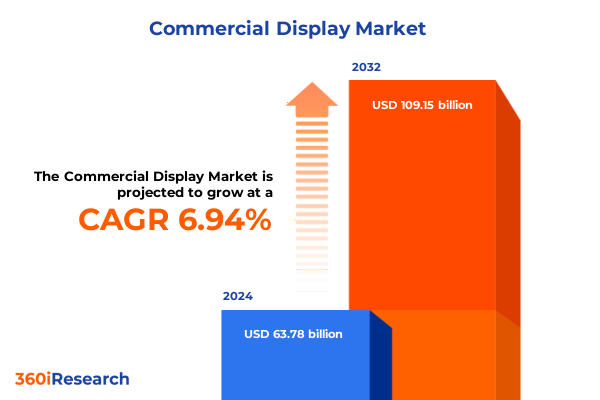

The Commercial Display Market size was estimated at USD 67.87 billion in 2025 and expected to reach USD 72.21 billion in 2026, at a CAGR of 7.02% to reach USD 109.15 billion by 2032.

Unveiling the Future of Commercial Displays: A Comprehensive Executive Summary of Market Dynamics and Strategic Imperatives

The commercial display sector stands at the forefront of digital transformation, reshaping how organizations communicate, advertise, and engage audiences across diverse environments. Modern displays extend beyond static images to dynamic, data-driven platforms that deliver targeted messaging, real-time analytics, and immersive experiences. As enterprises prioritize customer engagement and operational efficiency, commercial displays have become indispensable assets in retail storefronts, corporate lobbies, transportation hubs, and healthcare facilities.

Against this backdrop, evolving technologies such as advanced display panels, Internet of Things integration, and cloud-based content management systems are converging to create a new ecosystem of intelligent signage. Organizations must navigate a complex landscape of hardware innovations, software capabilities, and regulatory considerations to harness the full potential of these solutions. This introduction lays the foundation for understanding key market catalysts, competitive drivers, and strategic levers that will define success in the commercial display industry.

How AI-Driven Personalization, IoT Integration, and Sustainability Initiatives Are Redefining the Commercial Display Landscape for 2025 and Beyond

The commercial display landscape is undergoing transformative shifts fueled by emerging technologies and evolving market demands. Artificial intelligence has become central to personalization, with more than 60 percent of digital signage systems now leveraging AI algorithms to tailor content based on user behavior, peak traffic, and environmental factors. This enables dynamic messaging that adapts in real time, enhancing engagement while optimizing resource allocation.

Simultaneously, the Internet of Things is extending the reach of displays, connecting over 75 percent of new installations to sensor networks by 2025. IoT-enabled screens integrate seamlessly with smart building systems, public safety infrastructure, and inventory management platforms, delivering contextual content for retail marketing, transportation updates, and facility operations.

Sustainability has also emerged as a core consideration, driving a 40 percent uptick in demand for energy-efficient solutions such as ePaper, microLED, and solar-powered displays. These eco-conscious innovations not only reduce operational costs but also align with corporate environmental objectives and regulatory requirements.

In parallel, immersive technologies like augmented reality and ultra-high-definition microLED displays are enabling truly interactive experiences. AR-enabled screens facilitate virtual product try-ons and interactive wayfinding, while 8K resolution microLED panels deliver unparalleled brightness and clarity for both indoor and outdoor applications.

Assessing the Cumulative Impact of United States Tariff Measures Through 2025 on Commercial Display Supply Chains and Cost Structures

Since 2018, U.S. trade policy has imposed escalating tariffs on Chinese imports under Section 301 and Section 232, reshaping the cost structure of commercial display components. As of June 12, 2025, the administration reinstated a blanket 20 percent tariff on all Chinese goods, citing national security and public health concerns. This sweeping measure affects display panels, driver chips, and ancillary hardware sourced from China.

On January 1, 2025, the Office of the U.S. Trade Representative increased Section 301 duties on solar wafers and polysilicon to 50 percent and on certain tungsten products to 25 percent, following a four-year statutory review. While these items are core to photovoltaic applications, the elevated duties underscore the broader protectionist environment impacting high-tech imports, including semiconductor substrates used in advanced displays.

Concurrently, tariffs on semiconductors are set to rise to 50 percent by 2025, with electric vehicle components facing duties up to 100 percent in 2024 under a separate review. These levies have increased sourcing costs for critical display driver chips, prompting many integrators to seek alternative suppliers in Southeast Asia and Taiwan.

Meanwhile, the continuation of 2018’s Section 232 national security tariffs on all steel and aluminum imports has elevated the cost of display enclosures and mounting hardware. Collectively, these cumulative duties have catalyzed supply chain diversification, compelled price adjustments, and stimulated investment in domestic manufacturing initiatives.

Deep-Dive Analysis of Market Segmentation Revealing Unique Opportunities and Growth Pathways in Commercial Display Technology

A granular examination of market segmentation reveals distinct growth pathways and technology adoption patterns within the commercial display landscape. The spectrum of display technologies spans low-power ePaper panels for static information boards, versatile LCD options-subdivided into IPS variants for superior color accuracy, TN panels for cost-effective installations, and VA screens for high contrast-and cutting-edge LED offerings, including direct view LED walls, microLED modules for enhanced brightness, and miniLED backlighting to deliver local dimming and HDR performance. Complementing these is the expanding adoption of OLED screens in premium applications where contrast and flexibility are paramount.

Panel size further differentiates use cases, as compact displays up to 32 inches excel in kiosks and point-of-sale terminals, mid-range formats between 32 and 50 inches serve as digital menu boards and retail shelf-edge displays, and larger configurations from 50 to 65 inches dominate corporate environments and educational settings. Ultra-large screens above 65 inches are increasingly found in control rooms, broadcast studios, and public venues demanding high-impact visual communication.

Diverse end-user sectors influence feature requirements; corporate environments prioritize integrated collaboration tools and security features, educational institutions emphasize interactive touch capabilities and simplified content management, health care facilities demand high-resolution clarity and hygiene-friendly surfaces, hospitality venues seek customizable aesthetics and remote monitoring capabilities, retail spaces focus on vibrant imagery and targeted advertising functionalities, and transportation hubs require ruggedized, weather-resistant displays offering real-time wayfinding and passenger information.

Resolution segments range from standard HD screens in basic wayfinding applications to Full HD devices in general advertising, Ultra HD panels in high-visibility retail and entertainment venues, and emerging 8K installations for luxury experiences and medical imaging. Brightness preferences align with ambient conditions-below 500 nits for dim environment displays, 500 to 2000 nits for most indoor venues, and above 2000 nits for outdoor or high ambient light installations. Finally, mounting modalities-ceiling mounts for overhead signage, floor stands for temporary installations, table-top screens in meeting rooms, and wall mounts for fixed signage-allow for tailored deployment strategies across environments.

This comprehensive research report categorizes the Commercial Display market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Display Technology

- Panel Size

- Resolution

- Brightness Level

- Mounting Type

- End User

Unraveling Regional Dynamics: Key Insights into Americas, Europe Middle East & Africa, and Asia-Pacific Commercial Display Trends

Regional dynamics exhibit pronounced variation in commercial display adoption and investment strategies. In the Americas, North America leads in revenue generation, bolstered by a mature advertising ecosystem and extensive use of large-format LED billboards in urban centers such as New York and Los Angeles. Retail chains and corporate campuses have embraced cloud-based content management and real-time analytics to drive foot traffic and optimize digital campaigns.

Europe contributes over 30 percent of global digital signage uptake, with Germany, the United Kingdom, and France spearheading deployments. Airports across the region have integrated digital flight information displays in more than 70 percent of terminals, and retail penetration exceeds 65 percent as omnichannel strategies become ubiquitous. Government-backed smart city initiatives account for 45 percent of new investments in outdoor digital billboards and transit signage. Meanwhile, the Middle East and Africa region is experiencing rapid growth, driven by infrastructure modernization in the United Arab Emirates, Saudi Arabia, and South Africa. Over 60 percent of luxury hotels in key markets have deployed interactive displays for guest services, and smart city projects are directing 45 percent of regional digital signage investments toward outdoor advertising screens and wayfinding systems.

Asia-Pacific is the fastest-growing regional market, responsible for 28.2 percent of global digital signage revenue in 2024 and projected to maintain a strong CAGR through 2030. Ambitious smart city agendas in China-with plans for 500 smart cities by 2025-and Singapore’s $2.5 billion infrastructure program are driving widespread adoption of advanced, AI-enabled displays for public safety, traffic management, and citizen engagement.

This comprehensive research report examines key regions that drive the evolution of the Commercial Display market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Landscapes and Innovation Drivers: Strategic Company Profiles Shaping the Future of Commercial Displays Worldwide

Leading technology providers continue to shape the competitive terrain of the commercial display market. Samsung Electronics distinguishes itself with pioneering microLED video walls and an integrated software platform that streamlines content orchestration across multi-site deployments. Its emphasis on modular direct view LED solutions caters to large venues seeking scalability and minimal maintenance overhead.

LG Electronics leverages its webOS content management system to offer unified control across OLED, LCD, and LED panels, enabling rapid content scheduling, remote diagnostics, and dynamic data feeds. By focusing on enhanced cybersecurity measures and flexible hardware configurations, LG targets mission-critical installations in corporate and healthcare environments.

Established players such as NEC Display Solutions and Sharp NEC concentrate on hospitality and transportation sectors, where robust, weather-resistant screens and user-friendly touch interfaces are essential. Their partnerships with system integrators ensure seamless integration with building management systems and emergency communications networks.

Emerging competitors like Leyard Optoelectronic and BOE Technology Group are expanding their global footprint by offering cost-optimized LED and miniLED solutions that challenge incumbents on price and performance. Meanwhile, specialized firms such as Planar Systems, Daktronics, and Barco focus on niche segments-broadcast studios, live events, and control rooms-where high brightness, precise color calibration, and redundancy features are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Display market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Absen Optoelectronic Co., Ltd.

- AG Neovo Technology Corporation

- AU Optronics Corp.

- Barco NV

- BOE Technology Group Co., Ltd.

- Daktronics, Inc.

- E Ink Holdings Inc.

- Hisense Group Co., Ltd.

- Hitachi, Ltd.

- Innolux Corporation

- Koninklijke Philips N.V.

- Konka Group Co., Ltd.

- Leyard Optoelectronic Co., Ltd.

- LG Electronics Inc.

- NEC Corporation

- Panasonic Corporation

- Planar Systems, Inc.

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Sony Group Corporation

- Sony Imaging Products & Solutions Inc.

- TCL Technology Group Corp.

- TPV Technology Limited

- ViewSonic Corporation

Actionable Strategies for Industry Leaders to Leverage Advances in Technology, Supply Chains, and Market Insights for Competitive Advantage

Industry leaders must adopt an integrated approach to harness technological advancements and navigate supply chain complexities. Prioritizing partnerships with AI platform providers and IoT integrators will enable the delivery of hyper-targeted content and predictive maintenance capabilities, reducing downtime and elevating the user experience.

In response to tariff-driven cost inflation, organizations are advised to diversify procurement channels by qualifying suppliers in Southeast Asia, Eastern Europe, and Latin America. Establishing strategic alliances with regional manufacturers can mitigate the impact of U.S.-China trade policies while supporting just-in-time inventory models.

Embracing modular hardware architectures and cloud-based CMS platforms will facilitate rapid content updates and enable experimentation with new applications, such as AR-enabled product demonstrations or contactless wayfinding experiences. Investment in sustainable display technologies-not only to meet environmental objectives but also to achieve operating expenditure savings-should be a cornerstone of procurement strategies.

Lastly, continuous engagement with industry associations and participation in standard-setting initiatives will ensure organizations remain at the vanguard of regulatory compliance and interoperability, positioning them to capitalize on emerging opportunities in smart cities, transportation, retail, and beyond.

Robust Mixed-Method Research Framework Outlining Data Sources, Analytical Techniques, and Validation Processes for Commercial Display Insights

This research employs a robust mixed-method framework to ensure rigor and relevance. Primary data was gathered through in-depth interviews with executives from display manufacturers, system integrators, channel distributors, and end-user organizations. These interviews provided first-hand perspectives on technology adoption, procurement challenges, and emerging use cases.

Secondary research incorporated trade publications, government tariff databases, company financial disclosures, and industry association reports. This information was triangulated to validate trends, quantify supply chain disruptions, and contextualize regional market dynamics. Tariff impacts were analyzed using harmonized tariff schedule data and cross-referenced with importer feedback to model cost pass-through scenarios.

Quantitative segmentation and scenario analyses were conducted to assess technology adoption rates across display types, panel sizes, resolutions, brightness levels, and mounting configurations. Regional insights were derived from economic indicators, smart city investment data, and digital infrastructure indices. All findings underwent a rigorous validation process by an expert advisory panel comprising industry veterans and academic researchers, ensuring accuracy and strategic relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Display market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Display Market, by Display Technology

- Commercial Display Market, by Panel Size

- Commercial Display Market, by Resolution

- Commercial Display Market, by Brightness Level

- Commercial Display Market, by Mounting Type

- Commercial Display Market, by End User

- Commercial Display Market, by Region

- Commercial Display Market, by Group

- Commercial Display Market, by Country

- United States Commercial Display Market

- China Commercial Display Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Perspectives on the Evolution, Challenges, and Strategic Imperatives Guiding Tomorrow’s Commercial Display Ecosystem

The evolution of commercial displays is charting a path toward more intelligent, interactive, and sustainable solutions. As artificial intelligence, IoT, and advanced panel technologies converge, organizations stand to benefit from heightened engagement and operational efficiencies. However, these opportunities are tempered by geopolitical risks, notably cumulative tariff measures that have reshaped sourcing strategies and cost structures.

Diverse segmentation analysis underscores that no single technology or configuration dominates universally; instead, success lies in aligning display capabilities with environmental conditions, user expectations, and end-user requirements. Regional disparities further highlight the need for tailored approaches-leveraging mature markets’ advanced infrastructure while capitalizing on rapid growth in emerging regions.

This executive summary provides a strategic roadmap for decision-makers to prioritize investments, forge resilient supply chains, and adopt cutting-edge technologies. By following the actionable recommendations contained herein, organizations can navigate regulatory complexities, drive innovation, and secure sustained competitive advantage in a dynamic commercial display ecosystem.

Empower Your Business Decisions with Expert Guidance from Ketan Rohom and Secure Comprehensive Commercial Display Research Today

Unlock unparalleled strategic insights and equip your organization to lead in the rapidly evolving commercial display market. Engage with Ketan Rohom, Associate Director, Sales & Marketing, to explore tailored research packages that address your unique challenges. His expertise will guide you through the report’s comprehensive analysis, ensuring you extract maximum value for informed decision-making.

Contact Ketan today to secure full access to the most actionable and in-depth commercial display market research available. Empower your team with data-driven intelligence and stay ahead of competitive pressures by leveraging this essential resource.

- How big is the Commercial Display Market?

- What is the Commercial Display Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?