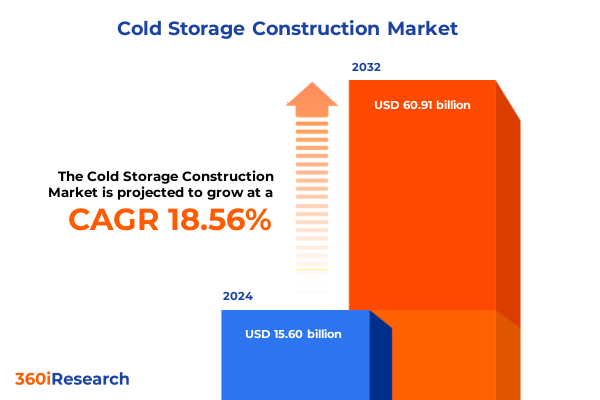

The Cold Storage Construction Market size was estimated at USD 18.44 billion in 2025 and expected to reach USD 21.81 billion in 2026, at a CAGR of 18.60% to reach USD 60.91 billion by 2032.

Unveiling the Critical Emergence of Cold Storage Infrastructure as a Fundamental Pillar of Global Supply Chain Resilience

The global supply chain has undergone a profound transformation in recent years, propelled by surging demand for perishable goods, stringent quality and safety regulations, and the rapid evolution of cold chain technologies. As consumers increasingly seek fresh food, biologics, and temperature-sensitive chemicals delivered with minimal delay, cold storage infrastructure has emerged as an indispensable foundation for ensuring product integrity, reducing waste, and maintaining regulatory compliance. This introduction sets the stage by exploring the convergence of market forces driving the urgent need for advanced construction techniques, sustainable materials, and integrated controls in cold storage facilities.

Against this backdrop, developers and operators face mounting pressure to design and construct storage facilities capable of accommodating diverse temperature requirements-from standard frozen chambers and refrigerated warehouses to ultra low-temperature environments demanded by vaccine storage and cryogenic applications. Coupled with rising energy costs and carbon reduction mandates, stakeholders must balance operational efficiency with capital expenditure and risk management. This introduction establishes the imperative for a holistic analysis of construction strategies, material innovations, and policy impacts, laying a solid foundation for informed decision-making and strategic investment in the cold storage sector.

Navigating Transformative Technological and Operational Shifts Shaping the Future of Cold Storage Construction

The cold storage landscape is undergoing a seismic shift driven by breakthroughs in automation, digitization, and sustainable engineering practices. Traditional construction models, which often rely on labor-intensive onsite assembly and standardized designs, are being replaced by modular prefabrication and digital twins that accelerate project timelines and enhance precision. As robotics-enabled material handling systems and smart sensors become integral to facility operations, construction strategies are evolving to embed technology platforms from the outset, ensuring seamless integration of Internet of Things (IoT) connectivity, real-time monitoring, and predictive maintenance capabilities.

Moreover, environmental imperatives have catalyzed the adoption of low-global-warming-potential refrigerants, high-performance insulation panels, and energy-efficient refrigeration systems. In response to regulatory mandates and corporate sustainability targets, design-build teams now emphasize passive cooling techniques, hybrid solar-assisted refrigeration, and waste heat recovery. The intersection of these transformative shifts underscores a holistic approach to cold storage construction, requiring multidisciplinary collaboration among architects, engineers, sustainability experts, and technology integrators. As a result, industry participants are reimagining project lifecycles to prioritize speed, flexibility, and resilience in the face of unforeseen disruptions.

Assessing the Cumulative Repercussions of 2025 United States Tariff Measures on Material Costs and Construction Dynamics in Cold Storage Projects

The imposition of new tariff measures by the United States in 2025 has exerted a pronounced influence on the cost structure and supply chain strategies for cold storage construction projects. Key inputs such as galvanized steel panels, insulation boards, and specialized refrigeration compressors have experienced elevated duties, compelling project sponsors to reassess sourcing options and manage budgeting contingencies. While some stakeholders have sought to mitigate impacts through volume-based exemptions and bilateral procurement agreements, others have faced extended lead times as domestic suppliers scale capacity to fill gaps left by higher-cost imports.

Cumulatively, these tariff adjustments have reshaped material cost expectations and procurement timelines, prompting a shift toward nearshoring and regional manufacturing hubs. Project teams are increasingly incorporating dual-sourcing strategies, longer horizon contracting, and value-engineering reviews to maintain financial viability. This recalibration emphasizes transparency in supplier pricing, closer collaboration with insulation and compressor manufacturers, and proactive engagement with trade compliance experts. Taken together, the 2025 tariff landscape underscores the importance of agility in procurement planning and highlights the need for robust risk management frameworks in cold storage construction.

Decoding Critical Segmentation Dynamics Revealing Diverse Cold Storage Needs Across Temperature, Industry, Construction, and Insulation Material Spectrums

A comprehensive examination of cold storage construction reveals critical insights when analyzed through multiple segmentation lenses. When categorizing by temperature range, frozen environments dominate initial investments, with blast freezer modules serving high-turnover food processors while standard freezer chambers support long-term bulk storage. Refrigerated construction, encompassing both chilled and advanced controlled atmosphere cells, underpins product freshness in perishables like fruits, vegetables, and dairy. Ultra low-temperature facilities, inclusive of cryogenic storage vaults and mechanical ultra low cells, address specialized needs in vaccine logistics and biologics research.

Evaluating end user industry segmentation highlights the diversified demand profile: chemical projects often integrate industrial gas storage, petrochemical intermediaries, and specialty chemical compounds within temperature-controlled enclosures. Food and beverage construction is tailored toward bakery and confectionery cooling lines, dairy and frozen product warehouses, fresh produce packing houses, and meat and seafood processing halls. Pharmaceutical developments require bespoke biologics and vaccine storage units, dedicated generics warehousing, research and development labs, and temperature-validated cryogenic suites. Construction type segmentation further delineates expansion projects such as capacity upgrades and technology retrofits from new build endeavors, whether as attached additions to existing distribution centers or standalone greenfield facilities. Lastly, insulation material segmentation informs thermal performance and cost considerations, from extruded polystyrene XPS board panels to high-density rock wool applications and polyurethane offerings, including rigid and spray foam variants. This layered segmentation framework illuminates how varied temperature requirements, industry demands, construction strategies, and material selections collectively influence design priorities and capital allocations in cold storage construction.

This comprehensive research report categorizes the Cold Storage Construction market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Temperature Range

- Construction Type

- Insulation Material

- End User Industry

Examining Regional Nuances and Growth Drivers That Distinctly Influence Cold Storage Construction Strategies Across Major Global Markets

Regional dynamics exert a profound influence on cold storage construction imperatives, shaped by climatic conditions, regulatory environments, and supply chain modalities. In the Americas, extensive trade corridors and the expanding e-commerce ecosystem drive demand for both near-port refrigerated warehouses and inland frozen hubs, supporting a burgeoning meat, seafood, and dairy export market as well as pharmaceutical distribution networks that rely on just-in-time delivery. The continent’s varied geography necessitates adaptive construction practices, from hurricane-resilient coastal facilities to energy-efficient cold rooms in temperate inland locales.

Across Europe, the Middle East, and Africa, stringent food safety regulations, cross-border trade agreements, and emerging cold chain corridors in the Gulf Cooperation Council countries underpin growth. Manufacturers in Western Europe focus on retrofitting legacy structures with cutting-edge controls and eco-friendly materials, while infrastructure investments in North Africa and the Levant target fresh produce handling and vaccine storage capacity. In Asia-Pacific, rapid urbanization, government incentives for agritech and pharmaceutical sectors, and the need to preserve tropical exports spur significant new build activity. Regional policy frameworks emphasizing renewable energy integration and carbon neutrality further shape design criteria, fostering innovation in solar-assisted refrigeration and advanced insulation techniques. These diverse regional drivers collectively underscore the necessity of geographically tailored construction strategies in cold storage deployment.

This comprehensive research report examines key regions that drive the evolution of the Cold Storage Construction market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Key Industry Players and Strategic Alliances Driving Innovation and Competitive Positioning in the Cold Storage Construction Arena

The competitive landscape of cold storage construction is defined by organizations that combine construction expertise with specialized cold-chain engineering capabilities. Leading global contractors have established dedicated cold storage divisions, forging alliances with refrigeration technology vendors and insulation manufacturers to deliver turnkey solutions. Their portfolios span greenfield projects in emerging markets, capacity expansions in mature logistics hubs, and retrofits of aging distribution centers to meet evolving regulatory requirements.

Strategic partnerships have become a hallmark of the sector, with technology integrators collaborating with construction firms to embed digital monitoring platforms, robotics-enabled storage systems, and advanced controls from project inception. Panel system providers differentiate through proprietary composite materials that deliver superior thermal resistance and rapid onsite assembly. Engineering consultancies leverage data analytics to model load requirements, optimize energy systems, and validate life-cycle cost projections. These converging capabilities shape competitive positioning, enabling front-runners to secure high-profile contracts with multinational food processors, pharmaceutical giants, and chemical manufacturers seeking seamless project delivery and operational excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cold Storage Construction market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A M King

- American Barcode and RFID Incorporated

- AmeriCold by HCI Equity Partners

- ARCO LIFE SCIENCE INDIA PRIVATE LIMITED

- Cas Gyw Cold Chain System (Jiangsu) Co., Ltd.

- ColdStorage Holding

- DuPont de Nemours, Inc.

- Fuzhou Thermojinn International Trading Co., Ltd.

- Hems Infratech Pvt. Ltd.

- Herocont Prefabricated Modular Building Solutions

- ISD Solutions by The P&M Group Ltd

- Kendall Cold Chain System Co., Ltd.

- Lineage Logistics Holdings, LLC

- Mak Building System Pvt. Ltd.

- NewCold Coöperatief UA

- Primus Builders, Inc.

- R-Cold, INC.

- S. M. Infrastructure Private Limited

- Shandong Greeninte New Energy Technology Development Co., Ltd

- Stellar Group by ICM Partners

- Ti Cold

- Tippmann Group

- United States Cold Storage, Inc.

- VersaCold Logistics Services

Actionable Strategic Imperatives Empowering Industry Leaders to Optimize Cold Storage Infrastructure Investment and Operational Excellence

Industry leaders seeking to capitalize on cold storage demand should prioritize the integration of prefabricated modular systems and offsite component manufacturing to accelerate project schedules and minimize onsite labor dependencies. Emphasizing digital engineering workflows, including virtual design and construction (VDC) and building information modeling (BIM), will facilitate cross-discipline coordination and reduce rework risk. To hedge against supply chain disruptions and tariff fluctuations, organizations should cultivate diversified supplier ecosystems, incorporating regional insulation material producers and domestic equipment fabricators.

Moreover, aligning construction practices with sustainability objectives will be instrumental in meeting regulatory and corporate carbon reduction targets. Investing in passive design measures, solar photovoltaic installations, and waste heat utilization can deliver significant operational savings and strengthen stakeholder value. Finally, establishing collaborative innovation forums with refrigeration technology suppliers and software developers will drive continuous improvement in automation, monitoring, and maintenance strategies. By implementing these actionable recommendations, industry leaders can secure a competitive edge while enhancing the resilience and efficiency of their cold storage infrastructure portfolios.

Outlining a Robust Research Approach Underpinning Comprehensive Analysis of Cold Storage Construction Trends and Market Dynamics

This research is grounded in a rigorous methodology designed to capture the multifaceted nature of cold storage construction. Primary data was collected through in-depth interviews with industry executives, project managers, and technical specialists, providing firsthand perspectives on construction challenges, technology adoption, and regulatory impacts. Complementing these insights, secondary research involved a comprehensive review of industry white papers, government publications, trade association reports, and peer-reviewed journals to validate emerging trends and benchmark best practices.

Data triangulation was employed to reconcile differing viewpoints and ensure the robustness of findings, while qualitative and thematic analysis techniques were used to elucidate patterns in segmentation preferences, regional strategies, and material innovations. The research framework incorporated cross-validation with an advisory panel of domain experts, enhancing the credibility of conclusions. Geographic segmentation analysis enabled comparative examination across major markets, and a strategic lens was applied to distill actionable recommendations. This methodological approach ensures that stakeholders are equipped with reliable, evidence-based guidance for navigating the complex dynamics of cold storage construction.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cold Storage Construction market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cold Storage Construction Market, by Temperature Range

- Cold Storage Construction Market, by Construction Type

- Cold Storage Construction Market, by Insulation Material

- Cold Storage Construction Market, by End User Industry

- Cold Storage Construction Market, by Region

- Cold Storage Construction Market, by Group

- Cold Storage Construction Market, by Country

- United States Cold Storage Construction Market

- China Cold Storage Construction Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Concluding Insights Synthesizing Major Themes to Reinforce Strategic Imperatives for Cold Storage Construction Stakeholders

In conclusion, the cold storage construction landscape is characterized by accelerating technological integration, regulatory complexity, and evolving material innovations. Stakeholders must navigate tariff-induced cost pressures, embrace modular and digital construction workflows, and refine sourcing strategies to maintain competitiveness. The segmentation frameworks outlined-spanning temperature ranges, end user industries, construction types, and insulation materials-highlight the heterogeneity of project requirements and underscore the necessity for tailored design approaches.

Regional insights reveal that nuanced drivers, from export-oriented meat hubs in the Americas to pharmaceutical corridor developments in EMEA and urban food distribution growth in Asia-Pacific, demand localized strategies. Leading contractors and technology integrators are forging alliances to deliver turnkey solutions, while sustainable design imperatives call for renewable energy integration and high-performance materials. By synthesizing these insights, stakeholders can make informed decisions that optimize operational efficiency, mitigate risks, and capitalize on transformative trends shaping the cold storage construction sector.

Embark on an Informed Journey—Connect with Ketan Rohom to Access the Definitive Market Research Report Transforming Cold Storage Construction Strategies

To secure a comprehensive understanding of prevailing and emerging opportunities in the cold storage construction sector, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive market acumen and can guide you through the granular insights, regional dynamics, and strategic imperatives revealed in this report. Engaging with him ensures you gain tailored support in aligning investment priorities, benchmarking against industry best practices, and capitalizing on the transformative shifts reshaping cold storage infrastructure worldwide. Reach out today to leverage expert counsel and accelerate your competitive advantage by accessing the full market research report.

- How big is the Cold Storage Construction Market?

- What is the Cold Storage Construction Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?