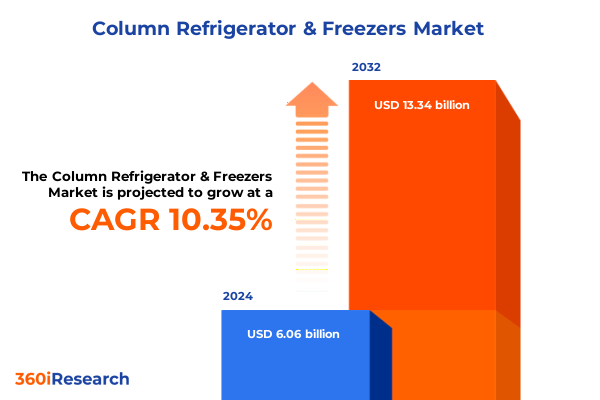

The Column Refrigerator & Freezers Market size was estimated at USD 6.55 billion in 2025 and expected to reach USD 7.08 billion in 2026, at a CAGR of 10.68% to reach USD 13.34 billion by 2032.

Comprehensive Insights into Emerging Technologies, Market Drivers, and Strategic Imperatives in the Column Refrigerator and Freezer Industry

The specialized segment of column refrigerators and freezers has emerged as a critical infrastructural backbone for sectors spanning biotechnology research to premium residential kitchens. As stakeholders seek units that marry precise temperature control with robust reliability, this ecosystem continues to evolve through technological innovation, regulatory influences, and shifting end-user demands. From single-door undercounter units to expansive double-door freezers, the industry now encompasses a diverse spectrum of configurations tailored to specific applications.

Transitioning from legacy mechanical controls to digital thermostats and IoT-enabled monitoring, product offerings have taken on heightened sophistication. Meanwhile, energy efficiency and sustainability have ascended to frontline priorities, driven by both environmental regulations and cost pressures. In parallel, the rising emphasis on cold-chain resilience, particularly in pharmaceutical and food-service applications, underscores the strategic importance of robust refrigeration assets. Thus, a nuanced understanding of underlying market drivers, supply-chain intricacies, and innovation trajectories is essential for navigating this dynamic landscape.

Major Catalysts and Technological Advancements Reshaping the Competitive Dynamics of Refrigeration Column and Freezer Solutions Worldwide

Industrial, commercial, and residential refrigeration markets have undergone transformative shifts fueled by a convergence of regulatory mandates, digital integration, and sustainability imperatives. Foremost among these is the accelerated adoption of smart refrigeration solutions that leverage embedded sensors and cloud-based analytics. By enabling real-time temperature monitoring, predictive maintenance alerts, and seamless remote control, these platforms help mitigate spoilage risks and optimize performance-reducing operational downtime and lifecycle costs in equal measure.

Concurrently, a regulatory pivot toward natural refrigerants with minimal global warming potential is reshaping product roadmaps. Driven by commitments under the Kigali Amendment and aggressive national emissions targets, manufacturers are integrating CO₂ and hydrocarbon-based cooling circuits. Beyond environmental impact, these low-GWP systems deliver tangible gains in energy consumption, aligning with both corporate sustainability goals and tightening energy-efficiency standards.

Furthermore, the expanding requirements of cold-chain logistics-propelled by e-commerce growth in perishable food and biologics distribution-are driving demand for specialized freezer solutions. As temperature integrity becomes non-negotiable, stakeholders increasingly prioritize units engineered for ultra-rapid recovery and advanced humidity control, reinforcing the necessity of next-generation refrigeration assets.

Assessing the Broad Economic and Operational Repercussions of 2025 United States Trade Measures on the Column Refrigerator and Freezer Sector

In 2025, new United States trade measures have imposed significant economic and operational repercussions across the column refrigerator and freezer industry. The expansion of steel and aluminum tariffs to encompass household appliances-including refrigerators and dishwashers-at a 50% duty rate effective June 23, 2025 has elevated input costs for manufacturers reliant on domestic metal supply chains. This adjustment compounds raw-material inflation pressures and narrows production margins unless costs are transferred downstream.

Moreover, the ongoing Section 301 investigations and related tariff exclusions on select Chinese imports have introduced additional complexity. While certain product lines benefit from temporary relief-through exclusions extended to August 31, 2025-others face reinstated duties, affecting the economics of imported compressors, evaporator coils, and control modules. As USTR continues to review exclusion lists, companies must navigate shifting duty burdens and adjust sourcing strategies accordingly.

Finally, the closure of the de minimis exemption in early May 2025 has eliminated the $800 threshold for tariff-free shipments from China and Hong Kong, thereby subjecting lower-value spare parts and components to standard duty rates. In aggregate, these measures have intensified supply-chain fragmentation, incentivizing near-shoring initiatives and forging heightened scrutiny on total landed costs across product portfolios.

Uncovering Intricate Market Segmentation Insights to Illuminate Performance Drivers Across Refrigeration and Freezer Subcategories

Disaggregating the column refrigerator and freezer market by product type reveals nuanced performance drivers. Standalone freezers-available in both single-door and double-door configurations-continue to attract investment from food-service operators seeking optimized freezing capacity, while combination units blending refrigeration and freezing zones cater to laboratories requiring multi-temperature protocols. Pure refrigeration units, likewise offered in single- and double-door options, dominate residential installations with their compact footprints and streamlined aesthetics.

A closer look at application contexts underscores the sector’s breadth. Biotechnology and pharmaceutical research facilities demand ultra-stable low-temperature environments, whereas commercial users in food retail-spanning convenience stores and supermarkets-and the hospitality industry prioritize rapid temperature restoration and remote diagnostic capabilities. Laboratory deployments impose stringent validation requirements, and residential end-users balance energy-efficiency credentials with design integration.

Distribution channels further segment the market. Offline routes, including direct OEM sales, specialty retail showrooms, and wholesale distributors, serve high-touch segments necessitating technical consultation. In contrast, online platforms have emerged as critical conduits for standardized residential and light-commercial units, leveraging digital configurators and streamlined delivery logistics.

Capacity classifications-below 200 liters, between 200 and 500 liters, and above 500 liters-drive divergent feature sets. Smaller volumes emphasize compactness and plug-and-play convenience, midrange capacities often integrate advanced control interfaces, and high-capacity systems address large-scale cold-chain and bulk storage requirements.

This comprehensive research report categorizes the Column Refrigerator & Freezers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Capacity

- Application

- Distribution Channel

Mapping Regional Dynamics and Demand Patterns Across the Americas, Europe, Middle East & Africa and Asia-Pacific Column Refrigerator and Freezer Markets

Regional dynamics exert discernible influence on demand profiles and strategic priorities. In the Americas, decades-old food retail and hospitality infrastructures foster a predominantly replacement-driven market where supermarkets and convenience chains routinely refresh refrigeration assets to maintain quality standards and comply with safety regulations. Meanwhile, growth corridors in Latin America reflect expanding cold-chain networks supporting agribusiness exports.

Europe, the Middle East, and Africa present a mosaic of regulatory imperatives and infrastructural development. Progressive regulations under the EU F-gas framework-which phased out high-GWP HFCs and instituted stringent leak prevention, digital reporting, and quota mechanisms-have catalyzed the adoption of natural-refrigerant systems. At the same time, emerging markets throughout the region are investing in healthcare and food logistics infrastructures, stimulating demand for robust and compliant refrigeration solutions.

Asia-Pacific remains the fastest-growing region, driven by rapid urbanization, expanding retail ecosystems, and significant investments in cold-chain capabilities to support pharmaceuticals and perishable food distribution. China’s domestic manufacturing prowess and India’s surging e-commerce platforms further accelerate the deployment of both light-commercial and heavy-duty column refrigeration equipment. Globally, Asia-Pacific is projected to lead regional growth fueled by a convergence of demographic shifts and industrial modernization.

This comprehensive research report examines key regions that drive the evolution of the Column Refrigerator & Freezers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Initiatives and Innovation Portfolios of Leading Players Driving Advancement in Refrigeration Column and Freezer Technologies

Leading enterprises are leveraging strategic partnerships, targeted acquisitions, and continuous innovation to fortify their market positions. For instance, BSH Home Appliances showcased its Matter-compatible French-door refrigerators at CES 2025, underscoring the company’s commitment to interoperable smart-home ecosystems and premium segment differentiation. Similarly, Haier’s acquisition of Carrier Commercial Refrigeration in 2024 underscores the consolidation wave aimed at marrying global R&D capabilities with regional go-to-market expertise.

Innovation initiatives span beyond connectivity to include advanced compressor architectures, natural-refrigerant adoption, and modular system designs that simplify maintenance and scale with evolving capacity needs. These developments are coupled with heightened after-sales service frameworks, remote diagnostics, and outcome-based service contracts that enhance lifecycle value and align vendor objectives with user performance.

Additionally, market leaders are increasingly embedding sustainability throughout their portfolios, from carbon-neutral manufacturing sites to circular-economy programs for end-of-life equipment. Joint ventures with energy-storage providers and digital analytics firms further empower stakeholders with comprehensive energy-management solutions and continuous performance optimization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Column Refrigerator & Freezers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Carrier Global Corporation

- Daikin Industries, Ltd.

- Electrolux Professional AB

- Emerson Electric Co.

- Epta S.p.A.

- Hoshizaki Corporation

- Krowne Metal Corporation

- Liebherr-International AG

- Midea Group Co., Ltd.

- Norlake, Inc.

- Panasonic Holdings Corporation

- SKOPE Industries Ltd.

- True Manufacturing Company, Inc.

- Turbo Air Inc.

- U-Line Corporation

- Zibo Shengxue Electric Appliance Co., Ltd.

Actionable Strategic Recommendations for Industry Leaders to Navigate Market Complexity and Capitalize on Emerging Opportunities in Column Refrigeration

Industry leaders should prioritize agile sourcing strategies by diversifying supply bases and engaging local fabrication partners to mitigate tariff volatility. Investing in flexible manufacturing lines capable of accommodating both traditional HFC and next-generation natural refrigerants will help ensure product availability and compliance as regulations evolve.

Moreover, embedding IoT-centric architectures and advanced analytics within units is no longer optional. By deploying predictive maintenance and energy-optimization algorithms, organizations can deliver demonstrable total-cost-of-ownership reductions that resonate with budget-conscious end-users and green-certification bodies.

Collaboration with cold-chain stakeholders-such as logistics providers and pharmaceutical distributors-can unlock integrated solutions that transcend standalone appliances, creating end-to-end visibility and accountability. Finally, a customer-centric service model that combines remote‐monitoring subscriptions with rapid-response field service networks will drive differentiation in a competitive landscape characterized by tightening margins.

Rigorous Multi-Phase Research Methodology Leveraging Primary and Secondary Data to Deliver Comprehensive Insights into Column Refrigerator and Freezer Markets

This research synthesized insights through a rigorous multi-phase approach. Primary data was collected via structured interviews with over three dozen executives across manufacturing, distribution, and end-use domains, supplemented by thousands of datapoints from proprietary transactional databases. Secondary research incorporated official policy registers, regulatory filings, and academic literature to triangulate emerging technological and legislative drivers.

Quantitative analysis employed segmentation matrices to assess performance across product types, applications, distribution channels, and capacity tiers. Scenario planning techniques facilitated evaluation of tariff-impact sensitivities and regulatory compliance costs. Data validation encompassed peer benchmarking and external expert reviews to ensure methodological robustness and minimize bias.

Finally, continuous market surveillance-monitoring USTR announcements, EU regulatory corridors, and key trade-show developments-underpins the report’s dynamic framework, enabling timely updates in response to unfolding policy shifts or disruptive technological breakthroughs.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Column Refrigerator & Freezers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Column Refrigerator & Freezers Market, by Product Type

- Column Refrigerator & Freezers Market, by Capacity

- Column Refrigerator & Freezers Market, by Application

- Column Refrigerator & Freezers Market, by Distribution Channel

- Column Refrigerator & Freezers Market, by Region

- Column Refrigerator & Freezers Market, by Group

- Column Refrigerator & Freezers Market, by Country

- United States Column Refrigerator & Freezers Market

- China Column Refrigerator & Freezers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesis of Key Findings and Future Outlook Highlighting Critical Themes Shaping the Next Phase of Column Refrigerator and Freezer Market Evolution

The analysis reveals that smart-connected evolution, natural-refrigerant adoption, and cold-chain resilience emerge as the most salient forces shaping the column refrigerator and freezer landscape. Product differentiation now hinges on seamless digital integration, regulatory alignment, and demonstrable sustainability credentials.

Supply-chain realignment-particularly in light of 2025 trade measures-will persist as organizations balance cost, compliance, and continuity. Regional dynamics underscore the criticality of tailored go-to-market strategies, whether addressing mature replacement demand in North America or scaling capacity in Asia-Pacific’s burgeoning cold-chain corridors.

Collectively, these insights provide a strategic compass for stakeholders seeking to navigate competitive complexities, capture growth vectors, and future-proof their portfolios against emerging policy, economic, and technological headwinds.

Engaging Pathway to Unlock Deep Market Intelligence and Propel Strategic Decisions with Ketan Rohom for Advanced Column Refrigerator and Freezer Insights

Ready to elevate your strategic edge with unparalleled insights? Connect directly with Associate Director, Sales & Marketing Ketan Rohom to secure your comprehensive market intelligence report today and empower your decision-making in the dynamic column refrigerator and freezer sector

- How big is the Column Refrigerator & Freezers Market?

- What is the Column Refrigerator & Freezers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?