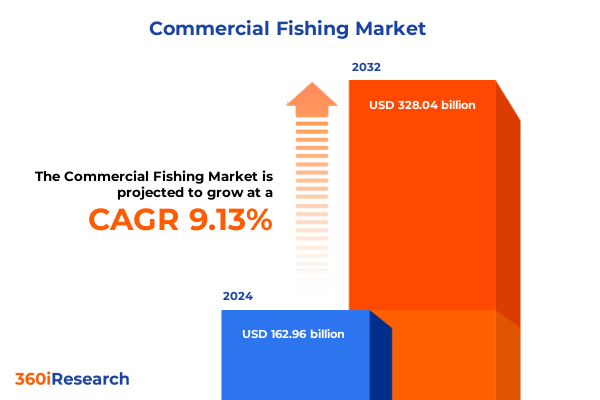

The Commercial Fishing Market size was estimated at USD 178.04 billion in 2025 and expected to reach USD 191.40 billion in 2026, at a CAGR of 9.12% to reach USD 328.04 billion by 2032.

Introducing the Multifaceted Commercial Fishing Landscape Defined by Sustainability, Regulatory Evolution, Technological Advancements, and Market Interconnections

Commercial fishing remains a cornerstone of global food security and economic vitality, supplying essential protein sources to millions and sustaining coastal livelihoods. Driven by complex interactions between marine ecosystems, consumer demand, and international trade, this sector operates at the intersection of environmental stewardship and commercial imperatives. Strategic management of fishery resources and effective regulatory frameworks underpin long-term viability, making an informed understanding of the industry’s landscape critical for decision makers.

Recent assessments reveal that United States fishery management has achieved remarkable progress in curbing overfishing, with 94% of managed stocks not subject to overfishing and 82% not classified as overfished. These figures underscore a positive direction for resource sustainability while highlighting the ongoing need for vigilant monitoring and adaptive regulation to accommodate evolving ocean conditions.

Amid shifting ocean temperatures and emerging environmental pressures, stakeholders must navigate an intricate regulatory environment shaped by national policies, international agreements, and conservation mandates. From catch limits to bycatch reduction measures, the rules governing commercial fishing continue to evolve, demanding a nuanced approach to compliance and strategic planning. Effective adaptation to these dynamics is essential for preserving the balance between ecological health and industry growth.

Examining the Major Transformative Shifts Redefining Commercial Fishing Through Sustainability, Technology Integration, and Market Adaptations

The commercial fishing sector is experiencing a seismic transformation driven by technological innovation, sustainability imperatives, and shifting consumer preferences. Leading this change is the integration of electronic monitoring systems, which now complement traditional human observers to enhance data accuracy and cost-efficiency. Recent investments of over $34 million support the modernization of data infrastructure and workforce capabilities, enabling real-time decision-making and more responsive management of fish stocks.

Parallel to technological advancements, sustainable aquaculture practices have gained prominence as wild stocks face mounting pressures. Modern recirculating aquaculture systems and eco-friendly gear, including biodegradable nets and bycatch reduction devices, are reshaping how seafood is produced. This pivot toward responsible cultivation not only eases the burden on natural fisheries but also meets the rising demand for ethically sourced seafood products.

Innovation in supply chain transparency, spearheaded by blockchain traceability initiatives, is further transforming market dynamics. By providing immutable records of catch origin and handling practices, these digital solutions strengthen consumer trust and support regulatory compliance. As traceability standards become more stringent, companies that embrace these tools position themselves to capture premium market segments and ensure long-term resilience.

Analyzing the Cumulative Effects of Recent United States Tariff Measures on the Commercial Fishing Industry in 2025

In 2025, newly imposed U.S. tariffs on seafood imports have profoundly reshaped trade flows and cost structures. Targeted duties of 26% on shrimp from India, 10% on Ecuadorian shrimp, 32% on Indonesian imports, and 46% on Vietnamese shrimp have elicited strong local reactions, particularly among Gulf Coast communities that view these measures as a revival opportunity for domestic shrimpers.

Concurrently, a 25% tariff on seafood imports from Canada and Mexico has disrupted traditional North American supply chains, leading to price adjustments and prompting domestic producers to explore new sourcing strategies. While these reciprocal tariffs aim to protect U.S. fishermen from unfair competition, they also carry the risk of reduced consumer demand due to higher retail prices.

Wider application of a 10% tariff across nearly all seafood categories underscores the complexity of the policy landscape and its global reverberations. According to the United Nations Conference on Trade and Development, these tariffs will likely elevate seafood prices in the United States and compel exporting nations to redirect shipments to alternative markets. This reorientation may strain U.S. importers and processors, while incentivizing investments in domestic aquaculture to meet rising consumption costs.

Uncovering In-Depth Segmentation Insights Across Species, Fishing Techniques, Vessels, Applications, and Distribution Channels

An in-depth segmentation of the commercial fishing market reveals crucial insights across species categories, techniques, vessel types, application areas, and distribution channels. Examining species-based distinctions shows that crustaceans, encompassing crab, lobster, and shrimp, often command premium valuation, while finfish segments such as cod, salmon, and tuna respond sensitively to shifts in consumer dietary trends and ecological considerations. Meanwhile, mollusk species including clams, mussels, oysters, and squid offer unique niche opportunities tied to regional culinary preferences and emerging export markets.

Turning to fishing methodologies, gillnet and longline operations excel in targeting specific fish populations with high precision, whereas seine and trawling fleets emphasize volume efficiency. Trap and pot approaches strike a balance between selectivity and yield, supporting artisanal operations that prioritize environmental minimization. The choice of gear thus informs both economic outcomes and ecological impact, underscoring the trade-offs faced by industry participants.

Vessel classification further delineates market behavior, with artisanal boats focusing on localized harvest cycles and maintaining community-based supply chains. Industrial vessels leverage scale economies for distant-water fishing, while semi-industrial fleets blend capacity with flexibility to adapt to seasonal and regulatory changes. Across these categories, application-driven demand for feed, food, nutraceutical, and pharmaceutical derivatives of seafood underscores the sector’s broad downstream linkages.

Distribution channels round out the segmentation picture, contrasting offline traditional seafood markets with surging online seafood commerce. While brick-and-mortar retailers maintain established consumer bases, digital platforms unlock expansive reach, enabling traceability-driven assurances and direct-to-consumer engagement that reshape competitive dynamics.

This comprehensive research report categorizes the Commercial Fishing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Species Type

- Fishing Technique

- Vessel Type

- Application

- Distribution Channel

Revealing Key Regional Market Behaviors and Competitive Dynamics in the Americas, Europe Middle East Africa, and Asia Pacific

Regional variances in the commercial fishing landscape illustrate distinct market drivers and challenges across the Americas, Europe, Middle East & Africa, and Asia-Pacific zones. In North America, robust regulatory frameworks and advanced monitoring technologies bolster sustainability outcomes, even as producers contend with tariff-induced cost pressures and the imperative to scale domestic aquaculture facilities.

In the Europe, Middle East & Africa region, a dynamic policy environment governs catch limits and fishing efforts. The European Union’s multiannual plans set total allowable catches to align with maximum sustainable yield objectives, while substantial EMFAF funding-amounting to over €12 billion-aims to modernize fleets and protect marine biodiversity. Despite these supports, small-scale fishers in Spain and Italy often face barriers accessing these funds, spotlighting the need for more equitable distribution mechanisms.

Asia-Pacific remains the largest producer and consumer nexus for aquatic harvests, with leading suppliers such as China, India, Vietnam, and Indonesia driving global seafood volumes. Rapid aquaculture growth, propelled by recirculating aquaculture systems and eco-certification adoption, has expanded production capacity. Yet this expansion must reconcile environmental impacts and social equity considerations as emerging markets in Sub-Saharan Africa and Latin America seek to replicate APAC’s success with responsible practices.

This comprehensive research report examines key regions that drive the evolution of the Commercial Fishing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Commercial Fishing Industry Players and Their Strategic Innovations in Sustainability, Technology, and Market Expansion

Leading players in the commercial fishing sector are leveraging distinct strategic approaches to secure market share, drive sustainability, and harness technological innovation. Thai Union stands out with its SeaChange® 2030 framework, committing USD 200 million through aggressive targets such as a 42% reduction in greenhouse gas emissions and 100% responsible sourcing of key species. This holistic approach-from ethical fishing vessel codes to ecosystem restoration investments-positions the company at the forefront of sustainability leadership.

Trident Seafoods, North America’s largest vertically integrated seafood company, pursues a stakeholder model that balances environmental stewardship with community welfare. Its 2025 Sustainability Progress Report details commitments to science-based resource management, operational excellence, and transparent governance, reinforcing a culture where ethical practices underpin scalable growth.

Cooke Aquaculture’s commitment to sustainable aquaculture is evident in its achievements in organic salmon production under EU standards, supported by extensive facility certification processes. By meeting stringent feed and welfare requirements, Cooke has not only advanced its environmental credentials but also tapped into premium markets demanding verified organic seafood products.

Mowi leads aquaculture digitalization with its Mowi 4.0 initiative, integrating smart farming technologies, autonomous feeding systems, and post-smolt strategies to enhance fish health and operational efficiency. Its ASC certification for feed mills and ambitious greenhouse gas reduction targets exemplify a forward-looking model that prioritizes transparency, resilience, and sustainable growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Fishing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Seafoods Company

- Austevoll Seafood ASA

- Austral Group SA

- Cermaq Group AS

- Charoen Pokphand Foods PCL

- Cooke Aquaculture Inc

- Dongwon Industries Co Ltd

- FCF Co Ltd

- Grieg Seafood ASA

- Grupo Nueva Pescanova SL

- High Liner Foods Inc

- Kyokuyo Co Ltd

- Lerøy Seafood Group ASA

- Maruha Nichiro Corporation

- Mowi ASA

- New Zealand King Salmon Co Limited

- Nippon Suisan Kaisha Ltd

- Oceana Group Ltd

- Pacific Seafood Group

- Red Chamber Co

- Royal Greenland

- SalMar ASA

- Thai Union Group Public Company Limited

- Tri Marine Group

- Trident Seafoods Corporation

Providing Actionable Strategic Recommendations to Enhance Competitiveness and Resilience in the Commercial Fishing Sector

Industry leaders should adopt an integrated digital monitoring platform that consolidates data from vessel sensors, electronic logbooks, and supply chain traceability systems to enhance operational visibility and compliance. By unifying information streams, organizations can make proactive adjustments to fishing effort, optimize logistics routes, and strengthen regulatory adherence.

Diversifying species portfolios and technique applications is critical for hedging against resource scarcity and market volatility. Firms can explore underutilized species segments, invest in bycatch reduction technologies, and tailor product offerings for high-growth downstream markets such as nutraceuticals and pharmaceuticals, thereby creating resilient revenue streams.

Strategic partnerships with ecosystem-based management programs and certification bodies can amplify sustainability credentials and unlock premium market access. Collaboration on research initiatives and public–private funding consortia will accelerate gear innovation, habitat restoration efforts, and community capacity building, ensuring equitable benefit distribution.

Finally, navigating the evolving tariff landscape requires agile supply chain reconfiguration. Companies should develop scenario-based trade models, establish regional processing hubs, and engage in bilateral trade advocacy to mitigate cost impacts while preserving market competitiveness.

Outlining the Comprehensive Research Methodology Underpinning the Commercial Fishing Market Analysis and Data Validation Processes

This study employs a robust methodology combining secondary research with primary stakeholder interviews and data triangulation. Initially, publicly available documents-including regulatory frameworks, industry reports, and sustainability disclosures-were analyzed to establish foundational insights.

Subsequently, structured interviews were conducted with vessel operators, aquaculture producers, trade association representatives, and regulatory authorities to validate and enrich secondary findings. Quantitative data from monitoring programs, certification databases, and trade statistics were integrated to ensure empirical rigor.

The research process adhered to stringent quality controls, including cross-verification of data sources, expert peer review, and sensitivity analyses to account for policy uncertainties and market fluctuations. This comprehensive approach guarantees a balanced and reliable depiction of the commercial fishing industry’s current state and future trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Fishing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Fishing Market, by Species Type

- Commercial Fishing Market, by Fishing Technique

- Commercial Fishing Market, by Vessel Type

- Commercial Fishing Market, by Application

- Commercial Fishing Market, by Distribution Channel

- Commercial Fishing Market, by Region

- Commercial Fishing Market, by Group

- Commercial Fishing Market, by Country

- United States Commercial Fishing Market

- China Commercial Fishing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Drawing Conclusions on the Current State, Challenges, and Future Directions of the Global Commercial Fishing Industry

The commercial fishing industry stands at a pivotal juncture, where sustainability, innovation, and regulatory adaptation converge to shape its future. Advances in monitoring and digital traceability have improved resource stewardship, while aquaculture developments offer alternative production pathways that relieve pressure on wild stocks.

However, emerging trade policies, notably U.S. tariffs, underscore the importance of flexible supply chain strategies and market diversification. Regional dynamics-from stringent EU catch limits to Asia-Pacific aquaculture expansion-highlight the need for localized approaches that respect ecological and cultural contexts.

Ultimately, success in this sector hinges on embracing integrated solutions that marry environmental responsibility with commercial acumen. By fostering collaboration across stakeholders and investing in cutting-edge technologies, the industry can achieve resilience, drive sustainable growth, and continue providing vital nutrition to global populations.

Empowering Industry Decision Makers to Secure the Full Commercial Fishing Market Research Report with Associate Director Ketan Rohom

Engage with Associate Director Ketan Rohom to explore how tailored insights and strategic depth in the commercial fishing market research report can inform your next moves. By partnering directly with Ketan Rohom, you gain exclusive access to in-depth analyses covering tariff impacts, segmentation nuances, regional behaviors, and leading company strategies. His expertise in sales and marketing ensures a seamless experience in acquiring the intelligence you need to stay ahead. Reach out to secure your comprehensive report and empower your organization’s decision-making with timely, authoritative market insights.

- How big is the Commercial Fishing Market?

- What is the Commercial Fishing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?