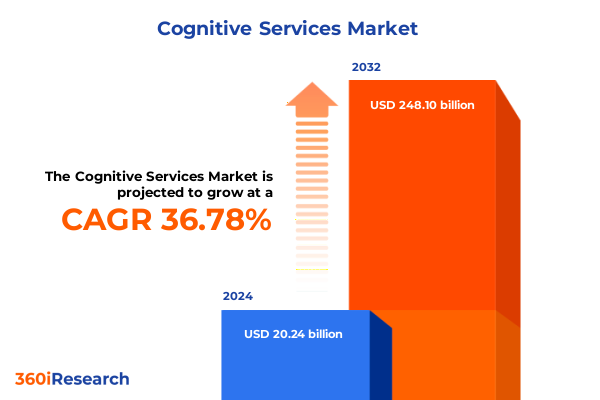

The Cognitive Services Market size was estimated at USD 27.56 billion in 2025 and expected to reach USD 37.53 billion in 2026, at a CAGR of 36.87% to reach USD 248.10 billion by 2032.

Setting the Stage for Cognitive Services Evolution by Unveiling the Foundational Elements Driving Next-Generation Intelligent Solutions

The realm of cognitive services stands poised at a pivotal juncture where advanced artificial intelligence capabilities intersect with real-world enterprise demands to redefine how organizations operate, engage, and innovate. As organizations strive to deliver more intuitive, context-aware user experiences and data-driven decision frameworks, cognitive services emerge as the critical enabler of these transformative ambitions. This introduction provides a foundational overview, setting the stage for an in-depth exploration of market drivers, segmentation dynamics, and strategic imperatives that influence adoption and deployment across industries.

Fueled by rapid advancements in machine learning, natural language processing, computer vision, and speech technologies, cognitive services have transcended experimental labs to become mission-critical business tools. These technologies empower systems to interact, reason, and learn from data, allowing enterprises to automate complex tasks, generate predictive insights, and personalize user interactions at scale. The unfolding narrative of cognitive services adoption reflects not only technological maturation but also evolving organizational mindsets prioritizing agility, customer centricity, and data-driven decision-making.

Transitioning from theoretical potential to tangible impact requires a clear understanding of the market landscape, including the shifting regulatory environment, evolving tariff regimes, and emerging competitive battlegrounds. By framing the cognitive services ecosystem through the lens of these forces, stakeholders can sharpen strategic priorities, align investment decisions with expected returns, and develop a roadmap that balances innovation with practical deployment considerations. This introduction, therefore, aims to equip decision makers with the contextual clarity necessary to navigate the interconnected factors shaping the future of intelligent enterprise infrastructure.

Charting the Transformative Shifts Redefining the Cognitive Services Landscape with Innovations in AI Architecture, Ethical Standards, Edge Deployment, and Low-Code Accessibility

The cognitive services landscape is undergoing a transformative metamorphosis driven by the convergence of adaptive AI architectures, democratized development frameworks, and scalable automation tooling. Organizations no longer perceive cognitive capabilities as isolated modules but instead embrace them as integral components of end-to-end business processes. This shift is underscored by the rise of low-code and no-code platforms that allow domain experts to configure advanced models without specialized data science expertise, accelerating adoption curves and reducing time to value.

Moreover, the proliferation of edge computing architectures has extended cognitive services beyond centralized cloud environments into on-device and near-device deployments, enabling real-time inference for scenarios with stringent latency and privacy requirements. This decentralization trend has prompted solution providers to offer hybrid deployment options that blend the expansive compute power of public cloud resources with the low-latency, secure processing capabilities of edge nodes.

Simultaneously, responsible AI principles and regulatory frameworks around data sovereignty, algorithmic fairness, and transparency are reshaping development lifecycles. Leading enterprises are integrating ethical guardrails into model training, validation, and monitoring processes to ensure compliance and build stakeholder trust. Consequently, the interplay between technological innovation, regulatory imperatives, and evolving deployment paradigms is charting a new trajectory in the cognitive services landscape-one defined by adaptive architectures, embedded trust mechanisms, and business-centric intelligence.

Assessing the Cumulative Effects of 2025 United States Tariffs on Cognitive Services Cost Structures, Supplier Dynamics, and Strategic Supply Chain Realignments

The imposition of updated tariff structures in the United States during 2025 has introduced both cost pressure and strategic recalibration across the cognitive services value chain. Hardware-dependent components such as high-performance GPUs, specialized AI accelerators, and optical sensors have faced increased import levies, compelling cloud providers and solution integrators to reassess sourcing strategies and negotiate longer-term supplier agreements to mitigate unit cost escalations.

At the same time, software licensing models anchored to proprietary algorithms have experienced indirect cost impacts as service providers adjust subscription fees to offset elevated infrastructure expenses. Organizations are responding by exploring open-source cognitive libraries and community-driven model repositories as alternatives, while hybrid and on-premises deployments gain renewed appeal for workloads with predictable scalability requirements and minimal cloud data egress.

Furthermore, the evolving tariff environment has prompted some global technology leaders to localize manufacturing and data center investments within the United States to qualify for favorable duty classifications and strengthen regional supply chain resilience. As a result, stakeholders across the ecosystem are intensifying strategic dialogues around tariff amortization tactics, total cost of ownership optimization, and collaborative procurement frameworks to sustain momentum in cognitive services adoption despite tariff-driven headwinds.

Unveiling Critical Segmentation Insights Illuminating Component, Deployment Model, Organization Size, and End Use Industry Dynamics Driving Cognitive Services Adoption

Understanding how cognitive services offerings align with diverse business requirements requires a granular view of market segmentation across four distinct dimensions. From a component perspective, the market bifurcates into Decision technologies encompassing anomaly detection, content moderation, metrics advisory, and personalization; Language capabilities such as conversational AI, natural language processing, text analytics, and translation; Speech services including speaker recognition, speech analytics, speech-to-text, and text-to-speech; and Vision modules covering face recognition, image recognition, optical character recognition, and video analytics.

Deployment model segmentation further delineates the market into cloud-native solutions available in public and private cloud configurations, hybrid architectures spanning integrated hybrid and multi-cloud environments, and on-premises installations tailored for organizations with stringent control and compliance mandates. This dimensional view underscores how deployment flexibility directly influences adoption rates, operational overhead, and integration complexity for enterprises of varying regulatory footprints.

Organization size segmentation illuminates divergent adoption patterns between large enterprises, segmented into Fortune 500 and non-Fortune 500 entities, and small and medium enterprises broken down into medium, micro, and small players. Large enterprises often leverage bespoke cognitive service implementations at scale to drive competitive differentiation, while smaller organizations prioritize cost efficiency and pre-integrated service bundles to accelerate time to market.

End use industry segmentation highlights vertical-specific requirements driving tailored cognitive solutions across BFSI, dissected into banking, capital markets, and insurance; government at federal and state and local levels; healthcare spanning hospitals, medical devices, and pharmaceuticals; IT and telecom covering IT services and telecom operators; manufacturing focused on automotive and electronics; and retail divided between brick-and-mortar and e-commerce operations. This comprehensive segmentation framework empowers stakeholders to calibrate go-to-market strategies, fine-tune product roadmaps, and align service portfolios with the nuanced demands of each industry vertical.

This comprehensive research report categorizes the Cognitive Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Organization Size

- Deployment Model

- End Use Industry

Mapping Key Regional Insights Revealing How Americas, Europe Middle East Africa, and Asia-Pacific Variances Influence Cognitive Services Growth Trajectories

Regional dynamics exert a profound influence on the trajectory of cognitive services adoption, reflecting differences in regulatory landscapes, infrastructure maturity, and investment priorities. In the Americas, robust cloud infrastructure and progressive data governance frameworks have catalyzed rapid uptake among enterprises seeking to leverage AI-driven analytics for customer engagement, operational efficiency, and risk management. Leading cloud providers continue to expand regional data centers to accommodate latency-sensitive use cases and meet localized compliance standards.

In Europe, Middle East, and Africa, the imperative to comply with data sovereignty regulations and emerging AI governance mandates has elevated the demand for hybrid and on-premises cognitive solutions. Governments and businesses in this region are collaborating on trusted AI initiatives, research consortiums, and public–private partnerships to foster responsible innovation while safeguarding privacy and ethical standards.

Asia-Pacific markets exhibit a dual-speed adoption pattern, where tech-forward economies prioritize next-generation intelligent applications-particularly in manufacturing automation and smart city projects-while developing markets focus on foundational use cases in financial inclusion, healthcare accessibility, and agriculture optimization. Cross-border data flow agreements and regional economic partnerships are accelerating infrastructure investments, establishing the Asia-Pacific region as a fertile ground for cognitive services experimentation and scale.

This comprehensive research report examines key regions that drive the evolution of the Cognitive Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Players and Strategic Alliances Steering Cognitive Services Innovation, Competitive Differentiation, and Market Leadership

The competitive landscape for cognitive services is shaped by a blend of established technology giants, specialized AI challengers, and innovative startups. Leading cloud providers continually enhance their cognitive portfolios with proprietary algorithms, prebuilt models, and developer-friendly toolkits, intensifying competitive pressures around feature differentiation, pricing models, and integration ease.

At the same time, niche players focus on domain-specific cognitive solutions, such as advanced image classification for medical diagnostics, sentiment analysis customized for financial market intelligence, or voice authentication tailored for secure access control. These specialized vendors drive ecosystem innovation by collaborating with academic institutions and open-source communities to accelerate algorithm development and validation.

Strategic partnerships and acquisitions also play a pivotal role in reshaping the competitive battleground. Alliances between hyperscale cloud providers and regional system integrators enable localized service delivery and specialized expertise, while targeted M&A activity allows organizations to acquire cutting-edge capabilities, expand geographic footprints, and consolidate market share in high-growth vertical segments. This multidimensional competitive dynamic underscores the necessity for continuous strategic scanning, partnership orchestration, and capability investment to maintain market leadership in cognitive services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cognitive Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- Baidu, Inc.

- Google LLC

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Rockwell Automation, Inc.

- Salesforce, Inc.

- Samsung Electronics Co., Ltd.

- Tencent Holdings Limited

Formulating Actionable Recommendations for Industry Leaders to Accelerate Cognitive Services Value Capture, Drive Ethical AI Integration, and Foster Sustainable Innovation

Industry leaders should prioritize a dual-track approach that balances immediate optimization of existing cognitive service deployments with long-term investment in emerging capabilities. In the near term, organizations can enhance ROI by auditing current cognitive implementations, identifying underutilized models, and reallocating resources toward high-impact use cases aligned with strategic goals.

Simultaneously, executives should establish dedicated innovation incubators to pilot advanced technologies such as federated learning, continuous model retraining, and adaptive inference engines. These initiatives will position enterprises to capitalize on next-wave cognitive capabilities, drive sustainable competitive advantage, and mitigate the risk of technology obsolescence.

To further strengthen market positioning, leaders must cultivate cross-functional teams comprising AI specialists, domain experts, and compliance officers. By embedding ethical AI frameworks into development and governance processes, organizations can preempt regulatory scrutiny and foster stakeholder trust. Equally important is forging strategic alliances with ecosystem partners, including academic research centers, industry consortia, and technology vendors, to accelerate co-innovation and share risk in high-stakes projects.

Finally, adopting a customer-centric mindset and leveraging data-driven performance metrics will ensure that cognitive service initiatives deliver measurable business outcomes. Through continuous monitoring, iterative refinement, and transparent reporting, industry leaders can demonstrate value generation, secure executive sponsorship, and sustain momentum in the dynamic cognitive services landscape.

Demonstrating Rigorous Research Methodology Integrating Primary Interviews, Secondary Analysis, Data Triangulation, and Multi-Tier Validation for Cognitive Services Insights

The analytical rigor underpinning this research is founded on a blend of primary and secondary methodologies designed to ensure accuracy, reliability, and strategic relevance. Primary data collection involved structured interviews with senior executives, technology architects, and solution providers, capturing firsthand perspectives on deployment challenges, technology roadmaps, and supplier selection criteria. These engagements provided critical qualitative insights that deepened the contextual understanding of cognitive services adoption dynamics.

Secondary research encompassed a comprehensive review of public disclosures, regulatory filings, patent databases, industry whitepapers, and academic publications. This extensive document analysis facilitated validation of key market trends, identification of emerging technology enablers, and triangulation of quantitative data points. In addition, proprietary data repositories and digital analytics tools were leveraged to track product releases, partnership announcements, and investment flows across the global cognitive services ecosystem.

To enhance methodological rigor, data triangulation techniques were employed, cross-referencing primary findings with secondary sources to mitigate bias and confirm thematic consistency. A multi-tier validation process involved peer reviews by domain experts, iterative feedback cycles with stakeholder groups, and sensitivity analyses to assess the robustness of strategic insights. This holistic research framework ensures that the conclusions drawn and recommendations provided are grounded in empirical evidence and aligned with real-world market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cognitive Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cognitive Services Market, by Component

- Cognitive Services Market, by Organization Size

- Cognitive Services Market, by Deployment Model

- Cognitive Services Market, by End Use Industry

- Cognitive Services Market, by Region

- Cognitive Services Market, by Group

- Cognitive Services Market, by Country

- United States Cognitive Services Market

- China Cognitive Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Concluding Reflections on Strategic Imperatives, Technological Convergence, and Responsible AI Practices Shaping the Future of Cognitive Services Ecosystems

Cognitive services stand at the forefront of enterprise innovation, offering transformative potential to automate complex tasks, personalize customer experiences, and unlock predictive insights from vast data repositories. The evolving interplay between technological advancements, regulatory imperatives, and competitive dynamics underscores the importance of strategic agility and proactive governance.

As organizations navigate the implications of tariff fluctuations, segmentation nuances, and regional variations, the ability to align cognitive deployments with overarching business objectives will determine success. Stakeholders must remain vigilant in monitoring emerging architectures, ethical frameworks, and partnership ecosystems to ensure sustained momentum and value realization.

Ultimately, success in the cognitive services domain requires a balanced approach that integrates short-term optimization with long-term capability development. By leveraging robust research insights, adhering to responsible AI principles, and fostering collaborative innovation, organizations can chart a course toward intelligent, data-driven enterprise ecosystems that deliver enduring competitive advantage.

Empower Your Organization with Tailored Cognitive Services Insights through Personalized Engagement and Market Intelligence Access

To gain an in-depth understanding of how cognitive services can empower your organization with actionable insights and tactical advantages, we invite you to engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By partnering with Ketan, you will unlock tailored guidance on integrating our comprehensive market intelligence into your strategic roadmap, ensuring alignment with your unique requirements and growth objectives. Ketan’s expertise will facilitate a seamless transition from analysis to implementation, providing you with the clarity needed to navigate complex decision points and maximize return on investment. Reach out today to schedule a personalized consultation and secure your copy of the full cognitive services market research report, equipping your leadership team with the foresight required to outpace competitors in an era defined by intelligent automation and data-driven innovation.

- How big is the Cognitive Services Market?

- What is the Cognitive Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?