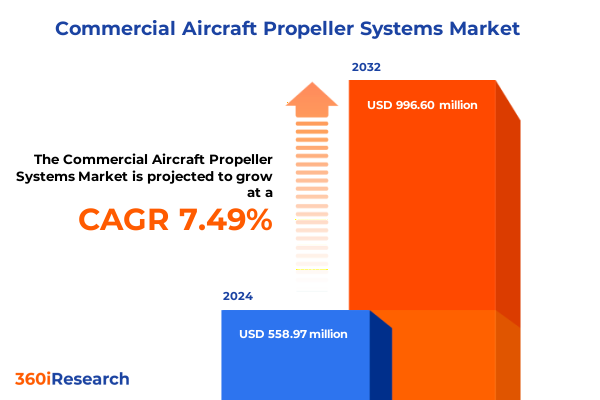

The Commercial Aircraft Propeller Systems Market size was estimated at USD 592.40 million in 2025 and expected to reach USD 629.75 million in 2026, at a CAGR of 7.71% to reach USD 996.59 million by 2032.

An in-depth overview of modern commercial aircraft propeller systems revealing their pivotal role in enhancing efficiency safety and operational performance

Modern commercial aviation continually strives for optimized performance, safety, and cost efficiency, with propeller systems playing an indispensable role in propulsive efficacy and operational reliability. Precision-engineered blades, advanced hub assemblies, and integrated control mechanisms collectively define the core of this technology, influencing every phase of an aircraft’s flight profile. As carriers expand regional connectivity and operators seek greater lifecycle value, propeller system design and manufacturing are subject to heightened scrutiny from engineers, regulators, and airline executives alike.

Throughout the industry, there is a growing emphasis on the integration of digital diagnostics, real-time monitoring, and predictive maintenance algorithms, marking a significant departure from traditional inspection protocols. Suppliers and service providers are increasingly collaborating to embed smart sensors within blades and hubs, enabling condition-based maintenance that reduces downtime and extends component lifespan. Consequently, the value proposition of propeller systems extends beyond mere thrust generation, encompassing enhanced reliability, decreased operational expenditures, and reduced environmental footprint.

This introduction sets the stage for a deeper exploration of how transformative technological trends, evolving trade policies, and a nuanced understanding of market segmentations are collectively reshaping the commercial aircraft propeller domain. In the following sections, we will examine these critical shifts, analyze the ramifications of recent tariff updates, and distill strategic insights to guide decision-makers in navigating this dynamic landscape.

Exploring groundbreaking technological transformations reshaping commercial aircraft propeller technology for greater sustainability and performance

The landscape of commercial aircraft propeller systems is undergoing a profound transformation driven by breakthroughs in materials science, digitalization, and sustainability imperatives. Composite blades with variable pitch functionality are becoming standard in regional turboprop fleets, leveraging lightweight constructions that improve fuel efficiency and reduce greenhouse gas emissions. Meanwhile, additive manufacturing techniques are enabling the rapid production of complex hub geometries that were once infeasible through traditional machining, fostering greater design flexibility and cost reduction.

Equally significant is the growing adoption of smart propeller systems that integrate onboard sensors, telemetry modules, and cloud-based analytics platforms. These solutions facilitate continuous monitoring of blade stress, vibration patterns, and wear rates, empowering operators to transition from scheduled to condition-based maintenance regimes. This shift not only improves aircraft turnaround times, but also enhances safety margins by identifying anomalies before they escalate into critical failures.

Furthermore, strategic alliances between tier-one suppliers, software innovators, and academic research institutions have accelerated the prototyping and certification of next-generation propeller architectures. Environmental regulations and the drive toward net-zero carbon targets have catalyzed these collaborative efforts, spawning designs that harness hybrid-electric powertrains and explore novel blade morphing technologies. As a result, the industry is witnessing an unprecedented convergence of aerodynamics, digital innovation, and sustainable priorities, signaling a new era of performance potential within the propeller systems market.

Analyzing the compound repercussions of newly imposed United States tariffs on commercial aircraft propeller components and supply chain dynamics

In 2025, newly enacted United States tariffs on imported propeller components and raw materials have introduced fresh variables into supply chain management and cost structures. By levying additional duties on aluminum billets, composite prepregs, and precision-machined hubs sourced from key international partners, these tariffs have reverberated through procurement strategies, compelling suppliers to reevaluate sourcing footprints and inventory practices.

Operators who previously relied on single-source contracts for high-grade aluminum components have been prompted to diversify their supplier base, fostering closer engagement with domestic manufacturers that can meet stringent aerospace specifications. This realignment, while reducing exposure to trade-related volatility, has also necessitated recalibrated logistics frameworks and advance commitments for critical raw materials. Throughout the value chain, research and development budgets have been redirected toward establishing qualified local supply pools, and risk mitigation plans now include dual sourcing and buffer inventories to accommodate potential tariff escalations.

Moreover, the tariff-induced cost pressures have accelerated the adoption of alternative materials such as advanced composites, which are not subject to the same import duties. In turn, this shift is driving further investment in in-house composite layup capabilities and autoclave facilities, as companies seek to internalize key manufacturing stages. Although these strategic responses incur initial capital expenditures, they promise to shield operating margins from future tariff adjustments and foster long-term supply chain resilience. As the industry adapts, stakeholders must remain vigilant to evolving trade policies and proactively align procurement, production, and innovation strategies to sustain competitive advantage.

Uncovering strategic segmentation insights across end users aircraft types materials operation modes and blade configurations driving market differentiation

Market dynamics in the propeller sector become more intelligible when examined through multiple segmentation lenses. Segmentation based on end users reveals distinct trajectories in aftermarket services compared to original equipment manufacturers, with the former prioritizing rapid overhaul cycles and the latter focusing on integrated design optimization. Similarly, segmentation grounded in aircraft type distinguishes the requirements of multi-engine turboprops operating short-haul routes from those of single-engine aircraft engaged in general aviation missions, each presenting unique performance envelopes and maintenance schedules.

Propeller material segmentation further delineates market trajectories, as aluminum blades remain prevalent in cost-sensitive fleets while composite variants command attention for their superior strength-to-weight ratios and fatigue resistance. Concurrently, there is a measured resurgence in wood-based blades for niche vintage and light aircraft, underscoring the enduring appeal of traditional materials in specific contexts. Operational segmentation highlights how commercial aviation’s stringent cycle demands differ from the lower-tempo operations of general aviation and the rigorous specification environment of military aviation, prompting tailored engineering solutions.

The final segmentation dimension addresses blade count configurations, where two- and three-blade assemblies offer simplicity and lower inertia, whereas four-blade designs and five-blade-and-above arrangements deliver enhanced smoothness and noise abatement. The further subdivision of higher-order blade sets into five-blade and six-blade-and-above categories informs customization opportunities for larger regional aircraft and next-generation hybrid-electric platforms. Together, these segmentation insights enable OEMs and service providers to tailor value propositions and differentiate offerings across a multifaceted market spectrum.

This comprehensive research report categorizes the Commercial Aircraft Propeller Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propeller Material

- Number Of Blades

- End User

- Aircraft Type

- Operation Type

Highlighting regional market dynamics across Americas EMEA and Asia-Pacific to reveal growth opportunities challenges and strategic focal points in propeller

Regional analyses bring to light the distinct trajectories shaping demand and innovation in the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, legacy turboprop fleets serving remote and regional routes continue to stimulate demand for proven aluminum and composite propeller systems, while ongoing fleet modernization programs in North and Latin America emphasize the integration of digital health monitoring solutions. Infrastructure investments and government support for regional connectivity further reinforce aftermarket growth and retrofit opportunities in this geography.

Across Europe, the Middle East, and Africa, stringent noise and emissions regulations are catalyzing the adoption of advanced composite blades coupled with active noise reduction mechanisms. Collaborative research initiatives between aerospace clusters in Western Europe and emerging aviation hubs in the Middle East have accelerated the certification of next-generation propeller architectures. Meanwhile, expanding general aviation operations in Africa, driven by business charter and humanitarian missions, are generating a parallel demand for robust, easily serviceable propeller components.

In the Asia-Pacific region, rapid air traffic growth and ambitious fleet expansion plans have heightened competition among OEMs to supply cost-effective and technologically advanced propeller systems. Domestic manufacturing capabilities are being bolstered through joint ventures and public-private partnerships, particularly in Southeast Asia, where low-cost carriers are upgrading to fuel-efficient turboprops. As a result, the Asia-Pacific market is characterized by a dynamic interplay of scale-driven production, emerging regulatory frameworks, and the strategic pursuit of localized value chains.

This comprehensive research report examines key regions that drive the evolution of the Commercial Aircraft Propeller Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining leading industry players competitive strategies partnerships and innovations that define the competitive arena of commercial aircraft propeller

A review of leading companies illuminates how strategic investments and partnerships are shaping market leadership. Industry titans have accelerated their research and development programs, focusing on high-modulus composite formulations and advanced bearing technologies that enhance blade longevity and fatigue performance. Several have also forged alliances with software providers to integrate digital health monitoring into propeller control units, offering operators turnkey solutions that extend beyond traditional maintenance offerings.

At the same time, emerging challengers are leveraging agility and niche expertise to capture segments of the market. By establishing centers of excellence for additive manufacturing and precision machining, these innovators are delivering custom hub geometries and optimized blade profiles that meet the exacting demands of regional and special-mission aircraft. They are also pioneering next-generation noise reduction designs, responding to tightening community noise regulations and operator preferences for quieter operations.

Competitive differentiation increasingly arises from comprehensive aftersales support networks, where service agreements encompass predictive analytics, rapid component turnaround, and in-field technical assistance. Partnerships between OEMs and global MRO providers are being deepened to facilitate co-located service centers at key hubs, thereby reducing aircraft on-ground time and improving fleet availability. As the competitive arena evolves, success hinges on a blend of technological leadership, strategic alliances, and a seamless service ecosystem that addresses the full lifecycle requirements of propeller systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Aircraft Propeller Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airmaster Propeller Systems, Inc.

- Avia Propeller s.r.o.

- Dowty Propellers Limited

- GSC Systems Ltd.

- Hartzell Propeller Inc.

- Hartzell Propeller Inc.

- Hercules Propellers Ltd.

- Hoffmann GmbH Propeller-Technik

- Hoffmann Propeller GmbH & Co. KG

- Hélices E-Props

- McCauley Propeller Systems

- McCauley Propeller Systems, Inc.

- MT-Propeller Entwicklung GmbH & Co. KG

- RTX Corporation

- Safran S.A.

- Sensenich Propeller Company

- ZF Luftfahrttechnik GmbH

Presenting actionable recommendations for industry leaders to optimize innovation tech adoption and strategic collaborations in the evolving propeller systems

To capitalize on evolving propeller system opportunities, industry leaders should initiate targeted investment in advanced material research, focusing on next-generation composites that deliver demonstrable gains in strength-to-weight performance. Simultaneously, forging strategic partnerships with predictive analytics providers will unlock condition-based maintenance paradigms, reducing unscheduled downtime and improving lifecycle costs. By coupling materials expertise with digital innovations, organizations can differentiate their offerings and command premium value propositions in both OEM and aftermarket channels.

In parallel, executives must reassess sourcing strategies in light of shifting trade policies. Diversifying supplier bases and qualifying domestic manufacturers for critical components will mitigate tariff risks and strengthen supply chain resilience. Leaders are advised to develop cross-functional teams that integrate procurement, engineering, and regulatory affairs to anticipate policy changes and adapt rapidly to emerging requirements. Early engagement with certification authorities on novel materials and manufacturing processes will expedite market entry and secure first-mover advantages.

Finally, cultivating comprehensive service ecosystems through joint ventures with MRO specialists and localized support centers will enhance customer satisfaction and foster long-term loyalty. Industry stakeholders that invest in co-located technical hubs and robust aftersales programs will build compelling narratives around reliability and efficiency, securing a competitive edge. Collectively, these recommendations provide a roadmap for organizations to navigate complexity, harness innovation, and achieve sustainable leadership in the commercial aircraft propeller arena.

Outlining rigorous research methodology integrating qualitative and quantitative approaches to ensure comprehensive data integrity and market relevance

The foundation of this market analysis rests on a hybrid research methodology that integrates both qualitative and quantitative approaches to ensure robust data integrity. Primary research comprised in-depth interviews with C-suite executives, design engineers, and maintenance directors across commercial airlines, MRO providers, and propeller OEMs. These conversations yielded firsthand insights into operational challenges, technology adoption timelines, and regional policy impacts, providing a nuanced understanding of market drivers and constraints.

Quantitative research efforts leveraged a comprehensive survey distributed to procurement professionals, technical specialists, and fleet planners, capturing perspectives on material preferences, maintenance intervals, and investment priorities. Statistical analysis of survey responses enabled validation of emerging trends and facilitated comparisons across end-user categories and geographic regions. In addition, secondary research encompassed a thorough review of public filings, regulatory filings, patent databases, and industry white papers, ensuring that all assertions are grounded in documented evidence and recognized best practices.

Data triangulation was employed to reconcile insights from different sources and solidify conclusions. Advanced analytics techniques, including regression analysis and scenario modeling, were applied to historical data on component lifecycles, trade policy shifts, and fleet utilization rates. Quality control measures, such as peer reviews and methodological audits, further underpin the report’s credibility. Taken together, this mixed-method approach provides a comprehensive and reliable framework for understanding the current state and future trajectory of commercial aircraft propeller systems.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Aircraft Propeller Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Aircraft Propeller Systems Market, by Propeller Material

- Commercial Aircraft Propeller Systems Market, by Number Of Blades

- Commercial Aircraft Propeller Systems Market, by End User

- Commercial Aircraft Propeller Systems Market, by Aircraft Type

- Commercial Aircraft Propeller Systems Market, by Operation Type

- Commercial Aircraft Propeller Systems Market, by Region

- Commercial Aircraft Propeller Systems Market, by Group

- Commercial Aircraft Propeller Systems Market, by Country

- United States Commercial Aircraft Propeller Systems Market

- China Commercial Aircraft Propeller Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding insights emphasize the strategic importance of propeller systems in modern aviation and outline imperatives for stakeholders to drive growth

In conclusion, commercial aircraft propeller systems stand at the nexus of technological innovation, regulatory dynamics, and evolving market demands. Advancements in composite materials, digital monitoring, and additive manufacturing are catalyzing a new generation of propeller architectures that promise enhanced efficiency, lower emissions, and superior reliability. Simultaneously, trade policy shifts, particularly the 2025 tariff adjustments, have underscored the criticality of resilient sourcing strategies and the pursuit of domestic manufacturing capabilities.

Segmentation and regional analyses have highlighted the diversity of requirements across end users, aircraft types, and global markets, demonstrating that one-size-fits-all solutions are no longer viable. Competitive leadership now depends on the ability to integrate advanced materials with predictive maintenance technologies, supported by comprehensive service ecosystems. Stakeholders who adopt the actionable recommendations presented-fostering material innovation, diversifying supply chains, and building collaborative service platforms-will be well positioned to drive sustainable growth.

As the propeller domain enters this transformative phase, the strategic imperatives surrounding innovation, supply chain resilience, and customer-centric service models will shape the competitive landscape. By leveraging the insights and methodologies outlined in this report, industry participants can confidently navigate challenges and capitalize on emerging opportunities in the dynamic realm of commercial aircraft propeller systems.

Connect with Associate Director of Sales and Marketing to unlock strategic insights and acquire the comprehensive commercial aircraft propeller systems report

To seize the benefits of this in-depth market research, industry professionals and decision-makers are encouraged to connect with Ketan Rohom, Associate Director of Sales and Marketing, who stands ready to provide personalized guidance and answer all inquiries. Engaging directly will ensure that you receive a thorough walkthrough of the report’s most salient findings, including how breakthroughs in propeller materials and emerging tariff implications intersect with your strategic objectives. Reach out to uncover tailored solutions that align with your organization’s growth ambitions, secure a competitive edge, and drive future innovation. Don’t miss the chance to access proprietary intelligence that empowers high-impact decisions and accelerates success in the evolving commercial aircraft propeller sector.

- How big is the Commercial Aircraft Propeller Systems Market?

- What is the Commercial Aircraft Propeller Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?