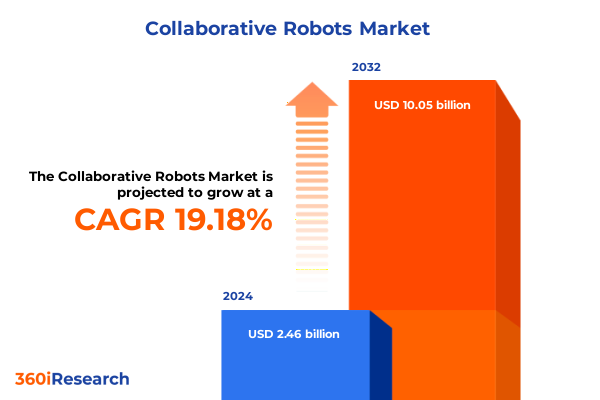

The Collaborative Robots Market size was estimated at USD 2.90 billion in 2025 and expected to reach USD 3.43 billion in 2026, at a CAGR of 19.39% to reach USD 10.05 billion by 2032.

Exploring the Rising Influence and Strategic Importance of Collaborative Robots Across Modern Industrial Processes Worldwide and Their Transformative Potential in Automated Workflows

The global manufacturing and automation sectors are witnessing a paradigm shift as collaborative robots-often referred to as cobots-take center stage in enhancing operational efficiency and workforce collaboration. Unlike traditional industrial robots that require safety cages and complex programming, cobots are designed to work alongside human operators safely and intuitively. By integrating advanced sensors, force-feedback algorithms, and user-friendly interfaces, these machines can adapt to dynamic environments and varying task requirements without extensive retooling.

In recent years, modular end-effectors and cloud-based software platforms have further expanded the applications of collaborative robots from high-precision assembly to delicate material handling. Organizations are now deploying cobots not only to augment human labor in repetitive tasks but also to drive higher throughput, improve product quality, and reduce injury rates. This rise in adoption is underpinned by converging factors such as the growing skills gap in technical trades, the need for flexible automation in small and medium enterprises, and a broader industry push toward digital transformation.

This executive summary provides a comprehensive overview of the collaborative robot landscape, charting the latest technological advancements, regulatory influences, and market segmentation insights. By examining how tariffs, regional dynamics, and leading players shape competitive positioning, stakeholders can gain a holistic understanding of where the industry is headed. Ultimately, this report aims to equip decision-makers with the evidence and strategic guidance necessary to implement and scale cobot initiatives successfully.

Unveiling Key Technological Innovations Operational Paradigm Shifts and Ecosystem Evolution That Are Redefining Collaborative Robotics in Manufacturing and Beyond

Over the past decade, collaborative robots have evolved from niche research prototypes into indispensable tools for modern manufacturing and service industries. Early iterations relied on simple collision detection and limited payload capacities, but recent breakthroughs in machine learning, edge computing, and digital twin technology have revolutionized cobot capabilities. Advanced vision systems and artificial intelligence enable real-time object recognition and adaptive motion planning, allowing robots to perform complex inspections and handle variable parts without extensive reprogramming.

Moreover, the integration of IoT connectivity has created new possibilities for predictive maintenance and seamless coordination with enterprise resource planning systems. By continuously monitoring force, speed, and environmental conditions, cobots can autonomously schedule service interventions before failures occur, thereby minimizing unplanned downtime. Meanwhile, the emergence of universal grippers and swappable tooling kits empowers manufacturers to reconfigure workcells on the fly, supporting shorter production runs and greater customization.

Ecosystem development has also accelerated with the proliferation of developer communities and open-source control architectures. Collaborative robotics platforms now feature software development kits that enable third-party application vendors to innovate specialized modules for welding, painting, and material dispensing. As a result, the marketplace for cobot accessories and application software has expanded rapidly, fostering competitive differentiation and driving down total cost of ownership. These transformative shifts are reshaping operational paradigms, enabling organizations of all sizes to harness the power of automation in ways previously unimaginable.

Assessing the Cumulative Impact of United States Tariffs Imposed in 2025 on Collaborative Robot Supply Chains Operational Cost Dynamics and Strategic Sourcing Decisions

In 2025, the United States implemented an incremental round of tariffs targeting imported robotic components and complete cobot systems, heightening the complexity of global supply chains. These measures build upon earlier levies introduced in the late 2010s and early 2020s, which had already prompted many original equipment manufacturers to diversify sourcing and localize certain production stages. The latest tariffs encapsulate not only finished robots but also critical subsystems such as advanced force sensors and pneumatic grippers, leading to a pronounced uptick in landed costs for end users.

Consequently, organizations reliant on imported collaborative robots have had to reassess capital expenditure plans and evaluate long-term service agreements to mitigate cost volatility. Some have engaged in co-investment partnerships with domestic integrators and robotics startups to establish in-country assembly lines, while others have negotiated volume discounts with global vendors in exchange for multi-year procurement commitments. Meanwhile, aftermarket service providers have seen increased demand for retrofits and component refurbishments as manufacturers seek to extend the operational life of existing installations.

Despite these headwinds, the tariff environment has accelerated innovation in the domestic robotics sector, spurring public-private collaborations and targeted funding for localized manufacturing hubs. As a result, nearly a third of new collaborative robot deployments in 2025 incorporate parts made or assembled on U.S. soil, reflecting a strategic shift toward supply chain resilience. Organizations that proactively adapted their sourcing strategies and invested in modular automation architectures have managed to preserve agility and control costs in an increasingly protectionist trade climate.

Illuminating Critical Segmentation Insights Across Technology Type Payload Capacity Mounting and Application End Users to Guide Targeted Cobot Strategies

A deep dive into market segmentation reveals diverse adoption drivers and performance requirements across collaborative robot deployments. When examining product types, hand guiding variants dominate scenarios requiring direct human interaction and rapid redeployment, whereas power and force limiting cobots excel at precision assembly tasks. Safety rated stop models have gained traction in applications such as machine tending and complex assembly, and speed and separation systems are increasingly leveraged for pick-and-place operations in shared workcells.

Payload capacity further stratifies use cases: lightweight units up to 5 kilograms serve electronics and pharmaceutical handling, while mid-range cobots in the 5 to 10 kilogram class facilitate tasks like screw driving and polishing. Robots in the 10 to 20 kilogram bracket are ubiquitous in food and beverage packaging, whereas higher capacity platforms-20 to 50 kilograms and beyond-address welding and heavy material transfer in automotive and metal fabrication settings.

Mounting configurations are equally critical to deployment flexibility. Ceiling-mounted cobots maximize floor space in high-throughput assembly lines, while floor-mounted units offer mobility for multipoint operations across logistics hubs. Wall-mounted systems enable tactile interactions and repetitive polishing or grinding tasks along fixed production lanes. Meanwhile, application-specific variants have emerged for sealant dispensing, inspection and testing, as well as painting processes that demand precise motion control.

End-user industries display differentiated uptake: automotive manufacturers leverage cobots for welding, material handling, and quality inspection, whereas electronics firms adopt them in delicate assembly and testing. Food and beverage processors employ hygienic grippers for packaging, and healthcare and pharmaceutical operations integrate robots in dispensing and laboratory automation. Logistics and warehousing operators rely on collaborative robots for palletizing and order fulfillment, while metal and machinery entities apply them to grinding and machine tending workflows. Sales channels vary significantly: offline partners handle large system integrations, yet online platforms-including brand websites and major ecommerce marketplaces-dominate smaller deployments and retrofit upgrades.

This comprehensive research report categorizes the Collaborative Robots market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Payload Capacity

- Mounting Type

- Application

- End User Industry

- Sales Channel

Mapping Regional Dynamics and Adoption Patterns Across the Americas Europe Middle East Africa and Asia Pacific in the Collaborative Robot Market

Regional dynamics in the collaborative robot market reflect a mosaic of adoption rates, regulatory frameworks, and industrial priorities. In the Americas, manufacturers and logistics providers invest heavily in automation to address labor shortages and enhance throughput. The United States leads in cobot-enabled automotive assembly and advanced life sciences laboratories, supported by federal incentives for domestic robotics innovation and workforce retraining programs.

Across Europe, the Middle East, and Africa, diverse industrial landscapes drive varied deployment strategies. Western European automotive and electronics clusters integrate cobots to maintain just-in-time production efficiencies, while manufacturers in Central and Eastern Europe focus on cost-effective assembly and machine tending solutions. The region’s stringent safety standards and certification requirements have propelled the adoption of advanced sensor suites and AI-driven collision avoidance technologies.

The Asia-Pacific region continues to outpace others in volume, fueled by high-volume electronics manufacturing in East Asia and burgeoning automotive output in Southeast Asia. Japan and South Korea spearhead collaborative robot innovation, with local OEMs offering bespoke solutions optimized for dense production environments. In China, government-backed initiatives support the integration of cobots in small and medium enterprises, accelerating technology transfer and boosting service robotics applications in logistics and retail.

This comprehensive research report examines key regions that drive the evolution of the Collaborative Robots market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Innovations Driving Competitive Advantage and Collaboration in the Evolving Collaborative Robotics Sector

An examination of leading participants reveals a competitive landscape shaped by diverse value propositions and innovation strategies. Global automation giants have expanded their collaborative robotics portfolios through targeted acquisitions and strategic alliances, integrating proprietary software ecosystems with a broad range of end-effectors. Simultaneously, specialized startups have carved out niches by focusing on human-centric design, ease of integration, and cost efficiency for small to medium enterprises.

Established industrial robot manufacturers leverage their global service networks and brand recognition to secure large-scale automotive and electronics contracts, while upstarts emphasize modular platforms and subscription-based software licensing. Several vendors have differentiated themselves by offering pre-validated application kits for specific tasks such as polishing, screw driving, and dispensing. Others have prioritized interoperability, developing platform-agnostic controllers compatible with multiple robot brands to simplify integrator workflows.

Strategic partnerships between hardware providers and software developers have given rise to integrated digital twin solutions, enabling virtual commissioning and performance optimization prior to physical deployment. Leading firms in this space have also invested in training academies and certification programs to cultivate a skilled operator base. As competition intensifies, the ability to deliver end-to-end automation solutions-combining hardware, software, and services-has emerged as the key differentiator in securing government contracts and global manufacturing agreements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Collaborative Robots market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Arcsecond Drive

- Bosch Rexroth AG

- Comau S.p.A.

- DENSO WAVE INC.

- F&P Robotics AG

- Fanuc Corporation

- Kawasaki Heavy Industries, Ltd.

- Kuka AG

- Locus Robotics Corporation

- Mitsubishi Electric Corporation

- MRK-Systeme GmbH

- Omron Corporation

- ONExia Inc.

- Productive Robotics, LLC

- PROMATION INC.

- RG Group

- Seiko Epson Corporation

- Shanghai Turin Smart Robot Co.,Ltd.

- Shenzhen Yuejiang Technology Co., Ltd.

- SMC Corporation

- Techman Robot Inc.

- Telefonaktiebolaget LM Ericsson

- Universal Robots A/S

- Yaskawa Electric Corporation

Delivering Actionable Strategic Recommendations for Industry Leaders to Navigate Technological Disruption Regulatory Challenges and Market Opportunities in Cobots

To capitalize on the strategic potential of collaborative robots, industry leaders should prioritize investments in workforce upskilling and cross-functional collaboration. Developing tailored training modules that blend virtual reality simulations with hands-on practice can accelerate operator proficiency and confidence. In parallel, organizations should establish cross-departmental automation councils to align IT, engineering, and operations stakeholders around common objectives and performance metrics.

Diversifying supply chains is equally critical. Companies must assess alternative sourcing options for critical components and explore partnerships with domestic integrators to mitigate tariff-related cost pressures. Incorporating modular automation architectures will enable rapid reconfiguration of workcells in response to shifting demand patterns or regulatory changes. Furthermore, pilot programs that test mixed fleets of cobots from multiple vendors can help identify optimal performance and total cost of ownership profiles.

Embracing data analytics and cloud connectivity will unlock predictive maintenance insights and real-time performance benchmarking. By aggregating operational data across facilities, executives can identify productivity bottlenecks and standardize best practices globally. Moreover, engaging with policymakers and industry consortia to shape safety standards and workforce development initiatives will ensure a conducive regulatory environment for cobot expansion. Finally, fostering customer education through live demonstrations and proof-of-concept trials can cultivate buy-in and accelerate deployment at scale.

Outlining a Rigorous Research Methodology Combining Quantitative Data Analysis Qualitative Stakeholder Engagement and Validation in Cobot Market Intelligence

This research integrates a comprehensive methodology designed to ensure rigor and reliability. The quantitative component draws upon a structured database of industry shipments, product registrations, and tariff schedules, triangulated with public financial disclosures and trade statistics. Parallel qualitative insights were obtained through in-depth interviews with senior executives at OEMs, integrators, and end-users across multiple continents, capturing real-world adoption patterns and decision-making criteria.

Desk research encompassed technical whitepapers, regulatory filings, and patent analyses to map emerging technology trajectories. To validate preliminary findings, a panel of independent subject matter experts-including robotics engineers, supply chain analysts, and labor economists-provided iterative feedback. This multi-stage review process ensured that assumptions around cost impacts, application suitability, and segmentation were grounded in both empirical evidence and industry consensus.

Finally, the study applied scenario planning techniques to assess potential disruptions from policy changes, technological breakthroughs, and macroeconomic shifts. By stress-testing various tariff scenarios and adoption curves, the research offers stakeholders a range of strategic pathways tailored to different risk appetites. Throughout, data integrity and transparency were maintained via rigorous documentation and audit trails, ensuring that conclusions can withstand scrutiny and inform long-term strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Collaborative Robots market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Collaborative Robots Market, by Type

- Collaborative Robots Market, by Payload Capacity

- Collaborative Robots Market, by Mounting Type

- Collaborative Robots Market, by Application

- Collaborative Robots Market, by End User Industry

- Collaborative Robots Market, by Sales Channel

- Collaborative Robots Market, by Region

- Collaborative Robots Market, by Group

- Collaborative Robots Market, by Country

- United States Collaborative Robots Market

- China Collaborative Robots Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Concluding Key Takeaways on Collaborative Robot Industry Evolution Strategic Imperatives and the Road Ahead for Stakeholders Seeking Competitive Differentiation

The collaborative robot industry stands at the nexus of technological innovation and evolving workforce paradigms. As manufacturers and service providers embrace cobots to augment human labor, they unlock new levels of productivity, quality, and operational agility. However, the journey is not without challenges: shifting trade policies and tariff regimes can introduce cost volatility, while rapid technological change demands continuous skill development and strategic foresight.

Drawing together the insights on transformative technology trends, tariff impacts, and segmentation dynamics reveals a clear imperative: organizations must adopt a holistic approach that balances investment in advanced automation with robust change management. Regional adoption patterns underscore the need for localized strategies, and competitive pressures necessitate a focus on interoperability, data-driven optimization, and ecosystem partnerships. By integrating these elements, stakeholders can position themselves to lead in the rapidly evolving landscape of collaborative robotics.

Encouraging Engagement with Associate Director Ketan Rohom to Unlock Exclusive Market Research Insights and Drive Informed Investment in Collaborative Robots

If you’re ready to translate these insights into strategic advantage and operational excellence, connect with Ketan Rohom (Associate Director, Sales & Marketing) to explore the full collaborative robots market research report. He can guide you through tailored solutions that align with your organization’s objectives, enabling you to make informed investment decisions and capture emerging opportunities in automation. Contacting Ketan will provide you with exclusive access to in-depth analysis, detailed case studies, and actionable recommendations designed to accelerate your robotics initiatives and maximize return on investment.

- How big is the Collaborative Robots Market?

- What is the Collaborative Robots Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?