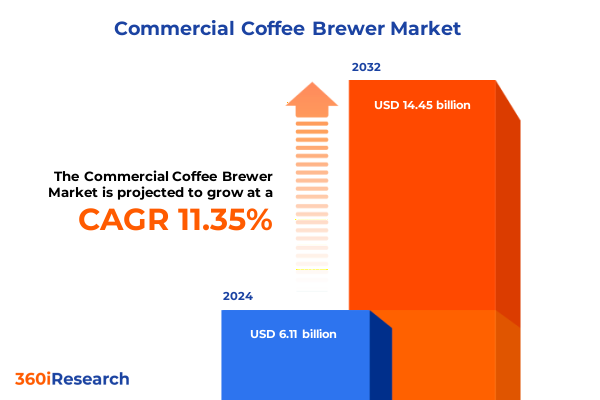

The Commercial Coffee Brewer Market size was estimated at USD 6.74 billion in 2025 and expected to reach USD 7.43 billion in 2026, at a CAGR of 11.51% to reach USD 14.45 billion by 2032.

Unveiling the Current State and Future Opportunities in the Commercial Coffee Brewer Market Amidst Rapid Technological and Consumer Changes

The commercial coffee brewer sector stands at a pivotal juncture, where evolving consumer expectations, technological breakthroughs, and shifting supply chain dynamics converge to redefine operational excellence. In this rapidly maturing market, decision-makers are prioritizing equipment that delivers consistent extraction quality, streamlined workflows, and seamless integration with digital platforms. As a result, traditional perceptions of brewing machinery are expanding to encompass holistic solutions that address both front-of-house experience and back-of-house efficiencies.

This executive summary distills the most critical developments shaping the commercial coffee brewing landscape today. By exploring transformative innovations, analyzing trade policy implications, uncovering granular segmentation patterns, and assessing regional dynamics, this document provides a cohesive narrative that supports informed strategic planning. Moreover, it highlights leading industry players, proposes targeted recommendations, outlines research methodology, and concludes with a clear path forward for organizations aiming to harness market opportunities.

Analyzing the Transformative Innovations and Shifting Consumer Preferences Driving Evolution in the Global Commercial Coffee Brewing Landscape

Innovation across brewing platforms is accelerating at an unprecedented pace, reshaping how operators approach both routine and specialty coffee preparation. Internet of Things connectivity has enabled remote monitoring, automated maintenance alerts, and real-time optimization of extraction parameters, ushering in a new era of proactive machine management. Concurrently, programmability enhancements allow baristas and operators to fine-tune profiles for single-origin beans, personalized beverages, and consistent batch-to-batch quality, further elevating consumer satisfaction.

Simultaneously, sustainability and user-centric design have emerged as critical differentiators. Manufacturers are integrating eco-friendly materials, water-conserving technologies, and energy-efficient heating systems to meet stringent environmental regulations and evolving corporate responsibility goals. In parallel, modular machine architectures facilitate rapid component replacement and system upgrades, extending equipment lifecycles and reducing total cost of ownership. Together, these advances reflect a broader shift toward solutions that marry performance with adaptability in dynamic hospitality settings.

Evaluating the Cumulative Impact of 2025 United States Tariffs on Commercial Coffee Brewer Supply Chains, Cost Structures, and Trade Dynamics

In 2025, the United States implemented a series of elevated tariffs on imported coffee brewer components, notably targeting precision metal parts and electronic modules. This policy shift has directly influenced procurement strategies across the supply chain, compelling equipment manufacturers to reevaluate sourcing models and production footprints. The added duties have introduced upward pressure on unit costs, which has reverberated through pricing negotiations with distributors and end users.

In response, many producers have accelerated nearshoring initiatives to mitigate tariff burdens, forging partnerships with regional suppliers to secure critical components while shortening lead times. Conversely, some organizations have opted to absorb marginal cost increases in the short term to preserve competitiveness and protect existing contracts. However, this approach has intensified margin compression, underscoring the necessity for long-term supplier diversification and value engineering efforts.

Furthermore, the tariff-driven landscape has stimulated cross-border collaboration between North American and international stakeholders. Companies are exploring joint ventures that enable shared investment in manufacturing capacity and technology transfer. These collaborative models not only offset trade barriers but also foster innovation by combining engineering strengths from multiple regions.

Exploring Comprehensive Segmentation Insights Highlighting Product Types, End Users, Distribution Channels, Operation Modes, Input Variations, Capacities, and Power Sources

A detailed examination of product type segmentation reveals distinct value propositions across Bean-To-Cup systems, traditional Espresso machines, Filter brewers, and Pod-based solutions. Bean-To-Cup units address operators seeking end-to-end automation, while Espresso equipment caters to the craft-driven artisan segment. Filter brewers maintain strong appeal for high-volume outlets focused on simplicity and consistency. Meanwhile, Pod devices-encompassing both K-Cup and Nespresso formats-offer convenience and portion control favored by offices and boutique establishments.

End user segmentation further underscores the need for specialized offerings. Chain Cafes demand standardized performance and brand-aligned aesthetics, whereas Independent Cafes often prioritize customization and local identity. Boutique Hotels value compact, stylish units that complement premium guest experiences, in contrast to Chain Hotels that emphasize cost efficiencies and durability. Co-Working Spaces require flexible brewer configurations to serve a diverse workforce, while Corporate Offices invest in robust, easy-to-maintain models. Full Service Restaurants seek integrated sous-vide brewing options to streamline service, and Quick Service Restaurants focus on rapid throughput and minimal training requirements.

Distribution channel dynamics shape market accessibility and margin structures. Direct Sales engagements facilitate customized solutions for flagship accounts, whereas Retail Outlets provide brand visibility among small-business purchasers. Specialty Dealers offer expert guidance and maintenance contracts, in contrast to Manufacturer Websites and Third-Party Platforms that expand reach through digital storefronts. This multifaceted channel ecosystem dictates how companies prioritize go-to-market investments.

Operational control categories range from fully Automatic machines-available in both Non-Programmable and Programmable variants-to Semi-Automatic platforms that balance automation with manual input, as well as Manual brewers for artisanal applications. Each mode aligns with different skill levels, throughput requirements, and investment considerations.

Coffee input types influence machine compatibility and maintenance routines. Bean-based systems deliver end-to-end freshness control, Ground brewers simplify cleaning cycles, and Pods in K-Cup or Nespresso formats ensure rapid single-serve consistency. Equipment design must accommodate the specific handling and disposal protocols associated with each input format.

Capacity considerations divide offerings into High Capacity units for bustling environments, Medium Capacity machines for mid-scale operations, and Low Capacity models tailored to boutique venues and office pantries. Throughput expectations directly inform component specifications, water supply infrastructure, and floor space allocations.

Power source options-Electric or Gas-address installation constraints and regional energy cost differentials. While Electric systems dominate urban and indoor settings, Gas-powered designs remain essential for venues with limited electrical supply or outdoor service areas.

This comprehensive research report categorizes the Commercial Coffee Brewer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Machine Operation

- Coffee Input

- Capacity

- Power Source

- End User

- Distribution Channel

Assessing Distinct Regional Dynamics Influencing Commercial Coffee Brewer Adoption and Growth Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

In the Americas, especially within the United States and Canada, sophistication in coffee culture drives demand for advanced commercial brewers. Operators there display strong preferences for machines that integrate seamlessly with loyalty apps and payment systems, while sustainability commitments spur adoption of energy star–rated and water recapture technologies. Meanwhile, specialty roasters collaborate closely with equipment vendors to develop co-branded units that enhance customer engagement.

Across Europe, Middle East and Africa, the marketplace exhibits significant heterogeneity. In Western Europe, heritage cafés continue to favor traditional espresso workflows, prompting incremental upgrades to classic boiler technologies. Conversely, emerging markets in the Middle East and Africa pursue rapid modernization, investing in robust automatic units to support franchise expansion and tourism growth. These divergent patterns necessitate flexible product roadmaps that can be localized to regulatory frameworks and cultural preferences.

The Asia-Pacific realm represents a dual narrative of mature and developing subregions. In established markets like Japan and Australia, discerning consumers demand precision temperature control and barista-grade interfaces. China’s urban centers exhibit exponential café proliferation, leading to high-capacity filter and bean-to-cup installations. Simultaneously, Southeast Asian territories are witnessing nascent coffee markets leveraging turnkey pod-based ecosystems to accelerate entry for small entrepreneurs. Coordinated regional strategies must account for these layered adoption curves.

This comprehensive research report examines key regions that drive the evolution of the Commercial Coffee Brewer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Key Industry Leaders’ Strategic Movements, Partnerships, and Technological Advancements Shaping the Competitive Commercial Coffee Brewer Arena

Leading manufacturers are charting diverse pathways to gain competitive advantage. Prominent consumer brands have intensified R&D investments to introduce AI-driven recipe customization, while specialty equipment makers are deepening service offerings to include remote diagnostics and subscription-based maintenance. Collaborative alliances between technology startups and established brewhouse titans are delivering novel solutions that address pain points in uptime reliability and predictive component replacement.

In addition, merger and acquisition activity has surged, as global players seek to consolidate niche innovators with unique IP or market access. These strategic transactions not only expand geographic footprint but also bolster product portfolios by integrating complementary brewing technologies and design capabilities. In parallel, joint ventures centered on manufacturing scale have emerged, enabling cost synergies and shared capital deployment.

Furthermore, forward-thinking organizations are enhancing their customer engagement models through digital ecosystems. Mobile apps that interface directly with brewer APIs facilitate remote start functions, automated ingredient replenishment orders, and loyalty program integration. By shifting from transactional relationships to ongoing service partnerships, companies are establishing recurring revenue streams and reinforcing brand loyalty in an increasingly commoditized environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Coffee Brewer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Animo B.V.

- Bravilor Bonamat B.V.

- Bunn‑O‑Matic Corporation

- De’Longhi S.p.A.

- Electrolux AB

- Food Equipment Technologies Company

- Franke Holding AG

- Groupe SEB S.A.

- Gruppo Cimbali S.p.A.

- Hamilton Beach Brands Holding Company

- Jura Elektroapparate AG

- Keurig Dr Pepper Inc.

- Marco Beverage Systems Ltd.

- Melitta Unternehmensgruppe

- Nestlé S.A.

- Newco Enterprises, Inc.

- Rancilio Group S.p.A.

- Wilbur Curtis Company

Presenting Actionable Strategic Recommendations to Enable Industry Leaders to Capitalize on Emerging Trends and Navigate Complex Market Challenges

Industry leaders should prioritize investments in connectivity and data analytics to differentiate their product lines. Integrating Internet of Things sensors and cloud-based monitoring capabilities will enable predictive maintenance, reduce downtime, and provide valuable usage insights for both operators and vendors. By leveraging these data streams, manufacturers can offer value-added services that foster long-term revenue relationships.

Additionally, diversifying sourcing strategies is essential to mitigate ongoing trade policy uncertainties. Nearshoring critical component production and establishing multi-region supplier networks will ensure continuity of supply while balancing cost pressures. In conjunction with value engineering efforts, this approach will preserve margin integrity without compromising on quality or performance standards.

Tailoring solutions to distinct customer segments will maximize market penetration. Developing modular brewer configurations that align with the unique needs of chain cafés, boutique hotels, corporate offices, and quick service restaurants will drive differentiated value propositions. Moreover, incorporating flexible financing and leasing models can lower adoption barriers for emerging entrants and small to medium–sized operators.

A regionally nuanced go-to-market strategy is also imperative. Localizing product features, support infrastructure, and marketing campaigns to reflect consumer tastes, regulatory climates, and energy availability will enhance competitive positioning. Partnerships with regional distributors and service providers should be structured to optimize responsiveness and service excellence.

Finally, embedding sustainability at the core of product development and corporate initiatives will resonate with environmentally conscious consumers and regulatory bodies. Prioritizing recyclable materials, energy-efficient operations, and certification compliance will underscore commitments to social responsibility and strengthen brand equity.

Detailing a Rigorous Multi-Step Research Methodology Integrating Primary Interviews, Secondary Data Analysis, and Multi-Dimensional Market Segmentation

This research initiative commenced with a comprehensive round of primary interviews encompassing senior executives from equipment manufacturers, leading café operators, and corporate procurement specialists. These candid discussions provided deep insights into pain points related to system reliability, maintenance costs, and evolving service expectations. In parallel, supplementary interviews with sustainability officers and technology providers enriched understanding of the broader operational context.

Secondary data collection involved rigorous analysis of trade publications, patent filings, regulatory directives, and publicly available corporate disclosures. Market intelligence platforms and custom survey panels contributed additional validation points, enabling a robust understanding of competitor strategies and emerging capability sets. This multi-layered approach ensured both breadth and depth in data synthesis.

To guarantee accuracy and objectivity, data triangulation protocols were employed, cross-referencing primary insights with secondary evidence and quantitative usage metrics. Statistical checks for consistency and anomaly detection reinforced confidence in the findings. Peer reviews by industry subject matter experts provided a final validation layer, ensuring that conclusions were grounded in practical realities.

Segmentation frameworks were meticulously developed based on product functionalities, operational modes, end user profiles, and distribution pathways. Regional mapping incorporated trade flow analyses, consumption patterns, and infrastructure considerations to capture the diversity of market dynamics across global geographies. This structured methodology underpins the credibility and actionability of the presented insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Coffee Brewer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Coffee Brewer Market, by Product Type

- Commercial Coffee Brewer Market, by Machine Operation

- Commercial Coffee Brewer Market, by Coffee Input

- Commercial Coffee Brewer Market, by Capacity

- Commercial Coffee Brewer Market, by Power Source

- Commercial Coffee Brewer Market, by End User

- Commercial Coffee Brewer Market, by Distribution Channel

- Commercial Coffee Brewer Market, by Region

- Commercial Coffee Brewer Market, by Group

- Commercial Coffee Brewer Market, by Country

- United States Commercial Coffee Brewer Market

- China Commercial Coffee Brewer Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2703 ]

Concluding Insights Emphasizing the Strategic Imperatives and Future-Proof Strategies for Sustained Success in the Commercial Coffee Brewer Industry

The commercial coffee brewer industry is undergoing a profound transformation driven by rapid technological innovations, evolving trade policies, and shifting consumer expectations. By dissecting the cumulative effects of recent tariff changes, uncovering granular segmentation nuances, and mapping regional growth trajectories, this executive summary illuminates the strategic imperatives that will define success over the next decade.

Proactive adaptation to emerging trends-such as digital integration, sustainability mandates, and flexible product architectures-will serve as a critical differentiator for market participants. Leading companies are already leveraging partnerships, M&A, and in-house R&D to secure competitive advantages, underscoring the importance of agility and foresight.

In conclusion, stakeholders who embrace a holistic, data-driven approach to decision-making will be best positioned to capture value in an increasingly complex and dynamic marketplace. By aligning strategic initiatives with rigorous research insights, industry leaders can navigate uncertainty, unlock new growth avenues, and build resilient, future-ready operations.

Connect Directly with Ketan Rohom to Access Deep-Dive Commercial Coffee Brewer Market Intelligence and Drive High-Impact Strategic Decisions

To unlock the full breadth of research, reach out to Ketan Rohom, Associate Director of Sales and Marketing, to gain customized access to comprehensive market intelligence, proprietary data tables, and in-depth case studies designed specifically for your strategic objectives.

By partnering with Ketan Rohom, you will benefit from tailored guidance that aligns with your organization’s unique needs, enabling your leadership teams to make high-confidence decisions, optimize investments, and secure competitive advantage in the rapidly evolving commercial coffee brewer industry.

Engage now to experience a collaborative consultation that integrates expert insights with actionable recommendations, ensuring you are equipped to capitalize on emerging market trends, mitigate risks, and drive sustainable growth.

- How big is the Commercial Coffee Brewer Market?

- What is the Commercial Coffee Brewer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?