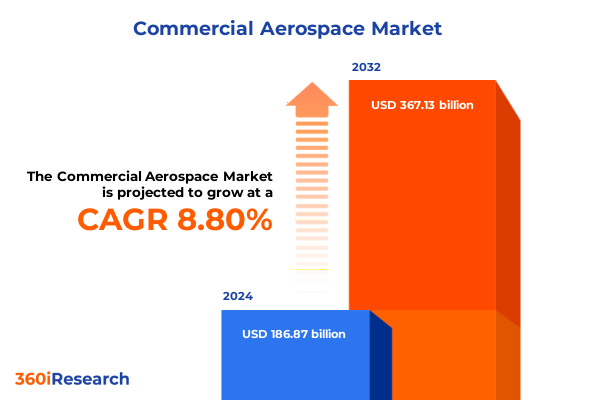

The Commercial Aerospace Market size was estimated at USD 202.31 billion in 2025 and expected to reach USD 219.26 billion in 2026, at a CAGR of 8.88% to reach USD 367.13 billion by 2032.

Navigating the Next Frontier of Commercial Aerospace Through Strategic Innovations, Operational Resilience, and Sustainable Advancements in 2025

The commercial aerospace sector in 2025 stands at a pivotal juncture, marked by the convergence of resilient recovery from global disruptions and an accelerating push toward next-generation capabilities. Passenger volumes have rebounded strongly, underpinned by pent-up demand for international travel and the proliferation of low-cost carriers expanding into underserved markets. Concurrently, cargo operations continue to leverage shifting trade patterns, bolstering freighter deployments to accommodate the growth of e-commerce and supply-chain realignment. In this dynamic environment, industry stakeholders are compelled to balance growth objectives with imperatives around cost containment, operational agility, and environmental stewardship.

Emerging propulsion technologies and digital innovation are redefining traditional product life cycles and service models. Airlines and lessors are actively assessing the integration of sustainable aviation fuels and hybrid-electric demonstrators, while aerospace manufacturers accelerate certification timelines for carbon-composite airframes and advanced aerodynamics. At the same time, supply-chain fragmentation, manifested in localized content mandates and materials sourcing constraints, demands more robust risk mitigation strategies. Against this backdrop, companies that foster cross-functional collaboration and agile workflows will be best positioned to capitalize on market openings and navigate potential headwinds.

This executive summary synthesizes the critical drivers shaping tomorrow’s commercial aviation landscape, examines the repercussions of recent policy changes, distills segmentation and regional nuances, profiles leading market participants, and delivers actionable recommendations. It is designed to equip decision-makers with the strategic context needed to prioritize investments, refine operational frameworks, and unlock sustainable competitive advantages.

Unprecedented Technological Environmental and Market-Driven Transformations Reshaping the Commercial Aerospace Landscape Beyond Traditional Boundaries

Commercial aerospace is being reshaped by an interplay of technological breakthroughs, environmental imperatives, and evolving customer expectations that transcend legacy paradigms. Rapid advances in alternative propulsion systems-ranging from high-bypass turbofans to hybrid-electric architectures-are opening new pathways for fuel efficiency and emissions reduction. Simultaneously, additive manufacturing techniques have matured to support on-demand production of complex components, compressing development cycles and enabling lighter, more resilient structures. As these capabilities advance, operators and manufacturers are collaborating on digital twin platforms to simulate aircraft performance in real time, drive predictive maintenance schedules, and optimize network utilization.

Environmental regulations and stakeholder expectations have also elevated decarbonization to a strategic priority. Carbon offsetting schemes have given way to binding net-zero targets, prompting accelerated certification of sustainable aviation fuels and scrutiny of end-to-end lifecycle emissions. Regulatory bodies across major regions are harmonizing standards for SAF blending and carbon accounting, compelling airframe producers and engine suppliers to realign R&D roadmaps. In parallel, customer demand for differentiated travel experiences is fueling investments in cabin innovations-ranging from modular, health-optimized interiors to connectivity upgrades that can enhance ancillary revenue streams.

Market participants are responding by forging cross-industry partnerships that blend aerospace expertise with software, energy, and materials science. This collaboration ecosystem is expanding to include new entrants focused on urban air mobility and advanced air transport systems, signaling a generational shift in how air travel is conceptualized and delivered. As capital flows into these transformative initiatives, incumbents must prioritize strategic agility to navigate rapidly changing risk profiles and capture first-mover advantages.

Assessing the Cumulative Consequences of the 2025 United States Tariffs on Commercial Aircraft Manufacturing Supply Chains and Market Dynamics

The imposition of 2025 United States tariffs on imported aircraft assemblies, aerostructures, and critical subsystems has introduced a new layer of complexity for global supply chains and manufacturing footprints. Levies on primary components have elevated input costs, compelling original equipment manufacturers and tier-one suppliers to scrutinize supplier diversification strategies. As a result, several airframer programs have accelerated nearshoring initiatives, reallocating key production tasks to domestic or allied facilities to mitigate tariff exposure and maintain program margins.

Beyond immediate cost impacts, the tariff regime has altered sourcing decisions for high-value materials such as advanced composites and precision-machined alloys. Supply-chain visibility has become paramount, prompting stakeholders to invest in digital provenance solutions that track origin and tariff classification in real time. This heightened transparency not only supports compliance but also strengthens resilience against unanticipated policy shifts. In parallel, service providers specializing in customs brokerage and trade compliance have seen expanded demand, reflecting a broader industry effort to streamline cross-border logistics under the new trade environment.

While some manufacturers have absorbed tariff-related cost increases through internal productivity gains, others have renegotiated long-term contracts and pursued joint ventures with domestic partners to secure preferential treatment. Airlines and lessors have similarly adapted by adjusting fleet acquisition timelines and evaluating retrofit packages that localize component refurbishment. As the tariff landscape continues to evolve, commercial aviation enterprises must remain vigilant, employing scenario planning and agile contract structures to safeguard operational continuity and preserve competitive positioning.

Uncovering Critical Market Segmentation Insights Spanning Aircraft Applications Types Engine Configurations Manufacturers Operators and Distribution Channels

A nuanced understanding of market segmentation reveals distinctive performance patterns across aircraft applications, types, propulsion systems, manufacturer portfolios, operator categories, and distribution pathways. In the freighter segment, combi configurations are capitalizing on flexible payload demands, while operators of full freighters target e-commerce routes with specialized handling capabilities. Passenger operations are diversifying cabin offerings, with business class experiencing heightened demand on transoceanic services even as economy cabins remain critical for high-density short-haul flights and first-class suites cater to premium long-haul travelers.

Aircraft type segmentation underscores divergent trends. Narrow body platforms, particularly those drawn from the A320 family and the Boeing 737 line, continue to dominate regional and domestic networks due to their efficiency and versatility. Regional jets such as the Bombardier CRJ series and Embraer’s E-Jet lineup are carving out specialized roles on thin routes, supported by emerging scope-clauses for smaller markets. Very large jets, including the Airbus A380 and Boeing 747, are being repurposed for ultra-long-haul missions or VIP transport, while wide body variants-Airbus A330, A350, and Boeing 777-remain the workhorses for high-capacity international corridors.

Propulsion segmentation is increasingly polarized between high-bypass turbofans, which underpin the majority of new deliveries, and turboprops, which hold enduring appeal for short-range connectivity and regional accessibility. Original equipment manufacturers from Airbus and Boeing to Bombardier and Embraer are tailoring their development pipelines to balance legacy derivatives with clean-sheet designs. Operator segmentation highlights the contrasting strategies of charter and government fleet managers, who prioritize flexibility and mission-specific configurations, versus low-cost carriers and major network airlines, which emphasize standardized fleets to achieve operational efficiencies.

Distribution channel segmentation highlights the rising significance of aftermarket services and diverse leasing structures. Finance and operating lease arrangements are facilitating operator fleet agility, while OEM sales teams deepen their footprint through bundled maintenance and digital service agreements. This multi-dimensional segmentation framework offers strategic clarity for stakeholders seeking to optimize portfolio alignment with evolving market demands.

This comprehensive research report categorizes the Commercial Aerospace market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Aircraft Type

- Aircraft Class

- Component

- Seating Capacity

- Payload Capacity

- Operator Type

Decoding Pivotal Regional Dynamics and Emerging Opportunities Driving Commercial Aerospace in the Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics are playing an increasingly decisive role in commercial aerospace strategy, with distinct trends emerging across the Americas, EMEA, and Asia-Pacific regions. In the Americas, robust infrastructure investments and a mature MRO ecosystem support both narrow body replacement cycles and freighter conversions. U.S. carriers are focusing on fleet modernization driven by fuel efficiency mandates and network densification, while Canadian operators leverage regional turboprops to enhance connectivity in remote areas. This combination of technological upgrading and niche market exploitation underscores the strategic importance of North American aerospace clusters.

Europe, the Middle East, and Africa present a heterogeneous landscape where defense modernization programs intersect with ambitious sustainability agendas. European flag carriers are investing heavily in next-generation wide bodies, aligning with carbon-reduction commitments and digital supply-chain initiatives. Middle Eastern hubs continue to expand ultra-long-haul capabilities, leveraging large wide-body fleets to establish global connectivity nodes. In Africa, government partnerships and charter services are filling crucial gaps in humanitarian and resource-sector logistics, underpinning a gradual build-out of regional maintenance infrastructure.

Asia-Pacific stands out as the growth engine of global commercial aviation, underpinned by sizeable low-cost carrier expansion and state-sponsored aircraft acquisition programs. Major airlines in China and Southeast Asia are ordering high-capacity narrow body variants to support burgeoning domestic travel, while lessors capitalize on attractive lease yields in emerging markets. Collaborative ventures between regional airframers and global component suppliers are strengthening local supply-chain resilience, and continued urbanization patterns are fueling nascent point-to-point demand. These regional contours collectively offer a roadmap for aligning strategic priorities with geographic opportunity windows.

This comprehensive research report examines key regions that drive the evolution of the Commercial Aerospace market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves and Competitive Strengths of Dominant Manufacturers Operators and Service Providers Powering the Commercial Aerospace Ecosystem

Leading original equipment manufacturers are pursuing differentiated value propositions to solidify their competitive standings. Airbus has amplified its focus on digital services and modular cabin innovations, positioning its platforms as technology demonstrators. Boeing has channeled R&D toward integrating alternative propulsion demonstrators into existing airframes, while also advancing lightweight materials. Bombardier and Embraer continue to refine regional jet offerings, emphasizing lower trip costs and cabin flexibility to capture thin-market opportunities.

Operator and lessor strategies further illustrate competitive nuances. Major network carriers are leveraging scale to negotiate favorable terms on sustainable aviation fuels and personalized digital experiences, while low-cost carriers optimize turnaround processes and ancillary revenue models. Charter and government operators are prioritizing fleet versatility, retrofitting platforms for specialized missions ranging from medical evacuation to VIP transport. Leasing firms and fleet financiers, recognizing risk diversification imperatives, are expanding their portfolios through hybrid lease structures and embedded maintenance reserves, thereby de-risking asset performance for their airline customers.

Service providers and aftermarket specialists are also stepping into the spotlight, with MRO networks investing in predictive analytics and robotics to reduce downtime and enhance part traceability. Logistics integrators are forging alliances with freight carriers to offer end-to-end supply-chain solutions. Collectively, these strategic moves highlight a competitive ecosystem in which collaboration and value-chain integration are key to sustaining differentiation in a market defined by technological change and regulatory complexity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Aerospace market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Bombardier Aerospace

- Commercial Aircraft Corporation of China, Ltd.

- Dassault Aviation

- Deutsche Aircraft GmbH

- Embraer S.A.

- GE Aviation

- Gulfstream Aerospace

- Hindustan Aeronautics Limited

- Honeywell Aerospace

- JetZero

- Kawasaki Heavy Industries, Ltd.

- Leonardo S.p.A.

- Lockheed Martin

- Mitsubishi Heavy Industries

- Northrop Grumman

- PJSC Yakovlev

- PZL Mielec

- Rolls-Royce Holdings

- Safran

- Spirit AeroSystems

- Tata Advanced Systems

- Textron Aviation

- The Boeing Company

- United Aircraft Corporation

Actionable Strategic Recommendations to Accelerate Technological Adoption Enhance Operational Efficiency and Elevate Competitive Advantage in Commercial Aviation

To navigate the accelerating pace of technological and regulatory transformation, industry leaders should adopt a portfolio of strategic initiatives focused on sustainable growth and operational excellence. Embedding sustainable aviation fuel capabilities into your long-term procurement roadmap will not only reduce carbon intensity but also hedge against future regulatory costs and stakeholder scrutiny. Complementing this, digital twin implementations across aircraft and supply-chain nodes can unlock predictive insights, driving maintenance efficiencies and lowering operational disruptions. By integrating these digital models with advanced analytics, companies can shift from reactive troubleshooting to proactive optimization.

Enhancing supply-chain resilience requires diversifying supplier networks and establishing strategic nearshore hubs for critical components. This approach, combined with real-time visibility platforms, will mitigate exposure to trade policy shifts and materials shortages. Similarly, embracing flexible financing models such as blended finance leases can empower operators to adjust fleet capacity while preserving capital agility. Engaging in co-development partnerships with energy, software, and materials science firms can accelerate technology maturation and reduce time to market for breakthrough designs.

Investing in workforce upskilling, particularly in data science, additive manufacturing, and sustainability program management, will safeguard talent pipelines and ensure readiness for emerging operational paradigms. Finally, fostering robust engagement with regulators, industry associations, and standard-setting bodies will help shape pragmatic certification frameworks and ensure alignment with evolving environmental mandates. Collectively, these actions will fortify competitive positioning and position organizations to lead the next chapter of commercial aviation.

Detailing a Multi-Source Research Methodology Integrating Primary Expert Interviews Secondary Data Analysis and Advanced Analytical Techniques

This research integrates a multi-tiered approach combining primary insights and secondary analysis to deliver a comprehensive view of the commercial aerospace sector. Primary research entailed in-depth interviews with senior executives from major airframers, tier-one suppliers, airlines, lessors, and regulatory agencies. These sessions provided firsthand perspectives on program roadmaps, procurement strategies, and emerging technology adoption patterns. Alongside interviews, a series of roundtable discussions with operations and supply-chain leaders yielded qualitative insights into resilience planning and sustainability integration.

Secondary research drew upon publicly available industry publications, governmental trade and regulatory filings, technical whitepapers, and academic studies. This data was meticulously cross-referenced to identify trend inflection points, corroborate executive testimony, and validate emerging projections. All data points underwent a rigorous triangulation process, ensuring consistency across sources and highlighting areas of strategic divergence.

Advanced analytical techniques, including SWOT analysis, scenario modeling, and risk mapping, were applied to distill key insights. Geospatial analytics supported the regional segmentation assessment, while proprietary frameworks guided the evaluation of tariff impacts and manufacturer positioning. The resulting synthesis offers a rigorously validated perspective designed to inform high-stakes investment decisions and operational transformation initiatives across the commercial aerospace value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Aerospace market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Aerospace Market, by Aircraft Type

- Commercial Aerospace Market, by Aircraft Class

- Commercial Aerospace Market, by Component

- Commercial Aerospace Market, by Seating Capacity

- Commercial Aerospace Market, by Payload Capacity

- Commercial Aerospace Market, by Operator Type

- Commercial Aerospace Market, by Region

- Commercial Aerospace Market, by Group

- Commercial Aerospace Market, by Country

- United States Commercial Aerospace Market

- China Commercial Aerospace Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing the Strategic Imperatives and Future Directions to Empower Stakeholders in the Evolving Commercial Aerospace Sector

Bringing together the strategic imperatives identified throughout this summary underscores the industry’s dual mandate: to drive decarbonization and digitalization while preserving financial and operational resilience. Stakeholders must accelerate the adoption of sustainable aviation fuels and invest in next-generation propulsion demonstrators to meet intensifying environmental targets. Concurrently, embedding digital twins and predictive analytics across product development and maintenance processes will yield operational efficiencies that offset rising cost pressures.

Enhancing supply-chain visibility through diversified sourcing and nearshore production hubs will mitigate geopolitical and policy-driven risks, ensuring continuity in program deliveries and aftermarket support. Geographically targeted strategies should capitalize on the Americas’ mature MRO and freighter conversions, EMEA’s sustainability-linked financing and hub expansions, and Asia-Pacific’s fleet growth and digital infrastructure advancements. At the corporate level, collaborative ventures between OEMs, technology providers, and financing partners will create integrated solutions that address market complexities more holistically.

Looking ahead, workforce development must be prioritized to equip talent with the skills needed for additive manufacturing, data science, and integrated sustainability management. Engaging proactively with regulators and standard bodies will facilitate pragmatic certification pathways and support consistent global deployment of emerging technologies. By synthesizing these imperatives, industry leaders can chart a course that balances innovation with sustainable profitability, ensuring that the commercial aerospace sector continues to soar.

Connect with Associate Director of Sales and Marketing to Secure In-Depth Commercial Aerospace Market Intelligence and Customized Strategic Insights Today

To explore tailored insights that align with your strategic goals and accelerate your competitive positioning, connect with Associate Director of Sales and Marketing Ketan Rohom today. By engaging directly, you will gain exclusive access to in-depth analysis across emerging propulsion systems, supply chain resilience frameworks, and regulatory developments shaping the next wave of commercial aviation. Ketan brings a wealth of industry expertise and will guide you through customized research packages that address your highest-priority opportunities, whether optimizing fleet composition, evaluating new financing models, or integrating digital twins into your operational backbone. Don’t miss the chance to leverage actionable intelligence that can inform board-level decision-making and drive sustainable growth. Reach out now to discuss how our comprehensive report and bespoke advisory services can support your mission to lead in a rapidly evolving aerospace landscape.

- How big is the Commercial Aerospace Market?

- What is the Commercial Aerospace Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?