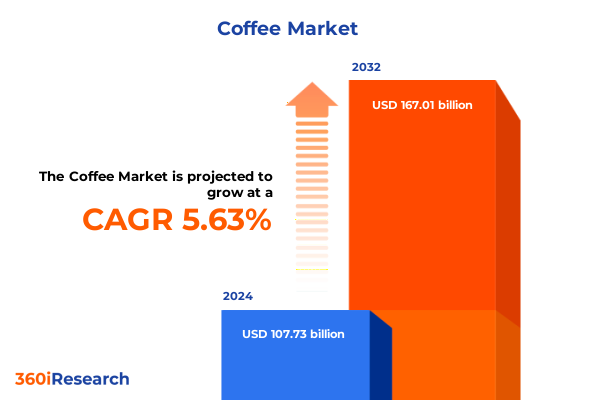

The Coffee Market size was estimated at USD 113.53 billion in 2025 and expected to reach USD 119.69 billion in 2026, at a CAGR of 5.66% to reach USD 167.01 billion by 2032.

Embarking on an In-Depth Executive Summary of the Evolving Coffee Industry Landscape Driven by Innovation, Convenience, and Sustainable Practices

Coffee remains one of the most consumed beverages worldwide, deeply embedded in daily routines. In the United States, millions start their day with a cup that transcends mere caffeine, symbolizing comfort, community, and productivity. Over recent years, consumption patterns have evolved as demographic shifts and lifestyle changes combined with a surge in specialty offerings to redefine what consumers expect from their brew.

At the same time, convenience-oriented formats such as single-serve pods and ready-to-drink beverages have captured significant mindshare among time-pressed consumers seeking premium experiences on the go. Meanwhile, the rise of digital ordering, subscription models, and AI-driven personalization tools has transformed the at-home and in-store coffee experience, offering tailored flavor profiles and seamless service interactions. Sustainability has also moved to the forefront of the industry, as climate concerns drive both producers and brands to invest in regenerative agriculture, traceability, and eco-conscious packaging solutions.

Moreover, recent adverse weather patterns and trade policy shifts have introduced new complexities into coffee supply chains, underscoring the industry’s vulnerability to external shocks. Record-high arabica prices due to drought in major producing regions and escalating geopolitical tensions have compelled brands to reconsider sourcing strategies and risk mitigation frameworks. As the industry stands at the intersection of consumer-driven innovation and geopolitical headwinds, stakeholders must adopt a holistic view that balances quality, sustainability, and resilience. The following sections offer a structured analysis to illuminate these multifaceted developments and guide strategic decision-making in the coffee sector.

Uncovering the Revolutionary Transformations in Coffee from Technological Personalization to Sustainable Agriculture and Packaging Innovations

Technological personalization has emerged as a cornerstone of industry innovation, with artificial intelligence reshaping everything from bean cultivation to beverage preparation. AI-powered espresso machines and smart brewing devices now analyze consumer preferences and optimize brew parameters in real time, allowing for hyper-personalized experiences that resonate with discerning customers. Leading operators are implementing machine learning algorithms to predict flavor trends and streamline inventory management, enhancing both consistency and profitability.

Simultaneously, sustainability has elevated from compliance issue to strategic imperative, driving transformative shifts in agricultural practices and supply chain transparency. Producers and roasters are increasingly investing in regenerative farming initiatives designed to bolster soil health, improve carbon sequestration, and enhance yield resilience in the face of climate volatility. Advanced traceability solutions, including blockchain-enabled platforms, now provide end-to-end visibility of bean provenance, fostering consumer trust and enabling premium pricing for verified sustainable lots.

In parallel, convenience-driven product innovation has redefined consumer expectations, with ready-to-drink formats and single-serve pods continuing to gain market traction. As urbanization and fast-paced lifestyles intensify, the demand for portable, high-quality brews has prompted brands to expand RTD portfolios and develop proprietary capsule systems. These formats cater to on-the-go consumption without sacrificing flavor complexity, appealing to both mass-market audiences and specialty enthusiasts.

Finally, advancements in packaging design are reinforcing environmental objectives while enhancing user experience. Industry players are piloting compostable pouches, biodegradable pods, and aluminum cans that offer superior recyclability and barrier properties. Driven by consumer advocacy and regulatory pressure, these innovations balance form and function, ensuring product integrity and minimizing ecological footprints in a resource-constrained world.

Together, these transformative shifts are converging to create a more agile, customer-centric, and sustainable coffee ecosystem, setting the stage for continued evolution in the years ahead.

Assessing the Comprehensive Effects of New United States Coffee Import Tariffs on Supply Chains, Consumer Prices, and Industry Competitiveness in 2025

In 2025, the United States implemented a new tariff framework that marks a significant departure from the traditionally duty-free status of coffee imports. Under this structure, a baseline tariff of 10% applies universally, with higher “reciprocal” rates scheduled for certain origins. While additional levies-up to 46% on products from Vietnam and 32% on Indonesian shipments-were announced, the administration paused these elevated rates after 90 days, maintaining the baseline on most origins. This dual-phase approach reflects a strategic balance between protecting domestic interests and preserving market access amid complex trade negotiations.

The initial impact has been uneven across key suppliers. As of April 2025, Brazil and Colombia, which together account for roughly 60% of U.S. arabica imports, faced a 10% tariff that directly adds to landed costs for roasters and retailers. Vietnam’s robusta exports encountered a 46% levy before the temporary pause, causing immediate disruptions to instant and ready-to-drink supply chains. Moreover, smallholder farmers in Brazil have voiced deep concerns about revenue losses, given the nation’s dependence on U.S. demand for economic stability. The resultant trade tensions have prompted several producing countries to seek tariff exemptions or negotiate bilateral concessions.

Consequently, industry stakeholders anticipate a pass-through effect on consumer prices, as increased import duties compound existing supply constraints from climate-induced yield declines. Following the tariff announcements, futures prices for both coffee and related commodities like orange juice spiked, underscoring the interconnected nature of global trade dynamics. Additionally, restrictions on foreign competition have begun to narrow consumer choice, potentially undermining product quality and inflating costs-impacts that tend to disproportionately burden lower-income households. In this evolving policy environment, companies are reevaluating sourcing strategies, hedging mechanisms, and supplier partnerships to mitigate risk and sustain profitability. Looking ahead, the tariff regime introduces long-term strategic considerations for supply chain resilience and diversification, as companies seek alternative origins and invest in nearshoring or vertical integration to shield against policy volatility.

Decoding Critical Market Segmentation Insights Across Product Types, Bean Varieties, Flavor Profiles, Packaging, Brewing Methods, Distribution, and End-Users

To fully understand the coffee market’s complexity, it is essential to analyze performance across various product formats, bean varieties, and premium segments. Consumer preferences diverge sharply between Coffee Pods, Ground Coffee, Instant formats, Ready-to-Drink options, and Whole Bean offerings, each requiring tailored roasting profiles, quality control standards, and packaging solutions. At the same time, the diverse botanical lineage of Arabica, Robusta, Liberica, and Excelsa demands distinct cultivation practices and flavor characterizations; specialty blends and single-origin labels further refine consumer perception and drive differentiation within crowded shelf spaces.

Flavor innovation adds another layer of nuance, as brands navigate between classic profiles, single-origin purity, and specialty blends infused with Caramel, Hazelnut, Mocha, or Vanilla undertones to satisfy evolving tastes. Packaging strategies, from foil and paper bag variants to pods, cans, and bottles, must balance barrier properties, sustainability goals, and user convenience. Similarly, brewing modalities-from Cold Brew and Drip Brewers to Espresso, French Press, and Pour Over systems-shape the at-home experience and influence accessory markets. Distribution networks span traditional retail halls to digital storefronts and subscription platforms, while end-use contexts range from commercial settings such as Coffee Shops, Hotels, and Restaurants to household kitchens and industrial-scale applications. This multi-dimensional segmentation framework provides a robust lens through which to identify growth pockets, optimize product assortments, and craft targeted marketing campaigns that resonate with specific consumer cohorts.

This comprehensive research report categorizes the Coffee market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Coffee Types

- Flavor Profile

- Packaging Type

- Brewing Method

- Distribution Channel

- End-User

Revealing Key Regional Dynamics Shaping Coffee Consumption and Market Growth Trends Across the Americas, EMEA, and Asia-Pacific

In the Americas, the United States remains the world’s largest per-capita coffee consumer, where price volatility from supply disruptions and trade policies has drawn significant attention. Recent wholesale arabica prices have doubled year-over-year, prompting roasters and retailers to adjust pricing structures and explore alternative sourcing pathways. Canada’s market emphasizes premium single-serve formats and a burgeoning specialty café scene, while Latin American nations like Colombia and Brazil balance robust export volumes with nascent domestic consumption growth driven by urban café culture.

Across Europe, the Middle East, and Africa, distinctive consumer preferences and distribution networks dictate market dynamics. Western Europe prioritizes ethically sourced specialty roasts and transparent supply chains, with consumers demanding certifications and origin stories. Meanwhile, the Middle East’s upscale hospitality sector and rapid café proliferation reflect rising disposable incomes and a competitive café landscape, evident in luxury coffee destinations from Dubai to Riyadh. Africa offers a dual narrative of being both an emerging consumer market and a key production hub, where sustainability initiatives and cooperative farming models are gaining traction to enhance community livelihoods and export quality.

In Asia-Pacific, the coffee footprint is expanding rapidly as traditional tea markets embrace espresso bars and cold brew innovations. Urbanization, economic growth, and social media-fueled café experiences are fueling demand in China, India, and Southeast Asia. Notably, Nepal’s shift from tea to coffee culture in metropolitan centers illustrates the region’s appetite for premium and aspirational beverage choices. Moreover, Innova data highlights that one in four Asia-Pacific consumers have increased hot coffee consumption due to greater product variety and novel flavor offerings, reinforcing the region’s strategic importance to global coffee brands.

This comprehensive research report examines key regions that drive the evolution of the Coffee market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategies and Performance of Leading Coffee Industry Players Navigating Market Challenges and Driving Innovation Globally

Keurig Dr Pepper (KDP) has showcased resilience amid a challenging coffee commodity environment, with its U.S. Refreshment Beverages segment delivering a 10.5% sales increase to $2.7 billion in Q2 2025, driven in part by strategic acquisitions in adjacent categories. Despite a slight 0.2% decline in U.S. coffee revenues to $900 million, Tim Cofer, CEO, cited robust volume growth moderated by price realization pressures as the company navigates elevated green bean costs and tariff uncertainties. KDP reaffirmed its guidance for high-single-digit adjusted EPS growth, underscoring disciplined operations and hedging strategies.

Starbucks has embarked on its “Back to Starbucks” turnaround, reporting consolidated Q2 net revenues of $8.8 billion, a 2% year-over-year increase. The company posted flat global comparable transactions, offset by higher average ticket prices and net store openings, ending Q2 with over 40,700 locations worldwide. Operating margin contraction reflects additional labor investments and restructuring costs tied to strategic realignment. CEO Brian Niccol emphasized the importance of nimble execution and innovation to restore growth momentum amid a tough consumer backdrop.

Nestlé continues to adapt to elevated commodity costs across coffee and cocoa, with CFO Anna Manz noting that pricing, efficiency gains, and strategic revenue management actions will offset most cost increases in 2025. The company is leveraging product innovations such as Nescafé Ice Roast and cold-concentrate offerings to fortify its leadership in the beverage category, while its decentralized manufacturing footprint provides some insulation from trade policy volatility. Nestlé’s emphasis on quality, efficiency, and portfolio diversification positions it to weather ongoing margin headwinds.

Together, these leading players demonstrate varied strategies to sustain growth, manage cost pressures, and capitalize on emerging consumer trends in a dynamic global coffee landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Coffee market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Four Sigma Foods, Inc.

- Gloria Jeans by Diedrich Manufacturing Inc.

- Keurig Dr Pepper Inc.

- Luckin Coffee, Inc.

- Luigi Lavazza S.p.A.

- Massimo Zanetti Beverage Group

- Melitta USA Inc.

- Mondelēz Global LLC

- Nestlé S.A.

- Peet’s Coffee Inc. by Koninklijke Douwe Egberts B.V.

- Reily Foods Company

- Starbucks Corporation

- Strauss Group Ltd.

- Stumptown Coffee Roasters

- Tata Global Beverages Ltd

- Tchibo GmbH

- The Coca-Cola Company

- The J.M Smucker Company

- The Kraft Heinz Company

- Tim Hortons Inc.

Actionable Strategic Recommendations Empowering Industry Leaders to Capitalize on Emerging Coffee Trends, Mitigate Risks, and Drive Sustainable Growth

Industry leaders should prioritize investment in advanced analytics and AI-enabled platforms to drive hyper-personalized customer experiences and optimize supply chain efficiency. By harnessing predictive modeling for demand forecasting and flavor trend identification, companies can improve inventory management, reduce waste, and accelerate product development cycles.

Given the heightened uncertainty in global trade policy, diversifying sourcing portfolios across alternative coffee-producing regions is critical. Establishing relationships with emerging origin suppliers and supporting regenerative agriculture initiatives can not only mitigate tariff exposure but also reinforce sustainable brand narratives that resonate with environmentally conscious consumers.

To capitalize on convenience-driven growth, brands should expand ready-to-drink and single-serve offerings with a focus on eco-friendly packaging innovation. Integrating compostable materials and lightweight aluminum solutions will address regulatory pressures and consumer preference shifts, while broadening distribution through digital retail channels and subscription models can deepen customer engagement.

Furthermore, fostering transparent traceability through blockchain or QR-enabled supply chain tracking offers a competitive advantage by validating ethical sourcing claims and enabling premium positioning. Partnering with third-party certification bodies and local cooperatives will strengthen stakeholder trust and support long-term agricultural resilience.

Finally, companies must balance strategic price adjustments with customer value preservation. Implementing tiered pricing strategies-paired with loyalty incentives and experiential marketing-can help maintain margin integrity without alienating price-sensitive segments. By executing these recommendations, industry leaders will be better equipped to navigate market volatility, reinforce brand equity, and drive sustained growth in the evolving coffee landscape.

Outlining the Rigorous Research Methodology Underpinning This Executive Summary Through Comprehensive Data Collection and Analytical Validation

To develop the insights presented in this executive summary, a rigorous multi-stage research methodology was employed. Initially, an extensive secondary research phase collated published materials from industry reports, trade publications, government databases, and reputable news outlets to establish a comprehensive view of market dynamics and emerging trends. This desk review emphasized the latest developments in sustainability, technology, and trade policy to capture the evolving landscape.

Subsequently, primary research was conducted through in-depth interviews with a cross-section of coffee industry stakeholders, including specialty roasters, equipment manufacturers, supply chain experts, and retail executives. These discussions provided contextual understanding of operational challenges, strategic priorities, and innovation roadmaps. Supplementary surveys targeting B2B buyers and end consumers gathered quantitative data on purchase drivers, format preferences, and willingness to pay for sustainability credentials.

To ensure analytical rigor, data triangulation techniques were applied, cross-verifying findings across multiple sources and stakeholder perspectives. Qualitative thematic analysis identified key patterns in consumer behavior and corporate strategy, while quantitative modeling quantified relative impact factors such as tariff-induced cost pressures and format adoption rates. Finally, all findings were validated through a stakeholder review panel comprising industry veterans and academic experts, enhancing the credibility and relevance of the insights. This methodological framework underpins the strategic recommendations and conclusions, offering decision-makers a robust foundation for informed planning and action.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Coffee market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Coffee Market, by Product Type

- Coffee Market, by Coffee Types

- Coffee Market, by Flavor Profile

- Coffee Market, by Packaging Type

- Coffee Market, by Brewing Method

- Coffee Market, by Distribution Channel

- Coffee Market, by End-User

- Coffee Market, by Region

- Coffee Market, by Group

- Coffee Market, by Country

- United States Coffee Market

- China Coffee Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Concluding Insights That Synthesize Coffee Market Developments, Strategic Imperatives, and Pathways for Future Industry Advancement

Coffee’s enduring appeal and cultural significance continue to fuel dynamic shifts across the global marketplace. As consumers demand greater personalization, convenience, and sustainability, technological innovation has accelerated the development of AI-driven brewing systems, digital engagement tools, and traceable supply chains. Meanwhile, geopolitical and regulatory pressures, exemplified by new U.S. trade tariffs, have introduced fresh challenges that require agile sourcing strategies and proactive cost management.

The segmentation lens reveals nuanced consumer segments-from single-origin aficionados to on-the-go RTD adopters-underscoring the importance of product diversity and targeted marketing. Regionally, the Americas, EMEA, and Asia-Pacific each present distinct growth narratives, shaped by demographic trends, cultural adoption patterns, and infrastructural developments. Leading industry participants such as Keurig Dr Pepper, Starbucks, and Nestlé illustrate varied approaches to balancing margin pressures with innovation investments.

By integrating advanced analytics, sustainable practices, and consumer-centric formats, industry leaders can harness emerging opportunities while mitigating risks. The wealth of insights and strategic recommendations distilled in this summary are designed to support executives in navigating a rapidly evolving coffee environment. As the industry continues to adapt to consumer demands and external disruptions, a holistic and forward-looking approach will be essential to sustaining competitiveness, driving profitability, and shaping the future of one of the world’s most beloved beverages.

Connect with Ketan Rohom to Unlock Tailored Insights and Acquire the Full Coffee Market Research Report for Informed Decision-Making

To explore how these comprehensive insights can inform your strategic planning and drive competitive advantage, contact Ketan Rohom, Associate Director of Sales & Marketing, to acquire the full coffee market research report. With in-depth analysis of the latest industry trends, tariff impacts, segmentation intelligence, and regional forecasts, this report offers actionable guidance tailored to your organization’s unique needs. Engage directly with Ketan to discuss customized research deliverables, pricing options, and partnership opportunities. Don’t miss the opportunity to leverage premier data and expert analysis that will empower your leadership team to make confident, informed decisions in today’s dynamic coffee landscape.

- How big is the Coffee Market?

- What is the Coffee Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?