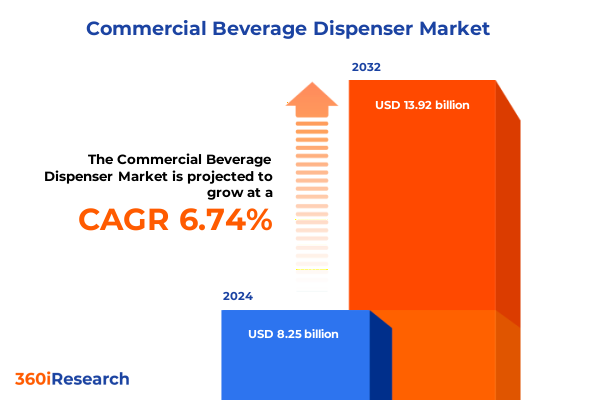

The Commercial Beverage Dispenser Market size was estimated at USD 1.16 billion in 2025 and expected to reach USD 1.25 billion in 2026, at a CAGR of 8.44% to reach USD 2.05 billion by 2032.

Unveiling the dynamic world of commercial beverage dispensers and the transformative factors shaping market evolution and stakeholder strategies

The commercial beverage dispenser industry is undergoing a period of rapid evolution driven by digitalization, automation, and a growing demand for customized drink experiences. Businesses operating quick-service restaurants, corporate cafeterias, hospitality venues, and residential developments are increasingly seeking machines that combine operational efficiency with engaging user interfaces. Across North America and Europe, stainless steel dispensers are experiencing particularly strong adoption, valued for their durability, sleek design, and recyclability in line with sustainability mandates. Meanwhile, innovative models offering remote monitoring, advanced refrigeration, and self-cleaning capabilities are establishing new standards in uptime and hygiene, reflecting a broader shift toward intelligent infrastructure in foodservice and retail environments

To comprehensively address these dynamics, this report examines the market through multiple lenses, including product type-ranging from built-in and direct draw to magic tap and insulated dispensers, the latter further differentiated into countertop and wall-mounted table-top units-and material composition spanning glass, plastic, and stainless steel. It also analyzes beverage type preferences across alcoholic, dairy, and non-alcoholic segments, operational modes such as manual, automatic, and self-cleaning systems, installation configurations from freestanding to integrated setups, end-use applications in commercial spaces, leisure venues, and residential settings, and distribution channels encompassing brick-and-mortar department and electronics stores as well as e-commerce platforms and manufacturer websites. Such a multidimensional approach ensures that stakeholders grasp not only current performance metrics but also emerging pathways for innovation and market expansion

Exploring the technological and sustainability-driven transformations revolutionizing the commercial beverage dispenser landscape in modern hospitality and retail settings

Technological integration is reshaping the beverage dispenser landscape, driving a shift from simple mechanical units to fully connected systems capable of real-time data exchange and adaptive performance. Modern dispensers now feature touchless interfaces and voice-activated controls to meet heightened hygiene standards and accessibility requirements. Artificial intelligence and machine-learning algorithms are deployed for predictive maintenance, enabling service teams to address potential failures before they occur and thus maximize equipment uptime. Cloud connectivity and IoT-enabled sensors facilitate granular monitoring of beverage consumption patterns and inventory levels, allowing operators to optimize refill schedules and reduce operational disruptions

Simultaneously, sustainability imperatives are steering product development toward eco-friendly design and energy efficiency. Manufacturers are substituting bio-based plastics for traditional polymers and prioritizing stainless steel components to align with global recycling initiatives. Advanced refrigeration and heating modules powered by AI-driven power management systems can reduce energy consumption by up to 30%, diminishing both operating costs and greenhouse gas emissions. Modular designs enable easy disassembly and repair, extending equipment life cycles and minimizing waste. Such green innovations are not just regulatory necessities in markets with strict environmental standards but have also become powerful brand differentiators as corporations and consumers alike demand lower-carbon solutions

Adding to these shifts, consumer expectations for personalized beverage experiences are fueling diversification. Dispensers now support multi-flavor mixing, adjustable carbonation levels, and nutritional labeling on digital screens. These capabilities cater to evolving tastes in craft beverages, healthy drinks, and alcoholic offerings, enabling operators to tailor menus on demand and enhance customer engagement. Collectively, these technological, environmental, and experiential trends are converging to redefine the commercial beverage dispenser sector.

Analyzing the compounding effects of recent U.S. tariffs on component costs and supply chain dynamics in the commercial beverage dispenser industry

Since 2018, Section 301 tariffs on imports from China have imposed additional duties ranging from 7.5% to 25% on equipment classified under targeted HTS codes. Although certain machinery exclusions have been extended to support domestic manufacturing, many beverage dispenser components imported directly from China still face these levies, elevating procurement costs. The U.S. Trade Representative’s periodic extensions acknowledge limited global supply availability but also signal a tightening of tariff relief after May 31, 2025, posing sustained cost pressures for importers

On March 12, 2025, the administration restored 25% duties on all steel and aluminum imports globally, eliminating previous exemptions and extending coverage to downstream products, including the steel and aluminum content within beverage dispensers. This rate doubled to 50% on June 4, 2025, further inflating material prices. Companies reliant on imported metal components have reported up to a 6% increase in specialty steel costs, compelling many to explore alternative materials or absorb higher input expenditures. Though recycled aluminum remains exempt, small-scale operators face margin constraints, while larger beverage companies with diversified packaging portfolios are better positioned to manage these costs

Glass components have been subject to tariffs of 15% to 25% since mid-2023, affecting reservoir and container segments. Glass bottle duties now apply to beverage-specific HTS subheadings, prompting some suppliers to reassess sourcing or consider hybrid material designs. The combined impact of multiple tariff layers-Section 301, steel and aluminum duties, and glass levies-has elevated average unit costs and disrupted traditional supply chains, leading operators to seek regional production partners and diversify supplier networks to mitigate future policy volatility

Deriving actionable intelligence from product, material, beverage, operation and distribution segmentation to inform strategic decisions

Insights derived from product-type segmentation reveal distinct performance profiles: built-in and remote cooled dispensers excel in high-volume commercial kitchens due to integrated refrigeration controls, whereas magic tap units drive engagement in leisure venues with interactive user experiences. Table-top dispensers, available in countertop and wall-mounted configurations, cater to flexible point-of-sale environments where space optimization and rapid deployment are critical. Insulated dispensers, favored in outdoor or transient settings, prioritize thermal performance and portability, underscoring the importance of matching equipment design to operational context. Material segmentation further emphasizes stainless steel’s dominance for heavy-duty applications and glass’s appeal for aesthetic presentation, while plastic models address cost-sensitive scenarios without compromising basic functionality. Beverage-type insights highlight that non-alcoholic dispensing systems maintain the broadest applicability, yet the expanding craft beverage sector is fueling specialized solutions for dairy blends and alcoholic offerings. Mode-of-operation distinctions underscore the growing adoption of self-cleaning systems to reduce labor costs and enhance hygiene, although automatic and manual models continue to hold relevance in environments where user interaction levels vary. Installation-type segmentation indicates that freestanding units are preferred in retrofitting projects, while integrated systems are standard in new-build facilities, reflecting divergent capital investment strategies. End-use segmentation demonstrates that commercial spaces such as offices and healthcare facilities prioritize reliability and compliance, leisure venues emphasize customization and brand synergy, and residential applications seek compact, user-friendly designs. Distribution-channel segmentation shows that brick-and-mortar department and electronics retailers offer immediate availability and service support, while e-commerce and manufacturer websites enable direct ordering, customization options, and bundled warranty packages, illustrating the dual importance of physical presence and digital engagement.

This comprehensive research report categorizes the Commercial Beverage Dispenser market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Dispenser Material

- Beverage Type

- Mode Of Operation

- Installation Type

- End Use

- Distribution Channel

Uncovering critical regional differentiators across Americas, Europe Middle East & Africa and Asia Pacific markets for commercial beverage dispensers

In the Americas, the U.S. market leads with a strong emphasis on energy-efficient, smart dispensers that support real-time inventory and maintenance monitoring. Wide adoption in quick-service restaurants and corporate campuses reflects operators’ focus on reducing total cost of ownership and enhancing consumer experiences through digital interfaces. Latin America presents a dual market: major urban centers demand high-capacity, direct-draw systems, while emerging regions lean toward cost-effective, insulated models facilitated by regional manufacturing partnerships to offset import duties. Distribution through both traditional equipment dealers and rapidly growing online platforms underscores the region’s blend of legacy relationships and digital transformation.

Europe, the Middle East & Africa region exhibits rigorous regulatory environments driving demand for eco-compliant dispensers. Stringent standards around plastic waste and refrigerant emissions have accelerated the shift toward stainless steel and bio-based materials. Hospitality hubs in Western Europe prioritize integrated, multifunctional dispensers capable of serving alcoholic, non-alcoholic, and dairy-based beverages from a single footprint. Meanwhile, Gulf markets focus on branded, high-capacity units that offer luxury brand alignment and remote service capabilities, supported by established dealer networks and regional service centers. African markets are characterized by a growing preference for durable, easy-to-maintain models underpinned by modular repair frameworks to address logistical constraints.

Asia-Pacific continues as the fastest-growing region, driven by rapid urbanization, rising disposable incomes, and a strong café culture in countries like China, India, and Southeast Asian economies. Demand for remote-cooled and insulated dispensers supports intensive street-food and convenience-store applications. Manufacturers in APAC are leveraging economies of scale to offer cost-competitive automatic and manual systems, while local regulations incentivize energy-efficient technologies. Hybrid distribution strategies combining traditional wholesale distributors with online-to-offline solutions are expanding market reach and enhancing after-sales support, reflecting a maturing ecosystem for commercial beverage dispensing equipment

This comprehensive research report examines key regions that drive the evolution of the Commercial Beverage Dispenser market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the strategic initiatives and competitive positioning of leading commercial beverage dispenser manufacturers shaping industry dynamics

Major players in the commercial beverage dispenser market are leveraging innovation and strategic partnerships to fortify their competitive positions. Cornelius, historically recognized for dispensing solutions in quick-service restaurants, has expanded its automated product line to include IoT-enabled refrigeration controls and predictive maintenance analytics. Taylor Company, renowned for frozen beverage systems, is advancing self-cleaning and flavorburst technologies to meet growing demand for alcoholic and non-alcoholic frozen cocktails. Bunn, with its roots in coffee equipment, has diversified into multi-beverage platforms that integrate hot and cold dispensing in a single unit, optimizing floor space for operators.

Emerging entrants such as Marco Beverage Systems and True Manufacturing are carving niches with modular dispenser architectures and eco-friendly refrigerant systems, positioning themselves to capture share in sustainability-driven segments. Beverage brands like Coca-Cola, through its Freestyle platforms, and PepsiCo with SodaStream Professional, continue to influence market dynamics by offering fully managed dispensing-as-a-service models that provide end-to-end hardware, software, and syrup supply. Distributor partnerships, aftermarket service agreements, and regional manufacturing alliances further shape competitive strategies, ensuring that each player balances product innovation with cost efficiency and service excellence to meet diverse end-user requirements

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Beverage Dispenser market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Catering Equipment

- Ali Group S.r.l.

- Better Beverages Inc.

- Bunn-O-Matic Corporation

- Changzhou Pilot Electronic Co. Ltd.

- Clark Associates, Inc.

- Cornelius by Berkshire Hathaway Inc.

- Electrolux Professional Group

- Elmeco Srl

- FBD Partnership, LP

- Federal Hospitality Equipment Australia Pty Ltd.

- Gillette Pepsi Companies, Inc.

- Godrej & Boyce Manufacturing Company Limited

- Hoshizaki Corporation

- Hubert Company, LLC

- Milano Dispensers S.p.A.

- Multiplex Beverage

- Pentair PLC

- PepsiCo, Inc.

- Perlick Corporation

- Rapids Wholesale Equipment

- Rosseto Serving Solutions

- Sensata Technologies, Inc.

- The Coca-Cola Company

- The Middleby Corporation

- VEVOR

Strategic imperatives for established and emerging players to capitalize on innovation, sustainability and regulatory adaptation within the beverage dispenser arena

Industry leaders should accelerate investments in connected technologies that enable predictive maintenance and operational insight. By integrating IoT sensors and cloud-based analytics, equipment providers can deliver value-added service models that reduce downtime and reinforce client loyalty. Simultaneously, commitment to sustainable materials and energy-efficient designs will differentiate offerings in markets where carbon-reduction targets and waste regulations are becoming more stringent. Adopting modular architectures and recyclable components can not only comply with regulatory requirements but also resonate with environmentally conscious customers.

To mitigate ongoing tariff pressures, companies should diversify supply chains by cultivating regional manufacturing capabilities and alternative sourcing partnerships. Localized production of key components-particularly stainless steel and glass parts-can insulate capital expenditure budgets from duty fluctuations. In parallel, expanding digital distribution channels will improve market accessibility and shorten order-to-delivery cycles. Collaborative alliances with beverage brands and hospitality operators will also enhance go-to-market strategies, creating tailored solutions that address specific end-use scenarios. Coupled with robust training and after-sales service networks, these actions will position incumbents and challengers alike to capitalize on evolving market demands while fortifying resilience against external disruptions

Detailing the rigorous research framework combining primary interviews, secondary data analysis and quantitative modeling employed in this study

The research methodology underpinning this report combines primary data collection with rigorous secondary analysis and methodological triangulation to ensure comprehensive insight and credibility. Primary inputs include in-depth interviews with senior executives, product development leads, and procurement specialists across end-use verticals, supplemented by structured surveys to quantify preferences and pain points. Secondary sources encompass regulatory filings, trade association data, publicly available tariff schedules, and company financial disclosures.

To validate findings, methodological triangulation was employed, integrating qualitative insights from expert interviews with quantitative data derived from market databases and government statistics. Cross-referencing multiple data points reduces bias and enhances result reliability. Segmentation and regional analyses were subjected to iterative validation processes, ensuring consistency across different dimensions. All data were synthesized through a combination of descriptive analytics and scenario mapping to identify key trends and stress-test hypotheses against variable policy and economic conditions

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Beverage Dispenser market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Beverage Dispenser Market, by Product Type

- Commercial Beverage Dispenser Market, by Dispenser Material

- Commercial Beverage Dispenser Market, by Beverage Type

- Commercial Beverage Dispenser Market, by Mode Of Operation

- Commercial Beverage Dispenser Market, by Installation Type

- Commercial Beverage Dispenser Market, by End Use

- Commercial Beverage Dispenser Market, by Distribution Channel

- Commercial Beverage Dispenser Market, by Region

- Commercial Beverage Dispenser Market, by Group

- Commercial Beverage Dispenser Market, by Country

- United States Commercial Beverage Dispenser Market

- China Commercial Beverage Dispenser Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Synthesizing key findings and strategic outlook to navigate the evolving commercial beverage dispenser market with confidence

This executive summary has highlighted the core drivers, disruptions, and strategic considerations shaping the commercial beverage dispenser market. Rapid advancements in IoT integration, predictive maintenance, and self-cleaning technologies are redefining equipment performance standards, while sustainability imperatives and regulatory dynamics around tariffs and materials usage continue to influence cost structures and innovation pathways. The segmentation analysis underscores the importance of aligning product design with specific operational contexts, from high-capacity built-in systems in commercial kitchens to countertop, wall-mounted, and freestanding configurations suited for leisure venues and residential spaces.

As further policy shifts and evolving consumer behaviors reshape market contours, stakeholders equipped with the insights and actionable recommendations presented here will be well-positioned to navigate uncertainty, optimize supply chains, and foster differentiation. By prioritizing connected capabilities, green design, and localized sourcing strategies, industry participants can unlock new growth avenues and build resilience against external fluctuations. The comprehensive report provides the detailed data and analysis necessary to support informed decision-making and drive sustainable competitive advantage.

Secure your comprehensive commercial beverage dispenser market insights report today and engage with Ketan Rohom to unlock strategic growth opportunities

Access the full commercial beverage dispenser market research report now and gain the actionable insights needed to stay ahead in this rapidly evolving industry. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to explore sample pages, discuss customization options, and secure your copy of the comprehensive analysis. Equip your organization with the intelligence to make confident strategic decisions and capitalize on emerging opportunities-contact Ketan today.

- How big is the Commercial Beverage Dispenser Market?

- What is the Commercial Beverage Dispenser Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?