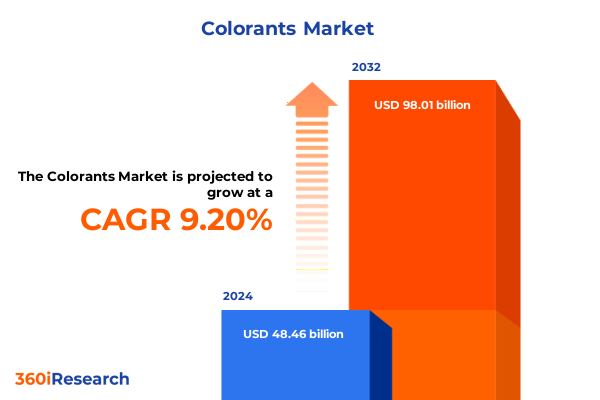

The Colorants Market size was estimated at USD 52.79 billion in 2025 and expected to reach USD 57.51 billion in 2026, at a CAGR of 9.23% to reach USD 98.01 billion by 2032.

Discover how evolving technological advancements and regulatory trends are redefining the global colorants industry and shaping market trajectories

The colorants market stands at the intersection of innovation, sustainability, and regulatory scrutiny, driven by ever-evolving end-user requirements across industries such as paints, plastics, textiles and food. Recent advancements in digital printing and precision manufacturing have heightened the demand for high-performance dyes and pigments that meet stringent safety and environmental standards. At the same time, growing consumer awareness and pressure from regulatory bodies have accelerated investment in bio-based and eco-friendly color solutions that reduce the reliance on petrochemical precursors. These parallel developments underscore a critical shift from traditional colorant formulations toward multifunctional products that deliver superior performance while minimizing ecological footprints.

Against this backdrop, manufacturers are re-evaluating their supply chains and R&D priorities to harness opportunities in specialized segments such as reactive dyes for textiles, high-opacity inorganic pigments for automotive coatings and naturally derived food colorants. Strategic partnerships between chemical producers, specialty ingredient suppliers and end-use customers are emerging to foster co-development of tailor-made solutions, optimize cost structures and ensure regulatory compliance. As technological convergence in formulation science and process engineering continues, companies able to integrate digital color matching, process intensification and circularity principles will secure a competitive edge.

This executive summary offers an in-depth overview of the transformative forces reshaping the colorants landscape. It highlights the cumulative impact of the 2025 U.S. tariff measures on cost frameworks and supply chain resilience, distills key segmentation and regional insights, and profiles leading industry participants. Lastly, it presents actionable recommendations for decision-makers seeking to capitalize on emerging opportunities and outlines the robust research methodology employed to ensure analytical rigor and reliability.

Explore how consumer preferences production innovations and sustainability imperatives are reshaping the competitive dynamics within the colorants landscape

The colorants industry has undergone transformative shifts driven by a confluence of changing consumer preferences, production innovations and stringent sustainability mandates. Consumers now demand products that not only deliver vibrant, durable hues but also align with broader environmental and social governance objectives. This has propelled a surge in demand for sustainably sourced natural dyes and low-VOC pigmentation technologies, challenging manufacturers to balance performance with eco-credentials.

In parallel, production processes are being revolutionized by digitalization, automation and continuous processing methods that streamline dye synthesis and pigment dispersion. Companies integrating advanced analytics and real-time quality monitoring are achieving enhanced batch consistency and reduced time to market. These technological breakthroughs are complemented by the rise of circular economy principles, with firms exploring recycling of pigment-containing waste streams and development of non-toxic byproducts that can be repurposed within other industrial processes.

Moreover, regulatory imperatives such as REACH in Europe and the Toxic Substances Control Act updates in the United States are enforcing stricter chemical reporting and safety assessments, placing an onus on colorant producers to fully characterize material life cycles. This regulatory backdrop has spurred investments in novel, safer chromophore chemistries and traceable sourcing frameworks. As a result, new entrants with agile R&D platforms and established players investing in green chemistry are forging differentiated market positions, ultimately redefining competitive dynamics across global colorants ecosystems.

Explore the impact of the United States’ 2025 tariff measures on supply chain resilience cost frameworks and import strategies within the colorants sector

In 2025, the United States implemented a series of tariffs on imported colorants and precursor chemicals, aiming to support domestic manufacturing and address strategic supply chain vulnerabilities. These measures have exerted a layered impact on cost structures, prompting companies to revisit sourcing strategies and in some cases, relocate production closer to end-use markets. Raw material suppliers have had to absorb or pass along higher duties, leading many formulators to explore alternative feedstocks and diversify supplier networks to mitigate exposure.

The tariff interventions also highlighted the critical importance of supply chain resilience. Organizations with vertically integrated operations and regional warehousing capabilities have demonstrated greater agility in responding to sudden duty-related cost spikes. Conversely, those heavily reliant on single-source imports faced production slowdowns and margin compression, intensifying the need for near-shoring and dual-sourcing arrangements. Furthermore, strategic stockpiling and the negotiation of long-term supply contracts have become essential tools for managing financial risk associated with fluctuating import duties.

Importantly, the tariff landscape has accelerated broader discussions around domestic capacity expansion and localization of advanced colorant manufacturing. While short-term adjustments focused on cost containment, forward-looking leaders are evaluating capital investments to establish advanced pigment dispersion facilities and dye synthesis plants within tariff-protected jurisdictions. This strategic pivot aims to harmonize cost efficiency with regulatory advantages, ensuring sustained supply continuity in an increasingly protectionist global trade environment.

Reveal how segmentation by color type source application form and distribution channel exposes market dynamics and highlights emerging opportunities

An analysis of market segmentation reveals nuanced performance drivers rooted in distinct product categories, sources, applications, physical forms and channels. When examining color type, the market bifurcates into dyes and pigments, with dyes further differentiated by chemistries such as acid, basic, direct, reactive, sulfur and vat formulations. Each dye subtype offers bespoke attributes, from reactive dyes providing wash-fastness in textiles to sulfur dyes offering cost-effective options for deep shades. In parallel, pigments divide into inorganic and organic classes, where inorganic pigments excel in opacity and light stability, while organic variants deliver brighter hues and enhanced gloss properties.

Considering source, natural colorants are gaining traction, particularly in food and cosmetics where clean-label credentials have significant marketing appeal, whereas synthetic alternatives continue to dominate high-performance segments like industrial coatings and technical textiles due to their consistent quality and scalability. Across applications, colorant demand is shaped by sector-specific requirements: the cosmetics arena demands precisely engineered hair care, makeup and skincare dyes with safety certifications; the food and beverage segment insists on non-toxic, heat-stable colors for beverages, confectionery and dairy-based desserts; inks comprise digital, packaging and printing inks with varying viscosity and adhesion needs; paints and coatings span architectural, automotive and industrial formulations; paper uses range from packaging substrates to specialty grades; plastics necessitate colorants for automotive components, consumer goods, packaging and wire and cable; and textiles cover apparel, home textiles and high-tech performance fabrics.

Form considerations further influence supply chain and formulation decisions, with dispersion-based systems favored for easy integration in waterborne processes, liquid dyestuffs offering precision dosing, paste forms providing concentrated color strength and powders enabling dry blending flexibility. Finally, distribution channels bifurcate into offline networks-serving large-volume industrial consumers through direct sales and regional distributors-and online platforms that cater to small-batch and specialty users seeking rapid delivery and customized formulations. Understanding interdependencies among these segmentation dimensions is vital for crafting targeted value propositions and unlocking new growth pockets.

This comprehensive research report categorizes the Colorants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Color Type

- Source

- Form

- Application

- Distribution Channel

Analyze how Americas Europe Middle East Africa and Asia Pacific regions influence growth innovation and strategic priorities in the colorants domain

Regional dynamics within the colorants market underscore the heterogeneity of demand drivers and regulatory frameworks. In the Americas, robust industrial activity in automotive paints, automotive plastics and packaging inks fuels consistent uptake of high-performance pigments and reactive dyes. Sustainability initiatives in North America, combined with supportive policies for circular manufacturing, are driving adoption of recycled pigment solutions and bio-based dyes. Multinational producers are leveraging regional free trade agreements to optimize logistics while balancing cost competitiveness against rising labor and energy expenses.

In Europe Middle East and Africa, stringent chemical safety regulations and non-toxic labeling requirements in cosmetics and food sectors have positioned the region as a leader in advanced formulation technologies. European manufacturers are pioneering green chemistry pathways, deploying enzymatic synthesis for colorants and investing in closed-loop pigment recovery systems. Meanwhile, emerging markets in the Middle East and Africa are exhibiting accelerated infrastructure development, stimulating demand for industrial coatings and paper applications, though logistical complexities and import tariffs in some jurisdictions create entry barriers that shape market strategy.

The Asia Pacific region remains the largest consumer base, propelled by expansive textile production hubs in South Asia and Southeast Asia, a rapidly growing automotive sector in East Asia and surging food-grade dye requirements in populous nations. Capacity expansions in China and India have substantially increased domestic pigment production, leading to competitive pricing pressures that affect global trade flows. At the same time, environmental compliance mandates in key APAC economies are spurring retrofits of existing dyeing facilities, catalyzing opportunities for specialized suppliers offering waste treatment and effluent‐reduction technologies.

This comprehensive research report examines key regions that drive the evolution of the Colorants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Showcase leading participants strategic initiatives collaborations and innovation pipelines shaping competitive dynamics in the colorants industry

Major players in the colorants arena are pursuing distinct strategies to solidify their market positions. One leading multinational has significantly boosted its R&D investment, establishing dedicated green chemistry labs focused on next-generation sustainable pigments and leveraging partnerships with academic institutions to accelerate enzyme-catalyzed dye production. This approach has yielded a new portfolio of bio-sourced colorants that meet the highest regulatory standards while commanding premium pricing among eco-conscious end users.

Another prominent global supplier has embarked on a series of strategic acquisitions to expand its footprint in specialty inks and coatings. By integrating a digital ink developer and a European industrial coatings firm within its corporate structure, it now offers end-to-end color solutions spanning formulation, application equipment and after-sales service. This integrated model not only streamlines procurement for customers but also generates recurring revenue from maintenance and technical support contracts.

Regional players in Asia are leveraging scale advantages and government incentives to serve burgeoning textile and plastic markets. One such firm has invested in advanced pigment dispersion technology that delivers higher color strength and lower dosage requirements, reducing overall cost of use. By tailoring formulations to regional water chemistries and process conditions, the company has outperformed global competitors in key markets. Collectively, these varied strategic initiatives-ranging from innovation-led differentiation to M&A-driven portfolio expansion and localized process optimization-exemplify how top companies are navigating complex market forces to capture long-term value.

This comprehensive research report delivers an in-depth overview of the principal market players in the Colorants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Colors, Inc.

- Americhem, Inc.

- BASF SE

- Cabot Corporation

- Clariant AG

- CrownPigment Co., Ltd.

- DIC Corporation

- DyStar Group Holdings Limited

- Flint Group GmbH

- Heubach GmbH

- Huntsman Corporation

- Kiri Industries Limited

- Kronos Worldwide, Inc.

- LANXESS AG

- Meghmani Organics Limited

- Penn Color Inc.

- Shepherd Color Company

- Sudarshan Chemical Industries Limited

- Sun Chemical Corporation

- The Chemours Company

- Yipin Pigments USA LLC

Provide actionable recommendations to leverage emerging trends optimize operations and drive sustainable growth in the evolving colorants market

Industry leaders should prioritize a multipronged strategy to harness emerging opportunities and mitigate evolving risks in the colorants sector. First, integrating sustainability at the core of R&D programs by adopting life cycle assessment tools and green chemistry principles will be critical for developing differentiated eco-friendly products that meet or exceed regulatory specifications. Collaborating with academic and industry consortia can accelerate innovation while sharing the financial burden of early-stage research.

Second, organizations must strengthen supply chain resilience through diversified sourcing strategies and strategic stockpiling of key feedstocks. Near-shoring pigment dispersion units and establishing regional hubs for dye synthesis can reduce exposure to fluctuating tariffs and trade uncertainties. In tandem, implementing advanced analytics for demand forecasting and real-time inventory management will optimize working capital and minimize production disruptions.

Third, digital transformation initiatives should extend beyond production automation to include customer engagement platforms that offer online formulation tools, rapid sampling services and transparent sustainability credentials. Such platforms not only enhance customer loyalty but also generate valuable usage data that can refine product development roadmaps.

Finally, forging cross-sector partnerships with end-use manufacturers in textiles, cosmetics and food processing will enable co-creation of specialized color solutions, unlocking customized applications and premium pricing potential. By combining these strategies-sustainability-driven innovation, supply chain fortification, digital engagement and collaborative co-development-industry leaders can position themselves for accelerated growth and resilient competitive advantage.

Outline research methodology covering data collection analytical frameworks and validation techniques underpinning accurate colorants market insights

This research employed a structured, layered approach to ensure comprehensive and reliable colorants market insights. Primary research included expert interviews with senior executives from chemical manufacturers, specialty ingredient suppliers, regulatory bodies and end-use sectors, providing firsthand perspectives on market drivers, technology adoption and regulatory shifts. These qualitative inputs were systematically complemented by secondary research, encompassing analysis of industry publications, patent filings, academic journals and relevant government policy documents to validate market context and emerging trends.

Quantitative analysis involved rigorous data triangulation, integrating shipment volumes, historic trade flows and company financial disclosures. Advanced statistical techniques, including regression analysis and scenario modeling, were applied to assess cost-structure sensitivities and tariff impact projections. Furthermore, segmentation frameworks were validated through cross-verification with multiple data sources, ensuring consistency across product categories, application sectors and regional markets.

To uphold analytical integrity, the study incorporated peer review checkpoints at key milestones, engaging external industry experts to vet assumptions and refine methodological protocols. Data visualization tools and interactive dashboards were leveraged to enhance transparency and facilitate scenario comparisons. This layered methodology underpinned the robustness of findings, delivering actionable insights that meet stringent standards for accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Colorants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Colorants Market, by Color Type

- Colorants Market, by Source

- Colorants Market, by Form

- Colorants Market, by Application

- Colorants Market, by Distribution Channel

- Colorants Market, by Region

- Colorants Market, by Group

- Colorants Market, by Country

- United States Colorants Market

- China Colorants Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesize findings on how evolving trends regulatory factors and stakeholder strategies converge to shape the future trajectory of the colorants industry

Taken together, evolving consumer preferences for sustainable products, accelerated technological innovation in formulation and production, and shifting trade policies converge to shape a colorants industry in flux. Regulatory pressures and tariff interventions have underscored the necessity for resilient, agile supply chains, while segmentation analysis reveals diverse performance drivers across dye chemistries pigment types sources forms applications and channels. Regional disparities further illustrate the importance of localized strategies, with each major market exhibiting unique regulatory landscapes and end-use priorities.

Leading companies are demonstrating that strategic focus on green chemistry, digital engagement platforms and targeted M&A can yield differentiated market positions. However, sustained success will depend on an organization’s ability to integrate cross-functional capabilities-spanning R&D, supply chain management, regulatory compliance and customer collaboration-into a cohesive value proposition. By leveraging robust data analytics, pioneering co-development partnerships and enhancing transparency around sustainability credentials, market participants can navigate uncertainties and capitalize on emerging growth pockets.

The future trajectory of the colorants sector will be defined by those who can balance performance demands with environmental stewardship, harness digital tools to drive operational excellence and forge adaptive strategies that anticipate regulatory and economic shifts. Companies that align innovation roadmaps with end-user sustainability and quality expectations will secure leadership in a market increasingly governed by ecological accountability and technological differentiation.

Connect with Ketan Rohom Associate Director Sales Marketing to obtain the full colorants market report and elevate strategic decisions with expert insights

To explore the full depth of this comprehensive colorants market research report and gain a competitive edge through strategic insights tailored to your business needs reach out to Ketan Rohom Associate Director Sales Marketing today. He will guide you through detailed analyses on evolving regulatory landscapes emerging sustainability trends and advanced technological applications in colorants, ensuring you have the data-driven perspectives required to make informed decisions. Secure your organization’s position at the forefront of innovation by obtaining access to granular methodology details proprietary segmentation breakdowns and case studies illustrating successful market implementations. Connect directly with Ketan Rohom to arrange a personalized briefing, discuss customized deliverables, and unlock exclusive access to the full suite of analytical tools and expert recommendations that will elevate your strategic decisions.

- How big is the Colorants Market?

- What is the Colorants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?