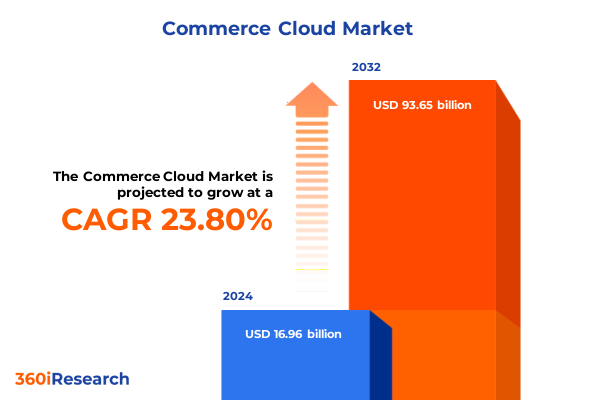

The Commerce Cloud Market size was estimated at USD 21.09 billion in 2025 and expected to reach USD 26.23 billion in 2026, at a CAGR of 23.73% to reach USD 93.65 billion by 2032.

Unveiling the Evolving Dynamics of the Commerce Cloud Landscape to Empower Businesses with Strategic Insights for Competitive Advantage

In an era defined by accelerating digital transformation, commerce cloud solutions have become the cornerstone of modern retail and enterprise strategies. Organizations of every size are recognizing that a robust commerce cloud platform is no longer a luxury but a necessity for delivering seamless customer experiences across digital and physical channels. As market dynamics continue to evolve at a rapid pace, understanding the intersection of technology, customer expectations, and operational demands is critical for maintaining competitive advantage.

Against this backdrop, today’s businesses must navigate multifaceted challenges including rising consumer demands for personalization, the proliferation of touchpoints, and the imperative for scalable, secure infrastructure. By embracing commerce cloud capabilities, companies can harness real-time data, drive process automation, and deploy innovative customer engagement tactics. The insights presented here lay the foundation for decision-makers seeking to chart a proactive course in a landscape where agility and resilience determine long-term success.

Navigating Pivotal Technological and Business Model Shifts That Are Redefining Commerce Cloud Platforms for Enhanced Customer Engagement and Operational Agility

Rapid advancements in cloud-native technologies and shifting consumer behaviors are catalyzing transformative shifts within commerce cloud platforms. The adoption of composable architectures, for instance, is redefining how businesses assemble modular services to respond instantaneously to changing market demands. Concurrently, enterprises are transitioning from monolithic platforms to headless commerce frameworks, enabling richer omnichannel experiences and more agile development cycles.

Beyond technological innovation, business models themselves are in flux. Subscriptions, marketplaces and direct-to-consumer channels are gaining prominence as brands seek to deepen customer relationships and diversify revenue streams. These parallel trends underscore the imperative for organizations to integrate cutting-edge commerce cloud functionalities with forward-thinking commercial strategies to outpace competitors and forge stronger connections with their audiences.

Assessing the Cumulative Impact of 2025 United States Tariff Adjustments on Commerce Cloud Infrastructure Costs and Market Adoption Strategies

In 2025, the introduction of new tariff schedules by the United States has triggered a cumulative impact across the commerce cloud ecosystem, particularly affecting hardware and infrastructure costs. Providers of edge computing equipment and data center hardware have adjusted pricing structures to accommodate increased duties, prompting a shift toward regional sourcing strategies and localized manufacturing partnerships. This realignment has encouraged many enterprises to reassess their vendor roadmaps and negotiate more flexible terms to mitigate cost escalations.

Simultaneously, service providers and systems integrators have recalibrated their operating models to absorb or pass through incremental expenses. While some vendors have opted to internalize these costs in the short term to preserve competitive pricing, others have introduced tiered support agreements to balance margin preservation with client budget constraints. As a result, long-term contracts are being structured with greater scrutiny around tariff clauses and supply chain contingencies, influencing procurement decisions and shaping the trajectory of commerce cloud adoption.

Unlocking Segmentation Insights by Component and Industry Vertical to Drive Tailored Commerce Cloud Solutions to Address Diverse Enterprise Requirements

A nuanced understanding of commerce cloud segmentation reveals how solution and service components align with distinct enterprise priorities. The landscape divides into core platforms versus professional services, with the latter encompassing implementation and deployment, support and maintenance, and training and consulting. Organizations evaluating platform capabilities must also weigh the value of end-to-end service offerings that streamline integration, optimize performance and build internal competencies through targeted workshops and certification programs.

Equally important is recognizing the role of industry verticals in shaping feature requirements and deployment cadences. Financial institutions, insurance providers and other banking segments demand tightly regulated security frameworks and audit trails, while healthcare organizations prioritize data interoperability and patient privacy. Technology and telecom firms focus on scalability to serve fluctuating demand, whereas manufacturers leverage commerce cloud modules for supply chain orchestration. Retailers, both online and brick-and-mortar, require seamless checkout workflows and AI-driven personalization to meet modern consumer expectations.

This comprehensive research report categorizes the Commerce Cloud market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Offering

- Industry Vertical

- Enterprise Size

Examining Regional Variations and Growth Trajectories in Commerce Cloud Adoption Across Americas, Europe Middle East and Africa, and Asia-Pacific Markets

Regional variations in commerce cloud adoption reflect differing maturity levels and strategic imperatives. In the Americas, particularly North America, early mover advantage has cemented cloud-first mindsets among leading retailers and B2B enterprises. The strength of digital payment ecosystems and advanced logistics networks has accelerated deployment cycles, enabling brand teams to roll out new features in weeks rather than months.

Conversely, Europe Middle East and Africa are navigating complex regulatory conditions, with data sovereignty and privacy mandates shaping platform architecture decisions. Enterprises in this region are adopting hybrid cloud models that combine on-premises control with public cloud scalability to balance compliance with innovation. Meanwhile, Asia-Pacific markets are charting dynamic growth trajectories driven by mobile commerce, super-app integration and cross-border trade. Stakeholders in these territories are prioritizing agile ecosystems and partnerships that can accommodate rapid shifts in consumer behavior and regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Commerce Cloud market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Commerce Cloud Providers’ Strategic Innovations and Partnership Ecosystems Shaping Competitive Market Dynamics and Customer Experiences

The competitive landscape of commerce cloud providers is defined by a handful of leading firms advancing strategic innovations and cultivating robust partnership ecosystems. One standout approach involves embedding artificial intelligence and machine learning directly into storefront and back-office modules, enabling dynamic merchandising and predictive analytics capabilities that drive conversion and retention. Another notable trend is the expansion of headless commerce offerings, which decouple front-end experiences from core payment and catalog services to allow for faster time-to-market and bespoke customer journeys.

Collaborations between platform vendors and global system integrators continue to shape solution roadmaps, with alliances focusing on cloud security hardening, API-first development and continuous integration pipelines. Some providers are investing in purpose-built applications for high-growth verticals, while others are enhancing developer toolkits to foster community-led innovation. These initiatives are elevating the bar for what organizations expect from their commerce cloud partners, reinforcing the importance of strategic alignment and roadmap transparency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commerce Cloud market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Adobe Inc.

- Amazon Web Services, Inc.

- AOE GmbH

- Apttus Corporation

- Bee IT

- BigCommerce Holdings

- Cloudfy Limited

- commercetools GmbH

- Elastic Path Software Inc.

- Elogicus Osaühing

- GitHub, Inc.

- Google LLC By Alphabet Inc.

- HCL Technologies Limited

- IBM Corporation

- Intellipaat Software Solutions Pvt. Ltd.

- Magento Inc.

- MagicFuse

- Optimizely AB

- Oracle Corporation

- Oracle Corporation

- OSF Global Services, Inc.

- Salesforce, Inc.

- SAP SE

- Shopify Inc.

- VTEX Group Ltd.

- VTEX IO

Translating Commerce Cloud Market Intelligence into Clear Action Plans to Empower Industry Leaders in Capturing Emerging Opportunities and Driving Innovation

To capitalize on emerging opportunities, industry leaders should adopt a modular architecture strategy that allows for incremental feature rollouts and rapid course corrections. By prioritizing headless implementations, organizations can future-proof digital experiences and reduce technical debt, while investing in composable services ensures seamless integration with CRM, ERP and marketing automation platforms. Additionally, fostering collaborative partnerships with niche technology specialists and systems integrators will broaden access to domain expertise and expedite project delivery.

Ensuring rigorous security and compliance measures is another critical recommendation. Stakeholders should implement zero-trust frameworks, continuous monitoring and compliance-as-code processes to maintain data integrity and meet evolving regulatory standards. Furthermore, developing internal talent through targeted training and consulting initiatives will create a sustainable repository of skills, reducing reliance on external resources over time. Finally, aligning product roadmaps with forward-looking market signals-such as AI-driven personalization, voice commerce and immersive experiences-will enable organizations to stay ahead of the curve and unlock new revenue streams.

Detailing a Rigorous Research Approach Incorporating Primary Stakeholder Interviews and Comprehensive Secondary Analysis for Robust Market Insights

This research draws upon a combination of primary and secondary data sources to ensure a holistic perspective on commerce cloud trends. Extensive in-depth interviews were conducted with senior executives, IT leaders and solution architects across key verticals, providing firsthand insights into strategic priorities and pain points. Complementing these conversations, a structured survey captured quantitative metrics on deployment timelines, technology preferences and resource allocations.

On the secondary analysis front, vendor whitepapers, technical documentation and industry publications were rigorously reviewed to validate emerging patterns. Data triangulation methods were employed to cross-reference qualitative findings with public company disclosures and reputable news outlets. An iterative validation process, including peer reviews and expert workshops, further refined the analysis, ensuring that conclusions and recommendations reflect the most current and relevant market developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commerce Cloud market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commerce Cloud Market, by Component

- Commerce Cloud Market, by Offering

- Commerce Cloud Market, by Industry Vertical

- Commerce Cloud Market, by Enterprise Size

- Commerce Cloud Market, by Region

- Commerce Cloud Market, by Group

- Commerce Cloud Market, by Country

- United States Commerce Cloud Market

- China Commerce Cloud Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Comprehensive Findings into a Strategic Blueprint to Guide Stakeholders Through the Ongoing Evolution of Commerce Cloud Ecosystems

The commerce cloud landscape stands at the threshold of another wave of innovation, driven by advances in artificial intelligence, edge computing and pervasive connectivity. Businesses that embrace modular platforms, foster strategic partnerships and uphold stringent security standards will be best positioned to seize emerging growth vectors. As regulatory frameworks evolve and consumer expectations become increasingly sophisticated, adaptability and proactive planning will define market leaders.

Ultimately, the convergence of technology and business strategy underscores the importance of an integrated approach to commerce cloud adoption. Organizations equipped with actionable intelligence and a clear roadmap for investments will navigate the complexities of digital transformation more effectively, delivering enhanced experiences to customers and sustainable value to stakeholders.

Engage with Ketan Rohom Associate Director Sales and Marketing at 360iResearch to Acquire In-Depth Commerce Cloud Market Intelligence for Strategic Growth

To gain a comprehensive understanding of the forces shaping commerce cloud evolution and to access in-depth market analysis, reach out to Ketan Rohom, Associate Director Sales and Marketing at 360iResearch. Ketan will guide you through the extensive report, highlight critical takeaways, and discuss how your organization can leverage these insights for sustainable growth.

Engaging directly with Ketan provides the opportunity to explore bespoke recommendations, clarify any questions regarding methodology or findings, and secure the full suite of supporting data and appendices. Elevate your strategic planning with a tailored consultation that ensures you maximize the value of the research.

Contact Ketan to arrange a personalized briefing and take the next step toward transforming your commerce cloud strategy.

- How big is the Commerce Cloud Market?

- What is the Commerce Cloud Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?