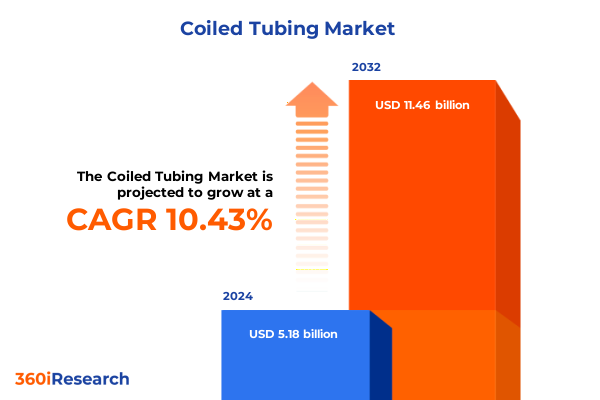

The Coiled Tubing Market size was estimated at USD 5.67 billion in 2025 and expected to reach USD 6.20 billion in 2026, at a CAGR of 10.58% to reach USD 11.46 billion by 2032.

Unveiling the critical role of coiled tubing technology in enhancing operational efficiency, safety, and sustainability across evolving oilfield services landscapes

Coiled tubing has emerged as a pivotal enabler of operational excellence in well intervention and drilling activities, offering continuous tubular deployment without the need for jointed pipes. By maintaining a seamless conduit, operators can perform intricate tasks such as cleanouts, acidizing, perforation, and circulation under pressure, all while minimizing the risks associated with conventional rigs. The inherent ability of coiled tubing units to navigate complex well trajectories and adapt to variable downhole conditions underscores its indispensable role in both onshore and offshore environments.

Furthermore, rapid technological progress and increasing demand for efficient well services have accelerated the adoption of coiled tubing solutions. As energy companies seek to optimize production from mature and unconventional reservoirs, the flexibility and speed of coiled tubing interventions deliver tangible cost and time savings. Enhanced safety profiles, derived from rigless interventions and reduced personnel exposure, further reinforce its appeal. Consequently, coiled tubing stands at the intersection of innovation and efficiency, driving service providers to refine equipment, integrate digital monitoring, and expand application scopes. Such momentum sets the stage for a market characterized by dynamic growth and continual advancement in materials, automation, and service delivery.

Examining transformative shifts driven by advanced materials, real-time digitalization, strategic partnerships, and automation that redefine coiled tubing operations in energy exploration

Recent years have witnessed a profound transformation in coiled tubing operations, propelled by the convergence of advanced materials, real-time data analytics, and automated control systems. With the integration of embedded downhole sensors, operators now access critical information on pressure, temperature, and flow rates, facilitating immediate adjustments to operational parameters and preemptive maintenance interventions. In parallel, the emergence of coiled tubing drilling (CTD) technology, featuring specialized bottom-hole assemblies and rotary steerable tools, is enabling efficient sidetracking and lateral drilling from existing wellbores.

Moreover, service providers are increasingly focusing on sustainability by adopting biodegradable lubricants, environmentally friendly fluids, and low-emission equipment, thereby reducing ecological footprints during interventions. Alongside these environmental considerations, the proliferation of composite materials-such as carbon fiber and fiberglass-has enhanced the strength-to-weight ratio of coiled tubing strings, granting deeper penetration capabilities and improved resistance to corrosion. Simultaneously, the industry’s digital wave, driven by machine learning and predictive analytics, is refining job designs and enabling operators to optimize asset performance, reduce non-productive time, and elevate safety standards across diverse well environments.

Analyzing the cumulative effects of United States steel, aluminum tariffs, and import restrictions implemented in 2025 on coiled tubing supply chains and cost structures in oilfield operations

The imposition of new United States tariffs in 2025, encompassing a 25% levy on steel and aluminum and additional duties on Canadian, Mexican, and Chinese imports, has reverberated across coiled tubing supply chains, intensifying cost pressures for service providers and operators alike. Direct cost increases have been particularly acute for OCTG products-central components of coiled tubing strings-where prices surged by 15–25% shortly after tariff enforcement. In deepwater projects, where tubular expenses already account for a significant portion of well expenditure, such hikes have the potential to erode margins substantially.

In response, major oilfield service firms have been compelled to pass through these elevated costs to their clientele, negotiating price adjustments and contract riders to manage inflationary impacts. Concurrent surveys by industry federations indicate concerns that well completion costs may rise by 2–3%, prompting some operators to temporarily moderate drilling plans and capital outlays. Furthermore, profit analyses suggest that for every dollar of revenue lost to tariffs, up to $1.35 of operating profit may be at risk due to diminished efficiencies and scale reductions. Collectively, these dynamics underscore the strategic imperative for stakeholders to reengineer supply chains and pursue greater operational resilience amid evolving trade policies.

Uncovering critical segmentation insights across type, material composition, application uses, performance requirements, and end-use sectors that shape diverse coiled tubing market dynamics

The coiled tubing market can be dissected through multiple analytical lenses, beginning with operational type, where equipment is classified as electric, hydraulic, or mechanical based on the driving mechanism used to power the tubing reel and downhole tools. This distinction informs both performance characteristics and maintenance protocols, as electric units offer precision control, hydraulic systems provide high torque output, and mechanical drives deliver robust durability under heavy loads.

Material composition further refines this segmentation by distinguishing between composite and steel tubing. Composite innovations, encompassing carbon fiber and fiberglass variants, pack lightweight advantages and enhanced corrosion resistance, thereby enabling extended reach and reduced operational wear. In contrast, traditional steel tubing-fabricated from alloy steel or carbon steel-remains prevalent for high-pressure applications, offering established supply chains and proven performance under extreme downhole temperatures and stresses.

Application-driven segmentation then categorizes market activity into drilling, well intervention, and workover services. Drilling operations subdivide into directional, horizontal, and straight drilling tasks, each demanding tailored tooling and control strategies. Well intervention covers jetting, milling, and stimulation activities, necessitating precise flow management and downhole diagnostics. Workover functions-including acidizing, fishing, and logging-leverage coiled tubing’s continuous deployment to execute maintenance and remedial operations efficiently. Lastly, end-use sectors span geothermal, mining, and oilfield applications, reflecting the technology’s versatility across energy and resource extraction contexts.

This comprehensive research report categorizes the Coiled Tubing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Application

- End Use

Revealing key regional dynamics, investment trends, and regulatory landscapes across the Americas, Europe–Middle East & Africa, and Asia–Pacific that drive unique growth patterns in the coiled tubing sector

Within the Americas, growth is underpinned by prolific shale plays in the United States and Canada, where operators leverage coiled tubing for rapid well interventions, sidetracks, and enhanced recovery methods. The region’s mature infrastructure and deep service networks support advanced deployments, while regulatory frameworks and environmental considerations continue to influence operational practices and technology adoption patterns.

Turning to Europe, the Middle East, and Africa, demand drivers are multifaceted, ranging from North Sea platform maintenance to Gulf Coast deepwater exploration and North African unconventional projects. Investments in offshore upgrades and strategic national oil company programs are fostering opportunities for coiled tubing services, particularly in complex high-pressure, high-temperature wells. Meanwhile, EMEA’s diverse regulatory regimes and geopolitical factors shape procurement strategies and encourage partnerships between local operators and global service firms.

In the Asia-Pacific arena, expanding liquefied natural gas projects, offshore developments in Southeast Asia, and emerging geothermal ventures in Indonesia and New Zealand are catalyzing coiled tubing applications. The region’s investment in modernizing aging fields, coupled with a growing emphasis on sustainable extraction technologies, is driving an uptick in coiled tubing interventions aimed at maximizing reservoir performance and minimizing environmental footprints.

This comprehensive research report examines key regions that drive the evolution of the Coiled Tubing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading company strategies, competitive innovations, partnership trends, and performance benchmarks among global coiled tubing service providers shaping industry leadership

Market leadership in coiled tubing services is concentrated among a handful of global players renowned for their extensive fleets, technological portfolios, and end-to-end service capabilities. Companies such as Schlumberger and Halliburton deploy intelligent coiled tubing systems equipped with real-time data analytics and downhole telemetry, enabling clients to monitor pressure, temperature, and mechanical stress continuously during well interventions. Baker Hughes and Weatherford maintain robust mechanical and hydraulic coiled tubing offerings, capitalizing on decades of field experience to optimize unit reliability and performance across diverse wellbore environments.

In addition to these tier-one operators, specialized manufacturers like Tenaris and Vallourec are pivotal in supplying advanced tubing materials. Vallourec’s recent cost-cutting initiatives and tight inventory management have improved profitability amid rising steel tariffs, highlighting the crucial interplay between manufacturing efficiency and service delivery in the coiled tubing ecosystem. Emerging service providers and regional partnerships further enrich competitive dynamics, as joint ventures tailor coiled tubing solutions to local conditions, regulatory requirements, and operator budgets, thereby broadening market access and accelerating technology diffusion.

This comprehensive research report delivers an in-depth overview of the principal market players in the Coiled Tubing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ArcelorMittal S.A.

- Forum Energy Technologies, Inc.

- Gautam Tube Corporation

- Global Tubing LLC

- HandyTube International Inc.

- HandyTube LLC

- JFE Steel Corporation

- John Lawrie Group

- Kinnari Steel

- Nippon Steel Corporation

- Nucor Corporation

- POSCO Holdings Inc.

- Precision Tubes

- Quality Tubing Inc.

- Sandvik AB

- Stewart & Stevenson, LLC

- T&H Lemont Corporation

- Tata Steel Limited

- Tenaris Coiled Tubes

- Tenaris S.A.

- Trident Steel Corporation

- Vallourec S.A.

- Webco Industries, Inc.

Offering actionable strategic recommendations for industry leaders to optimize coiled tubing operations through digital transformation, mitigate risks, and seize emerging market opportunities

To remain at the forefront of coiled tubing excellence, industry leaders should prioritize investments in digital transformation, integrating predictive analytics and remote monitoring platforms to enhance decision-making and reduce non-productive time. By deploying real-time telemetry systems and machine learning algorithms, operators can detect downhole anomalies before they escalate, safeguard equipment integrity, and optimize job planning in dynamic well environments.

Simultaneously, diversification of material sourcing-leveraging high-performance composite tubing alongside conventional steel-can mitigate supply chain vulnerabilities, especially under fluctuating tariff regimes. Strategic alliances with leading material suppliers and joint technology development initiatives will enable service providers to introduce innovative offerings that meet stringent performance and environmental criteria. Moreover, comprehensive training programs and cross-functional expertise development are essential to ensure that field personnel can fully exploit advanced control systems and maintain rigorous safety standards during complex interventions.

Finally, fostering collaborative partnerships between operators, service firms, and research institutions will accelerate the co-development of next-generation coiled tubing solutions. By jointly exploring robotics, automation, and novel downhole tool designs, stakeholders can unlock efficiencies, reduce operational risks, and create a resilient ecosystem capable of adapting to evolving energy transition imperatives and regulatory landscapes.

Detailing rigorous research methodology encompassing primary interviews, secondary data analysis, expert validation, and triangulation techniques ensuring robust coiled tubing market insights

This research adopts a multifaceted methodology combining primary and secondary data sources to deliver a comprehensive perspective on the coiled tubing market. Initially, a detailed review of public filings, technical papers, and industry publications was conducted to establish a foundational understanding of market drivers, technological advancements, and tariff implications. These secondary insights were then validated through structured interviews with subject-matter experts, including senior engineers, operations managers, and procurement specialists from leading service providers and operators.

Quantitative analysis involved collecting and synthesizing historical pricing data, material cost indices, and regional deployment statistics to identify trend patterns and derive segmentation insights. Where possible, cross-verification techniques such as data triangulation and sensitivity testing were employed to ensure accuracy and reliability. Additional vetting was performed through peer reviews by industry analysts and academic researchers, ensuring that the findings reflect current best practices and emerging innovations. This rigorous approach underpins the report’s strategic recommendations and supports robust decision-making for stakeholders navigating the coiled tubing landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Coiled Tubing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Coiled Tubing Market, by Type

- Coiled Tubing Market, by Material

- Coiled Tubing Market, by Application

- Coiled Tubing Market, by End Use

- Coiled Tubing Market, by Region

- Coiled Tubing Market, by Group

- Coiled Tubing Market, by Country

- United States Coiled Tubing Market

- China Coiled Tubing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding insights that synthesize technological, regulatory, and market trends with strategic imperatives to illuminate the future outlook of the coiled tubing industry

The evolution of coiled tubing technology reflects a broader commitment to efficiency, safety, and sustainability within the energy sector. Technological advancements-spanning sensor integration, composite materials, and digital automation-are empowering operators to execute complex well interventions with unprecedented precision and reduced environmental impact. Concurrently, new trade policies and tariff structures have underscored the necessity for agile supply chain strategies and cost-management frameworks to safeguard profitability in volatile markets.

As the industry continues to navigate regulatory shifts and regional market dynamics, the ability to segment services by type, material, application, and end use remains vital for tailoring offerings to client needs. Regional variations-driven by shale activity in the Americas, offshore projects in EMEA, and LNG and geothermal investments in the Asia-Pacific-illustrate the importance of localized strategies supported by global expertise. At the same time, leading service providers are reinforcing their competitive positions through digital platforms, strategic partnerships, and performance benchmarking, setting new standards for coiled tubing excellence.

Looking ahead, the intersection of digital transformation, material innovation, and cross-sector collaboration will shape the future trajectory of coiled tubing services. Stakeholders that embrace these trends, adopt proactive risk mitigation measures, and invest in continuous learning will be best positioned to capitalize on emerging opportunities and deliver resilient solutions in an increasingly complex energy landscape.

Take decisive action by contacting Ketan Rohom to access the complete market research report, tailored solutions, and unlock comprehensive coiled tubing industry intelligence

The comprehensive coiled tubing market research report offers unparalleled depth in technical, economic, and strategic analysis, delivering actionable insights that industry leaders can harness to refine their operations. To obtain this authoritative resource and leverage customized solutions tailored to your organization’s objectives, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engage today to fortify your competitive stance, access in-depth expert commentary, and secure timely intelligence vital for navigating the evolving coiled tubing landscape

- How big is the Coiled Tubing Market?

- What is the Coiled Tubing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?