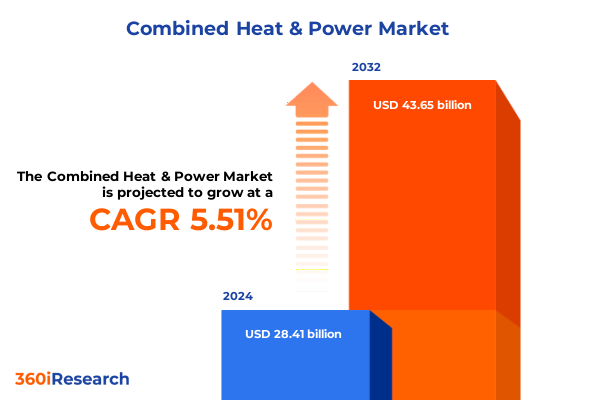

The Combined Heat & Power Market size was estimated at USD 29.88 billion in 2025 and expected to reach USD 31.46 billion in 2026, at a CAGR of 5.56% to reach USD 43.65 billion by 2032.

Unlocking the Potential of Combined Heat and Power Systems for Efficient and Sustainable Energy Management in a Shifting Global Energy Landscape

Combined heat and power (CHP) systems represent a transformative approach to energy generation by capturing and utilizing waste heat that would otherwise be lost in traditional power plants. Through the integration of electricity generation and thermal energy recovery, CHP installations can achieve overall efficiencies exceeding seventy percent, significantly outperforming the separate production of heat and power which typically operates below forty-five percent efficiency. Transitioning to CHP not only reduces fuel consumption, but also drives down greenhouse gas emissions and enhances grid resilience by providing on-site distributed generation capable of sustaining critical loads during grid disruptions. The U.S. currently deploys nearly eighty gigawatts of CHP capacity across over four thousand facilities, underscoring its proven viability across industrial, commercial, institutional, and utility applications.

Charting the Transformative Drivers Redefining Combined Heat and Power Strategy Through Policy Incentives, Digital Innovation, and Emerging Clean Hydrogen Integration

The CHP sector is at the nexus of multiple transformative forces reshaping global energy markets. From a policy perspective, the Inflation Reduction Act has classified CHP systems under Section 48 energy credits, offering a base six percent investment tax credit that can rise to thirty percent when projects meet prevailing wage and apprenticeship requirements, domestic content thresholds, or qualify as located in energy communities. These incentives have prompted many project sponsors to accelerate construction timelines to safe harbor before the January 1, 2025 deadline for maximum credit eligibility.

Simultaneously, the rise of digital twins, edge computing, and real-time analytics is revolutionizing operational performance and maintenance strategies for CHP assets. By embedding Internet of Things sensors and cloud-based analytical models, operators can now predict equipment degradation, optimize load dispatch, and simulate energy flows under different fuel and demand scenarios with unprecedented accuracy. The global digital twin market for energy is projected to grow at a compound annual rate exceeding forty percent, enabling faster detection of anomalies and reducing unplanned downtime by up to twenty percent.

Moreover, emerging clean hydrogen projects are creating synergy opportunities for CHP systems, particularly where fuel cells and hydrogen turbines coexist. Recent partnerships between utilities and hydrogen technology providers aim to convert natural gas into low-carbon hydrogen, generating power and heat while isolating carbon in solid form. Integrating hydrogen-ready turbines and fuel cells alongside traditional CHP modules offers a pathway to gradually decarbonize thermal generation and support grid reliability in regions with abundant renewable resources.

Evaluating the Cumulative Effects of United States Section 301 and Section 232 Tariffs on Equipment Supply Chains and Cost Structures within the Combined Heat and Power Market

In 2025, U.S. trade policy continues to reshape supply chain economics for CHP equipment manufacturers and project developers. Under the Section 301 tariffs finalized in late 2024, duties on Chinese-origin solar wafers and polysilicon have risen to fifty percent, taking effect January 1, 2025. While primarily targeting photovoltaic supply chains, these measures can indirectly affect solar-integrated CHP installations and heat exchangers that rely on polysilicon products.

On the metals front, Section 232 tariffs on steel and aluminum, originally imposed in March 2018 at twenty-five percent and ten percent respectively, remain in place to safeguard national security interests. As of February 10, 2025, fabricated structural steel was explicitly added as a covered downstream derivative product, extending duties to heat exchangers, pressure vessels, and turbine casings critical to CHP systems. These combined trade actions have introduced material cost escalations and extended lead times, prompting OEMs to re-evaluate sourcing strategies and explore domestic manufacturing partnerships to mitigate tariff exposure and supply chain risk.

Illuminating Technology, Fuel Type, Capacity, End Use, and Application Segmentation Dynamics Guiding Combined Heat and Power Market Evolution

Technology segmentation reveals a clear differentiation in adoption patterns across CHP system types. Fuel cells-spanning molten carbonate, phosphoric acid, proton exchange membrane, and solid oxide chemistries-lead in applications demanding low emissions and high electrical efficiencies, while gas turbines dominate higher-capacity industrial sites where fuel flexibility and rapid ramp rates are paramount. Microturbines and reciprocating engines occupy the mid-range capacity spectrum, providing modular solutions for commercial campuses and data centers, whereas steam turbines continue to serve large-scale utility and district heating networks with mature performance and long service intervals.

Fuel type segmentation underscores natural gas as the prevailing feedstock, driven by abundant supply and lower combustion emissions. However, biomass, biogas, and waste heat streams are increasingly incorporated in decarbonization strategies, particularly in pulp and paper, food processing, and wastewater treatment sectors. The expansion of hydrogen blending and oil co-firing capabilities is emerging as a pathway to repurpose existing assets for lower-carbon operations.

When examined by generating capacity, below 50 kW micro-CHP units facilitate localized resilience in residential and small commercial facilities. Systems in the 50 kW to 500 kW band serve medium-sized commercial buildings, district heating nodes, and small manufacturing sites, while 500 kW to 5 MW and above 5 MW installations address large industrial plants and utility-scale district energy grids. These segments exhibit distinct financing models, regulatory requirements, and vendor landscapes.

End-use segmentation highlights industrial users-particularly chemicals, refineries, and textiles-as the largest adopters, followed by commercial and residential sectors where CHP supports load management and demand charge reduction. Utilities leverage CHP for ancillary services and peak-shaving, deploying systems adjacent to high-value thermal load centers. In applications, data centers prioritize uninterrupted power supply; hospitals emphasize reliability under extreme weather; hotels and district heating schemes focus on guest comfort and system scalability.

This comprehensive research report categorizes the Combined Heat & Power market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Fuel Type

- Generating Capacity

- End Use

Analyzing Regional Deployment Patterns and Growth Enablers for Combined Heat and Power across the Americas, EMEA, and Asia-Pacific Markets

The Americas region maintains the largest installed base of CHP capacity, driven by supportive policy frameworks in the United States and Canada, abundant natural gas infrastructure, and corporate sustainability commitments. The U.S. market’s maturity is evident in robust OEM networks and financing mechanisms, yet emerging Latin American economies are increasingly exploring CHP to alleviate grid instability and reduce diesel dependence in industrial zones.

In Europe, Middle East & Africa, stringent emissions targets and carbon pricing schemes are accelerating CHP adoption, especially in close-coupled district heating networks in northern and eastern Europe. Germany, the United Kingdom, and the Nordic countries have integrated CHP within biomass and waste-to-energy frameworks, while Middle Eastern nations evaluate gas turbine-based CHP to enhance desalination plant efficiency and industrial park reliability.

Asia-Pacific is characterized by rapid infrastructure expansion and rising energy demand. China leads in large-scale gas turbine CHP deployments, while Japan focuses on micro-CHP fuel cell systems for residential applications. Australia’s industrial sector embraces CHP for mining and processing operations, and Southeast Asian nations are piloting waste heat recovery projects to support food processing and agribusiness clusters. Regional growth is supported by local content requirements and export-oriented manufacturing hubs.

This comprehensive research report examines key regions that drive the evolution of the Combined Heat & Power market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Leaders Advancing Combined Heat and Power Innovation through Strategic Partnerships, Product Development, and Market Expansion

Leading global players are driving innovation and consolidation in the CHP landscape. Caterpillar leverages its engine portfolio and dealer network to deliver turnkey reciprocating engine and microturbine solutions for commercial and industrial clients. Siemens Energy’s backlog of gas turbine CHP orders underscores its emphasis on high-efficiency combined cycle plants and digital service offerings.

Capstone Turbine remains a prominent provider of microturbines with a focus on remote and distributed generation, while Bloom Energy and FuelCell Energy compete in the fuel cell segment by advancing solid oxide and PEM stacks with longer lifetimes and lower degradation rates. General Electric’s hybrid turbine configurations and Mitsubishi Heavy Industries’ steam turbine expertise address utility-scale district energy needs.

Partnerships between equipment manufacturers and EPC contractors are becoming more prevalent, as integrated project delivery models streamline procurement, installation, and commissioning. Meanwhile, regional OEMs such as Cummins, Doosan, and MAN Energy Solutions secure strong positions in select markets through localized production and service networks. As system performance guarantees and outcome-based contracts gain traction, companies with digital monitoring platforms and predictive maintenance capabilities are distinguishing themselves in competitive bids.

This comprehensive research report delivers an in-depth overview of the principal market players in the Combined Heat & Power market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Aegis Energy Services Inc.

- Bosch Thermotechnology GmbH

- Capstone Green Energy Corporation

- Caterpillar Inc.

- Centrica plc

- Clarke Energy Ltd.

- Cummins Inc.

- Doosan Corporation

- Edina Ltd.

- ENER-G Holdings plc

- FuelCell Energy, Inc.

- General Electric Company

- Kawasaki Heavy Industries, Ltd.

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries, Ltd.

- Rolls-Royce Holdings plc

- Siemens AG

- Tecogen Inc.

- Viessmann Group

- Wärtsilä Corporation

- Yanmar Holdings Co., Ltd.

Delivering Actionable Strategic Recommendations for Industry Leaders to Optimize Combined Heat and Power Portfolio, Supply Chains, and Policy Engagement

To navigate the evolving CHP market, industry leaders should diversify their supply chains by establishing domestic manufacturing partnerships or qualifying for free trade zone incentives to mitigate tariff exposure. Integrating digital twins and advanced analytics into new and retrofit projects can enhance asset performance, reduce maintenance costs, and unlock operational flexibility under dynamic load conditions.

Organizations should leverage emerging tax credits and grant programs by securing safe-harbor milestones before eligibility deadlines and pursuing bonus credits for domestic content, prevailing wage compliance, and energy community designations. Collaborating with fuel cell and hydrogen technology providers offers opportunities to pilot low-carbon system configurations and position portfolios for net-zero mandates.

Engaging proactively with policymakers to shape incentive frameworks and grid interconnection rules will ensure favorable market structures. Finally, forging strategic alliances with ESCOs, utilities, and community energy planners can accelerate project deployment and expand access to outcome-based contracting, aligning long-term revenue streams with energy service performance metrics.

Outlining a Rigorous Research Methodology Combining Secondary Analysis, Primary Stakeholder Engagement, and Robust Data Triangulation to Ensure Insight Accuracy

This research employs a multi-stage methodology combining comprehensive secondary research, primary stakeholder engagement, and rigorous data triangulation. Initial secondary research encompassed review of policy directives, tariff notices, OEM literature, and industry publications to establish market context and identify key trends. Primary interviews were conducted with equipment manufacturers, EPC firms, utility executives, and end-users to validate market drivers, segmentation criteria, and regional dynamics.

Quantitative data from governmental agencies, customs databases, and financial reports were cross-referenced with proprietary ICF project registries and vendor order books to ensure accuracy in technology adoption and capacity deployment metrics. Tariff and trade insights were corroborated through official USTR, Federal Register notices, and reputable trade law analyses. The resulting dataset underwent iterative validation through feedback loops with subject matter experts, ensuring that conclusions reflect real-world operational and policy conditions.

Analytical frameworks such as Porter’s Five Forces, SWOT analyses, and scenario modeling were applied to evaluate competitive landscapes, tariff impacts, and future growth scenarios. All findings were synthesized to generate actionable recommendations and strategic roadmaps tailored to stakeholder needs.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Combined Heat & Power market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Combined Heat & Power Market, by Technology

- Combined Heat & Power Market, by Fuel Type

- Combined Heat & Power Market, by Generating Capacity

- Combined Heat & Power Market, by End Use

- Combined Heat & Power Market, by Region

- Combined Heat & Power Market, by Group

- Combined Heat & Power Market, by Country

- United States Combined Heat & Power Market

- China Combined Heat & Power Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Essential Findings Highlighting the Imperative for Integrated Combined Heat and Power Solutions in a Decarbonizing Energy Ecosystem

In summary, combined heat and power remains a cornerstone technology for advancing energy efficiency and resilience in a decarbonizing world. Policy incentives have catalyzed near-term project acceleration, while digital and hydrogen innovations are redefining system capabilities. Supply chain headwinds from tariffs underscore the importance of diversified sourcing and domestic partnerships.

Segmentation analysis reveals distinct value propositions across technology types, fuel options, capacity ranges, and end-use applications. Regional market dynamics highlight pockets of maturity alongside high-growth opportunities, particularly in Asia-Pacific and Latin America. Competitive intelligence indicates that OEMs differentiating themselves through integrated digital solutions, performance guarantees, and hydrogen readiness are best positioned for long-term success.

As stakeholders navigate this complex landscape, a strategic focus on technological flexibility, financial optimization, and collaborative policy engagement will be critical to unlocking CHP’s full potential as a sustainable, resilient energy solution.

Engage with Associate Director of Sales and Marketing to Secure the Comprehensive Combined Heat and Power Market Research Report Today

For tailored guidance on leveraging the insights presented in this report and to acquire the full Combined Heat and Power Market Research report, please connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep expertise in energy transition trends and can guide you through the data, segmentation analysis, and regional insights to develop a strategy aligned with your organizational goals. Reach out today to discuss licensing options, customization of the research deliverables, and how this comprehensive study can inform your next investment, partnership, or product development decision. Elevate your competitive positioning by securing the definitive market intelligence on combined heat and power systems.

- How big is the Combined Heat & Power Market?

- What is the Combined Heat & Power Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?