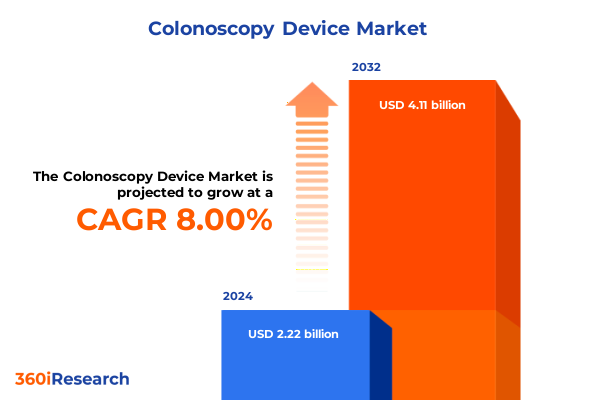

The Colonoscopy Device Market size was estimated at USD 2.38 billion in 2025 and expected to reach USD 2.57 billion in 2026, at a CAGR of 8.07% to reach USD 4.11 billion by 2032.

Innovation drives a new frontier in colonoscopy devices as advanced imaging and patient-centric protocols reshape diagnostic precision and treatment pathways

The colonoscopy device landscape has rapidly evolved to become one of the most dynamic segments in gastrointestinal diagnostics. Recent years have witnessed a surge in patient screening initiatives driven by updated clinical guidelines and preventative healthcare imperatives, placing colonoscopy devices at the heart of colorectal cancer detection and management. As healthcare systems seek to improve early detection metrics, the demand for advanced endoscopic technologies has intensified, propelling vendors to innovate across imaging clarity, ergonomics, and procedural efficiency.

Against this backdrop of growing clinical need, manufacturers have accelerated investment in next-generation colonoscopes, accessories, and integrated visualization platforms. This convergence of heightened screening volumes and technological innovation underscores a pivotal moment for stakeholders seeking to deliver improved patient outcomes. With reimbursement frameworks and regulatory pathways evolving in parallel, the colonoscopy device sector is entering an era where strategic alignment between clinical requirements and device capabilities will determine market leadership.

Pioneering breakthroughs and emerging disruptors are redefining the colonoscopy device landscape with unprecedented imaging fidelity and procedural efficiencies

The colonoscopy device market is undergoing transformative shifts propelled by breakthroughs in high-definition optics, AI-assisted lesion detection algorithms, and disposable accessory design. Manufacturers are now embedding machine learning capabilities directly into endoscopic platforms, enabling real-time polyp characterization and risk stratification. These technological leaps not only improve diagnostic yield but also facilitate standardized reporting and enhanced operator confidence across diverse clinical settings.

Concurrently, regulatory bodies in leading markets have streamlined approval processes for digital health integrations, expediting time to market for advanced colonoscopy systems. This regulatory agility has encouraged a flurry of partnerships between device OEMs, software innovators, and academic institutions to co-develop solutions that marry hardware excellence with analytics-driven decision support. As a result, the market is witnessing a shift from monolithic systems toward modular, interoperable architectures that can be tailored to institution-specific workflows and budget constraints.

Anticipated tariff escalations in 2025 are imposing layered cost pressures on colonoscopy device supply chains and reshaping sourcing strategies

Beginning January 1, 2025, the United States Trade Representative finalized new Section 301 tariffs that elevate duties on key imported components and finished goods linked to colonoscopy device production. Semiconductors used in video processing and advanced imaging modules will face a 50 percent tariff increase, up from the previous 25 percent rate, creating significant cost implications for OEMs relying on Chinese-origin microchips. In addition, rubber medical and surgical gloves saw their duty jump to 50 percent, adding to the expense burden on procedure packs and single-use accessories imported from China. These escalated tariffs compound the existing 100 percent levy on syringes and needles, enacted in September 2024, thereby intensifying price pressures across the consumables supply chain.

Deep-dive segmentation analysis uncovers how component, therapeutic area, and end user dynamics are driving targeted advancements in colonoscopy device innovation

The colonoscopy device market can be deconstructed through multiple lenses that reveal nuanced opportunities. From a component perspective, the evolution of fiber-optic devices and the rapid adoption of video colonoscopes underscores a shift toward digital imaging solutions, supported by advancements in sensor miniaturization and light-source innovations. Visualization systems have similarly benefited from improved display technologies and software overlays that streamline endoscopist workflows. Transitioning to therapeutic areas, the imperative to enhance colorectal cancer detection remains paramount, yet expanding indications for inflammatory conditions such as Crohn’s disease and ulcerative colitis are catalyzing the development of specialized accessory lines and procedural protocols. Furthermore, genetic screening programs for Lynch syndrome are driving demand for high-precision endoscopy platforms to facilitate surveillance in at-risk populations. Meanwhile, end-user segmentation illuminates divergent adoption curves: ambulatory surgical centers prioritize cost-effective, disposable accessory bundles, whereas tertiary hospitals demand full-featured systems with advanced analytics and integration capabilities. Diagnostic centers often lean toward portable or benchtop visualization stations, and research laboratories require extensible platforms for investigational device studies. Clinics focus on streamlined point-of-care solutions designed for office-based endoscopy, demonstrating that customization across these end-user categories is critical to capturing share in a heterogeneous market.

This comprehensive research report categorizes the Colonoscopy Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Therapeutic Area

- End User

Distinct regional trends across the Americas, Europe Middle East Africa, and Asia Pacific reveal unique growth drivers and market adoption patterns for colonoscopy devices

Examining the Americas reveals a mature screening environment, underpinned by established colorectal cancer guidelines and high patient awareness, which supports wide adoption of premium colonoscopy systems and disposable accessory solutions. Regional reimbursement policies incentivize the use of advanced imaging modalities, such as narrow-band imaging and chromoendoscopy, driving mixed plastic-fiber and video colonoscope sales. In contrast, Europe, the Middle East & Africa exhibit a varied landscape; Western Europe’s health-technology assessment frameworks reward clinical efficacy supported by robust real-world evidence, while select markets in the Middle East accelerate capital equipment procurement through national screening initiatives. Conversely, Africa’s growth remains nascent, with affordability and infrastructure constraints shaping demand for portable, cost-optimized endoscopes. Turning to the Asia-Pacific region, rapidly expanding screening programs in China, Japan, and South Korea are fueling demand for high-throughput endoscopy suites. Investment in local manufacturing and government subsidies for equipment upgrades are catalyzing a shift from traditional fiber-optic devices toward digital video colonoscopes in tier-one urban centers, establishing the region as a critical growth engine for global vendors.

This comprehensive research report examines key regions that drive the evolution of the Colonoscopy Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Top companies are forging strategic alliances accelerating R&D innovation and optimizing portfolios to secure leadership in the colonoscopy device market

Leading colonoscopy device providers are intensifying their focus on strategic collaborations and targeted service offerings to differentiate themselves in a crowded market. Prominent industry names are entering licensing partnerships with image-analysis software firms to embed AI-based polyp detection modules into their platforms, thereby enhancing diagnostic accuracy and reducing procedure times. Concurrently, select players are fortifying their aftermarket services by rolling out subscription-based maintenance and upgrade plans, which align with hospital budget cycles and guarantee system uptime. Some vendors are also exploring adjacent acquisitions in digital health, enabling end-to-end workflow solutions that encompass procedure documentation, reporting, and case-review integration. These concerted efforts highlight that fostering an ecosystem of interoperable hardware, analytics software, and lifecycle support will be pivotal for companies aiming to secure long-term contracts with large healthcare systems and capitalize on the expanding procedural volumes driven by screening mandates and therapeutic endoscopy indications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Colonoscopy Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ambu A/S

- Avantis Medical Systems

- Boston Scientific Corporation

- ColoWrap, LLC.

- ConMed Corporation

- Dantschke Medizintechnik GmbH & Co. KG

- Endomed Systems GmbH

- FUJIFILM Holdings Corporation

- G.I. View Ltd

- Getinge AB

- Hologic, Inc.

- HOYA Corporation

- Huger Medical Instrument Co.,Ltd

- Karl Storz SE & Co. KG

- Medtronic PLC

- Olympus Corp.

- Ottomed Endoscopy by Mitra Medical Services LLP

- Pro Scope Systems LLC

- Richard Wolf GmbH

- SHAILI ENDOSCOPY PRIVATE LIMITED

- Shanghai Shiyin Photoelectric Instrument Co.,Ltd.

- Smith & Nephew Plc

- Sonoscape Medical Corp

- Steris Corporation

- Stryker Corporation

Strategic recommendations for industry leaders to mitigate tariff exposures and strengthen supply resilience in the colonoscopy device market

Industry leaders must adopt a multi-pronged strategy to address escalating tariff burdens and evolving market demands. First, diversifying supply chains by qualifying non-China component sources can mitigate the financial impact of Section 301 levies and stabilize cost structures. Establishing dual-sourcing agreements for semiconductors, fiber-optic bundles, and display modules will reduce exposure to single-market disruptions. Second, investing in local assembly or final testing facilities in tariff-exempt jurisdictions can unlock cost savings and shorten lead times, while reinforcing regional market presence. Third, accelerating modular system designs that allow for rapid integration of third-party innovations will enable faster product iterations and customizable configurations aligned with specific end-user needs. Finally, fostering early and continuous engagement with regulatory agencies to secure favorable classification for next-gen devices will expedite market entry and protect against potential compliance delays. By implementing these recommendations, device makers can optimize resilience, preserve margin, and sustain growth amid shifting trade policies and competitive dynamics.

Methodology integrating expert interviews secondary data analysis and rigorous validation to uncover precise insights into the colonoscopy device market

The research framework underpinning this analysis combined a structured, multi-stage approach. Initially, secondary research efforts aggregated and synthesized publicly available information from regulatory filings, clinical guidelines, and peer-reviewed publications to map the technological landscape, tariff changes, and reimbursement frameworks. This was followed by primary research, consisting of in-depth interviews with executive-level stakeholders across device OEMs, hospital procurement teams, and supply chain experts, which provided nuanced perspectives on market drivers, pain points, and strategic priorities. Quantitative data was validated through cross-referencing import/export records and harmonized tariff schedules to quantify duty impacts on key components. Finally, the findings underwent rigorous triangulation and peer review with subject-matter experts to ensure robustness and eliminate potential biases. This methodology ensures that the insights presented are both actionable and reflective of real-world market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Colonoscopy Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Colonoscopy Device Market, by Component

- Colonoscopy Device Market, by Therapeutic Area

- Colonoscopy Device Market, by End User

- Colonoscopy Device Market, by Region

- Colonoscopy Device Market, by Group

- Colonoscopy Device Market, by Country

- United States Colonoscopy Device Market

- China Colonoscopy Device Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 795 ]

The evolving colonoscopy device market underscores the importance of innovation strategic adaptability and data-driven insights to drive future growth

As the colonoscopy device market continues to advance, the interplay between regulatory shifts, technological innovation, and supply chain resilience will shape its trajectory. The imperative to improve colorectal cancer screening rates, expand indications for inflammatory bowel disease management, and integrate AI-driven diagnostics underscores the transformative potential of next-generation endoscopy platforms. Concurrently, evolving tariff landscapes and regional reimbursement policies emphasize the need for strategic adaptability and localized operational models. Through targeted segmentation, companies can align product portfolios with specific clinical use cases and end-user requirements while leveraging regional growth levers to maximize adoption. Ultimately, success in this sector will hinge on the ability to marry technical excellence with strategic supply chain agility and evidence-based value demonstration to healthcare providers and payers alike.

Unlock market intelligence and connect with Ketan Rohom Associate Director Sales Marketing to elevate your colonoscopy device strategy today

To gain immediate access to a comprehensive analysis of current market dynamics, strategic growth drivers, and emerging opportunities within the colonoscopy device sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By partnering directly, you will unlock tailored insights and in-depth guidance designed to align with your business objectives and inform critical decision-making processes.

Don’t miss the opportunity to leverage our expert intelligence to sharpen your competitive edge, optimize product development roadmaps, and capitalize on evolving regulatory and reimbursement landscapes. Connect with Ketan today to discuss customized licensing options, enterprise subscription packages, or bespoke research engagements. Elevate your market understanding and position your organization at the forefront of innovation in colonoscopy technology.

- How big is the Colonoscopy Device Market?

- What is the Colonoscopy Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?