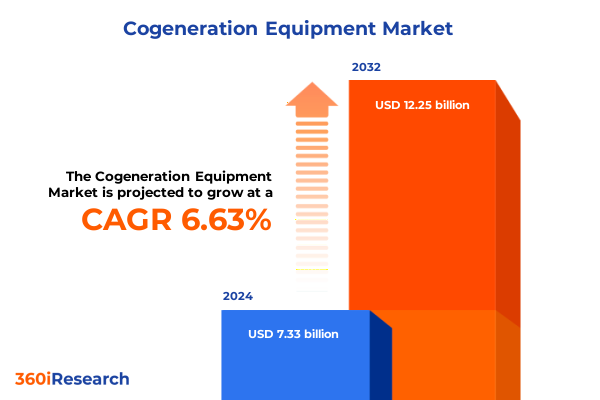

The Cogeneration Equipment Market size was estimated at USD 7.81 billion in 2025 and expected to reach USD 8.32 billion in 2026, at a CAGR of 6.64% to reach USD 12.25 billion by 2032.

Driving Efficiency and Resilience: Introducing the Strategic Importance of Advanced Cogeneration Equipment in Modern Energy Ecosystems

The evolution of global energy systems has elevated the role of cogeneration equipment as a cornerstone of efficiency and resilience. By simultaneously producing electricity and thermal energy from a single fuel source, cogeneration systems maximize energy utilization while reducing greenhouse gas emissions. This dual output capability addresses both power needs and heating demands, positioning cogeneration as a critical enabler of decarbonization pathways and grid reliability. In an era defined by climate imperatives and supply chain uncertainties, organizations increasingly view cogeneration as a strategic solution to bolster energy security and operational continuity.

Against this dynamic backdrop, this analysis delivers a succinct yet comprehensive introduction to the current cogeneration equipment landscape. It synthesizes key market drivers, technological advancements, and policy influences shaping procurement and deployment strategies. Through a balanced examination of regulatory trends, tariff implications, and segmentation insights, readers will gain a foundational perspective that informs strategic planning. Moreover, this introduction underscores how stakeholders across industries can harness cogeneration to achieve both sustainability targets and cost efficiencies in a rapidly evolving energy economy.

Unprecedented Technological Advances and Regulatory Reforms Driving a Paradigm Shift in Cogeneration Solutions towards Sustainability and Digital Integration

In recent years, a convergence of technological breakthroughs and policy initiatives has fundamentally reshaped cogeneration markets. Innovations such as high-temperature solid oxide fuel cells and modular microturbines have enhanced system flexibility, enabling more precise matching of supply with dynamic demand profiles. Concurrently, digital integration through advanced monitoring and predictive analytics has optimized operational performance, reducing downtime and maintenance costs. Regulatory reforms, including stricter emissions standards and incentives for distributed energy resources, have further catalyzed investment in next-generation cogeneration projects.

These transformative shifts underscore an accelerating transition toward resilient, low-carbon energy models. Stakeholders now prioritize solutions that integrate seamlessly with renewable power sources, offer rapid ramp-up capabilities, and support grid ancillary services. In addition, growing emphasis on industrial decarbonization has driven deployment of fuel cell-based cogeneration in sectors with high thermal demand, such as data centers and manufacturing. Together, these drivers are forging a market landscape defined by technological agility, regulatory alignment, and sustainability-focused value propositions.

Assessing the Comprehensive Impact of 2025 United States Tariffs on the Cogeneration Equipment Industry Value Chain and Competitive Dynamics

The introduction of new tariff measures in 2025 has had sweeping effects on the cogeneration equipment supply chain within the United States. Increased duties on imported gas turbines and fuel cell components have prompted manufacturers to reassess sourcing strategies and accelerate domestic production capacities. These policy actions have also influenced procurement timelines, as project developers seek to mitigate cost uncertainties by locking in equipment orders before additional tariffs are enacted. While some vendors have absorbed tariff costs to maintain competitive pricing, others have redirected investments toward localized assembly and strategic partnerships.

Cumulatively, these tariff developments have reinforced the importance of supply chain resilience and diversified manufacturing footprints. End users have responded by exploring hybrid procurement models that blend domestic and international sourcing, thereby balancing price considerations with delivery reliability. Moreover, the tariff environment has heightened focus on aftermarket services and spare parts availability, as operators aim to shield existing assets from escalated maintenance expenses. By navigating these evolving trade dynamics, industry participants are adapting to a more complex cost landscape while strategically positioning for sustained growth.

Deep Diving into Market Segmentation Insights Revealing Technology, End Use, Fuel Type, Capacity, Installation, and Ownership Patterns

A nuanced understanding of market segmentation reveals diverse applications and technology preferences shaping cogeneration adoption. Within the technology spectrum, stakeholders allocate investments across fuel cell configurations-spanning molten carbonate, proton exchange membrane, and solid oxide offerings-alongside gas turbines categorized into aero derivative and industrial classes. Microturbines and reciprocating engines, available in both diesel and gas variants, cater to specific scale and fuel requirements, while steam turbines continue to serve high-capacity thermal networks. These technology choices reflect a balance between capital intensity, operational efficiency, and emissions performance.

End use patterns further delineate market dynamics, as commercial, industrial, institutional, and residential sectors exhibit distinct demand profiles. Industrial applications such as chemicals and petrochemicals, data centers, and manufacturing subsegments-including automotive, food and beverage, and paper and pulp-drive substantial thermal and electrical loads. Fuel type considerations, encompassing biogas from agricultural, landfill, and sewage sources, diesel, multi-fuel, and natural gas delivered via pipeline or liquefied forms, influence both emissions and logistics. Capacity tiers spanning up to 500 kW, 500 to 2000 kW, and above 2000 kW align with site requirements, while installation configurations differentiate grid-connected and standalone systems. In addition, ownership structures including independent power producers, industrial captives, and utility-operated assets shape investment models and operational control. By integrating these segmentation lenses, decision-makers can tailor cogeneration solutions to specific operational constraints and strategic objectives.

This comprehensive research report categorizes the Cogeneration Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Fuel Type

- Capacity

- Installation Type

- Ownership

- End Use

Uncovering Regional Dynamics and Growth Drivers Across the Americas, Europe, Middle East & Africa, and the Asia-Pacific Cogeneration Markets

Regional dynamics in the cogeneration equipment market reflect a mosaic of regulatory frameworks, resource availability, and infrastructure maturity. In the Americas, supportive policy instruments and rising energy costs have spurred growth in combined heat and power projects across commercial buildings and industrial facilities. Latin American markets, in particular, are leveraging abundant biogas feedstocks to decouple energy generation from grid constraints and reduce reliance on imported fuels. Transitioning northward, the United States and Canada continue to invest in fuel cell integration and advanced reciprocating engines to meet stringent emissions targets and bolster grid resilience.

Across Europe, the Middle East, and Africa, diverse regional drivers are at play. Europe leads in stringent carbon pricing mechanisms and district heating integration, encouraging deployment of high-efficiency cogeneration assets. In the Middle East, industrial hubs are adopting gas turbine solutions to optimize energy-intensive operations, while select African markets explore off-grid cogeneration to address electrification deficits. Meanwhile, Asia-Pacific stands out for rapid urbanization and expanding manufacturing bases. Strong policy support in countries like Japan and South Korea propels fuel cell adoption, and growing natural gas infrastructure in Southeast Asia unlocks new opportunities for combined heat and power solutions. These regional variations underscore the importance of tailored strategies that align technology choices with local market conditions.

This comprehensive research report examines key regions that drive the evolution of the Cogeneration Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Delivering Innovative Cogeneration Equipment Solutions and Strategic Collaborations

Industry leaders are advancing cogeneration capabilities through strategic partnerships, product innovations, and service expansion. Leading equipment manufacturers are integrating digital platforms to offer predictive maintenance and performance optimization services, thereby extending asset life and reducing operational risk. Collaborative ventures between gas turbine producers and fuel cell developers have emerged to create hybrid systems that deliver enhanced flexibility and reduced emissions footprints. Additionally, several original equipment manufacturers have expanded their aftermarket networks, ensuring rapid spare parts delivery and turnkey installation services to heighten customer satisfaction.

Furthermore, financial engineering and project financing frameworks have evolved to support cogeneration investments through energy-as-a-service models and performance-based contracting. Equipment providers are tailoring offerings to include comprehensive lifecycle support, from initial feasibility studies to long-term performance guarantees. These strategic moves not only differentiate market participants but also accelerate adoption by lowering barriers to entry and aligning stakeholder incentives. As competition intensifies, companies that excel at orchestrating end-to-end solutions-combining advanced technologies with robust service portfolios-are poised to capture disproportionate market share.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cogeneration Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 2G Energy AG

- American DG Energy Inc.

- Ansaldo Energia S.p.A.

- Baxi Group Ltd.

- Bosch Thermotechnology GmbH

- Caterpillar Inc.

- Clarke Energy Ltd.

- Cummins Inc.

- Doosan Škoda Power a.s.

- E.ON SE

- General Electric Company

- Kawasaki Heavy Industries, Ltd.

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries, Ltd.

- MTU Onsite Energy GmbH

- Rolls-Royce plc

- Rolls‑Royce Holdings plc

- Siemens AG

- Tecogen, Inc.

- Thermax Limited

- Turner Crane Allied Equipments Inc.

- Veolia Environnement S.A.

- Wärtsilä Corporation

- Yanmar Holdings Co., Ltd.

Actionable Strategies for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Risks in Cogeneration Markets

To capitalize on the evolving cogeneration landscape, industry leaders should pursue targeted strategies that unlock value across the supply chain. First, investing in modular and scalable technologies can address diverse capacity requirements and streamline deployment timelines. By adopting fuel cell and reciprocating engine modular solutions, organizations enhance operational flexibility and future-proof assets against shifting energy demands. Next, cultivating collaborative partnerships with local manufacturing and service providers can mitigate tariff impacts and ensure responsive maintenance support, thereby strengthening supply chain resilience.

Moreover, integrating digital twins and remote monitoring platforms enables real-time performance tracking and predictive analytics, which can reduce unplanned downtime and optimize fuel consumption. Aligning innovation roadmaps with emerging regulatory frameworks-such as carbon pricing and emissions trading schemes-will ensure compliance while unlocking incentive programs. Finally, exploring performance-based contracting and energy-as-a-service business models can lower upfront costs, attract new customers, and align stakeholder objectives. By executing these actionable measures, decision-makers can fortify competitive positioning, enhance sustainability outcomes, and drive long-term growth in cogeneration markets.

Rigorous Research Framework Combining Qualitative and Quantitative Methods to Ensure Comprehensive Cogeneration Insights

This research is grounded in a rigorous framework that blends qualitative and quantitative methodologies to ensure comprehensive and objective insights. Initial desk research involved systematic review of industry publications, patent databases, and regulatory filings to map technology trends and policy developments. These findings were supplemented by in-depth interviews with equipment manufacturers, utilities, independent power producers, and end users across key sectors to capture experiential perspectives and real-world use cases. Data triangulation techniques were applied to reconcile disparate sources and enhance the robustness of conclusions.

Quantitative analysis encompassed evaluation of technology performance metrics, supply chain cost structures, and historical tariff impacts to identify salient patterns. Capacity deployment data and fuel consumption profiles were normalized to facilitate comparative assessment across regions and segments. Furthermore, a dedicated expert panel reviewed draft analyses to validate assumptions and refine strategic recommendations. This multi-layered methodological approach ensures that the insights presented herein reflect both the current market reality and the underlying dynamics shaping future developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cogeneration Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cogeneration Equipment Market, by Technology

- Cogeneration Equipment Market, by Fuel Type

- Cogeneration Equipment Market, by Capacity

- Cogeneration Equipment Market, by Installation Type

- Cogeneration Equipment Market, by Ownership

- Cogeneration Equipment Market, by End Use

- Cogeneration Equipment Market, by Region

- Cogeneration Equipment Market, by Group

- Cogeneration Equipment Market, by Country

- United States Cogeneration Equipment Market

- China Cogeneration Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding Perspectives Synthesizing Key Findings and Strategic Imperatives to Guide Decision Making in Cogeneration

The synthesis of findings underscores the critical role of cogeneration equipment in advancing energy efficiency, resilience, and decarbonization objectives. Technological innovations-from high-temperature fuel cells to modular microturbines-are unlocking new value propositions, while tariff environments and regulatory reforms are reshaping supply chain dynamics. Segmentation insights reveal that tailored solutions, aligned with specific technology, end use, and fuel preferences, drive optimal performance and economic outcomes. Simultaneously, regional analyses highlight that success hinges on adaptability to diverse policy landscapes and resource endowments.

In conclusion, stakeholders who embrace integrated strategies-combining technological agility, regional customization, and strategic collaborations-will achieve enduring competitive advantage. By leveraging the actionable recommendations and methodological rigor outlined in this document, decision-makers can navigate complexity, mitigate risks, and capitalize on emerging opportunities. These strategic imperatives will guide investments and partnerships, ensuring that cogeneration deployments not only meet present needs but also align with long-term sustainability and resilience goals.

Connect with Ketan Rohom to Secure the Full Cogeneration Market Research Report and Empower Your Strategic Energy Decisions

Ready to translate insights into action and drive growth in your cogeneration initiatives? Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure immediate access to the comprehensive cogeneration market research report. This actionable resource embodies rigorous analysis of technological evolution, tariff impacts, regional dynamics, and competitive landscapes to inform strategic decisions. By partnering with Ketan Rohom, you will receive tailored guidance on leveraging transformative shifts, optimizing segmentation opportunities, and reinforcing resilience against regulatory headwinds. Unlock exclusive perspectives and data-driven recommendations that will empower your organization to enhance operational efficiency, elevate sustainability performance, and achieve a competitive edge in the evolving energy sector

- How big is the Cogeneration Equipment Market?

- What is the Cogeneration Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?