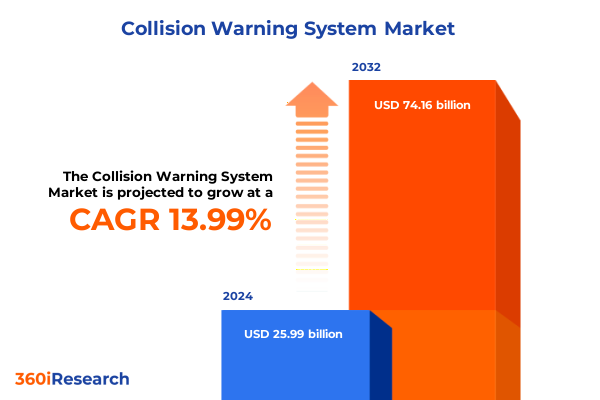

The Collision Warning System Market size was estimated at USD 29.52 billion in 2025 and expected to reach USD 33.53 billion in 2026, at a CAGR of 14.06% to reach USD 74.16 billion by 2032.

Charting the Dawn of Next-Generation Collision Warning Systems and Unveiling a Comprehensive Executive Summary of Evolving Automotive Safety Solutions

Collision warning systems have undergone rapid evolution over the past decade, transitioning from isolated radar modules to fully integrated advanced driver assistance platforms. Early deployments relied primarily on ultrasonic and basic radar technologies to alert drivers of imminent hazards, but technological advancements in sensor fusion have enabled a cohesive orchestration of cameras, Lidar arrays, radar units, and ultrasonic detectors. With the integration of high-definition mapping data and AI-driven algorithms, modern collision warning solutions are now capable of accurately identifying dynamic objects, predicting trajectories, and providing timely alerts, thereby enhancing vehicle safety and reducing the likelihood of collisions.

This executive summary distills the key themes and insights driving innovation in collision warning systems, offering a holistic overview without delving into numerical market projections. Each section synthesizes critical trends, regulatory influences, segmentation dynamics, regional variations, and corporate strategies. The objective is to equip industry leaders with a concise yet comprehensive narrative that supports strategic decision-making, technology prioritization, and partnership considerations as the industry progresses toward broader adoption and higher automation levels.

Exploring the Transformative Technological and Regulatory Shifts Reshaping Collision Warning Systems in the Global Automotive Landscape

In recent years, the collision warning landscape has been reshaped by the dual forces of technological innovation and regulatory momentum. Breakthroughs in sensor miniaturization have driven the proliferation of high-resolution cameras and solid-state Lidar units, while advances in radar signal processing have enhanced object detection in challenging weather conditions. Concurrently, the proliferation of edge computing architectures and 5G connectivity has enabled real-time processing and collaborative safety frameworks, where vehicles communicate hazard data with infrastructure and peer nodes. This sensor fusion paradigm leverages data from ECU-managed subsystems, mapping algorithms, and machine learning–infused perception stacks to deliver predictive collision alerts that are more accurate and contextually aware than ever before.

At the regulatory front, stringent safety mandates and new automotive standards around the globe have accelerated the deployment of advanced driver assistance systems. In mature markets, regulatory bodies are extending mandatory collision warning functionalities beyond high-end segments, fostering a shift toward universal safety technology adoption. Electrification trends have also had a profound impact, as electric vehicle platforms integrate safety systems natively within their electronic architectures, streamlining production and maintenance workflows. Furthermore, the rising emphasis on transportation-as-a-service models and autonomous ride-hailing fleets has underlined the criticality of collision warning systems as foundational safety measures, compelling original equipment manufacturers and service providers to innovate at unprecedented speed.

Assessing the Far-Reaching Implications of Newly Imposed United States Tariffs on Collision Warning System Supply Chains and Costs

At the start of 2025, the United States Government implemented revised tariff schedules that imposed higher import duties on automotive sensors and electronic control units central to collision warning systems. These measures, targeting hardware components sourced predominantly from certain overseas suppliers, were justified under national security and trade balancing objectives. The immediate consequence has been a noticeable increase in landed costs for industry participants relying on imported camera modules, Lidar assemblies, and radar chips. While the tariff escalation aimed to incentivize domestic manufacturing, it has also prompted vehicle manufacturers and Tier 1 system integrators to reassess global sourcing strategies and explore alternative supply bases.

Supply chain dynamics have responded with accelerated initiatives to localize production of critical hardware in North America. Joint ventures between sensor specialists and domestic foundries have gained traction, and some software developers have offered greater value-added integration services to offset the burden of increased hardware pricing. The services segment, encompassing installation, maintenance, and training, has likewise adapted its pricing structures to accommodate higher component expenses while emphasizing the long-term reliability benefits. Moreover, the impact of tariffs has varied across segments, with aftermarket channels experiencing more pronounced cost pressures compared to original equipment manufacturers that can amortize production expenses over higher volume platforms. As a result, industry stakeholders are balancing between mitigating short-term cost inflation and preserving long-term technology roadmaps.

Unveiling How Comprehensive Segmentation Across Components Vehicles Technologies Channels and Applications Shapes Collision Warning System Adoption Trends

In examining the collision warning system landscape through segmentation lenses, the interplay between component categories and service tiers reveals nuanced adoption patterns. Within the hardware domain, electronic control units act as the command center, orchestrating inputs from an array of sensors that include optical cameras, Lidar assemblies, radar arrays, and proximity-focused ultrasonic modules. This hardware framework is complemented by software offerings that extend from perception and decision-making algorithms to high-fidelity mapping data that contextualizes raw sensor inputs. Meanwhile, service-oriented components such as installation, maintenance, and specialized training programs ensure operational readiness and system longevity, especially in fleet applications and commercial vehicle platforms.

In terms of vehicle-type segmentation, commercial platforms-ranging from heavy-duty trucks to light commercial vans-have increasingly adopted collision warning systems to safeguard payloads and optimize driver safety. Passenger cars, spanning hatchback, sedan, and sport utility vehicle segments, exhibit a growing preference for alert-only functionalities or active braking support depending on target price points. Two-wheelers, including motorcycles and scooters, represent an emergent frontier where compact sensory modules and lightweight algorithmic stacks must balance form factor constraints with real-time hazard detection. Technology segmentation further distinguishes solutions by their reliance on camera-based, Lidar-based, radar-based, or ultrasonic-based architectures, each with unique performance characteristics. Sales channels diverge between manufacturer-fitted original equipment and aftermarket upgrades, and application segmentation spans blind spot detection with audio or visual alerts, forward collision warning with alert-only or active braking support, lane departure warning, pedestrian detection, and rear collision warning, evidencing a broad spectrum of safety use cases that align with diverse regulatory and consumer expectations.

This comprehensive research report categorizes the Collision Warning System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Vehicle Type

- Technology

- Sales Channel

- Application

Examining Regional Dynamics and Growth Drivers Across the Americas Europe Middle East Africa and Asia-Pacific for Collision Warning System Deployment

In the Americas, a combination of strict safety regulations and evolving insurance frameworks has positioned collision warning systems as a standard expectation in both passenger and commercial vehicles. Regulatory programs in the United States and Canada have incrementally expanded mandatory collision avoidance functionalities, driving OEMs to incorporate advanced sensor suites and AI-based algorithms as factory-fitted options. At the same time, aftermarket providers have leveraged this momentum by offering retrofitable modules, particularly for fleet operators seeking to enhance roadside safety and reduce liability.

In Europe, Middle East & Africa, harmonized vehicle safety directives under the UNECE conventions and the European New Car Assessment Program have accelerated the deployment of collision warning modules across diverse automotive segments. Infrastructure enhancements in urban centers, with a focus on pedestrian zones and bike lanes, have further stimulated demand for pedestrian detection and lane departure warning features. Regionally based component manufacturers and system integrators are collaborating to tailor solutions that meet both regulatory compliance and local environmental challenges.

In Asia-Pacific, burgeoning urbanization, rising road traffic volumes, and government-led road safety campaigns are fueling rapid adoption of collision warning systems. Local vehicle manufacturers are increasingly investing in domestic sensor production to mitigate import dependencies while catering to markets with high two-wheeler usage through compact, lightweight detection modules. Additionally, partnerships between technology startups and OEMs are facilitating the integration of radar and camera fusion platforms into new vehicle models, reflecting a dynamic landscape where affordability and innovation converge.

This comprehensive research report examines key regions that drive the evolution of the Collision Warning System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Strengths and Collaborative Innovation Among Leading Industry Players in the Collision Warning System Market

In the collision warning system market, established automotive suppliers have maintained leadership through comprehensive portfolios that span sensor hardware, embedded control units, and AI-driven software stacks. Companies such as Bosch have leveraged their expertise in radar signal processing and camera integration to deliver solutions that perform reliably under adverse weather conditions while minimizing false alerts. Continental has expanded its offerings with Lidar-infused fusion platforms that enhance object detection ranges and support active braking interventions. Denso’s focus on miniaturizing sensors and optimizing energy consumption has gained traction among hybrid and electric vehicle segments, whereas Valeo has pioneered modular camera arrays that can be adapted for blind spot detection and pedestrian awareness functionalities. Meanwhile, technology-centric players like Mobileye have become synonymous with mapping-based AI algorithms, offering cloud-enabled updates and fleet-wide data analytics services.

Collaboration has become a defining strategy among key stakeholders, with numerous joint ventures and strategic alliances forming to accelerate time-to-market and share R&D investments. For example, partnerships between sensor hardware developers and mapping data providers have yielded perception platforms that seamlessly integrate environment modeling with real-time hazard assessment. Recent mergers involving radar module manufacturers and ECU specialists have streamlined supply chains, fostering end-to-end system solutions that OEMs can adopt with minimal integration overhead. A growing cohort of agile startups is also disrupting the market by introducing edge-compute-friendly architectures and open-platform software frameworks, compelling incumbents to continuously refine product roadmaps and licensing models. Collectively, the competitive landscape underscores a balance between scale-driven incumbency and innovation-focused agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Collision Warning System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- Aptiv PLC

- Autoliv, Inc.

- Continental AG

- Denso Corporation

- General Electric Company

- HELLA GmbH & Co. KGaA

- Honeywell International Inc.

- Hyundai Mobis Co., Ltd.

- Infineon Technologies AG

- Magna International Inc.

- Mobileye Global Inc.

- NXP Semiconductors N.V.

- Panasonic Holdings Corporation

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Siemens AG

- Texas Instruments Incorporated

- Valeo SA

- Veoneer, Inc.

- Wabtec Corporation

- ZF Friedrichshafen AG

Implementing Effective Strategic Initiatives and Partnership Models to Accelerate Innovation and Market Penetration in Collision Warning Systems

Industry leaders must prioritize supply chain resilience by diversifying their component sourcing strategies and fostering local manufacturing capabilities. Establishing regional sensor assembly hubs and collaborating with domestic foundries for radar and camera production can mitigate tariff-induced cost pressures while reducing lead times. Concurrently, investing in cross-functional research and development initiatives that integrate algorithmic perception with hardware design will yield optimized system performance. Forming consortiums with mapping data providers, semiconductor manufacturers, and telematics operators will accelerate feature rollouts and support continuous over-the-air software enhancements.

To capture growing demand across varied market segments, stakeholders should initiate comprehensive pilot programs with fleet operators and ride-hailing services. These testbeds can validate emerging functionalities such as predictive trajectory analysis and multi-vehicle cooperative warning systems under real-world conditions. Furthermore, engaging with regulatory bodies to advocate for harmonized safety standards will streamline certification processes and reduce time-to-market. Embracing open-platform software architectures and scalable subscription-based models for algorithm updates can also generate recurring revenue streams while deepening customer engagement. Lastly, cultivating a pipeline of skilled talent through partnerships with academic institutions and specialized training programs will ensure the necessary expertise for system integration and maintenance services. Emphasizing modular design principles will enable scalable upgrades and facilitate interoperability across vehicle platforms, positioning companies to respond nimbly to technological breakthroughs and market shifts.

Robust Mixed Methodologies Incorporating Primary Insights Secondary Analyses and Data Triangulation Ensuring Rigorous Collision Warning System Research

Our research methodology is founded on a mixed-methods approach that synthesizes primary qualitative insights with comprehensive secondary analyses. Primary research included one-on-one interviews with senior executives from original equipment manufacturers, Tier 1 suppliers, and technology innovators, complemented by in-depth discussions with regulatory experts and end-user fleet managers. These interactions provided firsthand perspectives on technology roadmaps, supply chain strategies, and deployment challenges associated with collision warning solutions. Concurrently, extensive secondary research involved reviewing publicly available regulatory documents, patent filings, corporate whitepapers, and industry conference proceedings to map evolving sensor partnerships and algorithm development trends.

Data triangulation was employed to validate findings across multiple sources and reduce bias. Market actor data points were cross-verified with trade association reports and logistics databases to affirm component shipment patterns. Case studies highlighting deployment success stories were analyzed alongside failure modes to distill best practices. The research team also utilized a dual bottom-up and top-down analytical framework to ensure consistency between granular deployment metrics and overarching market dynamics. Throughout the process, a rigorous quality assurance protocol, including peer reviews and executive validations, was executed to uphold the research’s integrity and reliability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Collision Warning System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Collision Warning System Market, by Component

- Collision Warning System Market, by Vehicle Type

- Collision Warning System Market, by Technology

- Collision Warning System Market, by Sales Channel

- Collision Warning System Market, by Application

- Collision Warning System Market, by Region

- Collision Warning System Market, by Group

- Collision Warning System Market, by Country

- United States Collision Warning System Market

- China Collision Warning System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing Critical Findings and Projecting Strategic Pathways to Shape the Future Trajectory of Collision Warning System Innovation and Implementation

This executive summary has outlined the pivotal innovations, regulatory shifts, and segmentation dynamics shaping the collision warning system ecosystem. Technological advancements in sensor fusion, edge computing, and AI-driven perception stacks are converging to deliver more reliable and context-aware collision avoidance solutions. Tariff realignments have prompted strategic re-evaluation of supply chains, spurring localization initiatives and collaborative alliances. Segmentation analysis has revealed distinct adoption trajectories across hardware versus software domains, vehicle segments from two-wheelers to heavy commercial trucks, and technology modalities including camera-, radar-, Lidar-, and ultrasonic-based architectures. Regional insights underscore differentiated growth patterns influenced by regulatory mandates, infrastructure maturity, and localized consumer safety priorities.

As the industry moves toward higher levels of automation and connectivity, staying attuned to evolving regulatory frameworks and emerging business models will be essential for sustaining competitive advantage. Companies that excel in agile R&D integration, cross-sector partnerships, and scalable deployment strategies will be best positioned to capitalize on the rising demand for advanced driver assistance systems. By leveraging the comprehensive insights and actionable recommendations presented herein, decision-makers can chart a clear path forward, aligning product innovation with market needs and emerging safety standards.

Connect with Associate Director of Sales and Marketing Ketan Rohom to Secure Your Access to the Comprehensive Collision Warning System Market Research Report

To secure access to the full market research report and gain deeper strategic insights into collision warning system trends, pricing dynamics, and competitive analyses, contact Ketan Rohom. As Associate Director of Sales & Marketing, he will guide you through tailored research solutions that address your organization’s requirements. Don’t miss the opportunity to leverage this authoritative resource for informed decision-making and strategic planning. Reach out today to discover how this report can inform your technology roadmap and accelerate your collision warning system initiatives.

- How big is the Collision Warning System Market?

- What is the Collision Warning System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?