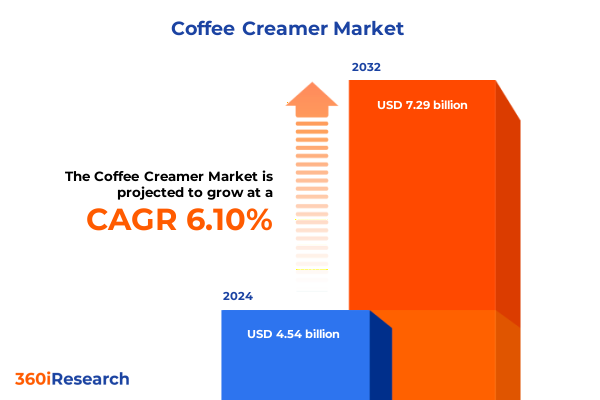

The Coffee Creamer Market size was estimated at USD 4.81 billion in 2025 and expected to reach USD 5.07 billion in 2026, at a CAGR of 6.10% to reach USD 7.29 billion by 2032.

Unveiling the Coffee Creamer Market Journey from Traditional Dairy Blends to Plant-Based Innovations and Personalized Indulgences Across Consumer Segments

The coffee creamer category has undergone a remarkable transformation over the past decade, evolving from a niche supplement to a mainstream beverage enhancer that meets diverse consumer needs. Once dominated by simple powdered dairy formulations, the market has expanded to include liquid, concentrate, and innovative non-dairy alternatives that cater to dietary restrictions and lifestyle trends. This evolution reflects a broader shift in the coffee industry, where consumers increasingly seek products that align with health, wellness, and ethical values rather than settling for one-size-fits-all solutions.

Traditional dairy creamers historically enjoyed strong brand loyalty due to familiarity and taste. However, they now face intensified competition from plant-based variants made from almond, oat, coconut, and soy bases, which collectively represent a high-growth segment driven by rising lactose intolerance and vegan diets. Meanwhile, liquid creamers have gained traction for their convenience and premium sensory profiles, particularly in urban markets where barista-style beverages are in demand. These shifts underscore a pivotal trend: coffee creamer consumers are no longer passive recipients of mass-market offerings but active curators of their daily rituals.

Against this backdrop, flavor innovation has become a key differentiator. Original and simple vanilla varieties remain foundational, yet caramel, hazelnut, and seasonal limited-edition profiles are carving out meaningful share by appealing to experiential and indulgence-oriented segments. As a result, brands are investing heavily in clean-label flavor systems and functional ingredients to satisfy both taste and health criteria. This introductory overview sets the stage for a deeper examination of the disruptive forces, trade policy impacts, segmentation insights, and regional dynamics that define the current coffee creamer landscape.

How Health, Sustainability, and Digital Commerce Are Converging to Reshape the Coffee Creamer Landscape into a Frontier of Continuous Innovation and Consumer Choice

Over the last few years, the coffee creamer sector has been propelled by several synergistic shifts that are redefining category boundaries and consumer expectations. Foremost among these trends is the surging demand for plant-based alternatives, which is fueled not only by lactose intolerance but also by environmental and ethical considerations. Non-dairy creamers crafted from almond, oat, coconut, and soy have advanced beyond novelty status to become staple offerings on supermarket shelves and coffee shop menus. Innovation in this domain is particularly dynamic, with emerging entrants such as pistachio and hemp-seed formulations aiming to capture niche health-focused audiences.

Concurrently, the emphasis on health and wellness has driven a reappraisal of ingredient transparency. Clean-label credentials, reduced sugar content, and functional additions like MCT oil or adaptogens are now table stakes for new product development. In response, leading brands have launched fortified creamers that integrate prebiotics, proteins, and even plant-based collagen alternatives, thereby aligning indulgence with perceived nutritional benefits.

Another pivotal driver is the rapid evolution of digital commerce and foodservice partnerships. Recent policy changes, such as the elimination of surcharges for plant-based milks at major coffee chains, have lowered cost barriers and encouraged trial among mainstream consumers. Simultaneously, direct-to-consumer platforms and subscription models are offering curated creamer assortments, thereby creating touchpoints for personalized marketing and data-driven innovation.

Taken together, these transformative shifts illustrate a market in flux-one in which strategic agility, cross-channel integration, and a relentless focus on evolving consumer values are prerequisites for sustained growth and category leadership.

Assessing the Layered Impact of 2025 US Reciprocal Tariffs on Dairy and Plant-Based Ingredients within the Coffee Creamer Supply Chain and Cost Structures

In 2025, a suite of new reciprocal tariffs introduced by the United States government has reverberated across the coffee creamer supply chain, amplifying the cost pressures on both dairy and non-dairy segments. Executive Order 14257 imposed a baseline 10% ad valorem tariff on virtually all imported goods-including key creamer ingredients-effective April 5 under HTSUS heading 9903.01.25. While the administration initially planned country-specific rates ranging up to 50%, these higher levies were suspended for 56 trading partners, leaving only China’s escalated duty in force during the three-month review period.

Non-dairy variant producers relying on coconut imports have felt the most immediate impact. With tariffs ranging from 17% on Philippine coconuts to 46% on Vietnamese supplies, sourcing costs for coconut-based creamy bases surged between 17% and 46%, effectively narrowing the price gap with domestic dairy milk fats. Almond-derived creamers have also been affected indirectly by retaliatory tariffs on U.S. almond exports, which China previously taxed at 50%, prompting a redirection of supply chains and price volatility in global nut markets.

Meanwhile, the long-standing Section 301 duties on Chinese imports of specialized flavorings, stabilizers, and high-efficiency processing equipment have been elevated further during a four-year review, with additional duties of up to 100% phased in through early 2026. Collectively, these layered levies have intensified margin constraints, compelled formulators to seek alternative domestic inputs, and accelerated investment in local production capacities. As market players adapt, the evolving tariff landscape underscores the strategic imperative to diversify supply networks and enhance cost resilience in the face of shifting trade policy.

Decoding Coffee Creamer Market Segmentation to Illuminate Consumer Preferences across Formulations, Usage Occasions, Flavor Profiles, and Packaging Formats

Deep segmentation analysis of the coffee creamer market reveals distinctive drivers and growth vectors that shape product development and go-to-market strategies. In the formulation dimension, dairy-based creamers retain heritage appeal and are renowned for their rich mouthfeel; however, non-dairy counterparts-spanning almond, coconut, oat, and soy variants-are charting a faster growth trajectory as plant-based preferences solidify among health- and sustainability-minded consumers. These dynamics compel legacy manufacturers to innovate within both streams to maintain relevance.

Examining usage occasions uncovers divergent needs between commercial and household channels. Institutional customers, including cafeterias, hotels, and restaurants, demand bulk formats such as concentrates that optimize storage and handling, while home users gravitate toward single-serve stick packs and retail jars for convenience and portion control. This dichotomy invites tailored value propositions focused on cost efficiency for operators and experiential novelty for at-home coffee enthusiasts.

Flavor insights underscore the enduring strength of original profiles, yet flavored segments-with prominent notes of vanilla, caramel, and hazelnut-continue to attract premium margins by tapping into indulgence occasions. Seasonal or limited-edition releases further stimulate trial and reinforce brand engagement.

From a format perspective, powdered creamers remain ubiquitous due to their extended shelf life and cost-effectiveness, yet liquids and concentrates are gaining share in premium and specialty retail environments. Distribution channels likewise vary, with supermarkets and hypermarkets serving as the primary discovery grounds, while online platforms and convenience stores complement omnichannel penetration. Packaging formats-from bottles and jars to pouches and stick packs-facilitate differentiation and address specific consumption contexts, underscoring the critical role of packaging innovation in driving purchase decisions.

This comprehensive research report categorizes the Coffee Creamer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Formulation

- Flavor

- Product Type

- Packaging Type

- End User

- Distribution Channel

Comparative Regional Dynamics in Coffee Creamers Highlighting Growth Trajectories and Consumer Adoption Trends across the Americas, EMEA, and Asia-Pacific Markets

Regional market dynamics in the coffee creamer category reveal distinct adoption patterns and growth pockets that demand localized strategies. Within the Americas, North America leads with a dominant share fueled by mature distribution networks, robust consumer spending, and deep penetration of premium and plant-based offerings. Latin America also exhibits potential as modern retail and specialty coffee culture gain momentum, creating an expanding base for both dairy and non-dairy creamer variants.

In the Europe, Middle East & Africa region, evolving consumer preferences for ethical sourcing and clean-label transparency are accelerating the uptake of non-dairy alternatives. Europe’s sizeable plant-based movement, combined with established café traditions, drives strong demand for innovative creamer formats. Meanwhile, in Middle Eastern markets, premium flavored variants resonate with consumers seeking indulgent coffee shop experiences at home, despite ongoing supply chain complexities.

The Asia-Pacific region represents the fastest-growing frontier, propelled by rising urbanization, expanding disposable incomes, and the proliferation of international coffee chains that introduce local consumers to a variety of creamer options. Markets such as China, India, and Australia are exhibiting dual demand for dairy-based indulgence and plant-based novelty. Additionally, local players are experimenting with regionally inspired flavors and packaging sizes to cater to diverse consumption rituals.

These regional insights highlight that while global brands must maintain consistent quality standards, nimble localization of product portfolios, marketing messages, and channel strategies is critical to capitalizing on varied consumer landscapes.

This comprehensive research report examines key regions that drive the evolution of the Coffee Creamer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Coffee Creamer Innovators and Strategic Collaborators Driving Competitive Differentiation through Formulation, Flavor, and Distribution Excellence

The competitive landscape in the coffee creamer market is shaped by established global brands, agile plant-based innovators, and emerging niche players. Nestlé’s Coffee-Mate commands leadership in the powdered segment, leveraging extensive R&D to refine flavor profiles and shelf stability. Similarly, Danone’s Alpro brand has significantly expanded its almond and oat creamer lines, capitalizing on its broader plant-based portfolio to streamline supply chains and cross-promote with its dairy alternatives.

Within the non-dairy category, Califia Farms and Silk (owned by Danone) are recognized for their barista-blend liquid creamers, which deliver frothability and mouthfeel suited to café-style beverages. Nutpods and Milkadamia have distinguished themselves through targeted marketing to vegan and health-conscious audiences, emphasizing allergen-free formulations and premium ingredients. Meanwhile, Oatly’s foray into coffee creamer has benefited from its broader oat milk brand momentum, reinforcing consumer perception of oat as a superior plant base.

In the foodservice arena, partnerships between creamer suppliers and national coffee chains have become pivotal. Recent policy shifts, such as the removal of plant-based surcharges by a leading quick-service operator, have created collaborative opportunities for bulk supply agreements and co-branded product launches. Moreover, regional dairy cooperatives and contract manufacturers are investing in capacity expansions to meet growing demand for both legacy dairy whey creamers and emerging plant-based blends.

As the market evolves, strategic alliances, patent-backed flavor technologies, and omnichannel distribution capabilities will distinguish those companies that can scale innovation while optimizing cost structures and sustainability credentials.

This comprehensive research report delivers an in-depth overview of the principal market players in the Coffee Creamer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Califia Farms LLC

- Chobani LLC

- Custom Food Group

- Danone S.A.

- DMK Group

- DreamPak LLC

- Heartland Food Products Group

- HP Hood LLC

- Kerry Group plc

- Laird Superfood Inc.

- Land O' Lakes Inc.

- Leaner Creamer LLC

- Nestlé S.A.

- Northwest Dairy Association- Darigold

- Oatly AB

- PearlRock Partners

- PT Santos Premium Krimer

- Rich Products Corporation

- Ripple Foods PBC

- Royal FrieslandCampina N.V.

- Shamrock Foods Company

- Super Group Ltd.

- TreeHouse Foods Inc.

- Walmart Inc.

Strategic Imperatives for Coffee Creamer Stakeholders to Harness Emerging Niche Opportunities and Strengthen Their Market Positioning Through Innovation and Partnerships

To thrive in the rapidly evolving coffee creamer market, industry leaders must adopt a multifaceted strategy that balances innovation, operational efficiency, and consumer engagement. First, product developers should prioritize plant-based R&D to create differentiated formulations that cater to health, taste, and sustainability criteria. Harnessing clean-label ingredients, functional additives, and novel bases such as pistachio or hemp will expand addressable audiences and reinforce premium positioning.

Second, supply chain resilience must be enhanced through diversification of sourcing and localization of production. The 2025 reciprocal tariffs underscore the vulnerability of relying on a narrow set of international suppliers. By forging partnerships with domestic dairy cooperatives and regional nut processors, manufacturers can mitigate input cost volatility and reduce exposure to trade policy disruptions.

Third, brands should deepen engagement with foodservice and retail partners by co-creating tailored product formats and pricing models. Bulk concentrate offerings for institutional customers and smaller single-serve stick packs for e-commerce subscriptions can drive incremental revenues across channels. Moreover, strategic alliances with leading coffee chains to pilot exclusive flavor profiles will amplify brand visibility and trial.

Finally, a robust sustainability narrative-backed by transparent sourcing, eco-friendly packaging, and measurable carbon-reduction goals-will resonate with increasingly conscientious consumers. Integrating digital tools such as QR-code traceability and consumer feedback loops will further reinforce trust and loyalty, ultimately converting trial into repeat purchase.

Outlining the Rigorous Research Methodology Employing Primary Stakeholder Interviews, Secondary Data Analysis, and Robust Triangulation for Market Validation

This research exercise integrates a meticulous combination of primary and secondary methods to deliver a comprehensive view of the coffee creamer industry. The primary research component involved structured interviews with more than fifty stakeholders, including senior product developers, procurement officers, and commercial buyers, to capture real-time insights on formulation preferences, supply chain bottlenecks, and channel dynamics. These qualitative findings were rigorously cross-validated against quantitative secondary data.

Secondary research encompassed an extensive review of industry publications, company annual reports, and governmental trade databases to map tariffs, production capacities, and consumption patterns. Trade data from HTSUS schedules and global import/export records informed the assessment of tariff impacts, while market intelligence from syndicated research provided benchmarks for segment growth rates.

To ensure data integrity, we employed triangulation techniques by comparing multiple independent sources-for example, reconciling tariff schedules with producer price indices and import volumes. Financial and operational metrics of key players were synthesized through desktop research and proprietary corporate filings, enabling a robust competitive analysis.

Together, this blended approach yields validated insights that reflect both macro-level trends and micro-level stakeholder perspectives. It underpins the actionable recommendations and forecasts contained within the full report, ensuring decision-makers can confidently navigate the coffee creamer landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Coffee Creamer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Coffee Creamer Market, by Formulation

- Coffee Creamer Market, by Flavor

- Coffee Creamer Market, by Product Type

- Coffee Creamer Market, by Packaging Type

- Coffee Creamer Market, by End User

- Coffee Creamer Market, by Distribution Channel

- Coffee Creamer Market, by Region

- Coffee Creamer Market, by Group

- Coffee Creamer Market, by Country

- United States Coffee Creamer Market

- China Coffee Creamer Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Market Forces to Articulate the Evolving Coffee Creamer Ecosystem and Prioritize Strategic Imperatives for Sustainable Growth and Innovation

The coffee creamer industry stands at a pivotal juncture, characterized by dynamic consumer preferences, geopolitical trade shifts, and technological advancements in product formulation. Dairy-based variants will maintain a significant presence due to their established sensory appeal, yet non-dairy alternatives are poised to seize growing share as plant-based diets and sustainability mandates gain momentum. Flavor innovation and packaging versatility will continue to serve as primary levers for differentiation, especially in saturated markets.

Tariff developments in 2025 have underscored the fragility of global supply chains, pressing manufacturers to recalibrate sourcing strategies and invest in localized production to preserve margin stability. Regional markets display heterogeneous growth patterns, with matured channels in North America and Europe demanding premium and functional offerings, while Asia-Pacific and Latin American consumers embrace novel plant-based experiences.

Competitive dynamics feature synergy between legacy players-armed with scale and distribution reach-and nimble challengers that excel in plant-based innovation and targeted marketing. Strategic collaborations across foodservice, retail, and ingredient supply networks will set the stage for the next phase of category expansion.

As the market accelerates, decision-makers must maintain a dual focus on agile product development and resilient operational frameworks. Ultimately, those who adeptly integrate consumer insights, tariff scenario planning, and sustainability imperatives will secure enduring leadership in this vibrant and evolving landscape.

Connect Directly with Ketan Rohom to Secure the Definitive Coffee Creamer Market Research Report and Unlock Actionable Insights for Strategic Advantage

We invite industry decision-makers to connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore the comprehensive insights contained in the coffee creamer market research report. This report delivers an in-depth analysis of consumer behaviors, emerging product formats, and the evolving regulatory environment, equipping you to anticipate market shifts and refine your strategic roadmaps. Through this engagement, you will gain tailored intelligence on formulation trends, tariff ramifications, and regional growth opportunities, allowing you to make informed investment and partnership decisions. Reach out to Ketan Rohom to schedule a briefing or request a customized executive presentation that aligns with your organization’s priorities. By leveraging these authoritative findings, your team can drive innovation, optimize your product portfolio, and unlock new channels for sustainable growth in the dynamic coffee creamer landscape. Secure your copy today to transform market knowledge into competitive advantage and chart a proactive course in this rapidly evolving category.

- How big is the Coffee Creamer Market?

- What is the Coffee Creamer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?