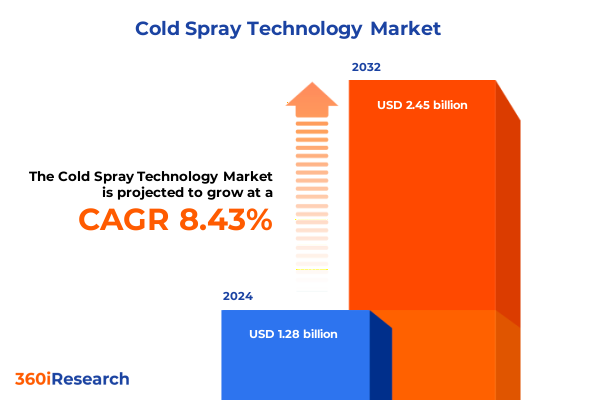

The Cold Spray Technology Market size was estimated at USD 1.38 billion in 2025 and expected to reach USD 1.49 billion in 2026, at a CAGR of 8.51% to reach USD 2.45 billion by 2032.

Unveiling the Power of Cold Spray Technology as a Game-Changing Surface Engineering Solution That Is Revolutionizing Sustainable Manufacturing and Maintenance

Cold spray technology represents a paradigm shift in surface engineering, leveraging supersonic particle velocities to deposit materials without the high thermal input characteristic of traditional thermal spray processes. This low-temperature, solid-state approach preserves the intrinsic properties of both feedstock powders and substrates, enabling the regeneration of worn components, the application of protective coatings, and the creation of near-net-shape parts with exceptional bond strength. Adopters have recognized cold spray’s ability to minimize oxidation, residual stresses, and heat-affected zones, thereby extending component lifespans and reducing maintenance cycles. Moreover, its environmental friendliness-stemming from reduced energy consumption and lower emissions compared to fusion-based alternatives-has catalyzed interest from industries committed to sustainable manufacturing practices. These foundational attributes have propelled cold spray from a niche repair solution to a versatile technology that underpins modern additive manufacturing and advanced coating applications.

Charting the Transformative Shifts Shaping Cold Spray Technology from Material Science Breakthroughs to Industry Four Point Zero Digital Integration

In recent years, cold spray technology has undergone transformative shifts fueled by material science breakthroughs and the advent of Industry Four Point Zero digital paradigms. Innovations in composite powder formulations, encompassing ceramic matrix composites, metal matrix composites, and advanced polymer blends, have expanded the range of achievable mechanical and thermal properties. Concurrently, the incorporation of digital twins and software-driven process control has enabled real-time optimization of particle velocity, feedstock flow rates, and nozzle geometries, thereby enhancing deposition consistency and reducing trial-and-error cycles. Augmented reality overlays and in-line process monitoring are rapidly becoming standard, empowering operators to visualize spray trajectories and detect anomalies before they compromise coating integrity. These digital integrations not only streamline workflow but also facilitate predictive maintenance of equipment, diminishing unplanned downtime. As the industry embraces these shifts, the convergence of material innovation and digital integration is redefining performance benchmarks, setting the stage for more resilient, cost-effective, and agile manufacturing ecosystems.

Assessing the Cumulative Impact of United States Tariff Policies on Cold Spray Technology Supply Chains and Cost Structures in 2025

The landscape of cold spray technology in the United States has been markedly influenced by an array of tariff adjustments enacted in 2025, exerting pressure on supply chains for critical inputs. Under Section 301 actions targeting Chinese imports, tariffs on select tungsten products rose to 25 percent while solar wafers and polysilicon faced rates elevated to 50 percent starting January 1, 2025. These measures aimed to counter intellectual property concerns and bolster domestic manufacturing resilience, but have simultaneously escalated procurement costs for powder raw materials and ancillary electronic components. Moreover, steel and aluminum products-integral to equipment frames and feedstock carriers-remain subject to 25 percent duties imposed under both Section 301 and Section 232 provisions, prompting many suppliers to reassess sourcing strategies. Although certain exclusions on medical gloves and ship-to-shore cranes have been extended through August 31, 2025, the broader cohort of tariffs has induced lead time unpredictability, compelling manufacturers to absorb higher landed costs or accelerate domestic qualifying processes to maintain competitive pricing. As a cumulative effect, the confluence of elevated import duties and tightened global logistics has underscored the imperative for agile supply chain reconfiguration and closer supplier collaboration across the cold spray ecosystem.

Unlocking Deep Insights across Offerings, Equipment Types, Propellant Gases, Materials, Applications, and End Uses to Illuminate Cold Spray Market Nuances

Deep insights across multiple dimensions of segmentation reveal nuanced market dynamics shaping cold spray adoption. Examining the offering dimension, consumables-encompassing powders and gases-have experienced heightened demand as coating and repair applications proliferate, whereas equipment and services continue to evolve through aftermarket support, training, and turnkey solutions. Simultaneously, the emergence of software-as-a-service platforms for process simulation reflects a maturing ecosystem seeking to optimize deposition parameters and predictive maintenance schedules. When viewed through the lens of equipment type, portable cold spray units are gaining traction for on-site repair in defense and aerospace settings, while stationary systems remain preferred for high-throughput production and additive manufacturing cells. Propellant gas selection has also shifted, with helium’s superior jet velocity offset by cost and scarcity concerns, leading to increased adoption of mixed-gas and nitrogen-only configurations that balance performance with operational economics. Material segmentation highlights the growing role of composite powders, from ceramic and metal matrix variants to advanced polymer composites, delivering tailored wear resistance and thermal barrier properties. Metallic powders, particularly aluminum, copper, nickel, and titanium, remain foundational due to their high bond strengths and broad applicability. Applications across additive manufacturing, coating, and repair and remanufacturing underscore cold spray’s versatility, with specialized coating subsegments targeting corrosion resistance, wear mitigation, and thermal barrier functions. End-use industries-from commercial and defense aviation within aerospace to automotive, electronics and electrical, medical devices, and oil and gas-are leveraging cold spray for both novel component fabrication and lifecycle extension of critical assets. These segmentation insights collectively illustrate a market trajectory defined by customization, operational efficiency, and cross-industry applicability.

This comprehensive research report categorizes the Cold Spray Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Process Type

- Material Type

- End-use

- Application

Revealing Key Regional Patterns and Strategic Opportunities for Cold Spray Technology Adoption across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in determining adoption trajectories and investment priorities for cold spray technology. In the Americas, North America serves as a leading adopter, underpinned by strong aerospace and defense sectors that leverage cold spray for aircraft alloy maintenance, naval vessel restoration, and military ground vehicle refurbishment. The presence of advanced additive manufacturing initiatives and federally funded research has further accelerated integration into repair and remanufacturing workflows, affirming the region’s role as a hub for technology maturation. Moving to Europe, the Middle East & Africa, governments are channeling investments into sustainable manufacturing and strategic autonomy, spurring demand for cold spray as a means to reduce waste and extend asset lifecycles. Defense procurement agencies in Europe have increasingly recognized cold spray’s utility for battlefield repairs and legacy equipment upgrade, while Middle Eastern petrochemical and energy sectors are piloting coatings to combat corrosion in harsh environments. Africa’s nascent manufacturing base is gradually exploring cold spray for critical infrastructure maintenance, signaling emerging growth potential amid supportive industrial policies. In the Asia-Pacific realm, rapid industrialization and a booming electronics sector drive significant uptake; countries like South Korea and Japan are integrating cold spray into semiconductor fabrication and electronic component repair, while China and India prioritize aerospace modernization and medical device manufacturing. The confluence of government incentives, sustainability mandates, and robust manufacturing expansion positions the Asia-Pacific region as a high-growth arena where cold spray is emerging as a cornerstone of next-generation production and service models.

This comprehensive research report examines key regions that drive the evolution of the Cold Spray Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Market Leaders Shaping the Future of Cold Spray Technology with Cutting-Edge Solutions

A diverse array of companies is shaping the cold spray technology landscape, each contributing unique innovations and strategic emphasis. Leading aerospace and defense primes-such as Boeing, General Electric, Pratt & Whitney, and Honeywell in the United States, alongside Airbus, Safran, and Rolls-Royce in Europe-are deeply engaged in cold spray research, applying the process to high-value component repair and novel part fabrication. Research institutions and technology providers like The Welding Institute (TWI) have advanced process fundamentals and developed standardized qualification protocols, fostering broader industry acceptance. Equipment manufacturers, including CenterLine, Oerlikon Metco, and Sandvik, have expanded portfolios to encompass portable and stationary systems optimized for diverse material classes, while Titomic’s introduction of augmented reality suites for its portable D523 machine underscores a trend toward immersive operator interfaces and real-time process feedback. Service specialists and software vendors are also gaining prominence, offering end-to-end solutions that blend deposit characterization, simulation-driven parameter optimization, and lifecycle analytics. Together, these players form an ecosystem characterized by collaborative R&D, cross-industry partnerships, and a collective push to unlock new performance frontiers in additive manufacturing, protective coatings, and sustainable remanufacturing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cold Spray Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bodycote PLC

- CenterLine (Windsor) Limited

- Cold Metal Spray

- Concurrent Technologies Corporation

- Flame Spray Technologies B.V.

- Hannecard Roller Coatings, Inc

- Höganäs AB

- IBC Coatings Technologies, Ltd.

- Impact Innovations GmbH

- Impact Innovations GmbH

- KANMETA ENGINEERING CORPORATION

- Lechler, Inc.

- Linde plc

- MALLARD - Mécanique Industrielle

- MetallizingEquipmentCo.Pvt.Ltd.

- OBZInnovation Gmbh

- Plasma Giken Co., Ltd.

- Solvus Global

- Titomic Limited

- TWI Ltd

- TWI Ltd.

- United Coatings Technologies Co., Ltd.

- VRC Metal Systems

- WWG Engineering Pte. Ltd.

Delivering Actionable Recommendations to Help Industry Leaders Navigate Supply Chain Challenges, Innovate Offerings, and Maximize Value with Cold Spray Solutions

Industry leaders can harness the insights presented to drive operational excellence and sustainable growth in cold spray applications. First, diversifying propellant gas sourcing by implementing helium-nitrogen blends or adopting nitrogen-only approaches can mitigate supply risks and manage cost pressures. Second, investing in digital twin platforms and augmented reality process overlays will accelerate knowledge transfer and reduce trial-and-error cycles, ensuring consistent deposition quality across decentralized teams. Third, cultivating strategic partnerships with equipment OEMs and research institutions facilitates access to the latest powder formulations-particularly composite and metallic matrix variants-positioning organizations to tailor coatings and additive manufacturing processes to specific asset requirements. Furthermore, engaging proactively with trade associations and policy forums on tariff developments can unlock exclusion opportunities and ensure timely adaptation to evolving import duty structures. Finally, embedding training programs that upskill maintenance crews and engineers on cold spray best practices will underpin safe, efficient, and innovative deployment, ultimately maximizing return on technology investment. By executing these recommendations, industry stakeholders will not only optimize total cost of ownership but also strengthen their competitive positioning through enhanced asset reliability and greater manufacturing agility.

Illuminating a Robust Research Methodology Blending Primary Interviews, Secondary Data Analysis, and Expert Validation to Ensure Insights Integrity in Cold Spray

This research integrates a multi-faceted methodology to ensure the highest caliber of insight and analytical rigor. The foundation comprises in-depth interviews with a spectrum of stakeholders, including powder suppliers, equipment manufacturers, service providers, and end users across aerospace, automotive, and electronics sectors. These primary engagements were complemented by a thorough review of official tariff notices, patent filings, industry whitepapers, and academic publications to validate technical trends and regulatory impacts. Secondary data was sourced from reputable databases, industry consortiums, and open-source government repositories, with each data point cross-referenced and triangulated to eliminate inconsistencies. An iterative framework guided the thematic synthesis, aligning quantitative observations with qualitative narratives to construct a cohesive market narrative. Expert validation workshops provided a final layer of scrutiny, convening subject matter experts to challenge assumptions, refine segmentation definitions, and confirm the applicability of recommendations. This robust approach ensures that findings are both statistically sound and pragmatically relevant, empowering decision-makers with actionable intelligence underpinned by empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cold Spray Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cold Spray Technology Market, by Offering

- Cold Spray Technology Market, by Process Type

- Cold Spray Technology Market, by Material Type

- Cold Spray Technology Market, by End-use

- Cold Spray Technology Market, by Application

- Cold Spray Technology Market, by Region

- Cold Spray Technology Market, by Group

- Cold Spray Technology Market, by Country

- United States Cold Spray Technology Market

- China Cold Spray Technology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Drawing Strategic Conclusions on Cold Spray Technology’s Role in Driving Efficiency, Sustainability, and Innovation across Diverse Industrial Applications

In conclusion, cold spray technology has transcended its origins as a niche repair process to become an indispensable tool for sustainable manufacturing, advanced additive applications, and strategic asset preservation. The confluence of material innovation, digital integration, and evolving regulatory landscapes-particularly tariff shifts-has catalyzed new opportunities and operational challenges alike. Key segmentations reveal that demand is diversifying across consumables, equipment types, and specialized applications, while regional analyses highlight distinct adoption drivers in North America, EMEA, and Asia-Pacific. Industry leaders must embrace adaptive strategies that address supply chain resilience, leverage software-driven optimizations, and foster collaborative innovation to fully capitalize on cold spray’s potential. As organizations navigate these dynamics, the ability to align technological capabilities with strategic objectives will determine competitiveness in an era defined by efficiency imperatives and sustainability mandates. Cold spray stands at the forefront of this transformation, poised to redefine how industries conceive repair, fabrication, and coating paradigms for the decades to come.

Don’t Miss This Opportunity to Access In-Depth Cold Spray Technology Insights—Contact Ketan Rohom, Associate Director of Sales & Marketing, to Secure Your Report

We invite you to seize this moment and gain a competitive edge by securing unparalleled insights into the cold spray technology market. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to receive a comprehensive market research report tailored to your strategic needs. Engage with Ketan to explore the depth of analysis, detailed segmentation, and actionable intelligence that will empower your organization to navigate emerging opportunities and challenges in the evolving cold spray landscape. Reach out today to ensure your decisions are informed by the highest-quality market data and expert perspectives-your gateway to unlocking the full potential of cold spray innovation.

- How big is the Cold Spray Technology Market?

- What is the Cold Spray Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?