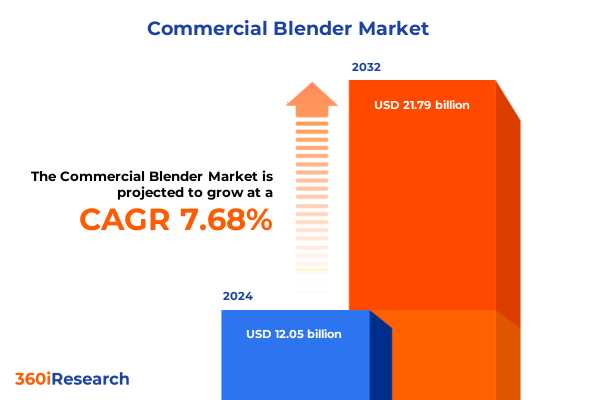

The Commercial Blender Market size was estimated at USD 12.96 billion in 2025 and expected to reach USD 13.95 billion in 2026, at a CAGR of 7.70% to reach USD 21.79 billion by 2032.

Unlocking the Core Drivers of Innovation and Demand in the Commercial Blender Sector for Enhanced Operational Efficiency and Culinary Excellence

Commercial blenders serve as the backbone of a wide range of professional kitchens, powering everything from emulsified sauces to high-volume beverage production. This introduction navigates the intricate ecosystem surrounding industrial blending technology, examining how operators increasingly prioritize machines that balance durability with precision. As culinary professionals and food processing specialists strive for both consistency and speed, blenders have evolved beyond simple mixing tools into integrated solutions that optimize workflow and product quality.

Bridging operational objectives with culinary innovation, modern commercial blenders encompass advanced motor designs, intelligent control interfaces, and robust construction materials. Stakeholders across hospitality venues, retail outlets, and food manufacturing facilities look to these machines not only to meet demand surges but also to differentiate offerings in competitive markets. Consequently, understanding the foundational drivers that propel product development, adoption, and end-user satisfaction is critical for decision-makers aiming to invest strategically in blending solutions that align with both performance expectations and long-term business goals.

Expanding on performance and market dynamics, this summary captures the essential factors that influence equipment selection, supplier partnership, and operational scalability. By establishing a clear view of current capabilities and emerging requirements, the introduction sets the stage for deeper analysis of industry shifts, tariff impacts, segmentation strategies, regional variations, and key market participants shaping the commercial blender landscape today.

Examining the Major Technological and Operational Transformations Reshaping the Commercial Blender Market Landscape Today with Unprecedented Innovation

Rapid advances in digital connectivity and automation have revolutionized the way commercial blenders integrate within professional food preparation environments. Controllers featuring touch-sensitive interfaces, programmable blending cycles, and real-time performance analytics empower operators to achieve consistent product results while minimizing waste. Simultaneously, the incorporation of Internet of Things (IoT) capabilities has enabled remote monitoring and predictive maintenance, ensuring high uptime and streamlined service schedules. Such technological maturation marks a departure from legacy units, underscoring a shift toward smart platforms that can adapt fluidly to varying throughput demands.

Material science breakthroughs further accelerate this transformation. High-strength alloys, impact-resistant polymers, and sanitary surface coatings all contribute to machines capable of handling abrasive ingredients and rigorous cleaning protocols with reduced risk of component fatigue. Alongside these hardware improvements, energy-efficient motor designs and variable-frequency drives have emerged as key enablers, allowing facilities to reduce power consumption while maintaining peak torque and blending performance under sustained loads.

Taken together, these innovations reflect an operational paradigm that values both versatility and reliability, directly influencing how food processors, hospitality enterprises, and retail operations approach equipment investment. As new performance benchmarks become industry standards, stakeholders must recalibrate procurement frameworks and training processes to align with next-generation blending technologies and the evolving demands they address.

Analyzing the Far-reaching Consequences of the 2025 United States Tariff Adjustments on Commercial Blender Supply Chains Cost Structures and Trade Dynamics

In 2025, the United States implemented targeted tariff revisions affecting key components and finished goods within the commercial kitchen equipment sector, including industrial-grade blenders. These adjustments aimed to rebalance trade deficits and protect domestic manufacturing interests by imposing additional duties on imported motor assemblies, electronic control modules, and accessory parts originating from certain countries. As a result, import costs have increased, prompting many distributors and original equipment manufacturers (OEMs) to reassess global supplier relationships and negotiate revised terms under the revised tariff regime.

Supply chain disruption emerged almost immediately, with lead times extending as customs clearance processes became more stringent and importers faced heightened scrutiny. Organizations reliant on just-in-time inventory models experienced stock fluctuations, compelling procurement teams to explore alternative sourcing strategies such as diversified supplier portfolios, nearshoring production, and localized assembly partnerships. Through these adaptive measures, businesses have sought to mitigate the volatility introduced by tariff implementation, although this has often necessitated additional frontline investment in vendor qualification, quality control, and logistics optimization.

Consequently, end-user pricing has reflected these underlying cost pressures, as manufacturers pass through a portion of duty increases to maintain margin integrity. In response, some market participants have prioritized modular design approaches that allow for flexibility in component selection, thereby reducing exposure to tariff-driven cost spikes. Looking ahead, the interplay between regulatory policy and supply chain resilience will remain a defining factor for stakeholders navigating the complex terrain of commercial blender procurement and deployment.

Discovering the Critical Segmentation Insights That Illuminate User Preferences Applications and Product Capacities within the Commercial Blender Market Ecosystem

A nuanced perspective of the commercial blender landscape emerges from how professional users deploy these machines across distinct operational contexts. In food processing environments, operators require machines capable of handling large batch volumes and consistent output for tasks such as baking batter preparation, beverage blending, and dairy product homogenization. Hospitality settings demand equipment tailored to specific venue needs: cafeterias rely on versatile, hard-wearing units, while hotels and restaurants emphasize quiet operation and refined control to complement diverse menu offerings. Retail outlets that integrate blending stations highlight user-friendly interfaces and rapid cleaning cycles to maintain hygienic standards and deliver seamless customer experiences.

Overlaying these application insights, product type segmentation delineates machinery purpose and design. Bulk and heavy-duty configurations deliver reinforced construction and sustained torque for abrasive or dense ingredients, making them ideal for continuous production lines. High-speed models focus on rapid shear and emulsification performance, offering precise texture control for premium sauces and smoothies, while overhead styles integrate fixed-mount operation, optimizing floor space and sanitation in high-volume commercial kitchens.

Capacity-focused segmentation then aligns machine volume with operational demands and kitchen layouts. Compact units under one liter serve niche or limited-space scenarios, facilitating precision blending in artisanal or boutique environments. Mid-range capacities between one and two liters balance flexibility with manageable size, suiting small restaurants and catering services. For large-scale facilities, models exceeding two liters provide the throughput necessary for uninterrupted batch processing, supporting high-demand workflows and multiple shift operations.

This comprehensive research report categorizes the Commercial Blender market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Capacity

- Power Rating

- End-Use

- Distribution Channel

Exploring Regional Variations in Demand Technology Adoption and Growth Drivers across Key Global Markets to Uncover Strategic Opportunities for Stakeholders

Within the Americas, commercial blender usage is heavily influenced by the robust foodservice sector and dynamic retail channels. In North America, a surge in fast-casual dining and the expansion of cloud kitchens have heightened demand for machines that deliver both speed and consistency, driving interest in digitally enabled models with customizable programming. Meanwhile, in Latin American markets, growth is fueled by rising consumer demand for fruit-based beverages and dairy variants, prompting regional manufacturers and distributors to offer locally tailored solutions with strong after-sales support and adaptable performance specifications.

In Europe, the Middle East, and Africa, stringent hygiene regulations and energy efficiency mandates shape equipment selection and innovation. European operators often prioritize units designed for easy sanitation and reduced power consumption, aligning with sustainability goals and food safety directives. In the Middle East, premium hospitality venues seek blenders that combine cutting-edge design aesthetics with reliable performance under high ambient temperatures, while African markets display growing interest in modular equipment that can accommodate diverse ingredient profiles and withstand variable voltage conditions.

Asia-Pacific presents one of the most dynamic landscapes for blending technology adoption. Rapid urbanization, rising disposable income, and a burgeoning food delivery ecosystem have accelerated the installation of high-performance blenders in commercial kitchens and retail outlets across key hubs such as China, India, Japan, and Southeast Asia. Manufacturers in this region emphasize cost-effective manufacturing, compact designs tailored to limited kitchen footprints, and integrations with digital ordering platforms to meet the needs of emerging cloud kitchen operators and specialty beverage chains. As regional nuances continue to evolve, stakeholders must calibrate market entry strategies and product development roadmaps to resonate with disparate consumer preferences and regulatory environments.

This comprehensive research report examines key regions that drive the evolution of the Commercial Blender market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Positioning Strengths and Innovation Approaches of Leading Commercial Blender Manufacturers and Their Impact on Competitive Dynamics

Leading players in the commercial blender market distinguish themselves through a blend of product innovation, strategic partnerships, and expansive distribution networks. Well-established brands such as Vitamix and Blendtec have cultivated reputations for reliability and performance, leveraging decades of engineering expertise to introduce motor technologies that deliver consistently high torque and extended service life. Meanwhile, manufacturers like Hamilton Beach and Waring balance affordability with functionality, addressing the needs of mid-tier operators by offering models with user-centric features such as one-touch controls and self-cleaning cycles.

Recent entrants and niche specialists have injected fresh competition, focusing on advanced digital interfaces and IoT-enabled analytics. Companies such as Breville and Robot Coupe integrate cloud-based monitoring and remote diagnostics, enabling clients to optimize maintenance schedules and reduce unscheduled downtime. Simultaneously, segments of the market are witnessing a shift toward sustainability-driven innovation, with certain manufacturers sourcing recycled materials for housings, adopting eco-friendly packaging, and designing interchangeable parts to extend equipment longevity.

Strategic alliances and distribution agreements further shape competitive dynamics, as companies collaborate with foodservice equipment dealers, hospitality chains, and food processing groups to secure preferred supplier status. Acquisitions of specialized component suppliers have also emerged as a key tactic, allowing market participants to control critical elements of the value chain, from motor manufacturing to blade design. Together, these positioning approaches underscore a marketplace in which continuous technological refinement, customer-centric service models, and adaptive go-to-market strategies determine long-term leadership trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Blender market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bear

- Blendtec Inc.

- Braun

- Breville Group Limited

- Conair Consumer Products, Inc.

- De’Longhi Group

- Dynamic Research, Inc.

- Electrolux AB

- Groupe SEB

- Hamilton Beach Brands Holding Company

- Hobart Corporation

- JTC Electronics Corp.

- Kenwood Limited

- Midea Group

- Mueller Austria GmbH

- Oster

- Panasonic Corporation

- Philips N.V.

- Robot Coupe International S.A.S.

- Sammic, S. Coop.

- SharkNinja

- SharkNinja Operating LLC

- Smeg S.p.A.

- Supor

- Vitamix Corporation

- Whirlpool Corporation

Formulating Actionable Strategies for Industry Leaders to Leverage Technological Advances Optimize Operations and Strengthen Market Presence in Commercial Blender Sector

Industry leaders looking to capitalize on the evolving commercial blender landscape should prioritize the integration of intelligent controls and connectivity features into core product lines. By embedding sensors and data analytics capabilities, manufacturers can deliver value-added services such as predictive maintenance alerts and usage insights, elevating client satisfaction and fostering long-term equipment partnerships. Collaborations with software providers and foodservice consultants can strengthen these offerings, ensuring seamless integration with existing kitchen management systems and enabling operators to fine-tune blending processes across diverse recipe requirements.

Equally important is the development of comprehensive after-sales support structures. Establishing robust training programs, both in-person and via digital platforms, equips end users with in-depth knowledge of machine operation, maintenance best practices, and safety protocols. A tiered service model that combines warranties, preventative maintenance contracts, and rapid-response technical assistance will differentiate suppliers in a market where uptime is paramount for high-demand operations. Furthermore, providing modular accessory kits and upgrade pathways reinforces customer loyalty by allowing facilities to adapt equipment to shifting menu trends without full system replacement.

Sustainability initiatives and localized manufacturing strategies also present significant competitive advantages. Embracing eco-friendly materials, energy-efficient motor technologies, and recyclable packaging enhances brand reputation and aligns with the environmental priorities of many foodservice chains. Simultaneously, nearshoring assembly or component fabrication in target regions reduces lead times and exposure to tariff fluctuations, bolstering supply chain resilience. By strategically combining technology enhancement, service excellence, and responsible production, industry leaders can reinforce their market position and drive sustained growth in the commercial blender sector.

Detailing the Rigorous Multi-phase Research Methodology Employed to Ensure Robust Data Collection Analysis and Comprehensive Coverage of the Commercial Blender Market

The research underpinning this executive summary followed a structured multi-phase methodology to guarantee comprehensive market coverage and analytical rigor. The initial phase involved secondary research, encompassing the systematic review of industry publications, regulatory filings, trade journals, and technical whitepapers related to commercial blending technologies. This desk-based investigation established foundational insights into product specifications, regulatory landscapes, and competitive positioning, serving as the baseline for subsequent analysis.

In the primary research phase, qualitative and quantitative methods were employed to enrich and validate secondary findings. Expert interviews were conducted with senior executives, R&D specialists, and procurement managers within food processing facilities, hospitality networks, and retail operations. These conversations yielded nuanced perspectives on technology adoption challenges, equipment performance criteria, and strategic priorities. Additionally, targeted surveys collected structured feedback from end users across various segments, enabling the identification of key functionality requirements, maintenance preferences, and purchasing considerations.

Analytical steps included rigorous data triangulation and cross-validation to ensure accuracy and consistency. Quantitative responses were statistically analyzed to highlight prevalent trends and segment-specific behaviors, while qualitative inputs were coded and synthesized to reveal underlying drivers and barriers. Segmentation and regional analyses were performed to distinguish differentiating factors across application types, product categories, capacity ranges, and geographic markets. Finally, the findings underwent peer review by industry experts to confirm the integrity of conclusions and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Blender market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Blender Market, by Product Type

- Commercial Blender Market, by Capacity

- Commercial Blender Market, by Power Rating

- Commercial Blender Market, by End-Use

- Commercial Blender Market, by Distribution Channel

- Commercial Blender Market, by Region

- Commercial Blender Market, by Group

- Commercial Blender Market, by Country

- United States Commercial Blender Market

- China Commercial Blender Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Core Findings Strategic Implications and Future Outlook That Validate the Critical Importance of Commercial Blenders in Diverse Operational Contexts

This executive summary has illuminated the pivotal role of commercial blenders within food processing, hospitality, and retail applications by examining technological innovations, segmentation dynamics, and regulatory impacts. The landscape is marked by a clear shift toward smart, connected machines that deliver precise control, remote diagnostics, and energy-efficient operation. At the same time, segmentation insights underscore the importance of tailoring equipment offerings to distinct application contexts and capacity requirements, while tariff-driven supply chain adjustments have fueled diversification of sourcing strategies and modular design approaches.

The strategic implications of these findings are significant for manufacturers, distributors, and end users alike. Stakeholders must navigate an ever-evolving environment where responsiveness to market shifts hinges on the ability to integrate advanced features, support agile service models, and maintain resilient supply networks. Companies that prioritize customer-centric innovation and develop scalable, adaptable product lines will be best positioned to capture emerging opportunities, mitigate risk, and reinforce competitive advantage in a crowded marketplace.

Looking ahead, the convergence of artificial intelligence, enhanced sustainability practices, and deeper interoperability between kitchen systems offers a fertile ground for differentiation. As machine learning algorithms become capable of autonomously optimizing blending parameters and carbon footprint reduction initiatives gain momentum, the next generation of commercial blenders will likely redefine operational benchmarks. Organizations that embrace these evolving paradigms early can expect to deliver superior performance outcomes and build lasting partnerships that resonate with modern culinary and processing demands.

Engage Directly with Ketan Rohom to Secure Your Comprehensive Commercial Blender Market Research Report Driving Informed Decisions and Competitive Advantage

To gain full access to detailed insights, in-depth analyses, and strategic recommendations tailored to the commercial blender market, please reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engaging directly with Ketan will ensure you receive a bespoke overview of the report’s findings, along with guidance on how these insights can be applied to your organization’s objectives. His expertise will facilitate a seamless purchasing experience and clarify any specific inquiries regarding customization options or extended service offerings.

We invite you to act now to lock in this opportunity to enhance your decision-making framework and strengthen competitive positioning. The comprehensive nature of the report means that you will have immediate access to segmentation breakdowns, tariff impact assessments, regional analyses, and actionable strategies that are critical for navigating the rapidly evolving landscape of commercial blending equipment. Contact Ketan Rohom today to begin leveraging this authoritative resource for sustained market leadership.

- How big is the Commercial Blender Market?

- What is the Commercial Blender Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?