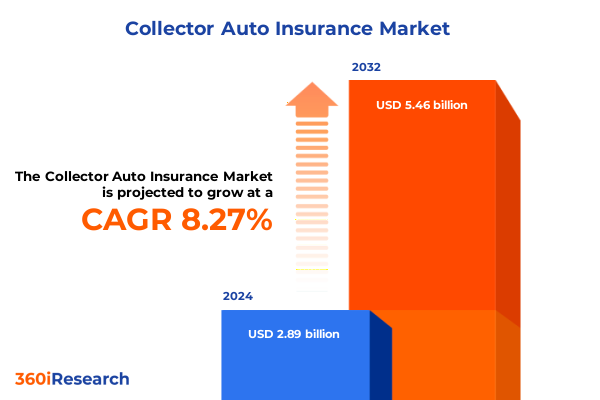

The Collector Auto Insurance Market size was estimated at USD 3.08 billion in 2025 and expected to reach USD 3.36 billion in 2026, at a CAGR of 8.50% to reach USD 5.46 billion by 2032.

Exploring the Rising Significance of Collector Auto Insurance in a Changing Regulatory Environment and Evolving Consumer Preferences

Collector auto insurance, once a niche offering, has evolved into a critical segment that bridges automotive passion with sophisticated risk management. This specialized coverage addresses the unique requirements of vintage, classic, and limited-edition vehicles whose values often appreciate over time, demanding bespoke underwriting approaches. Against a backdrop of shifting regulatory landscapes and technological advancements in vehicle restoration, stakeholders are redefining the parameters of fiduciary responsibility and asset protection for high-value autos.

In the wake of digital transformation across insurance ecosystems, both insurers and policyholders are seeking seamless integration of policy management, claims reporting, and valuation tracking. This integration underscores the necessity of adaptive frameworks that align traditional appraisal methodologies with real-time data analytics. Consequently, industry participants are investing in cloud-based platforms and AI-driven tools, setting the stage for a collector auto insurance market that thrives on precision, transparency, and customer-centric service.

Uncovering the Pivotal Shifts That Are Redrawing the Collector Auto Insurance Landscape Across Technology, Regulation, and Customer Behavior

The collector auto insurance market is witnessing pivotal shifts as emerging technologies and consumer expectations converge. Digital valuation tools are transforming how insurers assess classic vehicles, enabling dynamic appraisal updates that reflect market conditions instantaneously. These advancements, in turn, facilitate more granular risk segmentation, empowering underwriters to craft premium structures that accurately mirror a vehicle’s preservation status and restoration investments.

Meanwhile, shifting regulatory frameworks-particularly those addressing emissions compliance, parts sourcing, and salvage title standards-are compelling insurers to revisit policy wordings and coverage boundaries. Insurers are increasingly collaborating with regulatory bodies to ensure that appraisal standards meet both consumer protection requirements and the unique preservation ethos of collector vehicles. This dynamic regulatory interplay is spurring the introduction of dedicated policy endorsements that accommodate specialized restoration activities and authentic replacement parts.

Concurrently, a growing cohort of affluent enthusiasts demands digital-first experiences, including instantaneous policy quotes and mobile-enabled claims processing. This behavioral shift is prompting insurers to optimize their digital channels through intuitive mobile apps and responsive websites. By anticipating evolving policyholder journeys, companies are forging new customer acquisition pathways and reinforcing loyalty through personalized engagement.

Assessing the Far-Reaching Consequences of United States 2025 Tariff Adjustments on Collector Auto Insurance Supply Chains and Premium Structures

The United States’ tariff adjustments implemented in early 2025 have reverberated through the collector auto insurance supply chain, fundamentally altering restoration cost dynamics. Elevated import duties on specialty steel and vintage auto parts have inflated replacement components costs, thereby increasing insured values and recalibrating premium structures. Insurers have responded by refining policy limits and endorsements to accommodate these cost pressures without diluting the comprehensive coverage essential for high-value vehicles.

Moreover, tighter tariff regimes on luxury automotive components have reshaped restoration timelines. Restoration workshops are navigating extended lead times for sourcing authentic parts, which can translate into prolonged storage exposures and potential liabilities. This scenario has accelerated the uptake of allied coverage options, such as extended storage indemnity and restoration delay reimbursement, as policyholders seek protection against timeline uncertainties directly tied to tariff-driven supply disruptions.

In addition, these cumulative tariff effects have led to the emergence of collaborative risk pools. By spreading specialized risk across multiple insurers, carriers are mitigating exposure volatility associated with fluctuating restoration costs. This collective approach promotes underwriting stability and ensures that collector auto insurance sustainability keeps pace with geopolitical and trade policy fluctuations.

Diving into Critical Segmentation Insights Revealing Diverse Collector Auto Insurance Needs by Coverage, Vehicle Type, and Customer Profiles

A nuanced examination of policy offerings reveals that coverage type distinctions-collision, comprehensive, and liability only-significantly influence both underwriting guidelines and customer expectations. Collision coverage remains paramount for frequent drivers, while comprehensive protection attracts those prioritizing environmental and vandalism risks. Liability only policies serve entry-level collectors who seek basic legal compliance without the frills of full restoration endorsements.

Equally critical is vehicle type segmentation, where heavy commercial vehicles, light commercial vehicles, and passenger cars each carry distinct risk spectrums. Commercial collectors often demand fleet-wide valuation models with unit-based deductibles, whereas passenger car enthusiasts emphasize customization coverage for engine modifications and aesthetic enhancements.

Distribution channels further delineate market behaviors: agent and broker networks cater to traditionalists who value advisory relationships, whereas direct channels streamline policy procurement for tech-savvy clients. The online channel, subdivided into mobile app and website platforms, facilitates real-time quotes and digital policy adjustments. This bifurcation underscores the necessity for omnichannel strategies that integrate human expertise with seamless digital experiences.

Policy type analysis differentiates new business from renewals, illuminating retention drivers and acquisition costs. New entrants often benefit from introductory appraisal credits, whereas renewals capitalize on loyalty pricing and accumulated valuation histories. Customer type insights divide corporate and individual segments; corporate fleets span large, medium, and small sizes with scalable indemnity tiers, while individual drivers categorize into adult, senior, and young age groups with tailored usage-based discounts.

Premium range considerations-high, medium, and low-complete the segmentation mosaic, reflecting risk appetite, restoration quality, and loss history. This layered segmentation landscape informs product innovation, targeted marketing, and underwriting precision.

This comprehensive research report categorizes the Collector Auto Insurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Coverage Type

- Vehicle Type

- Policy Type

- Customer Type

- Premium Range

- Distribution Channel

Mapping Regional Collector Auto Insurance Dynamics Across Americas, Europe Middle East & Africa, and Asia Pacific Markets

Regional dynamics in collector auto insurance reflect divergent cultural attitudes toward vehicle preservation and varying economic landscapes. In the Americas, robust collector communities in North America and emerging interest in Latin markets drive demand for comprehensive restoration endorsements. Enthusiasts in the United States and Canada often leverage specialized claims adjudication services, fostering an ecosystem of certified repair shops and valuers.

Across Europe, Middle East & Africa, the collector auto insurance scene is characterized by legacy marques and historic preservation mandates. Regulatory environments emphasize authenticity verification, requiring insurers to partner with heritage vehicle registries and restoration certifiers. Meanwhile, the Middle East’s luxury collector segment propels demand for high-value comprehensive policies underpinned by bespoke concierge services that handle logistics and parts procurement.

In the Asia-Pacific region, a burgeoning affluent class fuels interest in classic and vintage automobiles, supported by growing restoration networks in Australia, Japan, and Southeast Asia. This market is witnessing the integration of digital inspection tools and drone-enabled condition reporting, enhancing risk assessment capabilities. Consequently, insurers are adapting policy frameworks to accommodate rapid growth and varying restoration standards across diverse jurisdictions.

This comprehensive research report examines key regions that drive the evolution of the Collector Auto Insurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Industry Players Driving Innovation and Competition in Collector Auto Insurance Markets Globally

The collector auto insurance landscape is shaped by a constellation of specialized carriers, each advancing distinct value propositions. Leading players have been investing in proprietary valuation databases and partnering with industry associations to offer certified restoration guidelines. This collaborative model not only elevates underwriting accuracy but also fosters trust among collectors who prioritize authenticity and provenance.

Innovative entrants are leveraging AI and machine learning to introduce usage-based endorsements, wherein telematics data informs real-time premium adjustments. By monitoring storage conditions, mileage, and environmental factors, these insurers can price policies with unprecedented granularity. Such technological integration distinguishes forward-looking companies from traditional peers reliant on historical loss data.

Strategic alliances between established carriers and restoration experts further define the competitive landscape. By embedding restoration consultancy within policy bundles, insurers differentiate their offerings and enhance customer experiences. These partnerships underscore a broader trend: the shift from transactional coverage to holistic risk management solutions tailored to the collector community’s unique needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Collector Auto Insurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allianz SE

- Allstate Insurance Company

- American Collectors Insurance, LLC

- American Modern Insurance Group, Inc.

- Chubb Limited

- Condon Skelly Agency, Inc.

- Footman James Insurance Services Limited

- Government Employees Insurance Company

- Grundy Worldwide, Inc.

- Hagerty Insurance Agency, LLC

- Heacock Classic Insurance

- Hiscox Ltd

- Lockton Companies, LLC

- Markel American Insurance Company

- Nationwide Mutual Insurance Company

- Progressive Casualty Insurance Company

- Safeco Insurance Company of America

- State Farm Mutual Automobile Insurance Company

Crafting Strategic Recommendations for Industry Leaders to Navigate Emerging Trends and Maximize Collector Auto Insurance Opportunities

Industry leaders must adopt a multi-faceted approach to capitalize on emerging opportunities in collector auto insurance. First, embracing advanced digital platforms that offer end-to-end policy management-from app-based quotes to virtual claims assessments-will enhance client engagement and operational efficiency. This digital acceleration should be coupled with personalized advisory services that leverage actuarial insights and restoration expertise.

Second, refining underwriting models to incorporate tariff-driven cost variables and telematics data will fortify portfolio resilience. By integrating real-time restoration cost indices and usage metrics, carriers can achieve dynamic premium recalibration, mitigating exposure to supply chain fluctuations. Moreover, fostering captive risk pools for high-value segments will distribute volatility and stabilize loss ratios.

Finally, deepening broker and agent partnerships through joint educational programs on heritage vehicle valuation and preservation standards will reinforce distribution strength. By positioning collectors as informed stakeholders, insurers can elevate policyholder loyalty and unlock cross-sell potential for allied insurance products such as extended restoration warranties and event liability coverage.

Explaining the Comprehensive Research Methodology Underpinning Credible Collector Auto Insurance Market Insights

The research methodology underpinning this analysis combines qualitative and quantitative approaches to ensure robust insights. Primary interviews with industry executives, restoration experts, and collector associations provided firsthand perspectives on evolving risk factors and coverage preferences. These insights were triangulated with secondary data from regulatory filings, trade journals, and insurance company disclosures to contextualize emerging trends.

Advanced analytical techniques-including scenario modeling and sensitivity analysis-were applied to evaluate the impact of tariff adjustments and technological integration on policy design. Geographic information system tools facilitated the mapping of regional collector hotspots and distribution network densities. Additionally, machine-learning algorithms processed telematics and claims data to identify predictive loss indicators and segmentation patterns.

Rigorous validation protocols, such as peer reviews and cross-sector benchmarking, ensured the credibility and relevance of all findings. Ethical guidelines and data privacy regulations were strictly adhered to throughout the research process, guaranteeing that proprietary information was handled with the highest standards of confidentiality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Collector Auto Insurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Collector Auto Insurance Market, by Coverage Type

- Collector Auto Insurance Market, by Vehicle Type

- Collector Auto Insurance Market, by Policy Type

- Collector Auto Insurance Market, by Customer Type

- Collector Auto Insurance Market, by Premium Range

- Collector Auto Insurance Market, by Distribution Channel

- Collector Auto Insurance Market, by Region

- Collector Auto Insurance Market, by Group

- Collector Auto Insurance Market, by Country

- United States Collector Auto Insurance Market

- China Collector Auto Insurance Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing Key Findings and Strategic Implications for Stakeholders in the Collector Auto Insurance Market

This executive summary has illuminated the transformative forces reshaping collector auto insurance, from burgeoning digital valuation tools and tariff-induced cost shifts to granular segmentation strategies and regional market distinctions. Collectively, these factors underscore a market in flux, poised for innovation driven by technology, regulatory collaboration, and tailored customer engagement.

Industry players that align underwriting precision with dynamic data inputs and forge strategic alliances with restoration specialists will be best positioned to capture the upward trajectory of collector auto insurance demand. Meanwhile, adaptive product design that accommodates evolving restoration timelines and parts availability will deliver competitive differentiation in a landscape where authenticity and provenance are paramount.

In closing, the convergence of technology, regulation, and consumer expectations offers a fertile ground for insurers to expand their collector auto offerings. By applying the actionable recommendations outlined herein, stakeholders can strengthen resilience, drive profitable growth, and ensure the preservation of automotive heritage for generations to come.

Engaging Industry Stakeholders with a Tailored Call To Action to Collaborate with Ketan Rohom for Advanced Collector Auto Insurance Intelligence

Unlock unparalleled insights and elevate your strategic edge by connecting with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in the nuances of collector auto insurance market intelligence can help tailor the research findings to your organization’s unique goals. By discussing your specific business challenges and objectives, you can leverage targeted adjustments and customized data visualizations that speak directly to your leadership and operational teams.

Engagement with Ketan ensures access to exclusive add-on modules covering advanced risk modeling, emerging restoration technologies, and regional compliance roadmaps. This collaboration extends beyond a one-time purchase; it forms a partnership dedicated to ongoing intelligence updates, quarterly market pulse briefings, and bespoke scenario planning workshops. Ultimately, this direct line to an industry authority accelerates your ability to make informed decisions, optimize underwriting strategies, and enhance client satisfaction in a competitive landscape.

Take the next step toward leadership in collector auto insurance by speaking with Ketan today. Discover how tailored advisory sessions and adaptive reporting frameworks can position your organization for sustained growth and resilience in 2025 and beyond.

- How big is the Collector Auto Insurance Market?

- What is the Collector Auto Insurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?