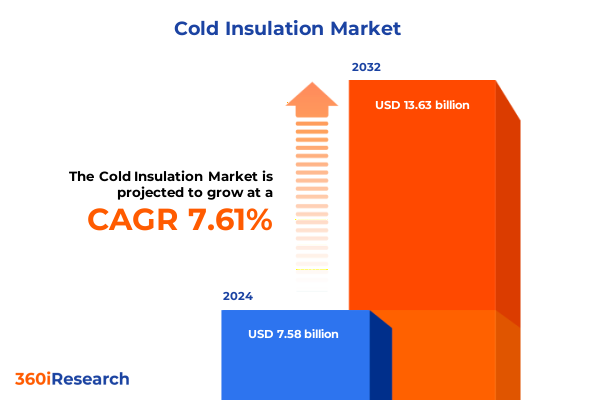

The Cold Insulation Market size was estimated at USD 8.16 billion in 2025 and expected to reach USD 8.79 billion in 2026, at a CAGR of 8.69% to reach USD 14.63 billion by 2032.

Setting the Stage for Advanced Cold Insulation Solutions That Drive Efficiency and Sustainability Across Industrial, Commercial, and Transportation Sectors

In today’s dynamic industrial and commercial landscape, the demand for efficient cold insulation solutions has never been more pressing. Organizations across manufacturing, logistics, and specialized processing are navigating a complex mix of performance requirements, sustainability goals, and regulatory pressures. Within this context, cold insulation emerges as a pivotal technology that drives energy savings, ensures product quality, and reduces emissions. The diversity of materials and application methods underscores the necessity to understand the market’s intricacies and adopt the right strategies.

As global supply chains become more integrated and customer expectations continue to evolve, insulation providers and end users are rethinking traditional approaches. Innovations in foam chemistries, mineral-based insulators, and hybrid products are progressively redefining cost-effectiveness, durability, and environmental credentials. Stakeholders seeking to optimize operational efficiency while meeting stringent environmental targets must gain a holistic perspective-a perspective grounded in both macro-level trends and granular segmentation insights. This report aims to lay the foundation for such an understanding, outlining the critical forces at play and setting the stage for informed decision-making.

Navigating the Wave of Sustainability Mandates Material Innovations and Digital Transformation Shaping Cold Insulation Evolution

In recent years, several transformative shifts have upended the cold insulation landscape, compelling industry leaders to adapt or risk obsolescence. A sustained focus on decarbonization has elevated the role of thermal performance, as organizations seek to diminish energy consumption and align with net-zero commitments. Consequently, material science breakthroughs-ranging from high-cellular polymer foams to engineered mineral wool blends-are being rapidly commercialized, offering enhanced R-values and extended service life under extreme conditions.

Parallel to technical innovation, the regulatory environment has intensified. Countries and regions worldwide are tightening building codes, industrial standards, and chemical usage guidelines. These changes not only accelerate the phase-out of legacy insulation practices but also create opportunities for next-generation systems that balance compliance with cost efficiency. At the same time, the advent of digital twin modeling, machine-learning-driven thermal simulations, and IoT-enabled monitoring is transforming how design, installation, and maintenance are executed. Taken together, these shifts form a holistic ecosystem where performance, sustainability, and data-driven insights converge to reshape market dynamics.

Understanding the Ripple Effects of Newly Implemented U.S. Trade Duties on Insulation Materials and Supply Chain Resilience

The introduction of new tariffs on insulation materials in the United States in early 2025 represents a pivotal juncture for suppliers and end users alike. By imposing additional duties on certain imported polymer foams and mineral-based insulating products, these measures aim to bolster domestic manufacturing capacity while protecting local employment. However, they also trigger immediate cost pressures for industries reliant on competitively priced imports.

In response, manufacturers have begun to reevaluate their supply chain footprints, exploring near-shoring and dual-sourcing strategies. Some are investing in upscaled domestic production lines for extruded polystyrene and advanced polyurethane formulations, while others are pursuing forward integration into compound blending and panel fabrication. The pass-through effect on downstream sectors varies: large-scale cold storage operators can amortize increased expenses over extended contract terms, yet smaller refrigerated transport providers face tighter margins. Overall, the tariff regime has prompted a strategic pivot toward supply chain resilience and localized value capture.

Unraveling Market Dynamics Through In-Depth Material, Product, Application, End-User, and Channel Segmentation Analysis

Delving into the market’s segmentation reveals nuanced performance and adoption patterns among various material classes. Cellular glass stands out for its waterproof properties and compressive strength, making it a preferred choice in high-moisture environments, whereas fiberglass-available in batt, blanket, loose fill, and pipe sections-continues to be valued for its cost effectiveness and fire resistance. Mineral wool, subdivided into rock wool and slag wool, offers remarkable thermal retention in both industrial and commercial settings, while polystyrene, encompassing expanded and extruded variants, delivers compact form factors and consistent insulating capacity. Polyurethane foam, whether in the form of elastomeric sheets, rigid blocks, or spray-applied systems, caters to rigorous specifications in refrigerated warehousing and process cooling.

When considering product form factors, blankets-both faced and unfaced-provide quick installation for non-critical barriers, yet boards with optional facing ensure greater dimensional stability and load-bearing capacity in core structural applications. Coatings have emerged as a thin-film alternative for retrofits and maintenance cycles, while precision-engineered pipe sections minimize thermal bridging in fluid transport networks. The choice of application further influences material selection: blast freezer storage and walk-in cold room installations prioritize high-density foams, whereas chiller and display case insulation often favor thinner mineral solutions to maximize space efficiency. Across transport modes-air, maritime, rail, and road-the balance between weight, durability, and thermal resistance dictates the adoption of specialized elastomeric and spray-foam options.

Ultimately, end-user requirements shape the competitive positioning of each segment. Petrochemical and specialty chemical operators call for corrosive-resistant barriers, dairy, frozen food, and meat & seafood handlers demand hygienic, antimicrobial surfaces, and pharmaceutical and biotech facilities require validated insulation with traceable installation records. Distribution channels influence market access, with direct sales enabling customization, established industrial distributors providing reach into remote regions, and online retail platforms offering rapid procurement for smaller projects.

This comprehensive research report categorizes the Cold Insulation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Product Type

- Distribution Channel

- Application

- End User

Illuminating Regional Growth Drivers and Divergent Investment Trends Across the Americas EMEA and Asia-Pacific Cold Chain Markets

Regional performance in the cold insulation sector is characterized by distinct drivers and investment appetites. Within the Americas, strong demand from food and beverage processing, combined with extensive cold chain infrastructure development, underscores a robust appetite for high-performance foams and boards. Supply chain optimization efforts are particularly focused on integrating modular insulation panels in large-scale cold storage facilities, while retrofit projects in legacy warehouses are accelerating the uptake of spray foam and elastomeric solutions.

Across Europe, the Middle East & Africa, regulatory harmonization under the European Union’s energy efficiency directives and Gulf countries’ sustainability mandates have spurred a shift toward mineral wool and facings with recycled content. Research labs and pharmaceutical plants in this region often lead in qualifying new insulation blends for hygienic and controlled-temperature environments. In Africa, nascent opportunities in cold storage for agricultural exports are driving pilot installations that leverage pre-insulated panels.

The Asia-Pacific region exhibits a bifurcated growth pattern: mature markets such as Japan and South Korea prioritize retrofitting older facilities to meet stricter emissions targets, while emerging economies in Southeast Asia and the Indian subcontinent are expanding greenfield cold storage capacity. These projects often rely on locally produced expanded polystyrene and blended polyurethane foams to balance performance with cost constraints. Integration with renewable energy sources, such as solar-assisted cold rooms in rural areas, further diversifies regional demand profiles.

This comprehensive research report examines key regions that drive the evolution of the Cold Insulation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Pivotal Roles of Scale Players and Agile Innovators Shaping the Cold Insulation Competitive Arena

A handful of industry leaders dominate the cold insulation landscape through technology leadership, scale, and global networks, while specialized innovators capture niche opportunities. Established foam manufacturers have leveraged integrated chemical processing capabilities to deliver high-R-value products at competitive costs, enabling them to supply large cold storage integrators and industrial end users. Conversely, mineral wool producers have focused on sustainability credentials, using recycled slag inputs and advanced binder systems to reduce carbon footprints and improve fire performance.

Engineering firms with turnkey insulation service divisions have gained traction by bundling design, installation, and maintenance support, particularly in complex pharmaceutical and biotech facilities. Meanwhile, agile start-ups are advancing spray-foam chemistry with lower global warming potential blowing agents, and developing hybrid panels that incorporate phase-change materials for transient temperature control. Distribution specialists with broad geographical coverage and e-commerce platforms have democratized access for smaller contractors and aftermarket projects, reshaping procurement practices in remote and underserved markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cold Insulation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Armacell Group

- Aspen Aerogels, Inc.

- BASF SE

- Certainteed by Saint-Gobain S.A.

- DuPont de Nemours, Inc.

- Halcyon Technologies

- Huntsman Corporation

- International Corrosion Services LLC

- Johns Manville

- Kingspan Group

- Knauf Insulation d.o.o.

- KORFF Isolmatic GmbH

- KRAMER GmbH

- Nichias Corporation

- OJ Insulation, L.P.

- Owens Corning

- Refmon Industries

- Rockwool A/S

- Sika AG

- The Dow Chemical Company

- Thermaflex

- Thermax Limited

- Zotefoams PLC

Advancing Competitive Advantage Through Innovation Collaboration and Supply Chain Resilience in Cold Insulation Markets

Industry leaders must prioritize strategic investments in next-generation materials and digital enablement to fortify their market positions. Establishing collaborative R&D partnerships with universities and national laboratories can accelerate the commercialization of novel insulation chemistries, particularly those targeting ultra-low temperature applications. Concurrently, digital twin modeling and predictive analytics should be integrated into product development and service offerings, allowing customers to quantify energy savings and lifecycle costs with precision.

On the supply chain front, near-shoring or multi-regional manufacturing footprints will enhance resilience against trade policy volatility, while investing in automation and continuous processing can drive down production costs. Companies are advised to diversify distribution by strengthening relationships with targeted industrial suppliers and expanding online fulfillment capabilities for rapid order execution. Customer segmentation strategies must be refined, leveraging data analytics to tailor solutions for key end-user verticals such as food & beverage and pharmaceuticals, where compliance and performance demands are most stringent.

Lastly, proactive engagement with regulatory bodies and industry associations will ensure early visibility into evolving standards, enabling preemptive product adaptation. By adopting a holistic approach that blends material innovation, digital transformation, and supply chain agility, market participants can not only navigate current challenges but also shape the next wave of cold insulation advancement.

Revealing an Integrated Research Approach Employing Qualitative Interviews Quantitative Data Triangulation and Case Study Validation

This analysis synthesizes insights derived from a comprehensive blend of primary and secondary research methodologies. Primary data was collected through in-depth interviews with procurement executives, facility engineers, and material scientists across diverse end-user segments. Supplementing these qualitative inputs, extensive secondary research encompassed industry journals, patent filings, and regulatory publications to capture the latest material developments and policy trajectories.

A rigorous data triangulation approach was employed, cross-validating trade association statistics, government import-export records, and proprietary supplier shipment data. Market trends were further validated through comparative case studies of landmark cold storage projects and retrofit initiatives. Quantitative metrics related to thermal performance, cost indices, and lifecycle environmental impact were normalized to industry benchmarks, ensuring consistency and reliability. The segmentation framework was developed through cluster analysis, incorporating material properties, application variables, and customer purchasing behaviors.

Throughout the study, adherence to methodological best practices-such as transparent data sourcing, detailed documentation of assumptions, and ongoing stakeholder feedback loops-ensured the robustness of conclusions and the relevance of recommendations for diverse strategic planning scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cold Insulation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cold Insulation Market, by Material

- Cold Insulation Market, by Product Type

- Cold Insulation Market, by Distribution Channel

- Cold Insulation Market, by Application

- Cold Insulation Market, by End User

- Cold Insulation Market, by Region

- Cold Insulation Market, by Group

- Cold Insulation Market, by Country

- United States Cold Insulation Market

- China Cold Insulation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Concluding On the Critical Intersections of Trade Policy Innovation and Strategic Agility Defining the Future of Cold Insulation Markets

The global cold insulation landscape is at a pivotal crossroads where technological innovation, regulatory evolution, and shifting trade policies intersect to redefine industry paradigms. As end users increasingly demand high-performance, environmentally responsible solutions, suppliers must leverage cutting-edge materials and data-driven services to capture opportunity and mitigate risk. Understanding the nuanced interplay of segmentation dynamics and regional growth trajectories will be critical for stakeholders aiming to differentiate their offerings and expand market share.

With U.S. tariff measures prompting supply chain realignment and sustainability imperatives driving material innovation, the next frontier in cold insulation hinges on agility-both in operations and in strategic planning. Companies that foster collaborative R&D, invest in digital modeling, and cultivate resilient distribution networks will be best positioned to outpace competition. Ultimately, the ability to translate deep market insights into actionable programs will determine success in an environment where efficiency gains translate directly into bottom-line results and long-term viability.

Unlock Critical Cold Insulation Market Insights and Propel Your Business Forward by Engaging with a Dedicated Research Expert

Act now to secure unparalleled clarity on the cold insulation market by connecting with Ketan Rohom, Associate Director of Sales & Marketing, for personalized insights and your tailored research report. Ketan Rohom brings extensive expertise in global insulation trends and stands ready to guide your decision-making process by aligning the report’s detailed analysis with your strategic objectives. Reach out today to discuss how this comprehensive study can inform your next move, whether you’re evaluating new materials, expanding into emerging regions, or assessing tariff impacts. With a custom consultancy approach, you’ll gain the actionable intelligence needed to stay ahead in an increasingly competitive and evolving market landscape.

- How big is the Cold Insulation Market?

- What is the Cold Insulation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?