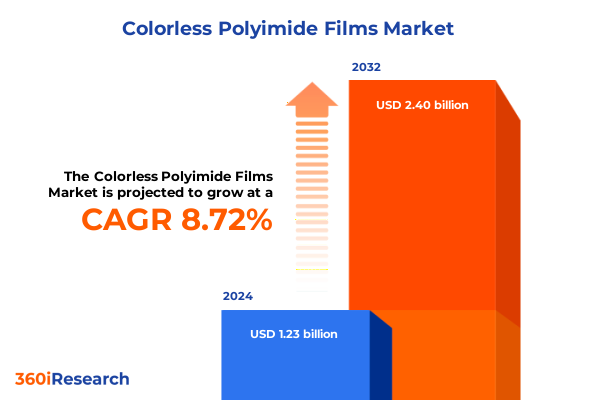

The Colorless Polyimide Films Market size was estimated at USD 1.32 billion in 2025 and expected to reach USD 1.43 billion in 2026, at a CAGR of 8.83% to reach USD 2.40 billion by 2032.

Setting the Stage for a Revolution in Industrial Materials with a Deep Dive into the Evolution and Defining Properties of Colorless Polyimide Films

Colorless polyimide films have emerged as a foundational platform material characterized by an extraordinary combination of optical clarity, thermal resilience, and mechanical robustness. These films represent the confluence of decades of polymer science advancements, transitioning from traditional amber-hued formulations to transparent variants that retain the hallmark heat resistance of polyimides. As a result, they have unlocked applications previously limited by color restrictions, enabling new design freedoms in flexible electronics and photonics. Furthermore, the unique chemical backbone of these films underpins their exceptional performance under extreme operational conditions, making them indispensable in sectors where reliability is paramount. This introduction sets the stage for understanding how colorless polyimide films are redefining material standards and catalyzing innovation across multiple high-value industries, from next-generation displays to advanced aerospace components.

Identifying Transformational Trends Shaping the Colorless Polyimide Film Market Landscape and Driving Next Generation Flexible Electronics Innovation

In recent years, the colorless polyimide film market has witnessed transformative shifts driven by converging technological and sustainability imperatives. The relentless push toward miniaturization in consumer electronics has heightened demand for ultra-thin yet resilient substrates, prompting material scientists to refine polymer chemistries and enable thicknesses below ten micrometers without sacrificing durability. Simultaneously, the rapid adoption of foldable and rollable displays has positioned these films at the core of flexible display technologies, where their clarity and flexibility address stringent optical and mechanical requirements. On the sustainability front, manufacturers are exploring solvent-free processing and closed-loop recycling systems to minimize environmental impact. This shift reflects a broader industry trend toward greener manufacturing protocols. Additionally, the pursuit of enhanced barrier properties has led to the integration of fluorinated and alicyclic structural motifs, resulting in films with superior moisture resistance for applications in flexible solar cells and advanced optics. Together, these developments underscore the dynamic nature of the landscape and the need for stakeholders to stay ahead of continuous innovation cycles.

Analyzing the Multifaceted Consequences of 2025 United States Tariffs on Colorless Polyimide Film Supply Chains and Cost Structures for Stakeholders

The introduction of 2025 tariffs by the United States on select imports of colorless polyimide films has had a multifaceted impact on supply chain economics and strategic sourcing decisions. While the measure aims to bolster domestic manufacturing, it has simultaneously increased procurement costs for industries reliant on imported films, from flexible printed circuit board producers to medical device manufacturers. In response, several stakeholders have accelerated efforts to diversify their supplier base, forging partnerships with domestic polymer processing facilities and secondary distribution networks. This trend toward nearshoring has improved lead-time reliability, yet has also necessitated additional investments in process qualification to ensure material consistency. Concurrently, firms are reevaluating inventory strategies, balancing the financial burden of higher tariff-inclusive pricing against the operational risks of supply disruptions. Importantly, the tariff environment has stimulated dialogue between material suppliers and end users, encouraging collaborative development programs aimed at localized production capabilities. As a result, the United States is charting a new course toward self-reliance in advanced film manufacturing, albeit with transitional challenges that demand strategic foresight.

Unveiling In-Depth Segmentation Drivers That Reveal How Type Grade Thickness Manufacturing Processes Applications and End User Verticals Intersect

A granular examination of the colorless polyimide film market through segmented lenses exposes nuanced drivers of demand and performance requirements. When viewed through the prism of type, the market delineates into Alicyclic CPI, Fluorinated CPI, and Noncoplanar CPI variants, each offering distinct balances of thermal expansion, optical clarity, and chemical resistance. Examining the grade dimension reveals an essential dichotomy between Optically Clear and Standard films, where the former is tailored for high-transparency applications such as display overlays and optical fibers, while the latter provides cost-optimized options for electrical insulation and basic barrier functions. Thickness-based distinctions further refine material selection, spanning Ultra-Thin Films below ten micrometers for foldable displays, Standard Films in the ten to one hundred micrometer range for flexible printed circuit boards, and Thick Films above one hundred micrometers for structural components in aerospace and defense. Manufacturing processes-including Blowing, Melt Extrusion, Melting, and Solvent Casting-play an integral role in defining film uniformity, production yield, and scalability, shaping supplier competencies. From an application perspective, colorless polyimide films address requirements for Drug Delivery Tubes, Flexible Displays, Flexible Printed Circuit Boards, Flexible Solar Cells, Lighting Equipment, Optical Fibers, Reflectors & Connectors, and Touch Panels, translating material properties into end-product performance. Finally, the end-user segmentation across Aerospace & Defense, Automotive, Electronics, Healthcare, Research Institutions, and Solar Energy underscores the films’ versatility across industries with demanding operational environments.

This comprehensive research report categorizes the Colorless Polyimide Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Grade

- Thickness

- Manufacturing Process

- Application

- End-User

Exploring Critical Regional Dynamics That Illuminate Growth Opportunities across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics are instrumental in shaping the trajectory of the colorless polyimide film market, with each geography presenting distinct growth catalysts and challenges. In the Americas, the United States dominates demand through a robust consumer electronics ecosystem while Canada and Mexico foster emerging manufacturing clusters, buoyed by nearshoring trends and supportive government incentives. Transitioning to Europe, the Middle East & Africa, stringent environmental regulations and a pronounced focus on sustainable production methodologies drive adoption among automotive and defense manufacturers, with pockets of innovation arising in Germany, France, and the United Arab Emirates. Meanwhile, the Asia-Pacific region commands a significant share of global consumption, underpinned by expansive flexible display and semiconductor fabrication facilities in China, Japan, and South Korea. Here, cost competitiveness and rapid technology iterations foster intense supplier competition. Across all regions, trade policies, logistical networks, and localized R&D investments collectively influence supply chain resilience and market penetration strategies.

This comprehensive research report examines key regions that drive the evolution of the Colorless Polyimide Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Competitive Terrain through Comprehensive Profiles and Strategic Movements of Leading Industry Participants in the Colorless Polyimide Segment

The competitive landscape of the colorless polyimide film sector is shaped by both legacy chemical conglomerates and specialized polymer innovators. Key players have strategically invested in capacity expansions, joint ventures, and proprietary process technologies to capture market share and secure high-value contracts in emerging applications. Several firms have introduced specialized grades targeting ultrathin film requirements for foldable consumer electronics, while others have focused on fluorinated chemistries to meet rigorous barrier specifications for solar energy modules. Partnerships between material suppliers and original equipment manufacturers reflect a growing emphasis on co-development to accelerate time-to-market and ensure application-level performance validation. Additionally, mergers and acquisitions activity has accelerated, as participants seek to augment their product portfolios and geographic footprints. Tier-one names are now integrating downstream capabilities, including coating and lamination services, to offer turnkey solutions. In parallel, smaller innovators leverage agile R&D processes to introduce niche film variants, exerting competitive pressure through targeted differentiation. This dynamic interplay underscores a market where strategic alignment across the value chain is essential for sustaining growth and building long-term resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Colorless Polyimide Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Applied Aerospace Structures Corporation

- Arkema S.A.

- Changchun Gao Qi Polyimide Material Co., Ltd.

- Chengdu Q-Mantic Industrial Products Co.,Ltd.

- Dr. Dietrich Mueller GmbH

- DuPont de Nemours, Inc.

- Industrial Summit Technology Corporation

- Isovolta AG

- Kaneka Corporation

- Kolon Industries Inc.

- Krempel GmbH

- Mitsubishi Gas Chemical Company Inc.

- Sekisui Chemical Co., Ltd.

- SK Innovation Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Suzhou Kinyu Electronics Co., Ltd.

- Taimide Tech. Inc.

- TORAY INDUSTRIES, INC.

- Tredegar Corporation

- UBE Corporation

- Wu Xi Shun Xuan New Materials Co., Ltd

- Wuhan Yimaide New Materials Technology Co., Ltd

Delivering Strategic Recommendations to Empower Industry Leaders in Navigating Market Complexities Mitigating Risks and Capitalizing on Emerging Opportunities

To navigate the complex landscape of the colorless polyimide film market, industry leaders must adopt a multifaceted strategy that balances innovation, supply chain resilience, and sustainability. Prioritizing research collaborations with academic institutions and equipment manufacturers can accelerate the development of next-generation polymer chemistries, while establishing multi-sourcing agreements across diverse geographies will mitigate tariff exposure and logistical risks. In parallel, investing in process optimization-particularly in solvent-free and energy-efficient manufacturing-will address mounting regulatory pressures and reduce carbon footprints. Strategic partnerships with end users are also critical; by integrating material performance objectives into product development roadmaps, both suppliers and OEMs can co-create solutions that precisely align with evolving application requirements. Furthermore, companies should leverage digital platforms for real-time supply chain visibility, enabling proactive risk management and enhanced customer responsiveness. Finally, embedding sustainability metrics into corporate KPIs will demonstrate environmental stewardship and strengthen brand reputation in a market increasingly driven by ESG considerations.

Detailing the Rigorous Multi-Method Research Framework Leveraging Primary and Secondary Data Collection for Robust Colorless Polyimide Film Market Analysis

This analysis is grounded in a rigorous multi-method research framework designed to ensure both breadth and depth of market intelligence. Secondary data sources formed the foundation of the study, incorporating peer-reviewed journals, industry whitepapers, patent databases, and publicly disclosed corporate filings to capture historical trends and technological advancements. Complementing this, primary research was conducted through structured interviews with material scientists, procurement specialists, and senior executives across leading user industries, ensuring first-hand insights into performance criteria and sourcing challenges. Quantitative validation was achieved via structured surveys targeting end-users in electronics, aerospace, and healthcare sectors, while qualitative case studies provided contextual understanding of application-specific material adoption. Data triangulation techniques were employed to reconcile discrepancies across sources, enhancing the reliability of findings. The result is a comprehensive perspective that articulates current market dynamics, future trajectories, and the strategic imperatives for stakeholders at every juncture of the value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Colorless Polyimide Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Colorless Polyimide Films Market, by Type

- Colorless Polyimide Films Market, by Grade

- Colorless Polyimide Films Market, by Thickness

- Colorless Polyimide Films Market, by Manufacturing Process

- Colorless Polyimide Films Market, by Application

- Colorless Polyimide Films Market, by End-User

- Colorless Polyimide Films Market, by Region

- Colorless Polyimide Films Market, by Group

- Colorless Polyimide Films Market, by Country

- United States Colorless Polyimide Films Market

- China Colorless Polyimide Films Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings to Highlight the Strategic Imperatives and Growth Catalysts Defining the Future Trajectory of the Colorless Polyimide Film Domain

In synthesizing the core findings of this executive summary, several strategic imperatives emerge as critical for stakeholders seeking to thrive in the colorless polyimide film market. First, continuous innovation in polymer design and manufacturing processes is paramount to meet the escalating performance demands of flexible electronics and optical applications. Second, proactive management of supply chain complexities-including tariff impacts and geographic diversification-will underpin operational stability and cost competitiveness. Third, the integration of sustainability initiatives, from solvent-free production to end-of-life recycling, will increasingly define market leadership and customer preference. Finally, collaborative engagement across the ecosystem-from material developers to equipment suppliers and end users-will accelerate product validation and time-to-market. By embracing these imperatives, organizations can position themselves at the forefront of a dynamic landscape, transforming challenges into opportunities and driving sustainable growth across multiple high-value end-use segments.

Driving Engagement through Personalized Outreach to Secure Definitive Market Insights for Colorless Polyimide Film Adoption and Competitive Advantage

To take the next step toward unlocking the full potential of colorless polyimide films in your organization, connect with Ketan Rohom (Associate Director, Sales & Marketing) to secure access to the comprehensive market research report. By engaging directly, you will gain tailored guidance on emerging trends, competitive benchmarks, and actionable data that can accelerate your innovation roadmap. Our team is prepared to support your strategic planning with in-depth analysis, ensuring a seamless integration of insights into your decision-making processes. Reach out to schedule a personalized briefing, explore customized data solutions, and discuss partnership opportunities designed to maximize your competitive advantage in the evolving colorless polyimide film ecosystem. Act now to harness these critical insights and drive measurable growth within your organization.

- How big is the Colorless Polyimide Films Market?

- What is the Colorless Polyimide Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?