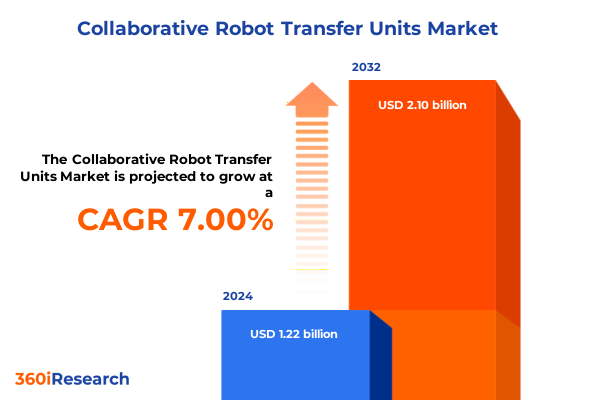

The Collaborative Robot Transfer Units Market size was estimated at USD 1.30 billion in 2025 and expected to reach USD 1.39 billion in 2026, at a CAGR of 7.09% to reach USD 2.10 billion by 2032.

Unveiling the Transformative Role of Collaborative Robot Transfer Units in Modern Manufacturing Environments to Enhance Efficiency and Safety

Collaborative Robot Transfer Units (CRTUs) represent a specialized class of cobots engineered to transport components and assemblies seamlessly between workstations, optimizing production continuity and safeguarding human operators. These systems leverage advanced force-torque sensing and integrated vision technologies to grasp parts with precision, adjust in real time to variations in position or orientation, and facilitate safe cohabitation within the same workspace.

Historically, manufacturers depended on static conveyors and manual handling for interprocess transfers, which introduced bottlenecks, ergonomic hazards, and inflexibility in mixed-production environments. The integration of collaborative robots into transfer applications has disrupted this model by embedding compliant joints, power and force limiting, and proximity sensors that eliminate the need for extensive safeguarding, thereby accelerating cycle times and reducing downtime for changeovers.

Market data reflect a robust upward trajectory for collaborative robot adoption in transfer roles, with 73,000 units shipped globally in 2025-an increase of 31% over the previous year-underscoring the industrial sector’s shift toward human-robot synergy in material handling tasks. Automotive chassis module handoffs, semiconductor wafer transfers, food packaging lines, and laboratory sample movements exemplify the diverse range of applications benefiting from CRTUs’ precision and repeatability.

These transfer units are designed for seamless integration with manufacturing execution systems and plant-floor networks, supporting protocols like Ethernet/IP and Profinet for real-time monitoring and diagnostics. Modular end-of-arm tooling enables rapid redeployment across different lines, meeting high-mix, low-volume demands and empowering manufacturers to respond swiftly to evolving production requirements.

Navigating the Industry 5.0 Revolution with Advanced Collaborative Cobotic Transfer Solutions Driving Flexibility and Precision

The collaborative robotics landscape is undergoing a seismic shift driven by the emergence of Industry 5.0 principles, where human creativity and machine precision converge. CRTUs now embed sophisticated artificial intelligence algorithms to dynamically plan grasping trajectories and optimize transfer paths within crowded cell layouts. Machine vision systems equipped with high-resolution RGB and time-of-flight cameras ensure 95% recognition accuracy while continuously updating spatial models for collision avoidance, enabling safe and efficient part handoffs alongside human colleagues.

Advancements in payload handling have expanded the operational envelope of transfer cobots. Introduction of models such as Universal Robots’ UR20, offering enhanced joint performance with a 30% improvement in reach, and Fanuc’s CRX-25iA, integrating carbon-fiber joints for a payload capacity of 28 kg, illustrate the trend toward heavier-duty collaborative applications. These developments have unlocked material transfer tasks previously reserved for traditional industrial robots, such as engine block movements in automotive plants and turbine blade handling in aerospace manufacturing, with cycle time improvements exceeding 15%.

The connectivity paradigm has also evolved, with IoT-enabled remote monitoring and predictive maintenance capabilities becoming commonplace. Manufacturers can now receive real-time operational alerts, maintenance forecasts, and performance analytics via secure cloud platforms, reducing unplanned downtime by over 40% and supporting continuous performance optimization. This integration of edge computing further enhances responsiveness, allowing CRTUs to execute complex tasks autonomously while reporting key metrics to enterprise systems.

Assessing the Aggregated Consequences of Evolving United States Tariff Policies on Collaborative Robotics Supply Chains and Costs

The cumulative impact of United States tariff policies enacted through 2025 has created significant headwinds for collaborative robotics supply chains and production costs. Tariffs targeting robotics components and subassemblies sourced from China, Taiwan, and South Korea-ranging from 10% to 25%-have elevated the price of critical parts such as actuators, sensors, and microcontrollers, leading to an average 15% increase in manufacturing expenses for CRTU producers.

These heightened costs have been passed through to end users, with equipment prices for cobot transfer units rising accordingly, challenging the value proposition for small and medium enterprises. As many of the key robot manufacturers and integrators relied on cost-effective Asian supply chains, the sudden spike in duties disrupted production timelines, leading to delays and uncertainty for OEMs and end users alike.

In response, leading firms have pursued reshoring and nearshoring strategies, relocating assembly and subassembly operations to Mexico, Southeast Asia, and select U.S. facilities. While these shifts have mitigated exposure to tariff-related price volatility, they have also introduced higher labor and facility costs, compressing margins and extending lead times for CRTU deployments. At the same time, R&D investment has accelerated as manufacturers redesign products to reduce reliance on high-tariff components and integrate alternative semiconductor and sensor suppliers.

Deciphering Intricate Segmentation Dynamics Shaping Cobotic Transfer Applications Through Payload Capacity Axis Mount and Integration Variants

Collaborative robot transfer units are analyzed through a multifaceted segmentation lens, beginning with application domains where automotive lines frequently employ units for chassis subassembly, engine assembly, and powertrain component handoffs, while electronics plants leverage these systems for wafer transfers, PCBA handling, and precision test socket loading. In the food and beverage sector, CRTUs streamline packaging, palletizing, and carton erecting, whereas healthcare and laboratory environments utilize them for specimen sorting, vial transfers, and medical device assembly.

Payload capacity represents another critical dimension, with categories extending from up to five kilograms for delicate pick-and-place tasks in electronics and medical laboratories, through five to ten kilograms for general industrial material handling, and above ten kilograms for heavy palletizing, engine block transfers, and automotive assembly tasks. This gradation ensures that systems are precisely matched to part weights, minimizing wear and optimizing cycle times.

The axis configuration classification encompasses six-axis articulated cobots that mimic human arm flexibility for complex transfers, Cartesian gantry systems suited to linear shuttle operations across extended work envelopes, high-speed Delta units optimized for rapid pick-and-place within confined cells, and SCARA robots that deliver selective compliance for planar assembly and transfer tasks. Each architecture fulfills distinct procedural requirements and spatial constraints.

Mount type further refines deployment strategies, with floor-mounted articulated arms integrated into ground-level cells, ceiling-mounted Delta systems suspended for high-throughput pick-and-place above conveyor lanes, and table-mounted SCARA units deployed for bench-top assembly and lab automation. Integration modalities vary between embedded CRTUs seamlessly incorporated as modules within larger production machinery and standalone cells configured as dedicated transfer stations. Connectivity options range from wired Ethernet links for reliable high-bandwidth data exchange to wireless protocols including Wi-Fi 6 and emerging 5G architectures that enable flexible, cable-free deployments and real-time telemetry.

This comprehensive research report categorizes the Collaborative Robot Transfer Units market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Payload Capacity

- Mount Type

- Integration Type

- Connectivity

- Application

Unearthing Pivotal Regional Trends Influencing the Deployment and Evolution of Collaborative Transfer Robots Across Americas EMEA and AsiaPacific

Regional dynamics profoundly influence the adoption and evolution of collaborative robot transfer units, with the Asia-Pacific region leading global deployments. In 2023, 70% of all new industrial robots were commissioned in Asia, underpinned by China’s record installations of 276,288 units and robust domestic manufacturing initiatives that continue to drive advanced automation investments. Government incentives and national Industry 4.0 and 5.0 programs further bolster this momentum, positioning Asia-Pacific as the epicenter of collaborative robotics innovation and scale.

Europe, the Middle East, and Africa collectively account for 17% of new robot installations, with the automotive sector serving as the primary catalyst. European automotive plants, particularly in Germany, Italy, and Spain, integrate CRTUs to automate subassembly and machine tending processes, contributing to regional total of 23,000 new industrial robot deployments in 2024-second only to North America among global regions in the automotive domain. The region’s high robot density underscores strong workforce upskilling programs and cross-industry technology transfer.

The Americas illustrate a diverse landscape, representing 10% of new installations globally and led by the United States, which recorded 37,587 robot commissions in 2023 despite a slight 5% year-over-year decline. Automotive, metals, and electronics industries remain core drivers, but reshoring efforts and workforce retraining initiatives are reshaping the market. Canada and Mexico display cyclical patterns tied to automotive investment, with Canada’s installations growing by 37% and Mexico maintaining a 70% share within its automotive segment.

This comprehensive research report examines key regions that drive the evolution of the Collaborative Robot Transfer Units market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Prominent Industry Leaders and Innovators Steering Advancements in Collaborative Robot Transfer Solutions and Technologies

Industry leaders are investing heavily in next-generation CRTU platforms to capture emerging market opportunities. Universal Robots’ UR20, introduced in 2023, exemplifies a high-payload cobot with 30% greater reach and 25% reduction in joint wear, facilitating heavier material transfers in automotive and logistics applications. ABB’s GoFa series expansion, launched concurrently, integrates advanced safety features and modular programming interfaces, resulting in a 33% adoption lift within electronics and small-scale assembly segments.

KUKA’s LBR iisy Gen 2, released in early 2024, combines precision and adaptability with a 35% increase in task accuracy and broader end-effector compatibility, driving uptake in metalworking and electronics assembly across European and Asian markets. Yaskawa’s AI-enabled HC20DTP model employs dynamic path optimization to deliver 38% productivity gains during pilot testing, while Fanuc’s CRX series, upgraded with IoT-driven remote monitoring and diagnostics, achieved a 42% reduction in unplanned downtime and accelerated deployment confidence among SMEs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Collaborative Robot Transfer Units market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Bosch Rexroth AG

- Denso Corporation

- FANUC Corporation

- Festo SE & Co. KG

- Han’s Robot Co., Ltd.

- HIWIN Corporation

- Igus GmbH

- Iplusmobot Technology Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- KUKA AG

- Mitsubishi Electric Corporation

- Mobile Industrial Robots ApS

- Nippon Bearing Company

- Omron Corporation

- Precise Automation, Inc.

- Rethink Robotics LLC

- Schunk GmbH & Co. KG

- Seiko Epson Corporation

- Thomson Linear

- Universal Robots A/S

- Yaskawa Electric Corporation

Empowering Manufacturing Executives with Strategic Recommendations for Optimizing Collaborative Robotic Transfer Implementation and Resilience

Manufacturing executives seeking to harness the full potential of collaborative robot transfer units should prioritize supply chain resilience by diversifying component sourcing across multiple geographies; this approach mitigates the risk of future tariff shocks and geopolitical disruptions in critical actuator and sensor supply lines. Establishing nearshore and onshore fabrication hubs can further stabilize costs and lead times, while maintaining proximity to key markets.

Investment in workforce development is equally imperative. Organizations must implement targeted training programs that upskill technicians, engineers, and operators in cobot programming, safety standards, and maintenance protocols to ensure seamless integration and sustained performance. Partnerships with academic institutions and specialized training providers can accelerate skill acquisition and cultivate a talent pipeline capable of driving continuous automation innovation.

Finally, leaders should embrace modular, scalable CRTU architectures that support rapid redeployment and multi-model flexibility. Adopting open communication standards and interoperable hardware enables swift adaptation to evolving product portfolios and market demands. By leveraging data analytics and predictive maintenance frameworks, companies can optimize uptime and extend asset lifecycles, translating automated transfer capabilities into measurable productivity and quality improvements.

Detailing a Robust Methodological Framework Employed to Analyze Diverse Data Sources and Validate Collaborative Robot Transfer Market Insights

This research synthesizes primary and secondary data to deliver an authoritative perspective on collaborative robot transfer units. Primary insights were gathered through structured interviews with plant automation engineers, system integrators, and R&D leaders, capturing real-world deployment challenges and best practices. Secondary research encompassed analysis of industry association reports, peer-reviewed technical papers, and press releases from leading robotics firms to validate technology trends and model performance claims.

A rigorous taxonomy was employed to segment the market across application verticals, payload capacities, axis architectures, mounting configurations, integration styles, and connectivity options. Quantitative data from global installation records, regional adoption rates, and component pricing indices were triangulated to ensure robust qualitative conclusions without disclosing sensitive market sizing or forecasting figures.

Technical assessments were corroborated via field demonstrations and supplier workshops, while regulatory and tariff impact analyses leveraged government publications, trade policy briefings, and economic research databases to contextualize cost and supply-chain dynamics. This multi-angle methodology ensures balanced coverage and actionable insights tailored to industry stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Collaborative Robot Transfer Units market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Collaborative Robot Transfer Units Market, by Payload Capacity

- Collaborative Robot Transfer Units Market, by Mount Type

- Collaborative Robot Transfer Units Market, by Integration Type

- Collaborative Robot Transfer Units Market, by Connectivity

- Collaborative Robot Transfer Units Market, by Application

- Collaborative Robot Transfer Units Market, by Region

- Collaborative Robot Transfer Units Market, by Group

- Collaborative Robot Transfer Units Market, by Country

- United States Collaborative Robot Transfer Units Market

- China Collaborative Robot Transfer Units Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Perspectives on the Rising Significance and Strategic Imperatives of Collaborative Robotic Transfer Units in Future Production

Collaborative robot transfer units have emerged as a cornerstone of modern manufacturing, bridging the gap between human ingenuity and machine consistency. Their ability to handle complex material transfers with precision, agility, and safety underpins the evolution toward highly flexible, human-centric production systems aligned with Industry 5.0 objectives.

The confluence of advanced payload capabilities, AI-driven vision, modular integration approaches, and resilient supply-chain configurations positions CRTUs as critical enablers of agile, scalable operations. Regional adoption patterns confirm that manufacturers worldwide recognize the strategic value of these systems in addressing labor challenges, quality imperatives, and market volatility.

As businesses continue to navigate tariff uncertainties, shifting labor dynamics, and rapid product innovation cycles, the strategic deployment of collaborative transfer robots will define competitiveness across key industries. Forward-looking organizations that couple technology investment with workforce upskilling and supply-chain diversification will unlock sustained productivity gains and quality enhancements.

Take Immediate Action Contact Associate Director Sales and Marketing for Exclusive Access to the Comprehensive Collaborative Robot Transfer Report

Embark on the next phase of operational excellence by securing your exclusive copy of the comprehensive collaborative robot transfer units market research report. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored insights and detailed strategic analysis designed for decision-makers seeking a competitive edge. Engage now to unlock forward-looking perspectives, proprietary data, and expert guidance to propel your organization’s automation initiatives forward and realize transformative outcomes

- How big is the Collaborative Robot Transfer Units Market?

- What is the Collaborative Robot Transfer Units Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?