate how distinct component categories, age demographics, clinical settings, distribution channels, and application areas influence adoption patterns. Regional perspectives highlight the unique opportunities and challenges present across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets. Competitive insights reveal that success hinges on synergistic partnerships, agile innovation pipelines, and customer-centric service models.

Ultimately, industry leaders seeking sustained growth must integrate these strategic imperatives into cohesive action plans. By aligning technological investments with regulatory awareness and patient engagement frameworks, stakeholders can drive superior outcomes and secure a leadership position. As the cochlear implant domain continues to evolve, this confluence of insights provides the roadmap for shaping its future trajectory.

Engaging Invitation to Partner with Ketan Rohom for Exclusive Access to In-Depth Cochlear Implant Market Insights and Customized Research Solutions

We invite decision-makers and innovators seeking comprehensive insights and strategic guidance to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By partnering with his team, stakeholders gain privileged access to high-resolution market analysis, tailored consulting services, and bespoke data packages that address unique organizational challenges. This collaborative approach ensures that business leaders can align their product development roadmaps, marketing strategies, and investment priorities with the nuanced realities of the cochlear implant landscape.

Through a personalized consultation, Ketan Rohom facilitates an in-depth exploration of the report’s findings, guiding executives toward data-driven decisions and actionable roadmaps. By leveraging this dialogue, companies can ensure that their next venture capital allocation, partnership negotiation, or clinical outreach program is grounded in robust evidence and market intelligence. We encourage you to capitalize on this opportunity to secure a competitive advantage and foster sustainable growth within the cochlear implant sector.

- How big is the Cochlear Implant Market?

- What is the Cochlear Implant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?