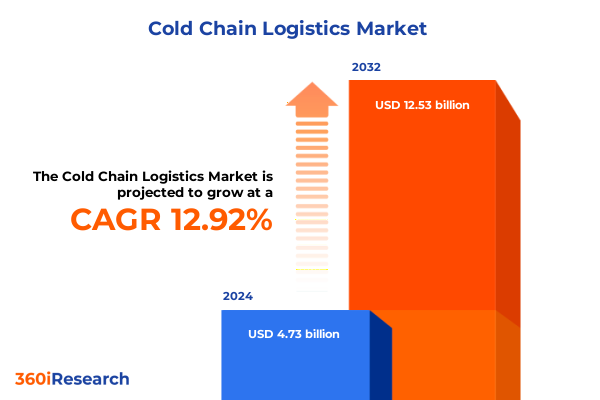

The Cold Chain Logistics Market size was estimated at USD 5.30 billion in 2025 and expected to reach USD 5.94 billion in 2026, at a CAGR of 13.05% to reach USD 12.53 billion by 2032.

Framing the Strategic Imperative of Cold Chain Excellence Amid Evolving Supply Disruptions and Rising Expectations

The accelerated globalization of commerce and the heightened demand for perishable and temperature-sensitive products have thrust cold chain logistics into the strategic spotlight. As consumer expectations for freshness, safety, and reliability continue to rise, businesses across industries must invest in robust end-to-end cold chain infrastructures that safeguard product integrity from origin to destination. This Executive Summary provides an integrated perspective on the forces shaping modern cold chain logistics, the transformative innovations redefining operational paradigms, and the critical factors that industry stakeholders must prioritize to maintain competitive differentiation and regulatory compliance.

Amid mounting supply chain uncertainties-from fluctuating trade policies to climatic disruptions-organizations are compelled to reassess legacy distribution models and embrace agile, data-driven frameworks. The introduction of real-time environmental monitoring, coupled with advanced analytics, establishes a new benchmark for visibility and proactive decision-making. Transitioning smoothly between storage, transportation, and value-added services requires cohesive collaboration, streamlined information flows, and strategic investment planning. With this context in mind, the following sections distill the core shifts, segmentation insights, regional dynamics, and actionable recommendations that define the contemporary cold chain ecosystem.

Unveiling the Convergence of Digital Innovation and Demand Shifts That Are Revolutionizing Cold Chain Operations

In recent years, the cold chain landscape has undergone seismic transformations driven by technological breakthroughs and shifting consumer demands. Cloud-based data integration platforms have emerged as the linchpin for seamless cross-border coordination, enabling stakeholders to harness granular temperature and location data throughout the shipment lifecycle. This level of transparency not only reduces spoilage risks but also fosters stronger trust among suppliers, distributors, and end customers. Simultaneously, the proliferation of Internet of Things sensors and edge computing devices has decentralized monitoring capabilities, allowing real-time alerts and automated corrective actions without manual intervention.

Operational paradigms are likewise shifting toward on-demand, hyperlocalized fulfillment models. As urbanization intensifies, shorter delivery windows and increased frequency necessitate modular cold storage facilities closer to consumption centers. Automated handling technologies, including robotic picking systems and autonomous vehicles, are unlocking new efficiencies, particularly within complex warehouse environments. Regulatory frameworks are adapting in tandem, with authorities emphasizing standardized digital documentation and blockchain-enabled traceability. These converging trends underline a broader industry transition from reactive problem-solving to predictive, resilience-focused strategies that anticipate disruptions and scale dynamically.

Assessing the Comprehensive Effects of 2025 United States Tariff Revisions on Cold Chain Supply Strategies

The 2025 tariff adjustments enacted by the United States have introduced a new layer of complexity to the global cold chain matrix. Steeper import duties on certain refrigerated equipment and ancillary materials have compelled logistics providers to reconfigure sourcing strategies and consider regional manufacturing partnerships to avoid tariff exposure. Companies that previously relied on streamlined international procurement are now evaluating nearshoring options to mitigate cost fluctuations and secure supply continuity. This strategic pivot not only influences capital expenditure priorities but also reshapes long-term vendor relationships and contractual frameworks.

Beyond direct cost implications, elevated tariffs have intensified the focus on total landed cost analysis and dynamic pricing models. Transportation providers are leveraging advanced freight-rate modeling to accommodate variable duties, optimize cross-docking operations, and refine multi-modal routing decisions. In response, some cold storage operators have invested in modular, tariff-exempt infrastructure components in domestic markets, thereby hedging against ongoing policy shifts. The cumulative effect of these measures underscores a critical insight: resilient cold chain networks demand strategic agility in tariff planning, adaptive procurement processes, and rigorous scenario analysis to safeguard margins and service consistency.

Decoding Multi-Faceted Segmentation Drivers That Shape Service Innovations Temperature Ranges and Industry-Specific Requirements in Cold Chain Logistics

Dissecting the cold chain market through multiple segmentation lenses reveals nuanced value propositions and investment priorities. When viewed by service types, the industry’s core components include storage services, transportation, and value-enhanced solutions. Within storage, both cold room environments and dedicated warehousing facilities underscore the need for specialized insulation, humidity control systems, and rigorous sanitation protocols. Transportation modalities span air, rail, road, and sea, each presenting distinct trade-offs in transit time, capacity, and carbon footprint. Value-added services further expand the ecosystem to encompass real-time temperature and environmental monitoring, comprehensive regulatory compliance and documentation oversight, reverse logistics with returns management, and advanced temperature-controlled packaging solutions designed for integrity throughout the supply chain.

Examining market dynamics based on temperature parameters highlights differentiated infrastructure and operational requirements. Chilled channels operating above zero degrees Celsius are pivotal for fresh horticulture, dairy, and bakery segments, where maintaining delicate texture and flavor profiles drives consumer satisfaction. In contrast, frozen environments below zero degrees Celsius cater to meat, seafood, and certain pharmaceutical bioproducts, emphasizing deep-freeze consistency and robust defrost protocols to prevent quality degradation over extended transit durations.

End-use segment analysis further unpacks strategic priorities. Chemical shipments mandate strict thermal thresholds to prevent hazardous reactions, while the dynamic food and beverage sector spans bakery items, dairy, frozen meals, and protein-rich foods, each with tailored handling guidelines. Meanwhile, the pharmaceutical vertical bifurcates into biopharmaceuticals and vaccines, where maintaining validated cold chain integrity is non-negotiable to ensure efficacy and patient safety. This segmentation framework illuminates how specialized requirements shape infrastructure design, service offerings, and compliance roadmaps across the industry.

This comprehensive research report categorizes the Cold Chain Logistics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Types

- Temperature Range

- End-Use

Unraveling How Regional Regulatory Environments Infrastructure Maturity and Consumer Demands Drive Cold Chain Evolution Across the Globe

Regional analysis underscores divergent growth trajectories and distinct operational imperatives across global geographies. In the Americas, stakeholders are capitalizing on expansions in fresh produce exports and increased e-commerce penetration. Investments in cross-border rail connections and inland cold hubs support high-frequency shipments spanning agricultural belts to urban delivery centers. Meanwhile, regulatory frameworks in North America are evolving to harmonize food safety and pharmaceutical distribution standards, compelling providers to refine digital traceability systems and leverage predictive quality controls.

Europe, the Middle East, and Africa present a mosaic of maturity levels. Western European markets lead in technology adoption, exemplified by integrated cold chain corridors linking major ports with inland destinations. Regulatory emphasis on carbon reduction is propelling low-emission vehicle fleets and green warehouse certifications. In emerging regions of the Middle East and Africa, infrastructural constraints coexist with surging demand for temperature-sensitive imports, prompting public–private partnerships to develop cold storage clusters adjacent to key consumption zones.

Asia-Pacific’s cold chain ecosystem is experiencing rapid modernization, driven by robust growth in pharmaceutical manufacturing and perishable exports. Investments in high-bandwidth monitoring networks and automated coldboxes are scaling across export-oriented corridors. At the same time, intra-regional trade facilitation is accelerating via streamlined customs protocols, enabling seamless movement of chilled and frozen goods. These regional insights highlight how localized regulatory drivers, consumer behaviors, and infrastructural capabilities influence strategic priorities for cold chain participants worldwide.

This comprehensive research report examines key regions that drive the evolution of the Cold Chain Logistics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Differentiation and Collaborative Innovation Among Leading and Specialized Cold Chain Service Providers

Leading players in cold chain logistics are adopting differentiated strategies to solidify their market positions and capture emerging opportunities. Many established incumbents are pursuing integrated service portfolios that combine end-to-end solution bundles encompassing warehousing, multi-modal transportation, and compliance management. This holistic approach facilitates deeper customer partnerships and generates recurring revenue streams by embedding value-added monitoring and reporting solutions into standard service contracts.

Simultaneously, a cadre of specialized providers is carving out niche leadership through technology-driven services. Early adopters of blockchain-enabled traceability platforms and predictive analytics suites are demonstrating measurable reductions in spoilage rates and expedited customs clearances. Partnerships between logistics firms and temperature assurance technology vendors underscore the growing importance of collaborative ecosystems, where joint innovation accelerates time-to-market for advanced cold chain solutions.

Regional players in high-growth markets are leveraging local distribution expertise and cost efficiencies to challenge global operators. By optimizing facility footprints and last-mile networks, these companies deliver competitive transit times while meeting tailored storage specifications. Collectively, these strategic initiatives illustrate a competitive landscape defined by convergence-where scale, specialization, and technological differentiation converge to set benchmarks for service excellence in cold chain logistics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cold Chain Logistics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.P. Møller - Mærsk A/S

- Americold Realty Trust, Inc.

- C.H. Robinson Worldwide, Inc.

- Cencora, Inc.

- Conestoga Cold Storage Ltd

- Congebec

- Constellation Cold Logistics S.à r.l.

- DHL Group

- DSV A/S

- Emergent Cold LatAm Management LLC

- FedEx Corporation

- FreezPak Logistics

- Frialsa Frigoríficos, S.A. de C.V.

- Green Rabbit by Performance Food Group, Inc.

- GXO Logistics, Inc.

- Interstate Cold Storage, Inc.

- J.B. Hunt Transport Services, Inc.

- Kerry Logistics Network Limited

- Kuehne+Nagel Group

- Lineage, Inc.

- NewCold Coöperatief UA

- Nichirei Logistics Group Inc.

- Orient Overseas (International) Limited

- Prime Inc.

- Ryder System, Inc.

- S.F. Express Co., Ltd.

- Snowman Logistics Limited

- Stevens Transport, Inc.

- Tippmann Group

- United Parcel Service, Inc.

- United States Cold Storage, Inc. by Swire Group

Empowering Leadership with Integrated Digital Platforms Workforce Excellence and Proactive Contingency Planning for Cold Chain Resilience

To thrive amid escalating complexity, industry leaders must embrace integrated digital platforms that unify temperature monitoring, shipment tracking, and compliance reporting across all service nodes. Investing in interoperable systems enables real-time visibility, predictive alerts, and data-driven decision support that collectively minimize operational risks and waste. Equally important is the cultivation of agile supplier ecosystems, where multi-lateral data-sharing arrangements and performance-based contracts bolster collective resilience against tariff fluctuations and regulatory shifts.

Operational excellence also hinges on workforce upskilling and cross-functional collaboration. Training programs focused on cold chain best practices, quality management, and regulatory standards should be embedded alongside continuous improvement frameworks. These initiatives foster a culture of accountability and innovation, where employees proactively identify process optimizations and champion sustainability goals.

Finally, leadership teams should establish scenario-planning protocols that simulate supply disruptions, equipment failures, and policy changes. By stress-testing network configurations and developing contingency playbooks, organizations can pivot quickly when faced with unforeseen challenges. This proactive stance, combined with a commitment to data transparency and strategic partnerships, empowers decision-makers to transform cold chain logistics from a cost center into a competitive differentiator.

Outlining a Rigorous Multistage Research Framework Combining Primary Engagement Secondary Analysis and Expert Validation

Our research methodology integrates a robust multi-stage approach to ensure comprehensive coverage and validity. Primary insights are captured through structured interviews with industry veterans spanning logistics providers, technology vendors, regulatory authorities, and end-user enterprises. These dialogues offer firsthand perspectives on operational challenges, emerging trends, and strategic imperatives.

Complementary secondary research entails rigorous examination of peer-reviewed publications, regulatory guidelines, and publicly available performance benchmarks. This process facilitates triangulation of primary findings against documented best practices and industry standards. Advanced data triangulation and qualitative coding techniques underpin our thematic analyses, ensuring that segmentation, regional dynamics, and competitive insights accurately reflect market realities.

Finally, validation is achieved through expert workshops and peer reviews, where preliminary findings are vetted and refined by seasoned practitioners. These collaborative forums enhance the robustness of conclusions, improve applicability, and align recommendations with evolving industry norms. Collectively, this structured research framework underpins the credibility and actionability of our cold chain logistics insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cold Chain Logistics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cold Chain Logistics Market, by Service Types

- Cold Chain Logistics Market, by Temperature Range

- Cold Chain Logistics Market, by End-Use

- Cold Chain Logistics Market, by Region

- Cold Chain Logistics Market, by Group

- Cold Chain Logistics Market, by Country

- United States Cold Chain Logistics Market

- China Cold Chain Logistics Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Integrating Critical Takeaways on Technology Trends Tariff Implications and Segment-Specific Strategies Shaping Cold Chain Success

Navigating the dynamic terrain of cold chain logistics demands a fusion of technological innovation, strategic foresight, and operational agility. The convergence of digital monitoring solutions, automation, and adaptive regulatory frameworks is reshaping how temperature-sensitive goods move across complex networks. Simultaneously, geopolitical factors and tariff realignments underscore the necessity for scenario-based planning and resilient supplier ecosystems.

Segmentation analysis reveals that tailored service models-spanning storage, transportation, and value-added solutions-are critical to meeting the distinct needs of chilled and frozen product flows. Region-specific insights emphasize how infrastructure maturity and regulatory environments drive divergent operational priorities across the Americas, EMEA, and Asia-Pacific. Leading companies differentiate through integrated offerings, collaborative partnerships, and technology-driven value propositions that reduce waste and enhance compliance.

As the cold chain ecosystem continues to evolve, stakeholders that adopt data-centric strategies, invest in workforce capabilities, and proactively stress-test their networks will secure sustainable growth. This Executive Summary synthesizes the essential considerations that inform strategic decision-making and lays the groundwork for informed investment, operational refinement, and market leadership.

Unleash Strategic Advantage Now by Partnering with Ketan Rohom for Bespoke Cold Chain Market Research Solutions

Take the next step in fortifying your supply chain by connecting directly with Ketan Rohom, whose seasoned expertise in research and strategic development ensures you receive analyses aligned precisely to your organizational goals. His deep understanding of cold chain trends and regulatory landscapes empowers you to interpret complex data and translate insights into robust operational plans. By partnering with Ketan, you gain access to bespoke guidance that addresses your unique challenges, from optimizing temperature control protocols to navigating cross-border tariff implications. Enhance your decision-making capabilities with tailored recommendations, rigorous competitive benchmarking, and forward-looking scenario planning that only high-caliber research can provide.

Reach out to Ketan Rohom today to secure your comprehensive market research report. Position your team at the vanguard of cold chain innovation through actionable data, progressive risk management approaches, and end-to-end visibility strategies. A conversation can unlock exclusive frameworks and pragmatic support designed to amplify your competitive edge in an increasingly complex logistics environment. Ensure your organization capitalizes on emerging opportunities while mitigating evolving challenges by engaging with the insights that drive industry leaders forward.

- How big is the Cold Chain Logistics Market?

- What is the Cold Chain Logistics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?