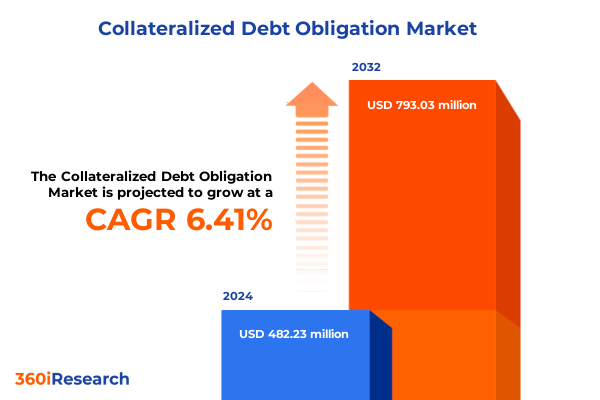

The Collateralized Debt Obligation Market size was estimated at USD 513.85 million in 2025 and expected to reach USD 549.03 million in 2026, at a CAGR of 6.96% to reach USD 823.03 million by 2032.

Exploring the Evolving Dynamics of Collateralized Debt Obligations Amidst a Volatile Financial Landscape, Regulatory Shifts, and Market Innovations

Collateralized debt obligations (CDOs) have evolved into a cornerstone of fixed-income innovation, reshaping the way investors access diversified pools of debt. Originally conceived to distribute and manage credit risk, these structured products now span a broad spectrum of asset classes and tranche structures, catering to the diverse risk appetites of institutional and high-net-worth investors alike. In the aftermath of global financial market fluctuations and tightening regulatory oversight, market participants have honed their analytical frameworks, deploying advanced risk management tools to navigate increasingly complex security structures.

At the same time, evolving macroeconomic factors-including persistent inflationary pressures, shifts in central bank policy, and geopolitical frictions-have heightened the importance of constructing CDO vehicles that balance yield objectives with robust credit safeguards. Against this backdrop, the interplay between regulatory developments, technological advancements, and investor sentiment is driving a renaissance in structured credit innovation. As market participants seek to recalibrate their strategies, it is critical to understand the foundational dynamics shaping current CDO issuances, underlying collateral mix, and tranche layering methodologies.

This executive summary provides decision-makers with a concise yet thorough introduction to the contemporary CDO landscape. By highlighting transformative market forces, the cumulative impact of United States tariff measures, segmentation and regional insights, key company strategies, and actionable recommendations, this overview equips stakeholders with the strategic foresight required to proactively position portfolios for sustainable performance in an ever-evolving credit environment.

Identifying the Seismic Shifts Reshaping the Collateralized Debt Obligation Market Through Technological, Regulatory, and Investor Preference Changes

Over recent years, the collateralized debt obligation market has experienced seismic shifts driven by a confluence of regulatory reforms, technological innovation, and changing investor preferences. In response to post-crisis regulations, issuing entities have adopted more stringent transparency standards and enhanced stress-testing protocols, redefining collateral quality measures and tranche waterfall designs. These developments have elevated due diligence practices, compelling originators and sponsors to adopt granular surveillance of underlying obligor credit metrics and real‐time performance data.

Simultaneously, the rise of digital platforms and artificial intelligence–powered analytics has revolutionized how market participants structure, price, and manage CDO instruments. Advanced modeling techniques enable dynamic monitoring of tranche-level risk exposures, facilitating more agile portfolio adjustments in the face of shifting economic indicators. Moreover, investor demand for bespoke structures-such as ESG-linked tranches and green asset CDOs-has injected fresh impetus into product innovation, driving issuers to embed sustainability criteria within collateral eligibility frameworks.

Looking ahead, market observers anticipate that the confluence of data-driven decision making, evolving regulatory landscapes, and thematic investment mandates will continue to catalyze transformative product evolution. As originators fine-tune credit enhancement strategies and asset managers leverage predictive analytics, the resulting CDO market will offer heightened customization, deeper liquidity, and more resilient performance profiles.

Assessing the Compound Effects of United States Tariff Measures Enacted by 2025 on Underlying Asset Performance and Investor Sentiment

United States tariff measures enacted through 2025 have accumulated to exert multifaceted pressures on the collateralized debt obligation landscape. Initially introduced to address trade imbalances and protect strategic domestic industries, these levies on imported machinery, intermediate goods, and raw materials have reverberated across asset types. Commercial mortgage–backed CDOs, for instance, have confronted rising construction costs and supply chain delays, which have, in certain sectors, weighed on property valuations and rental income projections.

Similarly, collateral pools composed of auto lease receivables and equipment loans have experienced margin compression due to higher vehicle component costs and protracted delivery timelines. These headwinds have prompted underwriters to adopt more conservative loss severity assumptions and adjust credit enhancement levels to preserve targeted ratings. Furthermore, tariff-induced volatility in commodity markets has led rating agencies to revise credit outlooks for CLO tranches backed by leveraged loans to industrial and materials companies, reflecting heightened refinancing risk in interest rate‐sensitive sectors.

Despite these challenges, the cumulative impact of tariffs has also spurred strategic realignments, with certain issuers pivoting toward domestic supply chains and exploring alternative collateral sources less prone to tariff fluctuations. In parallel, hedging strategies-such as cross-currency swaps and commodity derivatives-have gained prominence as investment managers seek to mitigate the residual risk exposure embedded within CDO structures. As such, navigating the intricate web of tariff dynamics has become a critical competency for market participants aiming to optimize risk-adjusted returns in a persistently protectionist trade environment.

Uncovering Critical Segmentation Insights Highlighting How Asset Type, Tranche, Credit Rating, End User, and Maturity Drive CDO Market Dynamics

A nuanced understanding of market segmentation is essential to appreciate how different collateral categories and tranche structures perform under varying economic conditions. When analyzing asset type distributions, collateralized loan obligations stand out for their superior yield profiles and dynamic credit selection processes, whereas asset backed securities benefit from well‐established cashflow conventions. Commercial mortgage exposures, by contrast, hinge on sector‐specific real estate cycles and borrower covenant strength, while residential mortgage pools are critically influenced by household debt metrics and mortgage refinancing trends.

Equally important are tranche-specific dynamics, which determine risk‐reward trade-offs. Equity tranches, often retained by sponsors, absorb initial losses and deliver elevated returns for sophisticated investors willing to assume first‐loss positions. Mezzanine segments balance intermediate risk with moderate yields, while senior note tranches offer enhanced credit protection, appealing to risk-averse institutions seeking stable income streams. Overlaying these structural layers, credit ratings ranging from Aaa down to Bbb and below encapsulate issuer quality and collateral performance history, guiding portfolio allocation and capital requirement calculations.

End-user profiles further shape issuance and trading activity, as banks leverage CDO investments for balance sheet optimization, hedge funds pursue arbitrage opportunities across tranche mispricings, insurance companies incorporate senior notes into liability-matching strategies, and pension funds seek diversified fixed-income exposure with tailored duration characteristics. Moreover, maturity horizons-whether short-term structures maturing under three years, medium-term vehicles spanning three to seven years, or long-term CDOs extending beyond seven years-directly influence duration risk, reinvestment assumptions, and rollover dynamics. Understanding these segmentation layers allows stakeholders to calibrate investment strategies according to specific risk tolerances and yield objectives.

This comprehensive research report categorizes the Collateralized Debt Obligation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Asset Type

- Tranche Type

- Maturity

- End User

Revealing Regional Variations in CDO Market Growth and Risk Profiles Across Americas, EMEA, and Asia-Pacific Regions

Regional market nuances play an instrumental role in shaping issuance trends, risk profiles, and investor demand within the collateralized debt obligation ecosystem. In the Americas, robust capital markets infrastructure, deep liquidity pools, and sophisticated regulatory oversight have supported a wide range of CDO structures, with a notable emphasis on collateralized loan obligations backed by leveraged corporate credits. The depth of investor participation-from domestic pension plans to international asset managers-has fostered a resilient secondary trading environment, enabling efficient price discovery and risk transfer.

Europe, Middle East, and Africa exhibit diverse issuance patterns driven by localized real estate cycles, currency considerations, and varying regulatory frameworks. While Western European markets have seen selective growth in ESG‐linked CDOs and synthetic structures hedging sovereign exposure, emerging economies across the Middle East and North Africa have begun exploring securitization vehicles to unlock liquidity for infrastructure and energy projects. Regulatory initiatives such as harmonized disclosure standards and centralized clearing protocols continue to influence the pace of market maturation in this region.

Asia-Pacific presents an evolving landscape where rapid economic growth, burgeoning credit demand, and evolving legal frameworks have created fertile ground for structured credit innovation. Japanese and Australian issuers have scaled up domestic CDO issuances to manage non-performing loan portfolios and improve capital efficiency, while select markets in Southeast Asia are leveraging asset-backed securitization and collateralized loan structures to fund SMEs and renewable energy projects. As cross‐border investment flows accelerate, currency hedging and local regulatory compliance remain critical considerations for participants navigating this dynamic region.

This comprehensive research report examines key regions that drive the evolution of the Collateralized Debt Obligation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Strategic Partnerships Shaping the Competitive Landscape of the Collateralized Debt Obligation Sector

The competitive landscape of collateralized debt obligations is shaped by a mix of global investment banks, specialist asset managers, and credit sponsors, each deploying distinct strategies to capture investor interest. Major universal banks leverage integrated balance sheet capabilities, underwriting large-scale issuances and providing secondary market liquidity. These players often collaborate with rating agencies and external auditors to ensure rigorous structure validation and maintain market reputation. Their involvement underpins high‐quality execution and broad distribution networks for senior note tranches.

In parallel, boutique credit managers have carved out niche expertise in specific collateral segments, such as middle‐market corporate loans, CLO equity management, and trade receivables securitizations. Their agile operating models facilitate bespoke structuring solutions and proactive credit monitoring, attracting sophisticated hedge funds and insurance clients seeking differentiated risk exposures. Additionally, alternative investment firms have expanded their footprint through strategic acquisitions and joint ventures, combining proprietary analytics platforms with global origination capabilities to develop innovative mezzanine and equity tranche offerings.

Collaboration between banks and specialist managers has given rise to hybrid models, where joint symbiotic arrangements deliver end‐to‐end execution from asset sourcing through tranche structuring to active management. This synergy enhances deal flow, optimizes cost of capital, and accelerates time to market. As competition intensifies, differentiators such as ESG integration, digital issuance platforms, and automated portfolio surveillance tools are becoming pivotal in securing capital commitments and strengthening client relationships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Collateralized Debt Obligation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bank of America Corporation

- Barclays PLC

- BNP Paribas S.A.

- Citigroup Inc.

- Credit Suisse Group AG

- Deutsche Bank AG

- Deutsche Bank Aktiengesellschaft

- Jefferies Financial Group Inc.

- JPMorgan Chase & Co.

- Morgan Stanley

- RBC Dominion Securities Inc.

- The Goldman Sachs Group, Inc.

- The GreensLedge Group LLC

- UBS AG

- Wells Fargo and Co

Delivering Strategic and Operational Recommendations for Industry Leaders to Navigate Emerging Risks, Regulatory Requirements, and Investment Opportunities

To thrive in an environment characterized by regulatory evolution, macroeconomic uncertainty, and the ongoing ramifications of trade measures, industry leaders must adopt a forward-looking strategic playbook. First, establishing robust risk governance frameworks that integrate tariff scenario analysis and stress testing across underlying assets will enable proactive identification of vulnerabilities. By embedding these insights into tranche structuring and derivative overlays, issuers can enhance resilience against supply chain disruptions and interest rate volatility.

Second, prioritizing technological advancements-such as blockchain‐enabled settlement systems and machine learning–driven credit models-will drive operational efficiency and data transparency. These innovations not only reduce transaction costs but also facilitate real-time monitoring of collateral performance, empowering investment managers to adjust positions swiftly and maintain compliance with evolving disclosure standards. Cultivating collaborative platforms that link sponsors, rating agencies, and institutional investors can further streamline due diligence and accelerate deal execution.

Finally, aligning product development with thematic mandates-particularly the integration of environmental, social, and governance criteria-will unlock access to new pools of capital. Structuring green asset CDOs, for example, can attract impact-focused investors while incentivizing borrowers to meet sustainability benchmarks. By adopting a multifaceted approach that combines advanced analytics, strategic hedging, and thematic alignment, market participants can position themselves at the vanguard of structured credit innovation and generate differentiated returns.

Outlining the Comprehensive Research Methodology Incorporating Quantitative Analysis, Qualitative Interviews, and Multi-Source Data Triangulation Techniques

This research report employs a rigorous, multi‐modal methodology to ensure the highest standards of data integrity and analytical rigor. The quantitative analysis is grounded in a proprietary database of historical cashflow performance metrics, tranche pricing information, and default rates, covering a broad spectrum of collateral types and credit ratings. Advanced econometric models and Monte Carlo simulations are deployed to stress-test tranche cashflows under varying macroeconomic and tariff scenarios, providing robust insights into potential loss distributions and return sensitivities.

Complementing the numerical assessments, qualitative insights are derived from in-depth interviews with C-suite executives, structuring specialists, rating agency analysts, and portfolio managers. These expert perspectives enrich the analysis by contextualizing market dynamics, identifying emerging structuring trends, and uncovering operational best practices. Additionally, a comprehensive review of regulatory filings, disclosure documents, and industry white papers informs the report’s evaluation of evolving compliance frameworks and transparency standards.

Data triangulation is achieved by cross-referencing proprietary datasets with publicly available sources, including central bank reports, trade policy announcements, and macroeconomic indicators. Rigorous validation procedures, such as back-testing against actual issuance outcomes and peer benchmarking, ensure the accuracy and reliability of the findings. The combined methodological approach offers stakeholders a holistic and actionable understanding of the collateralized debt obligation market landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Collateralized Debt Obligation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Collateralized Debt Obligation Market, by Asset Type

- Collateralized Debt Obligation Market, by Tranche Type

- Collateralized Debt Obligation Market, by Maturity

- Collateralized Debt Obligation Market, by End User

- Collateralized Debt Obligation Market, by Region

- Collateralized Debt Obligation Market, by Group

- Collateralized Debt Obligation Market, by Country

- United States Collateralized Debt Obligation Market

- China Collateralized Debt Obligation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Remarks Emphasizing Critical Takeaways and Strategic Considerations for Stakeholders Engaged in the CDO Market Ecosystem

The collateralized debt obligation market stands at a pivotal juncture, shaped by an intricate interplay of policy decisions, technological innovations, and evolving investor mandates. As protectionist trade measures continue to influence collateral performance and cost structures, stakeholders must maintain vigilant oversight of tariff developments and their implications for collateral cashflows. Simultaneously, the integration of advanced analytics and thematic criteria-particularly in the domains of sustainability and digital transformation-presents compelling avenues for product differentiation and enhanced risk mitigation.

By synthesizing segmentation and regional insights, along with detailed evaluations of leading market participants, this executive summary underscores the importance of agile structuring and proactive risk management. Industry leaders who embrace data-driven decision making, foster collaborative ecosystems, and align with thematic investment trends will be best positioned to capture emerging opportunities. The strategic recommendations outlined herein offer a blueprint for navigating market complexities while achieving resilient performance across diverse tranche structures and collateral types.

In closing, the evolving collateralized debt obligation landscape rewards those who balance innovation with discipline, harnessing deeper transparency, robust governance, and forward-looking scenario analysis. For decision-makers seeking to refine their credit strategies amidst uncertainty, this report delivers the strategic foresight and practical guidance necessary to secure sustained competitive advantage.

Inviting Stakeholders to Engage with Associate Director Ketan Rohom to Access Detailed Market Intelligence and Drive Strategic Decision Making

In today’s fast-moving financial world, access to accurate and granular market intelligence can be the difference between seizing opportunity and falling behind. To explore the depths of trends, risks, and strategic opportunities within the collateralized debt obligation market, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s deep expertise and consultative approach will guide you through tailored insights, enabling your organization to make informed decisions and optimize portfolio performance.

By engaging directly with Ketan, you will gain exclusive previews of detailed data, bespoke analysis, and scenario planning tools designed to address your organization’s unique requirements. Whether you seek to understand the nuanced effects of changing regulatory frameworks, emerging tariff dynamics, or cutting-edge structuring techniques, this customized dialogue will deliver the clarity and foresight necessary to enhance risk-adjusted returns. Reach out today to arrange a consultation and secure your copy of our comprehensive market research report, unlocking the full potential of high-yield fixed income markets.

- How big is the Collateralized Debt Obligation Market?

- What is the Collateralized Debt Obligation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?