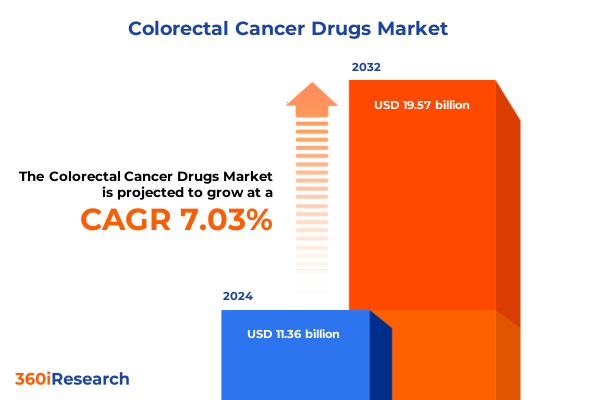

The Colorectal Cancer Drugs Market size was estimated at USD 11.99 billion in 2025 and expected to reach USD 12.66 billion in 2026, at a CAGR of 7.24% to reach USD 19.57 billion by 2032.

Escalating incidence and mortality rates in colorectal cancer emphasize urgent need for strategic interventions and novel therapeutic solutions

Colorectal cancer remains a formidable public health challenge, with an estimated 154,270 new cases and approximately 52,900 deaths projected in the United States for 2025. These figures represent nearly 8 percent of all new cancer cases and more than 8 percent of cancer mortality nationwide, underscoring the critical need for improved prevention, early detection, and treatment strategies. Over the past decade, incidence rates have plateaued, yet mortality improvements have been modest, reflecting the complexity of this disease and the limits of current therapeutic approaches.

Breakthrough drug approvals and technological innovations are reshaping colorectal cancer treatment paradigms with precision medicine and targeted therapies

The therapeutic landscape for colorectal cancer is undergoing unprecedented transformation as precision medicine and novel drug classes converge to deliver targeted, effective treatments. In early 2025, the U.S. Food and Drug Administration granted approval for the combination of Amgen’s oral KRAS G12C inhibitor Lumakras with the EGFR-targeting monoclonal antibody Vectibix, marking the first synergistic regimen aimed at a subset of patients harboring specific KRAS and EGFR mutations. This decision, backed by data demonstrating a progression-free survival benefit of 5.6 months versus two months with standard care, illustrates the power of molecularly guided combination strategies.

Cumulative impact of imposed U.S. tariffs on pharmaceutical imports is disrupting colorectal cancer drug supply chains and altering global pricing dynamics

The cumulative impact of imposed U.S. tariffs on pharmaceutical imports is reverberating across supply chains and pricing structures, particularly for colorectal cancer drugs that rely heavily on imported active pharmaceutical ingredients. As of April 2025, APIs sourced from China and India face duties of up to 25 percent and 20 percent, respectively, while nearly all healthcare imports are subject to a baseline global tariff of 10 percent. These measures have immediately inflated production costs for both branded therapies and lower-margin generics, challenging manufacturers to absorb higher expenses or risk passing them onto patients and payers.

Comprehensive segmentation reveals colorectal cancer drug classes, administration routes, therapy lines, distribution channels, targets, and treatment settings

Comprehensive segmentation reveals colorectal cancer drug classes, administration routes, therapy lines, distribution channels, targets, and treatment settings. Within drug class segmentation, traditional chemotherapy agents remain categorized into fluoropyrimidines, platinum compounds, and topoisomerase inhibitors, while immunotherapy offerings span adoptive cell therapies and checkpoint inhibitors. Monoclonal antibodies are distinguished by epidermal growth factor receptor and vascular endothelial growth factor inhibitors, and small molecule inhibitors include BRAF, MEK, and tyrosine kinase inhibitors. Distribution channels delineate products dispensed through hospital pharmacies, online pharmacies, and retail outlets, each with unique procurement and reimbursement dynamics. Route of administration further separates treatments administered intravenously, orally, or subcutaneously, influencing patient adherence and healthcare resource utilization. A focus on line of therapy clarifies whether agents are positioned as first-, second-, or third-line options, guiding clinical decision-making. Target molecule segmentation underscores therapies directed at EGFR, PD-1, PD-L1, and VEGF, reflecting the era of precision oncology. Treatment setting segmentation divides interventions between inpatient and outpatient care, highlighting shifts toward ambulatory delivery models and evolving payer policies.

This comprehensive research report categorizes the Colorectal Cancer Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Distribution Channel

- Route Of Administration

- Line Of Therapy

- Target Molecule

- Treatment Setting

Regional market dynamics in Americas, Europe Middle East & Africa, and Asia-Pacific highlight regulatory variations, adoption patterns, and distinct growth drivers

In the Americas, robust regulatory frameworks and established healthcare infrastructure facilitate rapid uptake of innovative therapies, particularly in the United States where recent FDA approvals have accelerated access to KRAS-targeted inhibitors and checkpoint blockade regimens. This dynamic environment is complemented by patient assistance programs and value-based purchasing initiatives that strive to balance affordability with clinical benefit, although high out-of-pocket costs remain a barrier for underserved populations.

This comprehensive research report examines key regions that drive the evolution of the Colorectal Cancer Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading pharmaceutical innovators are advancing colorectal cancer treatment through partnerships, targeted therapy pipelines, and differentiated drug portfolios

Leading pharmaceutical innovators are advancing colorectal cancer treatment through partnerships, targeted therapy pipelines, and differentiated drug portfolios. Amgen’s integration of Lumakras and Vectibix exemplifies strategic combination approaches designed to overcome resistance pathways, while Bristol Myers Squibb’s accelerated approval of adagrasib in combination with cetuximab underscores the shift toward KRAS G12C-mutated indications. Meanwhile, Takeda’s Fruzaqla introduces an oral kinase inhibitor option for refractory disease, and Bristol Myers Squibb’s subcutaneous nivolumab/hyaluronidase formulation enhances patient convenience across multiple solid tumor indications. These developments are supported by collaborations with diagnostic firms to refine companion assays, ensuring that therapies reach biomarker-defined patient subsets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Colorectal Cancer Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accord Healthcare Limited by Intas Pharmaceuticals Ltd.

- Amgen Inc.

- Amneal Pharmaceuticals, Inc.

- Apotex Inc.

- Bayer AG

- Bristol-Myers Squibb Company

- Eisai Co., Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline PLC

- HUTCHMED (China) Limited

- Lupin Limited

- Mallinckrodt Pharmaceuticals

- Manus Aktteva Biopharma LLP

- Marksans Pharma Ltd.

- Merck & Co., Inc.

- Mylan N.V. by Viatris Inc.

- Novartis AG

- Pfizer Inc.

- Regeneron Pharmaceuticals, Inc.

- Sanofi S.A.

- Sumitomo Pharma Co., Ltd.

- Taiho Pharmaceutical Co., Ltd. by Otsuka Pharmaceutical Co., Ltd.

- Takeda Pharmaceutical Company Limited

- VolitionRx Limited

Actionable recommendations for industry leaders focus on optimizing supply chains, advancing pipeline innovation, enhancing patient access, and engaging payers effectively

Industry leaders must prioritize supply chain resilience by diversifying API sourcing and engaging in nearshoring initiatives to mitigate the effects of import tariffs and geopolitical disruptions. Investment in next-generation KRAS inhibitors and subcutaneous formulations can enhance patient adherence and optimize clinical outcomes, while establishing value-based contracting frameworks with payers will reinforce alignment between therapeutic benefit and reimbursement. Additionally, proactive engagement with regulatory agencies to expedite accelerated approval pathways and adaptive trial designs can shorten time to market, and strategic collaborations with diagnostic developers will ensure precise patient selection. Finally, leveraging real-world evidence platforms can generate post-market data to support label expansions, pricing negotiations, and clinical guideline incorporation.

Research methodology incorporates primary interviews, secondary data review, expert consultation, and rigorous validation to underpin colorectal cancer market analysis

Research methodology incorporates primary interviews, secondary data review, expert consultation, and rigorous validation to underpin colorectal cancer market analysis. Primary interviews were conducted with oncologists, payers, and supply chain specialists across key geographies to capture qualitative insights into clinical adoption, reimbursement challenges, and logistical constraints. Secondary data review drew from peer-reviewed clinical trial publications, regulatory agency announcements, and public health databases to quantify approval timelines, survival outcomes, and incidence trends. Expert consultation involved an advisory panel of oncologists and pharmacoeconomists who guided the interpretation of efficacy data and market dynamics. Finally, rigorous validation through cross-referencing multiple data sources and sensitivity analyses ensured the reliability and robustness of key findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Colorectal Cancer Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Colorectal Cancer Drugs Market, by Drug Class

- Colorectal Cancer Drugs Market, by Distribution Channel

- Colorectal Cancer Drugs Market, by Route Of Administration

- Colorectal Cancer Drugs Market, by Line Of Therapy

- Colorectal Cancer Drugs Market, by Target Molecule

- Colorectal Cancer Drugs Market, by Treatment Setting

- Colorectal Cancer Drugs Market, by Region

- Colorectal Cancer Drugs Market, by Group

- Colorectal Cancer Drugs Market, by Country

- United States Colorectal Cancer Drugs Market

- China Colorectal Cancer Drugs Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concluding analysis synthesizes key findings and underscores strategic priorities for stakeholders in the evolving colorectal cancer therapeutics landscape

This analysis synthesizes pivotal developments in colorectal cancer therapeutics, highlighting transformative regulatory approvals, tariff-driven supply chain disruptions, and nuanced segmentation insights. The convergence of innovative drug classes-ranging from KRAS inhibitors to checkpoint inhibitors-and evolving distribution models underscores a dynamic market environment. Regional variations in regulatory processes and pricing pressures further amplify complexity for stakeholders seeking to navigate diverse healthcare landscapes. As industry leaders refine strategies around supply chain diversification, value-based contracting, and precision diagnostics, the imperative remains clear: to deliver sustainable, patient-centric solutions that address unmet needs across the colorectal cancer continuum.

Empower your organization with in-depth colorectal cancer market research — connect with Ketan Rohom for personalized guidance and access to the full report today

Are you ready to transform your organization’s strategic direction with granular insights and expertly curated data? Connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to gain immediate access to the full colorectal cancer market research report. Ketan will guide you through tailored solutions that address your specific challenges and objectives, ensuring your team can make informed decisions backed by comprehensive analysis. Engage directly with an expert who can provide pricing information, discuss customized deliverables, and outline the best ways to leverage this intelligence for maximum impact.

Don’t miss the opportunity to secure a competitive edge in the rapidly evolving colorectal cancer therapeutics landscape. Reach out today to schedule a personalized briefing and discover how this report can accelerate your growth strategies, optimize your product portfolio, and enhance stakeholder value.

- How big is the Colorectal Cancer Drugs Market?

- What is the Colorectal Cancer Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?