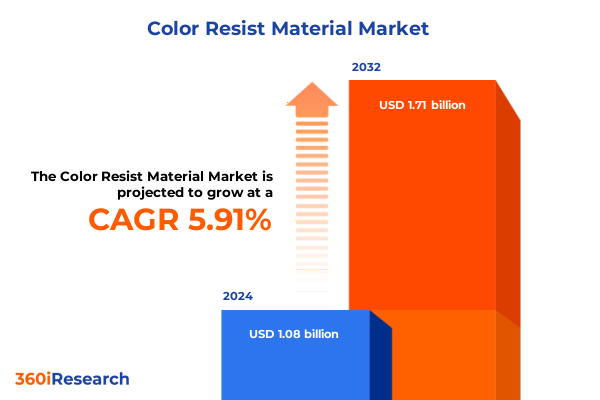

The Color Resist Material Market size was estimated at USD 1.14 billion in 2025 and expected to reach USD 1.21 billion in 2026, at a CAGR of 5.90% to reach USD 1.71 billion by 2032.

Pioneering Precision and Sustainability with Next-Generation Color Resist Materials Shaping Modern Electronics Manufacturing

In an era defined by rapid technological advancement, color resist materials have emerged as critical enablers of next-generation electronic devices and displays. These specialized materials, applied across flat panel displays, printed circuit boards, and semiconductors, fundamentally determine the resolution, color fidelity, and reliability of consumer electronics, industrial systems, and aerospace components. As manufacturers push the boundaries of miniaturization and performance, the precision and consistency of resist formulations play an increasingly pivotal role in differentiating product offerings and maintaining cost efficiencies.

The evolution of display technologies-spanning LCD to OLED, microLED, and beyond-has heightened demand for photoresists and etch resists tailored to unique optical and chemical environments. Simultaneously, the semiconductor industry’s transition to extreme ultraviolet lithography (EUV) introduces exacting requirements for resist sensitivity and line edge roughness. Compounding these technical challenges, environmental and sustainability considerations are reshaping formulation strategies, driving the development of water-based and solvent-minimized resist systems. Against this backdrop, stakeholders must understand both the broad trajectory of the market and the nuanced performance differentiators that inform material selection.

Harnessing Cutting-Edge Lithography and Sustainable Formulations to Forge the Future of Color Resist Technologies

The color resist materials sector is witnessing transformative shifts fueled by technological breakthroughs and evolving end-market demands. First, the advent of advanced lithography techniques-specifically EUV for semiconductors and fine-pitch photolithography for flexible displays-has accelerated the innovation cycle. Resist chemistries are now engineered for ultra-thin coating applications and high aspect-ratio patterning, enabling circuit densities previously unattainable with legacy processes.

Concurrently, the convergence of digital manufacturing and smart factory initiatives has introduced automation and in-line process monitoring for resist application. Sophisticated spin coating and inkjet printing platforms are integrating real-time quality control sensors, reducing defect rates while optimizing material usage. Moreover, heightened focus on environmental stewardship has prompted the emergence of solvent-minimized and bio-based resist formulations, reflecting a broader commitment to circular economy principles. Together, these shifts underscore an industry at the nexus of precision engineering and sustainable innovation, where strategic investment decisions determine competitive advantage.

Strategic Realignment of Sourcing and Production in Response to 2025 United States Tariffs Altering the Color Resist Supply Chain Dynamics

The cumulative impact of new United States tariffs implemented in 2025 has reverberated throughout the color resist materials supply chain, prompting manufacturers to reassess sourcing strategies and cost structures. Tariffs on key intermediate chemistries, particularly those originating from regions with established heavy production of photoresist precursors, have increased landed costs and compressed profit margins. In response, leading suppliers have accelerated efforts to localize upstream production capabilities, forging partnerships with regional specialty chemical producers to mitigate exposure to import duties.

Downstream, original equipment manufacturers and assemblers face the dual challenge of preserving price competitiveness while maintaining stringent performance standards. Many have negotiated long-term contracts or engaged in collaborative R&D ventures to secure preferential access to tariff-protected supply lines. At the same time, alternative sourcing hubs in East Asia and Europe have gained prominence, offering tariff-exempt or preferential trade agreement routes for critical intermediates. As a result, the tariff landscape has catalyzed a broader realignment of global supply networks, emphasizing resiliency, strategic stock management, and agile production footprint adjustments.

Uncovering Differentiated Opportunities Across Application, Industry, Technology, Form, and Processing Dimensions in Color Resist Markets

Insightful segmentation reveals nuanced performance and opportunity differentials across application, end-use industry, technology, type, form, and process dimensions. Within applications, flat panel displays leverage LCD resist for traditional backlit screens while OLED resist is tailored for emissive display panels, each demanding distinct chemical stability and adhesion profiles. Printed circuit boards incorporate dry film resist for precision etching, whereas liquid resist formulations deliver conformal coverage on complex geometries. Semiconductor lithography segments subdivide into DUV, EUV, and I-Line resists, with each wavelength regime dictating unique sensitivity, resolution, and line edge roughness requirements.

End-use industries further differentiate the landscape. Automotive applications require resists with elevated thermal shock resistance and long-term UV stability, while consumer electronics emphasize rapid throughput and high yield for mass-market devices. Industrial electronics and military & aerospace segments impose rigorous reliability and traceability standards, often necessitating bespoke formulations and stringent documentation. Technologically, dye resist chemistries underpin cost-sensitive applications, oligomer-based systems-spanning acrylate and epoxy backbones-balance performance and process versatility, and pigment resist formulations address high-contrast patterning needs.

Across types, etch resist categories bifurcate into metal and polymer resist formulations, each designed for specific substrate interactions. Photoresist types-negative and positive tone-enable complementary patterning strategies, and solder mask variations, available in dry film or liquid formats, protect copper traces from oxidation while maintaining solderability. Form factors span films, liquids, and powders, with solvent-based and water-based liquid resist options responding to environmental directives. Finally, process segmentation highlights inkjet printing for digital patterning, screen printing for high-viscosity materials, and spin coating-conducted in batch or single-wafer modes-for high-uniformity thin films. These layered insights equip stakeholders to pinpoint application-specific material requirements and streamline development roadmaps.

This comprehensive research report categorizes the Color Resist Material market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- End Use Industry

- Technology

- Type

- Form

- Process

Examining Regional Drivers of Demand Across the Americas, Europe Middle East & Africa, and Asia-Pacific Shaping Resist Material Strategies

Regional dynamics underscore the strategic imperatives for manufacturers and end users alike. In the Americas, advanced automotive electronics and large-scale data center deployments drive demand for robust etch and photoresists engineered to meet North American regulatory and performance standards. Close proximity to leading semiconductor and display assembly clusters facilitates agile supply chain collaborations, though ongoing geopolitical considerations spur the need for dual-source models.

Within Europe, the Middle East, and Africa, stringent environmental regulations and ambitious green manufacturing targets have elevated interest in water-based and low-VOC resist systems. This region’s diverse industrial base-from automotive powertrains in Germany to consumer device assembly hubs in Eastern Europe-encourages suppliers to tailor formulations for broad operating conditions and compliance frameworks. Meanwhile, infrastructure investments across the Middle East accelerate adoption in signage and smart building applications.

In Asia-Pacific, the world’s largest display and semiconductor manufacturing centers coalesce in China, South Korea, Taiwan, and emerging hubs in India. Intensified competition among local and international suppliers drives rapid introduction cycles for next-generation resist chemistries, particularly those optimized for EUV lithography and microLED displays. Government incentives for domestic production and technology transfer agreements further solidify this region as the epicenter of innovation and volume manufacturing.

This comprehensive research report examines key regions that drive the evolution of the Color Resist Material market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring How Top Innovators Are Driving Technology Leadership, Sustainability, and Strategic Integration in the Color Resist Arena

Leading companies in the color resist materials arena are differentiating through a mix of technology leadership, strategic partnerships, and sustainability commitments. Industry pioneers invest heavily in R&D to develop ultrafine resist chemistries for sub-5nm semiconductor nodes and next-generation flexible display technologies. Collaborative ventures with equipment manufacturers and research institutes enhance co-development of photolithography processes, fostering early access to emerging applications.

Simultaneously, select players are expanding capacity for water-based and low-VOC product lines in response to tightening environmental regulations. Vertical integration strategies, including acquisitions of specialty chemical firms and joint ventures with regional producers, provide control over critical precursors and improve supply resilience. In parallel, digital transformation initiatives within these companies leverage data analytics and in-line metrology to optimize yield and reduce defect rates, further solidifying their competitive position. By balancing innovation, sustainability, and operational excellence, these leading organizations set benchmarks for performance and strategic agility in the market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Color Resist Material market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALLRESIST GmbH

- Asahi Kasei Corporation

- BASF SE

- Brewer Science Inc

- Chi Mei Corporation

- DONGJIN SEMICHEM CO LTD

- Dow Inc

- DuPont de Nemours Inc

- Eternal Materials Co Ltd

- Fujifilm Holdings Corporation

- Henkel AG & Co KGaA

- Hitachi Chemical Company Ltd

- Jiangsu Nata Opto-electronic Material Co Ltd

- JSR Corporation

- Kolon Industries Inc

- LG Chem Ltd

- Merck KGaA

- Micro resist technology GmbH

- Mitsubishi Chemical Corporation

- Nippon Kayaku Co Ltd

- Samsung SDI Co Ltd

- Shin-Etsu Chemical Co Ltd

- Sumitomo Chemical Co Ltd

- Tokyo Ohka Kogyo Co Ltd

- Toyo Ink SC Holdings Co Ltd

Formulating Strategic Investments in Innovation, Supply Chain Resilience, and Sustainability to Secure Long-Term Leadership in Color Resist Markets

To thrive amidst intensifying competition and complex supply dynamics, industry leaders should prioritize targeted investments in next-generation resist technologies and resilient supply chain architectures. Establishing co-innovation partnerships with both equipment vendors and end users can accelerate time-to-market for specialized formulations, while joint development agreements ensure alignment with evolving process requirements.

Building localized production and secure supply channels for critical intermediates will mitigate the impact of trade policy fluctuations and reduce logistical lead times. Concurrently, embedding sustainability metrics into product development and manufacturing-such as prioritizing water-based systems and reducing volatile organic compound usage-will satisfy regulatory mandates and enhance brand reputation. Adopting advanced analytics for predictive quality control and yield optimization will further drive cost efficiencies and performance consistency.

Finally, maintaining a vigilant focus on emerging applications-ranging from microLED displays to advanced 3D packaging and flexible electronics-will enable proactive roadmap adjustments. By orchestrating these strategic initiatives, leaders can fortify their market position, foster innovation ecosystems, and capture value across the full spectrum of color resist material applications.

Leveraging In-Depth Primary Interviews, Patent and Supply Chain Analyses, and Segmentation Frameworks to Deliver Rigorous Market Intelligence

Our research methodology synthesizes rigorous primary and secondary data collection, ensuring a holistic and unbiased view of the color resist materials landscape. Primary insights were gathered through in-depth interviews with senior executives, process engineers, and procurement specialists across leading semiconductor, display, and printed circuit board manufacturers. These firsthand perspectives provided clarity on formulation challenges, performance benchmarks, and supply chain contingencies.

Complementing this, secondary research incorporated a comprehensive review of patent filings, technical white papers, and regulatory filings to map technological trajectories and identify emerging formulation chemistries. Supply chain analysis leveraged trade data and specialty chemical import/export trends to understand tariff impacts and regional production shifts. Our segmentation framework drew on publicly available corporate disclosures, industry consortium standards, and expert opinion to delineate application, end-use industry, technology, type, form, and process categories. This multi-pronged approach ensures robust, actionable insights grounded in current market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Color Resist Material market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Color Resist Material Market, by Application

- Color Resist Material Market, by End Use Industry

- Color Resist Material Market, by Technology

- Color Resist Material Market, by Type

- Color Resist Material Market, by Form

- Color Resist Material Market, by Process

- Color Resist Material Market, by Region

- Color Resist Material Market, by Group

- Color Resist Material Market, by Country

- United States Color Resist Material Market

- China Color Resist Material Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Positioning Your Organization at the Intersection of Technological Innovation, Supply Chain Agility, and Sustainable Growth in Color Resist Materials Market

As electronic and display markets continue their inexorable march toward higher performance, miniaturization, and sustainability, color resist materials remain at the heart of innovation. The ongoing shifts in lithography techniques, the imperative to localize supply chains amid tariff pressures, and the accelerating demand for environmentally conscious formulations collectively redefine competitive dynamics.

Organizations that integrate advanced resist chemistries, embrace collaborative development models, and reinforce supply chain agility will capture emerging opportunities across diverse applications. Regional nuances-from environmental regulations in EMEA to manufacturing incentives in Asia-Pacific-underscore the need for tailored strategies. Ultimately, the companies that balance technological leadership with operational resilience and sustainability commitments will shape the next chapter of the color resist materials market.

Unlock Unparalleled Market Intelligence and Drive Strategic Growth in Color Resist Materials by Securing This Exclusive Research Report

For organizations seeking to navigate the complex and rapidly evolving color resist materials landscape, our comprehensive market research report provides unparalleled clarity and actionable insight. To leverage these findings and gain a competitive edge, we invite you to engage directly with Ketan Rohom at Associate Director, Sales & Marketing. His expertise in aligning strategic objectives with market realities will ensure your investment in this research translates into tangible business outcomes. Reach out to Ketan Rohom today to secure your copy of the report and begin a transformative journey toward innovation, resilience, and market leadership in color resist materials.

- How big is the Color Resist Material Market?

- What is the Color Resist Material Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?