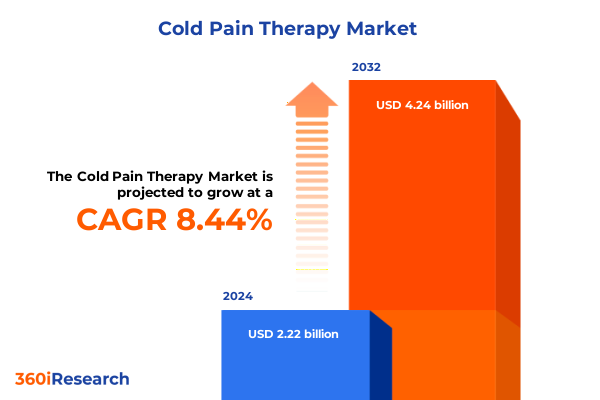

The Cold Pain Therapy Market size was estimated at USD 2.41 billion in 2025 and expected to reach USD 2.61 billion in 2026, at a CAGR of 8.42% to reach USD 4.24 billion by 2032.

Exploring the Advancements and Growing Significance of Innovative Cold Pain Therapy Solutions Within Modern Healthcare and Patient-Centered Wellness Practices

Cold pain therapy has emerged as a cornerstone of multimodal pain management, reflecting an increasing emphasis on non-pharmacological interventions to enhance patient outcomes. Recent advancements in materials science and device engineering have elevated traditional methods-such as ice packs and cold sprays-to technologically sophisticated systems that combine precise temperature control with user-friendly designs. This shift supports a broader trend toward patient-centered care, where comfort, convenience, and efficacy converge to reduce reliance on opioids and other analgesics.

Moreover, as healthcare providers and consumers alike seek evidence-based alternatives, clinical studies continue to validate the efficacy of cryotherapy and compression-based approaches in alleviating acute and chronic pain. This evolving landscape underscores the significance of cold pain therapy within both professional settings and home-based self-care environments, setting the stage for dynamic growth and innovation.

Identifying the Key Technological, Clinical, and Consumer-Driven Shifts Reshaping the Cold Pain Therapy Market Landscape

Over the past few years, the cold pain therapy market has undergone transformative shifts driven by technological breakthroughs and shifting consumer preferences. Innovative device miniaturization, along with the integration of digital monitoring tools, has enabled the development of portable systems capable of delivering consistent and controlled cooling. These advances have facilitated broader adoption beyond clinical settings, empowering users to manage symptoms with precision outside traditional healthcare facilities.

At the same time, collaborations between medical device manufacturers and research institutions have accelerated the translation of laboratory discoveries-such as novel phase-change materials-into commercially viable products. Combined with heightened patient awareness of the risks associated with prolonged medication use, these developments are reshaping the competitive landscape. As a result, companies are prioritizing product differentiation through enhanced safety features, connectivity, and ergonomic design, while regulatory bodies continue to refine standards to ensure efficacy and user safety.

Assessing the Comprehensive Influence of 2025 United States Tariffs on Supply Chains, Pricing Dynamics, and Industry Stakeholders in Cold Pain Therapy

In 2025, the implementation of revised United States tariff schedules has had a palpable effect on the cold pain therapy sector, influencing the cost structure of imported components and finished devices. Tariffs on cooling-control units and specialized packaging materials have particularly impacted manufacturers relying on global supply chains, leading to incremental increases in production expenditures. These elevated costs have, in turn, exerted upward pressure on the end-user pricing of select product categories.

Consequently, domestic producers have intensified efforts to source alternate materials and bolster local manufacturing capabilities in order to mitigate the impact of import duties. At the same time, some global competitors have explored tariff-optimization strategies, such as establishing U.S.-based assembly lines or renegotiating supplier agreements. These adaptive measures highlight both the challenges and opportunities arising from tariff-driven market realignment, ultimately fostering greater resilience and supply chain diversification.

Unveiling Critical Market Segmentation Insights Across Product Types, End Users, and Applications Driving Cold Pain Therapy Adoption

A nuanced understanding of market segmentation reveals distinct performance drivers and adoption patterns across multiple dimensions. By type, the landscape encompasses traditional cold packs, handheld cold sprays, and compression cold therapy systems, further subdivided into electronic and manual variants. In addition, the field includes sophisticated cryotherapy devices offering both localized and whole-body treatments, as well as integrated ice bath systems suitable for high-intensity athletic and rehabilitation applications. Each category presents unique value propositions: for instance, electronic compression units deliver programmable temperature profiles, while manual solutions deliver simplicity and cost-effectiveness.

Segmentation by end user uncovers equally diverse dynamics, with home care settings encompassing both professional home health providers and consumer self-administration. In parallel, hospitals and clinics-spanning private and public institutions-prioritize clinical-grade solutions featuring stringent safety certifications. Rehabilitation centers break down into occupational therapy and physical therapy facilities, where specialized device ergonomics and durability are critical. Finally, sports clinics and fitness centers encompass both commercial fitness establishments and professional sports organizations, each seeking high-performance systems to expedite athlete recovery. Furthermore, application segmentation highlights the range of targeted uses, from joint pain and muscle soreness to neuropathic discomfort and postoperative recovery. Within sports injuries, the distinction between acute trauma and chronic overuse underscores specific therapeutic protocols and device customization requirements.

This comprehensive research report categorizes the Cold Pain Therapy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- End User

- Application

Analyzing the Diverse Regional Dynamics and Growth Factors Shaping the Cold Pain Therapy Market Across the Americas, EMEA, and Asia-Pacific Regions

Regional analysis of the cold pain therapy landscape underscores significant variations in growth catalysts and regulatory environments. Within the Americas, established reimbursement frameworks and a robust network of outpatient facilities drive uptake of advanced compression and localized cryotherapy solutions. Conversely, emerging economies in Latin America are beginning to adopt home-based systems as consumer purchasing power increases and distribution channels mature.

Across Europe, the Middle East, and Africa, regulatory harmonization under the Medical Device Regulation in the European Union has elevated safety requirements, prompting manufacturers to innovate with compliant and interoperable designs. Simultaneously, high demand for whole-body cryotherapy in wellness-focused markets such as the United Arab Emirates and South Africa highlights the region’s appetite for premium recovery experiences. In Asia-Pacific, rapid expansion of sports medicine centers in China and India, coupled with growing health awareness in Australia and Japan, fuels interest in cost-effective manual systems and next-generation electronic devices. These regional distinctions emphasize the need for tailored go-to-market strategies that align product portfolios with local market drivers.

This comprehensive research report examines key regions that drive the evolution of the Cold Pain Therapy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Strategic Collaborations Propelling Innovation in the Cold Pain Therapy Sector

Industry leaders have taken divergent approaches to capitalize on evolving market opportunities. Prominent medical device companies have expanded their portfolios through strategic acquisitions of specialized cryotherapy startups, securing proprietary technologies and clinical expertise. In parallel, innovative entrants have focused on modular device architectures that allow seamless upgrades and integration with digital health platforms.

Strategic partnerships between equipment manufacturers and sports organizations have further validated product efficacy, while co-development agreements with research universities have accelerated clinical validation. Service-oriented providers have introduced device-as-a-service models, enabling healthcare facilities to access premium technologies through subscription-based offerings. These initiatives exemplify how collaboration, innovation, and flexible business models collectively enhance competitive positioning in the cold pain therapy arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cold Pain Therapy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Aetna Inc.

- Beiersdorf AG

- Breg, Inc.

- Brownmed, Inc.

- BTL Industries, a.s.

- Cardinal Health, Inc.

- Compass Health Brands

- CryoInnovations, LLC

- CryoScience Co., Ltd.

- DJO Global, Inc.

- Fisioline S.r.l.

- Haleon PLC

- Hisamitsu Pharmaceutical Co., Inc.

- HyperIce, Inc.

- Innovative Medical Equipment, LLC

- Johnson & Johnson Services, Inc.

- Kaiser Foundation Health Plan, Inc.

- MECOTEC GmbH

- Medline Industries, LP

- Medtronic PLC

- MeyerDC

- Pacira Pharmaceuticals, Inc.

- Performance Health Holding, Inc.

- Right Coast Medical

- Romsons Scientific & Surgical Pvt. Ltd.

- Sanofi S.A.

- Terran, LLC

- Unexo Life Sciences Pvt. Ltd.

- Whiteley Corporation Pty Ltd

- Zimmer MedizinSysteme GmbH

- Össur Group

Formulating Strategic and Operational Recommendations for Industry Leaders to Capitalize on Emerging Opportunities in Cold Pain Therapy

To thrive in this evolving environment, industry stakeholders should prioritize multi-pronged strategies. First, investing in modular and platform-based designs will facilitate rapid product iteration and customization, enabling swift response to emerging clinical data and regulatory updates. Second, establishing localized assembly and component sourcing networks can buffer against tariff fluctuations, reducing cost volatility and enhancing supply chain resilience.

Additionally, forging alliances with healthcare providers and sports organizations can generate real-world evidence that underscores product differentiation. Finally, embracing outcome-based service models and digital health integrations will address evolving customer expectations, creating recurring revenue streams and reinforcing long-term partnerships. By implementing these recommendations, organizations can position themselves at the forefront of cold pain therapy innovation and secure sustainable growth.

Detailing the Robust Research Methodology Encompassing Data Collection, Expert Validation, and Analytical Frameworks Underpinning Market Insights

This research report synthesizes insights collected through a comprehensive methodology that blends primary and secondary approaches. Quantitative data were gathered from proprietary industry surveys, annual reports, regulatory filings, and publicly available databases. Simultaneously, qualitative inputs were obtained through in-depth interviews with key opinion leaders, including clinicians, physical therapists, and sports medicine experts, to validate market assumptions and uncover emerging trends.

Rigorous data triangulation ensured consistency across various sources, while a structured analytical framework guided the segmentation and company benchmarking processes. Additionally, scenario analysis techniques were applied to assess tariff impacts, supply chain disruptions, and technology adoption pathways. This robust methodological approach underpins the reliability and actionable relevance of the report’s findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cold Pain Therapy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cold Pain Therapy Market, by Type

- Cold Pain Therapy Market, by End User

- Cold Pain Therapy Market, by Application

- Cold Pain Therapy Market, by Region

- Cold Pain Therapy Market, by Group

- Cold Pain Therapy Market, by Country

- United States Cold Pain Therapy Market

- China Cold Pain Therapy Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Synthesizing Key Insights and Strategic Imperatives to Guide Stakeholders in Navigating the Evolving Cold Pain Therapy Market Landscape

The dynamic cold pain therapy market reflects a confluence of technological innovation, shifting regulatory landscapes, and evolving end-user preferences. From precision-controlled electronic compression units to versatile manual systems and immersive cryotherapy chambers, the sector offers a spectrum of solutions tailored to diverse therapeutic needs. Regional variations and tariff implications further underscore the importance of agile strategies and localized partnerships.

As clinical evidence continues to reinforce the benefits of non-pharmacological pain management, stakeholders that adopt modular product architectures, strengthen supply chain resilience, and foster collaborative ecosystems will be well positioned to lead the next wave of market growth. These insights provide a strategic foundation for informed decision-making and future-proof planning in cold pain therapy.

Engage with Ketan Rohom to Secure In-Depth Cold Pain Therapy Market Intelligence and Strategic Guidance for Informed Decision Making

To acquire a comprehensive and data-rich market research report packed with actionable insights, strategic analysis, and future-ready recommendations, connect with Ketan Rohom, Associate Director of Sales & Marketing at our firm. His expertise in cold pain therapy research ensures seamless access to tailored intelligence that meets your business objectives and decision-making requirements. By engaging directly with Ketan, you will gain personalized guidance on optimizing market entry strategies, understanding regulatory nuances, and leveraging technological advancements to secure competitive advantage in this rapidly evolving sector.

Take the next step toward informed investment, product development, and partnership decisions in cold pain therapy by reaching out to Ketan Rohom today. His dedicated approach will help you navigate complex market dynamics, harness emerging opportunities, and mitigate potential risks. Don’t miss the opportunity to transform your strategic planning with authoritative research insights and customized support that drive tangible outcomes and sustainable growth.

- How big is the Cold Pain Therapy Market?

- What is the Cold Pain Therapy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?