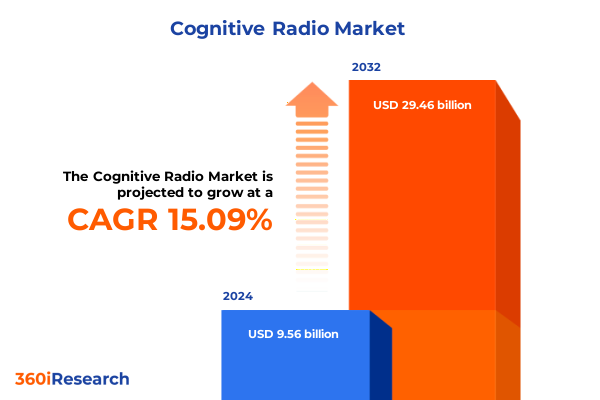

The Cognitive Radio Market size was estimated at USD 10.94 billion in 2025 and expected to reach USD 12.52 billion in 2026, at a CAGR of 15.19% to reach USD 29.46 billion by 2032.

Establishing the Strategic Imperatives and Technological Evolution Catalyzing the Next Generation of Cognitive Radio Networks and Adaptive Spectrum Solutions

Cognitive radio represents a transformative leap in wireless communications, leveraging intelligent systems to optimize spectrum usage in real time. As global demand for high-speed data escalates, network operators and device manufacturers face mounting pressure to overcome congestion and interference across conventional frequency allocations. Cognitive radio addresses these challenges by embedding adaptive algorithms that detect vacant channels, dynamically allocate frequencies based on contextual awareness, and continuously learn from environmental feedback. Consequently, the technology not only enhances spectral efficiency but also lays the groundwork for robust, interference‐resilient networks capable of supporting next-generation applications.

Moreover, the evolution of cognitive radio has progressed from foundational theoretical models in academia to commercially viable solutions, driven by breakthroughs in software-defined radio platforms and machine learning integration. Initially confined to experimental research, cognitive radio architectures now incorporate advanced signal processing, artificial intelligence frameworks, and open radio access network principles. This confluence of hardware and software innovations empowers spectrum‐aware devices to predict usage patterns, autonomously adjust transmission parameters, and collaborate with adjacent nodes in a decentralized manner. In turn, stakeholders across telecommunications, defense, utilities, and critical infrastructure sectors are increasingly recognizing the strategic importance of cognitive radio in fulfilling stringent connectivity requirements with minimal capital and operational expenditure.

This executive summary offers a comprehensive overview of the cognitive radio landscape, examining transformative shifts, tariff impacts, segmentation dynamics, regional differentiation, and leading corporate strategies. It aims to inform executives and decision-makers about the underlying drivers shaping supply chains, regulatory frameworks, and technology roadmaps. By exploring actionable recommendations and outlining the rigorous research methodology underpinning these insights, this document seeks to equip industry leaders with the strategic foresight necessary to harness cognitive radio’s full potential.

Revolutionary Advances in Cognitive Radio Shaping Future Wireless Ecosystems Through Machine Learning Integration and Dynamic Spectrum Allocation Strategies

The cognitive radio landscape is undergoing profound transformation, propelled by advances in machine learning, virtualization, and distributed architectures. Artificial intelligence engines now enable predictive spectrum analytics, empowering devices to forecast frequency availability with unprecedented accuracy. Simultaneously, software-defined radio advancements facilitate seamless reconfiguration of physical layers, accelerating time-to-market for new functionalities. These technological synergies have given rise to modular, cloud-native cognitive radio solutions that integrate edge computing and network slicing, thereby enhancing resilience and scalability across heterogeneous environments.

In addition to technological breakthroughs, the ecosystem is reshaping through strategic partnerships between chipset vendors, cloud service providers, and regulatory bodies. Collaborative consortia are pioneering open interfaces and interoperability standards that reduce vendor lock-in and foster multi-stakeholder innovation. Meanwhile, dynamic spectrum access initiatives-such as shared access frameworks-are redefining how spectrum is assigned and auctioned, encouraging more efficient utilization of underused bands. This collaborative trend underscores a shift towards ecosystem-centric models, where value is co-created through joint research, co-development labs, and pilot deployments that validate real-world performance.

Furthermore, regulatory landscapes are evolving in tandem with technological progress. Policymakers are increasingly embracing progressive spectrum management policies, including dynamic allocation and database-driven coordination schemes. These reforms mitigate legacy constraints, unlock underutilized frequencies, and stimulate investment in cognitive radio infrastructures. As a result, stakeholders must navigate an environment where technical innovation, regulatory change, and ecosystem collaboration converge to reshape wireless connectivity paradigms.

Analyzing the Complex Ripple Effects of 2025 United States Tariffs on Cognitive Radio Supply Chains and Cross-Border Technology Deployment Challenges

In early 2025, a series of United States tariff measures targeting electronic components, including semiconductor chips, RF front end modules, and antenna assemblies, began to reverberate through the global cognitive radio supply chain. These measures introduced higher duties on imported hardware subassemblies, sharply increasing the landed costs of essential components. As manufacturers grappled with elevated input expenses, delays intensified at key ports due to additional customs scrutiny, leading to extended lead times and inventory bottlenecks. Consequently, production cycles for cognitive radio devices experienced notable disruptions, challenging original equipment manufacturers to maintain tight delivery schedules.

As tariffs compelled hardware providers to reconsider their sourcing strategies, many began exploring alternative suppliers in regions less impacted by trade restrictions. Companies evaluated nearshoring options in the Americas and Southeast Asia to mitigate geopolitical and logistical vulnerabilities. At the same time, procurement teams intensified negotiations with domestic foundries to diversify their supply base and secure preferential terms. Despite these adaptations, the transitional phase introduced inefficiencies and compelled some stakeholders to absorb increased costs or pass them on to end users, potentially dampening demand for new deployments in price-sensitive markets.

Looking ahead, the sustained impact of tariffs is expected to spur deeper structural shifts within the cognitive radio industry. Manufacturers are accelerating investments in local manufacturing capabilities and seeking government incentives to offset duties. Simultaneously, alliances between hardware suppliers and integrated device manufacturers are gaining prominence as a strategy to optimize vertical integration. These developments underscore the importance of agile supply chain management and proactive policy engagement in navigating the evolving tariff landscape, ensuring continued momentum in the roll-out of adaptive spectrum technologies.

In-depth Analysis of Cognitive Radio Market Segmentation Illuminating Component, Application, End User, Frequency Band, and Technique Dimensions

Segmenting the cognitive radio market by component type reveals a clear dichotomy between hardware and software offerings, each driving distinct value propositions. On the hardware front, antennas, RF front end modules, and spectrum sensing arrays constitute the physical foundation that enables agile frequency detection and channel allocation. Conversely, software solutions concentrate on cognitive engine platforms that leverage artificial intelligence to interpret spectral data, and spectrum management applications that orchestrate dynamic access policies. This segmentation highlights the critical interplay of specialized subsystems and high-level orchestration layers required to deliver resilient, context-aware connectivity.

Shifting attention to application contexts, cognitive radio technologies are finding traction across a diverse set of use cases. Commercial communications networks harness dynamic spectrum allocation to mitigate congestion in urban broadband deployments, while military communications systems exploit adaptive algorithms to maintain secure, interference-free links in contested environments. Public safety agencies deploy cognitive radios to establish reliable communication channels during emergencies, and smart grid infrastructures integrate these systems to enable real-time monitoring and control across distributed energy assets. Each application scenario imposes unique performance, reliability, and security requirements, shaping the product features and service models offered by solution providers.

Examining end user segmentation further underscores the technology’s widespread adoption across consumer electronics, government and defense bodies, telecom operators, and utilities. Consumer devices that incorporate cognitive capabilities promise seamless connectivity and optimized battery life, whereas government and defense organizations prioritize hardened systems capable of operating under jamming and surveillance conditions. Telecom operators leverage cognitive radio as part of broader network densification efforts, and utility companies integrate these platforms within grid modernization initiatives to support smart metering and demand response programs. Meanwhile, frequency band specialization in microwave, UHF, and VHF ranges addresses different propagation and throughput requirements, and techniques such as spectrum management, spectrum mobility, and spectrum sensing form the backbone of adaptive operational frameworks.

This comprehensive research report categorizes the Cognitive Radio market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Frequency Band

- Technique

- Application

- End User

Comparative Regional Dynamics of Cognitive Radio Adoption Highlighting Market Drivers and Infrastructure Variances Across Americas, EMEA, and Asia-Pacific

Regionally, the Americas stand at the forefront of cognitive radio adoption, driven by robust infrastructure investments, favorable regulatory policies, and a vibrant ecosystem of chipset manufacturers and network operators. The United States, in particular, has championed shared spectrum initiatives, creating commercial pilot programs that validate dynamic access frameworks. Canada and Latin American nations are following suit, with utilities and industrial sectors piloting systems for grid resilience and IoT connectivity. This regional leadership fosters a competitive landscape where innovation hubs and research institutions collaborate closely with industry to accelerate time‒to‒market for cognitive solutions.

In Europe, the Middle East & Africa region exhibits a mosaic of adoption patterns influenced by regulatory harmonization efforts and localized investment priorities. The European Union’s Radio Spectrum Policy Program has facilitated cross-border spectrum sharing trials, catalyzing cooperative research in cognitive radio deployments for transportation corridors and smart city applications. Meanwhile, Middle Eastern countries are investing in large-scale infrastructure projects that integrate cognitive systems into critical national telecommunications backbones. In Africa, energy and connectivity challenges have prompted pilot programs leveraging cognitive radio to bridge digital divides, with international development agencies funding initial rollouts aimed at rural communities.

Across Asia-Pacific, rapid urbanization and ambitious technology agendas are driving extensive R&D and commercialization of cognitive radio platforms. China, India, Japan, and South Korea have launched dedicated government initiatives to develop intelligent spectrum frameworks, often in partnership with leading universities and defense research labs. Network operators in this region are actively testing dynamic spectrum sharing in 5G and beyond, while ecosystem players are exploring the convergence of cognitive radio with edge computing and AI-powered network analytics. Such coordinated efforts underscore Asia-Pacific’s critical role in shaping next-generation wireless connectivity standards.

This comprehensive research report examines key regions that drive the evolution of the Cognitive Radio market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cognitive Radio Innovators and Strategic Partnerships Driving Competitive Differentiation and Technology Leadership in the Global Arena

The competitive landscape for cognitive radio is anchored by established technology leaders and emerging specialists collaborating to push the boundaries of spectrum intelligence. Leading semiconductor companies are integrating cognitive capabilities into system-on-chip solutions, reflecting a trend toward greater miniaturization and power efficiency. Simultaneously, renowned telecommunications equipment providers are embedding cognitive features within radio access network products, enabling operators to transition seamlessly from static allocations to dynamic spectrum coordination. These incumbents are leveraging their global scale and deep customer relationships to accelerate deployments and drive interoperability across standards bodies.

Emerging players are carving out niches by focusing on specialized spectrum sensing modules and advanced cognitive engine software. These agile organizations concentrate on developing low-latency processing algorithms, hardware acceleration for real-time analytics, and open API frameworks that facilitate integration with diverse network management systems. By forging partnerships with academic institutions and engaging in collaborative trials, they are validating performance gains and earning early adoption from forward-looking enterprise customers and niche government agencies.

Furthermore, strategic alliances between chipset manufacturers, system integrators, and service providers are shaping a more cohesive ecosystem. Consortiums and joint ventures are advancing reference architectures that combine best-in-class hardware, software, and service components. Investment activity from venture capital and private equity is also catalyzing innovation, with funding round announcements reflecting strong investor confidence in cognitive radio’s role in 6G and beyond. Collectively, these dynamics underscore a maturing market where collaboration, standardization, and strategic positioning determine competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cognitive Radio market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAE Systems plc

- Cisco Systems, Inc.

- DataSoft Corporation

- EpiSys Science, Inc.

- Ettus Research LLC

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Intel Corporation

- InterDigital, Inc.

- Kyynel Oy

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- NEC Corporation

- NuRAN Wireless Inc.

- Nutaq Technologies Inc.

- Qualcomm Incorporated

- Rohde & Schwarz GmbH & Co. KG

- RTX Corporation

- Shared Spectrum Company

- Thales S.A.

- Vecima Networks Inc.

- Vislink Technologies, Inc.

Actionable Industry Roadmap for Cognitive Radio Stakeholders to Capitalize on Emerging Trends, Optimize Spectrum Utilization, and Enhance Collaborative Ecosystems

Industry leaders are advised to expand investment in artificial intelligence–driven cognitive engine research, prioritizing algorithms capable of real-time spectrum analytics and predictive channel allocation. By establishing dedicated R&D centers that co-locate data scientists, radio frequency engineers, and software developers, organizations can accelerate the translation of theoretical models into deployable solutions. In addition, fostering an open innovation culture through partnerships with universities, research consortia, and start-up incubators will catalyze access to emerging talent and cutting-edge methodologies.

Engagement with regulatory bodies should be elevated to a strategic priority, as dynamic spectrum policies continue to evolve. Forming transparent dialogues with national and regional spectrum authorities will enable companies to influence the design of shared spectrum frameworks and pilot initiatives. Participation in industry coalitions can amplify collective expertise and secure early visibility into policy roadmaps. These efforts will not only streamline spectrum access but also reduce the uncertainty that often hampers long-term investment decisions.

Supply chain resilience can be enhanced by diversifying component sourcing strategies and exploring regional manufacturing partnerships. Establishing nearshore production and warehousing capabilities will mitigate tariff volatility and logistical disruptions. Simultaneously, investment in modular hardware designs can improve agility, allowing rapid reconfiguration in response to changing trade environments. Companies should also prioritize interoperability standards to ensure seamless integration across heterogeneous networks and devices.

Finally, cultivating a workforce skilled in cognitive radio engineering, spectrum regulation, and cybersecurity is critical. Comprehensive training programs and certification pathways will equip personnel with the knowledge to develop, deploy, and maintain sophisticated spectrum‐aware systems. By aligning organizational capabilities with emerging market demands, industry leaders can position themselves at the vanguard of cognitive radio innovation.

Robust Multi-Method Research Framework Underpinning the Comprehensive Cognitive Radio Market Analysis Integrating Qualitative and Quantitative Approaches

This analysis is grounded in a rigorous research framework that combines qualitative and quantitative approaches to capture a holistic view of the cognitive radio market. Primary research consisted of structured interviews with senior executives at network operators, chipset manufacturers, and system integrators, alongside surveys of end-user organizations in government, defense, utilities, and consumer electronics sectors. These engagements provided insights into strategic priorities, technology roadmaps, and deployment challenges, ensuring that the report reflects real-world decision-making criteria.

Secondary research included a systematic review of industry publications, patent portfolios, technical white papers, regulatory filings, and academic journals. This enabled a deep examination of technological trends, intellectual property landscapes, and evolving policy frameworks. Data points were cross-validated through triangulation, comparing findings from multiple sources to minimize bias and verify accuracy.

The market landscape was further refined through top-down and bottom-up analyses. A top-down approach assessed macroeconomic indicators, spectrum allocation policies, and global technology adoption rates to establish broad market contours. Concurrently, a bottom-up evaluation aggregated company-level data, product launch announcements, and trial outcomes to delineate granular market segments and competitive dynamics.

All findings were subjected to validation by an expert panel comprising academia, industry analysts, and domain specialists. This rigorous vetting process ensures that the conclusions and recommendations presented herein are robust, actionable, and reflective of the current state of cognitive radio innovation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cognitive Radio market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cognitive Radio Market, by Component Type

- Cognitive Radio Market, by Frequency Band

- Cognitive Radio Market, by Technique

- Cognitive Radio Market, by Application

- Cognitive Radio Market, by End User

- Cognitive Radio Market, by Region

- Cognitive Radio Market, by Group

- Cognitive Radio Market, by Country

- United States Cognitive Radio Market

- China Cognitive Radio Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Insights from Cognitive Radio Market Exploration to Illuminate Strategic Pathways and Conclude on Sustainable Innovation Imperatives

In synthesizing the multifaceted insights gathered, it becomes evident that cognitive radio stands at the nexus of technological innovation, regulatory evolution, and market demand. The convergence of machine learning, software-defined radio, and dynamic spectrum access is redefining connectivity paradigms, offering unprecedented opportunities for spectrum efficiency and resilience. As tariffs reshape supply chains, companies must adopt agile sourcing strategies and forge deeper partnerships to sustain momentum and mitigate cost pressures.

Segmentation analysis highlights that the interplay of hardware and software components underpins value creation across diverse application domains-from commercial broadband networks to mission-critical defense communications, public safety systems, and smart grid deployments. Regional dynamics further underscore the importance of tailored strategies: while the Americas lead in pilot programs and regulatory innovation, EMEA initiatives emphasize collaborative policy frameworks, and Asia-Pacific demonstrates rapid commercialization backed by strong government support.

Competitive positioning will hinge on the ability to integrate advanced spectrum sensing, management, and mobility techniques into cohesive platforms that address end-user requirements. Organizations that invest in open standards, workforce development, and regulatory engagement will be best positioned to accelerate adoption and capture emerging market opportunities. By aligning strategic priorities with the evolving spectrum landscape, stakeholders can navigate complexity, unlock new revenue streams, and contribute to the next wave of wireless connectivity breakthroughs.

Engage with Ketan Rohom to Unlock Exclusive Cognitive Radio Market Intelligence That Drives Strategic Growth and Informed Decision-Making

Contact Ketan Rohom, Associate Director of Sales & Marketing, to gain privileged access to an in-depth cognitive radio market intelligence report tailored to address your strategic priorities and accelerate your competitive positioning. By engaging directly with this resource, organizations can benefit from customized data that illuminates the latest technological breakthroughs, regulatory developments, and segmentation nuances needed to craft proactive investment strategies. Reach out today to secure your copy and transform complex spectrum challenges into actionable growth opportunities through expert-driven analysis and insights.

- How big is the Cognitive Radio Market?

- What is the Cognitive Radio Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?