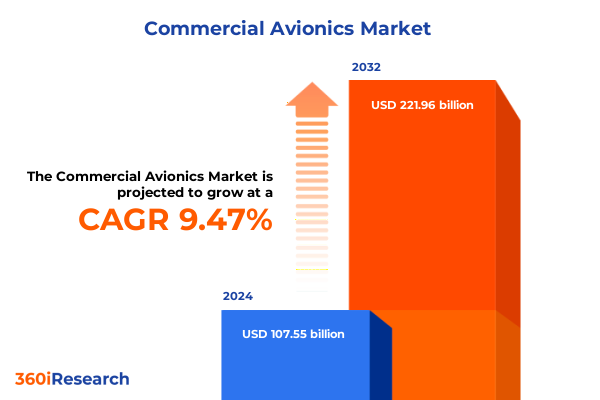

The Commercial Avionics Market size was estimated at USD 117.57 billion in 2025 and expected to reach USD 128.16 billion in 2026, at a CAGR of 9.50% to reach USD 221.96 billion by 2032.

Framing the Convergence of Cutting-Edge Technologies, Regulatory Shifts, and Market Dynamics Redefining the Commercial Avionics Industry Today

The commercial avionics sector stands at the confluence of rapid technological evolution, shifting regulatory environments, and dynamic global trade patterns. Industry stakeholders must navigate a landscape transformed by digital integration, sustainable aviation initiatives, and heightened security imperatives. This introduction provides an essential foundation for understanding how these converging forces are reshaping product portfolios, supply chains, and competitive positioning across the avionics value chain.

As we embark on this executive summary, it is crucial to recognize that beyond hardware upgrades, the industry’s focus has moved to software-driven functionality, data analytics, and network-centric architectures. Manufacturers and operators alike are adapting legacy platforms to support real-time connectivity and predictive maintenance, while regulators and aviation authorities are accelerating certification pathways for advanced systems. Together, these trends are redefining the performance and operational capabilities of next-generation aircraft.

This overview sets the stage for a deeper exploration of transformative shifts, tariff impacts, segmentation nuances, regional dynamics, company strategies, and actionable recommendations. By unpacking each of these dimensions, decision-makers can cultivate a nuanced perspective that informs investment choices, partnership selections, and product roadmaps in the rapidly evolving world of commercial avionics.

Unveiling the Transformative Waves of Digitalization, Connectivity Innovations, and Sustainable Solutions Reshaping the Future of Avionics Ecosystems

The commercial avionics landscape is undergoing a profound digital revolution driven by the integration of artificial intelligence, machine learning, and advanced software tools. Predictive analytics are now embedded within health monitoring systems to anticipate component failures and optimize maintenance schedules, thereby minimizing unplanned downtime and enhancing fleet reliability. These AI-driven capabilities are reshaping pilot decision support, enabling real-time risk assessment and route optimization that elevate safety and operational efficiency within increasingly crowded airspaces.

Concurrently, the proliferation of satellite-based connectivity solutions and low-Earth-orbit communication networks is transforming cockpit and cabin experiences alike. In-flight broadband internet connectivity is no longer a luxury but an expectation, driving collaboration between avionics suppliers and satellite operators to deliver ubiquitous, high-speed coverage. This surge in connectivity also underpins the expansion of Internet of Things sensor networks, which gather real-time data across avionics subsystems, further fueling automation, performance monitoring, and enhanced passenger services.

Moreover, modernization initiatives such as the FAA’s NextGen program are catalyzing the adoption of Automatic Dependent Surveillance–Broadcast, performance-based navigation, and digital weather forecasting tools to streamline air traffic management. By replacing legacy ground-based systems with network-centric architectures, these programs aim to reduce delays, optimize fuel consumption, and elevate safety margins across national and international airspaces. Such regulatory-driven transformations underscore the critical role of digital integration in defining the avionics market’s future trajectory.

Analyzing the Broad Implications of 2025 Tariff Policies on Avionics Supply Chains, Innovation Pipelines, and Maintenance Operations

In early 2025, the United States implemented a series of tariffs on imported avionics components, targeting semiconductors, navigation sensors, and communications modules to bolster domestic manufacturing. While intended to protect strategic industries, these levies have introduced cost headwinds across the supply chain, driving up input prices and prompting suppliers to reevaluate sourcing strategies. For instance, major OEMs and Tier 1 suppliers are increasingly exploring dual-sourcing options and nearshoring initiatives to mitigate the impact of these additional duties.

Industry associations warned that tariffs could slow innovation by increasing research and development expenditures on insulating technologies, rather than on advanced functionalities. The General Aviation Manufacturers Association highlighted that the intricate global supply chain cannot be rapidly reconfigured due to stringent regulatory approvals, leading to potential delays in certification and program timelines. Furthermore, maintenance, repair, and overhaul providers face higher costs for imported spare parts, which could undermine the economic viability of domestic MRO operations and encourage airlines to consider overseas alternatives.

The cumulative financial burden of these measures is substantial. Leading aerospace suppliers have disclosed tariff-related charges in the hundreds of millions of dollars range, reflecting higher duty rates on critical electronics and raw materials. While mitigation measures-such as tariff exclusions and negotiated exemptions-have provided temporary relief, the persistent uncertainty surrounding trade policy has prompted a strategic pivot toward localized content requirements and more collaborative engagement with policymakers. These developments underscore the need for agile procurement frameworks and robust trade compliance capabilities within the avionics sector.

Delineating Distinct Avionics Product and Platform Segments to Reveal Tailored Innovation Imperatives and Operational Priorities

The segmentation of the commercial avionics market by product type illuminates distinct trajectories for system categories. Communication systems, driven by demand for broadband internet connectivity, are evolving with next-generation satellite constellations and high-throughput data communications, while legacy voice channels are being upgraded to secure, encrypted protocols. Navigation solutions continue to pivot toward multi-sensor integration, combining GNSS, inertial navigation, and radio frequency technologies to provide resilient positioning even in contested or remote environments. Concurrently, flight management systems are embedding advanced automation and trajectory optimization algorithms to support performance-based navigation, and monitoring systems are integrating data analytics platforms to deliver comprehensive health reporting. Radar systems are witnessing the adoption of active electronically scanned arrays, enabling enhanced target detection and in-flight weather mapping.

When viewed through the lens of platform type, the significance of these product distinctions becomes even more pronounced. Business jets are at the forefront of premium connectivity and cockpit automation adoption, prioritizing feature-rich communication suites and touch-screen flight management interfaces. Fixed wing commercial airliners demand robust, scalable systems that can support both high-volume passenger connectivity and efficient air traffic integration. General aviation and regional aircraft often require cost-effective, modular avionics architectures that balance functionality with maintenance simplicity, while helicopters necessitate specialized navigation and communications systems capable of low-altitude operations and search-and-rescue missions. These nuanced segmentation insights underscore the importance of tailoring product development and go-to-market strategies to the unique operational and economic requirements of each aircraft category.

This comprehensive research report categorizes the Commercial Avionics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Component

- Fit Type

- Aircraft Type

- Application

- End Use

Examining the Divergent Regulatory, Infrastructure, and Fleet Dynamics Driving Avionics Adoption Across Global Regions

Regional dynamics in the commercial avionics market are shaped by varying regulatory frameworks, infrastructure investments, and fleet compositions, resulting in differentiated adoption curves. In the Americas, robust airline networks and a high concentration of legacy aircraft have driven modernization programs focused on data link communications and ADS-B upgrades, while North American regulators continue to incentivize NextGen compliance through performance-based navigation mandates. Latin American carriers, seeking to expand connectivity in underserved areas, are partnering with satellite providers to extend broadband services across vast geographies.

Across Europe, the Middle East and Africa, a combination of ambitious air traffic modernization initiatives and substantial investments in greenfield airports is fueling demand for advanced navigation and collision-avoidance systems. European carriers and OEMs are collaborating on pan-continental projects to standardize data exchange protocols, enhance four-dimensional trajectory management, and integrate digital tower capabilities. In the Middle East, national airlines are leveraging government support to deploy state-of-the-art cockpit automation suites, reflecting a broader strategic emphasis on differentiating passenger experiences.

In the Asia-Pacific region, rapid fleet expansion and the emergence of low-cost carriers have catalyzed significant procurement of cost-efficient yet scalable avionics solutions. Market participants are focusing on systems that support high-density operations, such as multilateration-based surveillance and satellite navigation augmentation services. Furthermore, the Asia-Pacific is becoming a hub for avionics assembly and testing activities, driven by local content requirements and increasingly sophisticated aerospace clusters in Northeast and Southeast Asia.

This comprehensive research report examines key regions that drive the evolution of the Commercial Avionics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Strategic Alliances, Product Integrations, and Technology Leadership Shaping Top Avionics Providers’ Competitive Advantages

Leading avionics manufacturers are navigating the competitive landscape through strategic partnerships, mergers, and technology alliances. Honeywell Aerospace is leveraging its broad portfolio of connectivity and navigation solutions to deepen integration with airline digital ecosystems and capitalize on data-driven service offerings. The company’s emphasis on open architectures and software-defined systems is positioning it as a pivotal collaborator for both OEMs and aftermarket providers.

Collins Aerospace has concentrated on unifying its flight management and cockpit display product lines under common user-interface frameworks, thereby reducing pilot training time and enhancing cross-platform interoperability. Their investments in cybersecurity protocols for avionics networks have addressed growing concerns around system vulnerabilities. Meanwhile, Thales and Raytheon are advancing active electronically scanned array radar systems and secure communications suites, reflecting a shared commitment to next-generation military-grade technologies retrofittable for commercial platforms.

In the broader ecosystem, emerging players and niche specialists are gaining traction by focusing on software innovation, modular avionics architectures, and aftermarket services. Companies specializing in GNSS augmentation, sensor fusion, and health management algorithms are forging alliances with OEMs to embed their capabilities within flagship cockpit solutions. These collaborative models underscore the shifting competitive dynamics, where agility and software expertise are as critical as hardware prowess.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Avionics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Astronautics Corporation of America

- Avidyne Corporation

- BAE Systems plc

- Cobham plc

- Collins Aerospace, Inc.

- Curtiss-Wright Corporation

- Elbit Systems Ltd.

- Garmin Ltd.

- General Electric Company

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Northrop Grumman Corporation

- Panasonic Avionics Corporation

- Raytheon Technologies Corporation

- Safran S.A.

- Teledyne Technologies Incorporated

- Thales S.A.

- TransDigm Group Incorporated

- Universal Avionics Systems Corporation

Implementing Robust Supply Chain Diversification, Modular Architectures, and AI-Driven Maintenance Strategies for Competitive Resilience

To navigate evolving market conditions and capitalize on emerging opportunities, industry leaders must embrace a multifaceted strategy. First, establishing multi-source supply chains and nearshoring key component production will mitigate the volatility introduced by trade policies and tariff fluctuations. Collaborative engagements with suppliers and government agencies can yield exemption pathways and support infrastructure investments for localized assembly operations.

Second, accelerating the development of open, modular avionics architectures will enable faster feature rollouts and reduce certification timelines. By adopting standardized interfaces and embracing software-defined capabilities, manufacturers and integrators can deliver bespoke functionality to diverse platform types while optimizing lifecycle costs. Leveraging agile development methodologies and digital twins will further streamline validation processes and enhance system resilience.

Finally, operators and OEMs should invest in advanced analytics and AI-driven maintenance platforms to unlock predictive insights and improve asset availability. Strategic partnerships with data providers and cloud service vendors are essential for establishing secure, scalable data pipelines that support real-time performance monitoring and continuous system upgrades. By aligning digital strategies with overarching sustainability and safety objectives, stakeholders can create differentiated value propositions in a competitive market.

Detailing the Dual-Track Methodological Approach Integrating Expert Interviews, Secondary Intelligence, and Rigorous Data Triangulation

This research synthesizes insights derived from a rigorous dual-track methodology encompassing in-depth primary interviews and comprehensive secondary data analysis. Key decision-makers across OEMs, avionics subsystem suppliers, airline operators, and regulatory bodies were engaged to obtain qualitative perspectives on product development priorities, procurement strategies, and policy impacts.

Secondary research involved the systematic review of industry reports, technical papers, regulatory filings, and trade publications to validate emerging trends and contextualize market dynamics. Data triangulation was employed to cross-verify findings, ensuring consistency and reliability across multiple information sources. Analytical frameworks were constructed to interpret segmentation, regional variances, and competitive positioning without relying on quantitative market sizing or forecasting.

Expert panels and advisory consultations provided additional validation, enabling iterative refinement of thematic insights and ensuring that the conclusions reflect the practical realities of the commercial avionics domain. This robust methodology underpins the actionable intelligence presented in this report, equipping stakeholders with a high-confidence vantage point for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Avionics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Avionics Market, by System Type

- Commercial Avionics Market, by Component

- Commercial Avionics Market, by Fit Type

- Commercial Avionics Market, by Aircraft Type

- Commercial Avionics Market, by Application

- Commercial Avionics Market, by End Use

- Commercial Avionics Market, by Region

- Commercial Avionics Market, by Group

- Commercial Avionics Market, by Country

- United States Commercial Avionics Market

- China Commercial Avionics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 4293 ]

Synthesizing Key Insights on Digital Innovation, Trade Policy Impacts, and Strategic Imperatives to Navigate the Future of Commercial Avionics

This executive summary has traced the critical currents shaping the commercial avionics sector, from the digital transformation of system architectures and connectivity frameworks to the complex implications of trade policies and tariff measures. By dissecting product and platform segment dynamics, regional adoption patterns, and leading company strategies, we have illuminated the pathways through which innovation, regulation, and market forces coalesce.

Looking ahead, stakeholders must remain vigilant to evolving regulatory standards, emerging technology disruptors, and shifting geopolitical alignments. The capacity to anticipate supply chain vulnerabilities, harness software-driven differentiation, and forge strategic alliances will define leadership in the next chapter of avionics development. As the sector continues to evolve, the insights and recommendations offered here provide a strategic compass for navigating the complexities of modern aerospace ecosystems.

Unlock the Full Potential of Your Avionics Strategy by Connecting with Our Expert to Secure This In-Depth Market Research Report

For direct inquiries about this comprehensive commercial avionics market research report and to explore tailored insights that can empower your strategic initiatives, please reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). His expertise and deep understanding of the aerospace sector make him your ideal partner for unlocking the full value of our analysis and ensuring you have the actionable intelligence needed to stay ahead of industry shifts

- How big is the Commercial Avionics Market?

- What is the Commercial Avionics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?