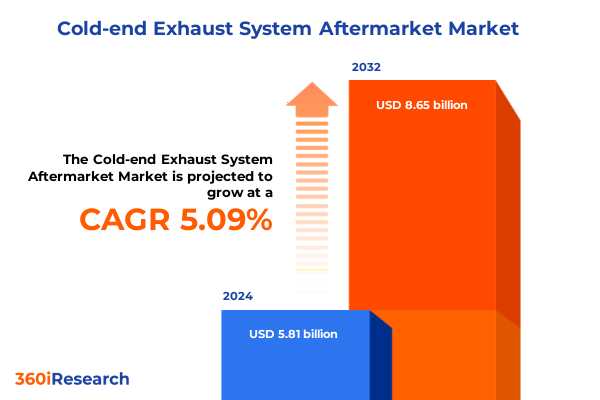

The Cold-end Exhaust System Aftermarket Market size was estimated at USD 6.09 billion in 2025 and expected to reach USD 6.38 billion in 2026, at a CAGR of 5.14% to reach USD 8.65 billion by 2032.

Setting the Stage for a Comprehensive Examination of the Aftermarket Cold-End Exhaust System Evolution and Industry Drivers Shaping Competitive Strategies and Growth Trajectories

The aftermarket cold-end exhaust system serves as a vital nexus between regulatory compliance, vehicle performance, and consumer experience. As automakers and vehicle owners alike navigate increasingly stringent emission standards, evolving consumer expectations, and the rapid integration of digital technologies, the components that govern exhaust flow and treatment have gained strategic importance. This analysis seeks to illuminate the multifaceted dynamics of catalytic converters, exhaust pipes, mufflers, resonators, and related downstream hardware as they intersect with broader automotive trends.

By weaving together comprehensive research findings, executive interviews, and data-driven perspectives, this report offers a panoramic view of the aftermarket cold-end exhaust system landscape. It establishes the groundwork for understanding how market participants-from tier-one suppliers to independent repair shops-must adapt to shifting regulatory frameworks, technological innovations, and new distribution paradigms. With this contextual foundation, stakeholders can identify strategic imperatives that position them for resilience, agility, and sustainable growth.

Uncovering the Transformative Technological, Regulatory, and Market Forces Reshaping the Aftermarket Cold-End Exhaust System Landscape in 2025

The aftermarket cold-end exhaust system is being redefined by a confluence of factors that span from material innovations to regulatory milestones. Recent advances in high-temperature aluminized steel and stainless steel alloys have enhanced corrosion resistance and extended component longevity, while modular design approaches enable faster installation and simplified maintenance. Concurrently, smart sensor integration within catalytic converters and mufflers is paving the way for predictive diagnostics, empowering service centers and independent repair shops to preempt failures and optimize component performance.

Moreover, evolving global emissions regulations are compelling market players to accelerate product development cycles. Stricter thresholds for particulate matter and nitrogen oxide emissions in major markets have heightened demand for advanced catalytic substrates and resonators engineered to deliver precise acoustic tuning without sacrificing filtration efficiency. At the same time, digital disruption in distribution channels-particularly the burgeoning role of e-commerce platforms-has reshaped customer engagement and ordering processes. As a result, incumbents and newcomers alike are reassessing their go-to-market strategies to align with omnichannel expectations, ensure robust inventory management, and streamline aftersales support.

Assessing the Cumulative Impact of 2025 United States Tariffs on the Aftermarket Cold-End Exhaust System Supply Chain, Cost Structure, and Trade Flows

In early 2025, a new wave of United States tariffs targeted key cold-end exhaust system components, signaling a strategic pivot in trade policy that reverberates across the supply chain. These levies, applied to import categories including catalytic converter cores, precision-bent exhaust pipes, and performance mufflers, were designed to incentivize domestic manufacturing and reinforce national security priorities. The immediate effect was a recalibration of cost structures for many aftermarket participants who rely on cross-border sourcing.

Consequently, suppliers have been compelled to revisit sourcing strategies, with some manufacturers exploring localized production partnerships and others reengineering product architectures to reduce dependency on tariff-affected inputs. Downstream, distributors and service centers are navigating margin compression by renegotiating contracts, optimizing logistics networks, and selectively passing incremental costs to end users. While some market actors perceive short-term headwinds, industry leaders view this disruption as an inflection point to strengthen resilience, cultivate regional supply partnerships, and recalibrate pricing models to maintain competitiveness.

Deriving Critical Insights from Multifaceted Segmentation to Illuminate Key Drivers and Opportunities within the Aftermarket Cold-End Exhaust System Domain

A granular examination of market segmentation reveals nuanced pathways for growth and differentiation across product and service dimensions. Within the product portfolio, catalytic converters remain core to emission compliance initiatives, whereas exhaust pipes, mufflers, and resonators deliver structural integrity and acoustic refinement for diverse end-use scenarios. Vehicle classifications further influence component demand, as heavy commercial vehicles require ruggedized materials and larger bore diameters, light commercial vehicles balance payload optimization with cost efficiency, and passenger cars emphasize noise reduction and design aesthetics.

Shifts in distribution dynamics create additional inflection points: e-commerce platforms offer data-rich channels for real-time inventory visibility and customer analytics, while traditional retail auto parts stores maintain critical relationships with service centers and independent repair shops. Dealerships continue to serve as a key conduit for warranty replacements, yet the rise of do-it-yourself consumers and boutique independent shops underscores the need for accessible technical documentation and tapered packaging strategies. Application segmentation delineates performance upgrade enthusiasts who prioritize sound enhancement and turbocharging enhancements from routine replacement buyers focused on scheduled maintenance or wear-induced failure. Material considerations-including aluminized steel’s cost-effective corrosion resistance, cast iron’s durability under extreme heat, and stainless steel’s premium longevity-further stratify supplier offerings and inform procurement decisions.

This comprehensive research report categorizes the Cold-end Exhaust System Aftermarket market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Vehicle Type

- Distribution Channel

- Application Type

- End User

Unraveling Regional Dynamics to Reveal Distinct Growth Patterns and Strategic Imperatives across the Americas, EMEA, and Asia-Pacific Aftermarket Cold-End Exhaust Markets

Regional markets manifest distinct growth trajectories shaped by local regulatory frameworks, economic conditions, and evolving consumer preferences. In the Americas, a large portfolio of aging passenger fleets and a thriving light commercial segment drive steady demand for replacement components, while sustained investments in logistics infrastructure underpin efficient distribution from Gulf Coast manufacturing hubs to inland repair networks. North American emission mandates continue to spur heightened interest in advanced converter technologies, whereas Latin America presents a dual opportunity for both replacement parts and cost-effective performance upgrades amid rising disposable incomes.

Across Europe, the Middle East, and Africa, regulatory heterogeneity creates a complex landscape where tiered emission zones and national test cycles require agile product calibration strategies. OEM-style components command authority in Western Europe, while aftermarket innovators enjoy growing traction in emerging EMEA markets. The Asia-Pacific region encapsulates both extremes: developed markets such as Japan and Australia demand high-precision stainless steel assemblies, and rapidly motorizing economies in Southeast Asia and India lean toward durable cast iron and aluminized steel solutions that balance cost and reliability. Pan-regional trade agreements and strategic free trade zones continue to influence routing decisions and cross-border inventory staging for global distributors.

This comprehensive research report examines key regions that drive the evolution of the Cold-end Exhaust System Aftermarket market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Dominant Players and Emerging Innovators Driving Competitiveness and Technological Advancement in the Aftermarket Cold-End Exhaust System Sector

The competitive arena of the aftermarket cold-end exhaust system segment features a blend of established automotive suppliers and specialized performance brands. Leading tier-one providers leverage global manufacturing footprints and deep expertise in catalytic substrate technology, investing heavily in research partnerships to meet tightening emission standards. Their product portfolios often integrate sensor technologies for onboard diagnostics, ensuring alignment with OBD-II and emergent OBD-III frameworks. Meanwhile, niche innovators in the performance exhaust category differentiate through bespoke muffler designs, precision-machined resonator chambers, and co-development initiatives with motorsport teams to drive brand equity among enthusiast communities.

Strategic alliances and vertical integration remain prevalent, as manufacturers seek to control critical inputs and accelerate time-to-market. Key market actors maintain stringent quality certifications and employ additive manufacturing techniques for rapid prototyping of complex geometries. Distributors and service network operators are forging digital partnerships to harness e-commerce analytics, enhancing order accuracy and predictive restocking algorithms. Importantly, independent repair shops and dealerships that cultivate strong relationships with these technology-driven suppliers gain preferential access to training, technical support, and early product launches, reinforcing a virtuous cycle of innovation and aftersales excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cold-end Exhaust System Aftermarket market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apex Motors, LLC

- BorgWarner Inc.

- Borla Performance Industries Inc.

- Bosal Group

- Catalytic Exhaust Products Ltd.

- Corsa Performance

- DBW Advanced Fiber Technologies GmbH

- DCSports

- Donaldson Company, Inc.

- Eberspächer Exhaust Aftermarket GmbH & Co. KG

- Faurecia SE

- Flowmaster, Inc.

- Gibson Performance Exhaust.

- Grand Rock Co., Inc.

- Injen Technology

- JEGS High Performance

- Just Bolt-On Performance Parts

- MagnaFlow

- Magneti Marelli S.p.A.

- MBRP Ltd.

- Melbourne Motorsport

- Nelson Global Products

- Rogue Engineering

- STILLEN

- Tenneco Inc.

Formulating Actionable Recommendations to Empower Industry Leaders to Capitalize on Emerging Trends and Navigate Market Disruptions in the Aftermarket Cold-End Exhaust Domain

To navigate current headwinds and capitalize on latent growth opportunities, industry leaders should prioritize innovation in materials science and modular manufacturing. By investing in next-generation stainless steel and composite hybrids, suppliers can deliver higher performance and longer service life while optimizing overall production costs. Simultaneously, strengthening digital distribution ecosystems through strategic partnerships with leading e-commerce platforms and implementation of advanced warehouse management systems can significantly enhance order fulfillment accuracy and reduce lead times.

Beyond operational enhancements, developing region-specific product lines tailored to local emission standards and consumer preferences will deepen market penetration. Organizations that offer bundled solutions-combining performance upgrade kits with technical training for independent shops-stand to capture incremental value and foster brand loyalty. Lastly, proactive engagement with regulatory bodies and participation in industry working groups will ensure that product roadmaps anticipate future policy shifts, safeguarding competitive advantage and aligning corporate strategy with evolving environmental objectives.

Detailing a Robust and Rigorous Research Methodology Underpinning Comprehensive Analysis of the Aftermarket Cold-End Exhaust System Value Chain and Market Dynamics

This report’s findings derive from a rigorous, multi-stage methodology designed to validate and triangulate insights across primary and secondary sources. The primary research phase encompassed structured interviews with senior executives at component manufacturers, distribution channel leaders, and key franchise dealerships, enriching quantitative data with qualitative perspectives on supply chain challenges, product innovation, and end-user behavior. In parallel, an extensive survey of independent repair shops and DIY consumers yielded granular insights into purchasing criteria, service frequency, and aftermarket brand perceptions.

Secondary research entailed a comprehensive review of legislative databases, trade association publications, and material science journals to map regulatory developments and technological trajectories. Trade flow analyses leveraged customs and tariff data to assess the impact of 2025 trade policies on import-export volumes. All data points underwent validation through a rigorous triangulation process, ensuring consistency across multiple information streams and fortifying the robustness of conclusions. Quality assurance protocols, including peer reviews by technical experts and audits of raw data sources, further reinforced the reliability of the analyses presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cold-end Exhaust System Aftermarket market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cold-end Exhaust System Aftermarket Market, by Product Type

- Cold-end Exhaust System Aftermarket Market, by Material Type

- Cold-end Exhaust System Aftermarket Market, by Vehicle Type

- Cold-end Exhaust System Aftermarket Market, by Distribution Channel

- Cold-end Exhaust System Aftermarket Market, by Application Type

- Cold-end Exhaust System Aftermarket Market, by End User

- Cold-end Exhaust System Aftermarket Market, by Region

- Cold-end Exhaust System Aftermarket Market, by Group

- Cold-end Exhaust System Aftermarket Market, by Country

- United States Cold-end Exhaust System Aftermarket Market

- China Cold-end Exhaust System Aftermarket Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Summarizing Core Findings and Implications to Chart a Strategic Roadmap for Sustainable Growth and Competitive Advantage in the Aftermarket Cold-End Exhaust Sector

The confluence of evolving regulations, material innovations, shifting trade policies, and dynamic distribution channels presents a rich tapestry of opportunities and challenges for aftermarket cold-end exhaust system stakeholders. From catalytic converters optimized for tighter emission thresholds to modular muffler assemblies that streamline installation, the market demands agility and foresight. Regional intricacies-whether driven by emission zones in Europe or fleet composition in the Americas-underscore the imperative for customized strategies that resonate with local market conditions.

By aligning R&D investments with emerging customer priorities, forging resilient supply partnerships, and leveraging digital channels to enhance service delivery, market participants can unlock sustainable growth. This report’s integrated perspective-covering segmentation insights, regional variances, and company benchmarks-provides a strategic framework for decision-makers intent on safeguarding competitiveness and capturing new revenue streams. As the aftermarket cold-end exhaust system domain continues to evolve, agility and innovation will distinguish the leaders from the followers.

Engage Directly with Ketan Rohom to Secure In-Depth Insights and Customized Solutions from This Authoritative Aftermarket Cold-End Exhaust System Research Offering

The thorough insights presented in this report set the stage for targeted discussions and tailored strategies. To delve deeper into specific market analyses or to explore customized solutions, we encourage you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating complex market intelligence into actionable business plans will provide clarity on critical trends, competitive positioning, and growth levers. By partnering with him, you can secure early access to detailed segments, regional breakdowns, and strategic roadmaps that align with your organization’s unique objectives and operational priorities.

Connect with Ketan Rohom to understand how this exhaustive research can fuel data-driven decisions, optimize your aftermarket product portfolio, and reinforce your market leadership in the cold-end exhaust system domain. He can guide you through bespoke insights and ensure you leverage the full depth of this study to capture emerging opportunities and mitigate potential risks.

- How big is the Cold-end Exhaust System Aftermarket Market?

- What is the Cold-end Exhaust System Aftermarket Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?