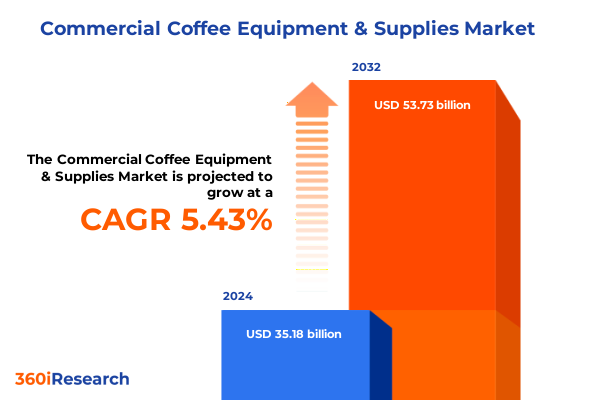

The Commercial Coffee Equipment & Supplies Market size was estimated at USD 37.08 billion in 2025 and expected to reach USD 38.96 billion in 2026, at a CAGR of 5.44% to reach USD 53.73 billion by 2032.

Unveiling the Dynamic Pulse of Commercial Coffee Equipment and Supplies Market with a Strategic Overview of Key Drivers and Opportunities

Commercial coffee equipment and supplies industry has evolved from a functional necessity into a strategic asset that distinguishes operator brands. The relentless pursuit of quality and consistency has driven establishments from bustling cafes to luxury hospitality venues to reevaluate their machinery portfolios, blending artisanal craftsmanship with industrial scaling. Consumers now expect barista-quality beverages delivered efficiently, prompting stakeholders to balance operational robustness with flavor precision. This dynamic interplay of artisanal authenticity and technological prowess marks the industry’s transformative journey.

Against this backdrop, businesses face a complex interplay of regulatory adjustments, pricing fluctuations and logistical constraints. The introduction of digital monitoring and predictive maintenance solutions adds an extra dimension of operational intelligence, guiding service schedules and reducing downtime. Meanwhile, sustainability considerations and circular economy principles influence procurement policies, with a growing emphasis on eco-friendly consumables and machines designed for energy efficiency. This executive summary unpacks the critical drivers reshaping the landscape, evaluates the cumulative impact of United States tariff adjustments in 2025 and distills insights through segmentation, regional perspectives and competitive intelligence to inform strategic decision-making

Charting the Tectonic Transformations Shaping Commercial Coffee Equipment and Supplies Industry through Innovation Adoption and Consumer Behavior Shifts

The past few years have witnessed an unprecedented acceleration of technology adoption in coffee equipment. Fully automatic machines integrating grinding, dosing and extraction in a single cycle have transitioned from niche offerings to mainstream essentials. Semi-automatic units equipped with programmable dosing, pressure profiling and remote monitoring capabilities empower operators to fine-tune beverage profiles at scale. This shift reflects an industry-wide pivot toward embracing data-driven precision, with real-time analytics guiding maintenance schedules and inventory management.

Furthermore, consumer preferences are evolving beyond taste and convenience toward values-driven purchasing decisions. Demand for plant-based milk options and zero-waste operations has spurred manufacturers to develop machines with simplified cleaning protocols and modular components for easy servicing. Moreover, the rise of mobile ordering and on-premise pickup models has transformed café layouts, necessitating compact, high-speed brewers and optimized supply workflows. These transformative shifts underscore the importance of technological agility and sustainable design, enabling businesses to stay ahead in a highly competitive market.

Additionally, the integration of coffee systems with point-of-sale platforms, loyalty applications and kitchen display networks fosters seamless customer experiences. Operators increasingly adopt ecosystem-oriented approaches, partnering with fintech and software innovators to deliver personalized recommendations, contactless payments and subscription-based services. This collaborative paradigm not only enhances brand engagement but also generates valuable consumer insights, fueling continuous product refinement

Assessing the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Commercial Coffee Equipment and Supplies Ecosystem

In early 2025, adjustments to import duties on key components and finished coffee machinery introduced new cost variables across the supply chain. Equipment sourced from traditional manufacturing hubs experienced duty increases, prompting importers to reassess vendor agreements and logistical frameworks. Cleaning chemicals, paper filters and pods imported from overseas suppliers similarly encountered revised tariff schedules, increasing landed costs and affecting margin structures for distributors and end users.

Moreover, these cumulative tariff effects have generated immediate pressures on pricing strategies. Distributors have absorbed portions of increased import costs to maintain competitive pricing, while operators have explored alternative sourcing channels, including regional manufacturing partnerships and nearshoring opportunities. The search for cost mitigation has accelerated vendor consolidation, with large buyers leveraging purchasing scale to negotiate favorable freight terms and duty deferral programs with customs authorities.

Over the long term, the tariff landscape is likely to catalyze structural changes. Manufacturers are evaluating localized assembly and component fabrication to bypass higher import levies and reduce lead times. Strategic alliances between equipment producers and supply companies are emerging to integrate tariff planning within procurement roadmaps. By proactively mapping supply routes and diversifying sourcing footprints, stakeholders can foster resilience in the face of evolving trade policies

Unraveling Core Segmentation Insights Illuminating How Product, Technology, and Application Divides Drive Market Dynamics in Coffee Equipment Sector

Market segmentation analysis reveals distinct nuances within product category divisions, where equipment and supplies serve complementary operational objectives. Equipment offerings range from high-performance brewers designed for rapid batch output to precision-oriented espresso machines capable of nuanced extraction profiles. Filter coffee machines and grinders contribute to consistent quality across bulk brewing scenarios, while supplies such as cleaning chemicals, paper filters and an expanding array of pods and capsules ensure end-to-end operational readiness. This granular segmentation highlights how product specialization addresses diverse service models and cost structures.

The role of technology segmentation further delineates market dynamics, distinguishing fully automatic, manual and semi-automatic solutions. Fully automatic platforms that integrate grinding and multi-function capabilities streamline workflows in high-volume settings, whereas fully manual configurations cater to artisanal operators prioritizing hands-on control. Semi-automatic systems equipped with pressure control modules and programmable interfaces bridge these extremes, offering scalable consistency while retaining customization potential. Understanding these technological strata enables suppliers to tailor value propositions for specific operator profiles.

Application-based segmentation provides critical context for market expansion strategies across cafes, hotels and resorts, offices and institutions, quick service restaurants and retail and grocery environments. Chain cafes and independent cafes leverage distinct machine portfolios to align with brand identities, while budget hotels, luxury properties and resort operators calibrate equipment choices against service tier and guest expectations. Corporate offices, educational institutions and healthcare facilities adopt solutions that balance ease of use with maintenance frequencies, and global chain versus local quick service outlets require machines optimized for speed. Convenience stores and supermarkets utilize versatile brewers that accommodate rapid turnover, highlighting how application-driven segmentation shapes product development pipelines

This comprehensive research report categorizes the Commercial Coffee Equipment & Supplies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Category

- Technology

- Application

Examining Vital Regional Perspectives Revealing Unique Demand Patterns and Growth Drivers across Americas, EMEA, and Asia-Pacific Coffee Equipment Markets

In the Americas, established coffee cultures in North America and emerging specialty scenes across Latin America drive divergent equipment demands. Urban hubs in the United States and Canada prioritize fully automatic, multi-function brewers that support rapid service models within busy cafes and office settings, while artisanal coffee movements in Brazil and Colombia emphasize precision espresso machines and premium grinders. This regional mosaic fuels demand for adaptive service contracts and maintenance offerings that align with diverse operator sophistication levels, creating opportunities for service providers to craft flexible support packages.

Europe, Middle East and Africa presents a tapestry of mature and developing markets, each shaped by unique consumption patterns and regulatory frameworks. Western European nations lead in the adoption of energy-efficient and low-emission equipment to comply with stringent environmental mandates, whereas Eastern Europe and the Middle East exhibit growing interest in semi-automatic and programmable solutions that balance performance with affordability. Across Africa, nascent cafe clusters in major cities demand turnkey equipment and supplies solutions, underpinned by robust training and aftersales support to address emerging skills gaps.

Asia-Pacific encompasses high-growth corridors where urbanization and rising disposable incomes fuel coffee culture expansion from metropolitan centers to secondary markets. In Australia and New Zealand, a deep-rooted cafe tradition supports continuous innovation adoption, including IoT-enabled machines for real-time performance monitoring. Rapidly developing economies in Southeast Asia and India are witnessing surges in quick service coffee outlets, driving demand for user-friendly, automated brewers and standardized supply chains for consumables. This regional diversity underscores the necessity for manufacturers to align product portfolios with local service norms and logistical constraints

This comprehensive research report examines key regions that drive the evolution of the Commercial Coffee Equipment & Supplies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Industry Players and Their Strategic Innovations Shaping the Competitive Landscape in Commercial Coffee Equipment Domain

Leading equipment manufacturers continue to differentiate through engineering excellence and brand heritage. Firms with decades of history have honed precision extraction technologies and robust component designs that serve as benchmarks for operational reliability. Their commitment to research and development yields iterative improvements in pump systems, temperature stability modules and grinder burr geometries, ensuring consistent beverage profiles under varying load conditions. Such innovations reinforce their market presence across premium cafes and hospitality segments.

In parallel, specialty suppliers of consumables innovate in sustainable materials and user-centric formats. Producers of cleaning chemicals are advancing bio-based formulations and concentrated dosing systems that minimize packaging waste without compromising sanitation efficacy. Meanwhile, paper filter manufacturers explore biodegradable fibers and optimized porosity ratings to extract clearer flavor profiles, and capsule and pod creators refine sealing technologies to extend freshness durations while integrating compostable shell materials. These supply-side advances complement equipment capabilities to elevate end-to-end quality assurance.

A growing cohort of integrated solution providers is redefining competitive dynamics by bundling hardware, consumables and digital service offerings. These ecosystem players offer subscription models that combine machine leasing, consumable replenishment and remote support analytics under unified contracts. By leveraging data insights on usage patterns and machine health, they enable proactive maintenance and just-in-time inventory replenishment, reducing downtime and operational complexity for end users. This convergence of hardware, supplies and software strategies underscores the shift toward service-oriented business models

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Coffee Equipment & Supplies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Astoria S.p.A.

- Behmor, Inc.

- Breville Group Limited

- Bunn-O-Matic Corporation

- Caffè La Messicana Piacenza S.p.A.

- Casadio S.p.A.

- Dalla Corte S.r.l.

- De’Longhi S.p.A.

- Food Equipment Technologies Company, Inc.

- Franke Coffee Systems AG

- Gruppo Cimbali S.p.A.

- JURA Elektroapparate AG

- La Marzocco S.r.l.

- Macquino Innovations LLP

- Nuova Simonelli S.p.A.

- Rancilio Group S.p.A.

- Rocket Espresso Milano S.r.l.

- Thermoplan AG

- WMF GmbH

Empowering Industry Leaders with Practical Recommendations to Navigate Market Disruptions and Capitalize on Emerging Opportunities in Coffee Equipment Sector

To thrive amidst evolving cost structures and competitive pressures, industry leaders should prioritize investments in modular automation platforms that enable swift configuration adjustments. Embracing modularity in machine design allows operators to upgrade or swap components based on shifting application needs or regulatory requirements, reducing total cost of ownership and extending equipment lifecycles. Integrating modular hardware with digital management platforms further empowers stakeholders to monitor performance metrics and optimize preventive maintenance schedules, ensuring peak operational efficiency.

Stakeholders can also enhance resilience by diversifying supply chains across geographic corridors and embracing local assembly partnerships. By forging alliances with regional fabricators and chemical producers, companies mitigate the impact of import duty fluctuations and shorten lead times for critical parts and consumables. Incorporating sustainability criteria into supplier selection-such as carbon footprint assessments and circular packaging commitments-aligns procurement strategies with emerging environmental regulations and resonates with increasingly eco-conscious end users, strengthening brand reputation.

Finally, cultivating customer-centric service frameworks is essential for deepening market penetration. Developing tiered support offerings that blend remote monitoring, periodic on-site calibrations and virtual training modules can address varying operator expertise levels. Enabling seamless integration with point-of-sale systems and loyalty applications creates touchpoints for personalized engagement, while recurring revenue models for consumable subscriptions stabilize cash flow and foster long-term account retention. Proactive communication of performance insights and guided best practices positions leaders as trusted partners rather than transactional vendors

Detailing Rigorous Research Methodology Employed to Ensure Credibility, Data Integrity, and Actionable Insights for Commercial Coffee Equipment Study

This analysis synthesizes insights from extensive primary consultations and comprehensive secondary research to ensure authoritative coverage of the commercial coffee equipment and supplies landscape. Primary research involved in-depth interviews with industry practitioners spanning equipment engineers, operations managers, procurement executives and service technicians. These conversations illuminated real-world pain points, emerging solution requirements and evolving procurement priorities, providing qualitative context to complement quantitative data points.

Secondary research encompassed the systematic review of trade publications, technical white papers, regulatory filings and manufacturer disclosures to map technological trajectories and policy developments. Emphasis was placed on tracing the impact of tariff modifications and environmental regulations, as well as cataloging advancements in machine automation and consumable formulations. Data triangulation methodologies cross-referenced disparate sources to validate emerging trends and resolve conflicting information, enhancing analytical rigor and reducing bias.

Analytical frameworks were applied to segment the market across product, technology and application dimensions, followed by regional clustering to identify geographic performance differentials. A structured scoring model evaluated supplier capabilities against parameters such as innovation potential, service breadth and sustainability credentials. Interim findings underwent expert review cycles to refine interpretations and ensure that final conclusions reflect both ground realities and forward-looking considerations. Throughout this process, strict quality controls upheld data integrity and report reliability

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Coffee Equipment & Supplies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Coffee Equipment & Supplies Market, by Product Category

- Commercial Coffee Equipment & Supplies Market, by Technology

- Commercial Coffee Equipment & Supplies Market, by Application

- Commercial Coffee Equipment & Supplies Market, by Region

- Commercial Coffee Equipment & Supplies Market, by Group

- Commercial Coffee Equipment & Supplies Market, by Country

- United States Commercial Coffee Equipment & Supplies Market

- China Commercial Coffee Equipment & Supplies Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Concluding Strategic Reflections Underscoring Key Takeaways and Forward-Looking Considerations for the Commercial Coffee Equipment Ecosystem

The commercial coffee equipment and supplies industry stands at a pivotal juncture characterized by rapid technological progress, shifting consumer expectations and evolving trade landscapes. Integration of advanced automation, data analytics and sustainability practices is transforming operational paradigms, while segmentation and regional insights reveal nuanced demand drivers across distinct sectors and geographies. Leaders who heed these insights can anticipate potential disruptions and adapt strategies to sustain competitive advantage.

Embracing a holistic perspective-one that aligns product innovation, supply chain resilience and customer-centric service models-will be instrumental in navigating the complexities ahead. By leveraging comprehensive market intelligence and deploying targeted investments in modular platforms, localized partnerships and ecosystem integration, decision-makers can position their organizations for sustained growth. The findings detailed herein provide a strategic blueprint for stakeholders to harness emerging opportunities and mitigate risks within the dynamic coffee equipment domain

Seize Strategic Advantage Today – Engage Directly with Associate Director of Sales and Marketing to Unlock Customized Commercial Coffee Equipment Market Report

Ready to transform your strategic approach and gain a competitive edge in the commercial coffee equipment space? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure a tailored market intelligence report that delves deeper into these critical insights.

Unlock the full spectrum of analysis, including detailed tariff breakdowns, segmentation deep dives and regional performance assessments. Engage directly with Ketan Rohom to discuss customization options, licensing frameworks and delivery timelines, ensuring you receive the precise intelligence needed to drive informed decisions and fuel operational excellence. For personalized consultation and immediate access to this comprehensive analysis, contact Ketan Rohom today and embark on a data-driven journey to elevate your market positioning

- How big is the Commercial Coffee Equipment & Supplies Market?

- What is the Commercial Coffee Equipment & Supplies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?