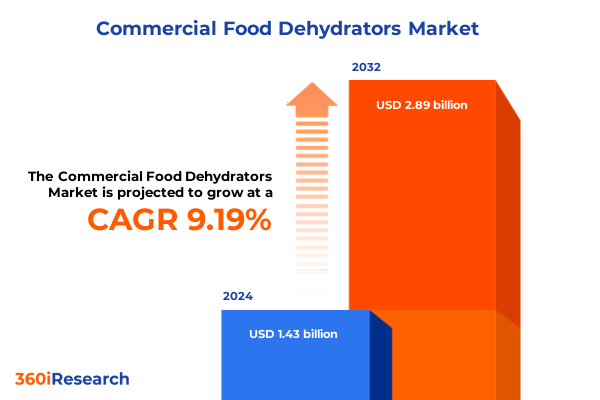

The Commercial Food Dehydrators Market size was estimated at USD 1.54 billion in 2025 and expected to reach USD 1.67 billion in 2026, at a CAGR of 9.36% to reach USD 2.89 billion by 2032.

Embracing the Rising Demand for Nutrient-Rich Preserved Foods While Elevating Operational Excellence in Commercial Dehydration Solutions

Commercial food dehydrators have evolved from rudimentary appliances into sophisticated systems that underpin a diverse array of food preservation, processing, and value-add applications. This transformative sector leverages thermal and mechanical engineering principles to deliver consistent moisture removal while safeguarding nutritional integrity and organoleptic qualities. In an era defined by heightened consumer interest in clean-label products and sustainable processing techniques, these systems have become indispensable across food manufacturing, hospitality, pet food production, and pharmaceutical processing. The confluence of evolving hygiene regulations, energy efficiency mandates, and escalating demand for shelf-stable ingredients has elevated the profile of professional dehydration solutions to a strategic imperative for operators seeking to differentiate their offerings and optimize operational workflows.

Moreover, the market landscape is shaped by accelerated adoption of advanced control systems that integrate real-time temperature and humidity monitoring, enabling precise adjustments to drying curves and throughput rates. This digital augmentation empowers manufacturers to reduce waste, curtail energy consumption, and achieve uniform product quality even under variable raw material conditions. Furthermore, cross-industry collaboration with IoT providers, renewable energy suppliers, and automation specialists is driving unprecedented levels of customization and modularity, allowing end users to tailor system configurations to their unique production footprints.

Consequently, decision makers must navigate a web of technological, regulatory, and consumer-driven factors to capitalize on growth opportunities. As the industry moves towards more resilient, sustainable, and scalable dehydration architectures, stakeholders will benefit from an in-depth examination of the forces propelling this sector forward and the strategic considerations that underpin investments in next-generation equipment.

Harnessing Next-Generation Innovations and Sustainable Energy Platforms to Revolutionize Commercial Food Dehydration for Enhanced Efficiency

In recent years, the commercial food dehydration domain has witnessed an influx of next-generation innovations that are reshaping traditional processing paradigms. Vacuum belt systems that operate under reduced pressure enable quicker drying at lower temperatures, preserving heat-sensitive nutrients and volatile compounds. Simultaneously, hybrid configurations that combine pneumatic air flow with infrared or microwave energy sources have gained traction, reducing cycle times by as much as 30 percent and delivering uniform moisture removal across batch loads. These advances are underpinned by the incorporation of advanced digital control architectures, which facilitate predictive maintenance, remote diagnostics, and adaptive process recipes.

Assessing How Recent United States Tariff Measures Have Altered Supply Chain Dynamics and Cost Structures in the Dehydration Equipment Sector

Beginning in early 2025, the United States enacted a series of tariff adjustments that have exerted a pronounced influence on the commercial dehydration equipment sector. Building on ongoing Section 232 levies targeting steel and aluminum inputs, the administration implemented additional duties on finished drying machines and key subcomponents originating from regions deemed to benefit from state-subsidized manufacturing. These supplementary tariffs have introduced a cost premium of up to 15 percent on imported units, compelling original equipment manufacturers to reassess their global sourcing strategies and supply chain architectures.

Moreover, the cumulative tariff burden has catalyzed a shift towards onshore assembly and partial domestic fabrication, as producers strive to mitigate duty impacts and preserve competitive pricing. Strategic partnerships with North American fabrication specialists have emerged, enabling certain vendors to reclassify final assembly as domestic value-added work and partially evade the highest tariff brackets. In parallel, nearshoring initiatives in Mexico and Canada have garnered renewed focus, offering logistical advantages and preferential treatment under the modernized USMCA framework.

These developments have not only altered landed costs but also reconfigured inventory planning, with distributors carrying larger safety stocks to buffer against potential duty escalations and shipping delays. Consequently, stakeholders are evaluating innovative procurement models, including tariff deferral programs and bonded-warehouse solutions, to preserve margin structures without sacrificing delivery performance.

Unveiling Critical Insights Across Diverse Product, Application, End User, Distribution, Power Source, and Capacity Segmentation Dimensions

The commercial dehydrator market exhibits nuanced dynamics when viewed through multiple segmentation lenses, each revealing distinct performance drivers and innovation pathways. When analyzed by product type, conveyor belt dehydrators dominate high-throughput operations due to their continuous processing capabilities, whereas drum dehydrators excel in uniform drying of granular or particulate inputs. Shelf dehydrators remain prevalent among small-scale producers that require flexibility and ease of cleaning, while stackable tray systems appeal to enterprises prioritizing modular expansion and space-efficient layouts.

Application-based insights further delineate the sector’s contours, as the dehydration of fruits and vegetables necessitates specialized airflow profiles and temperature ramp-up sequences to protect delicate cell structures. In contrast, herbs and spices benefit from precision humidity control to preserve volatile oils, while meat and seafood processing demands rigorous sanitary designs and pathogen control features. Pet food dehydration, spanning both premium cat food and dog food segments, underscores the broader trend towards specialized ingredient profiles and texture optimization, driving OEMs to offer configurable chamber environments.

End-user considerations also vary markedly, with agriculture and produce centers valuing robust throughput and washdown capabilities, whereas household-level units emphasize intuitive interfaces and energy consumption transparency. Pharmaceuticals impose stringent compliance and sanitary standards, prompting certifications such as FDA 21 CFR Part 11 integration, while restaurants and foodservice operators prioritize compact footprints and rapid turnaround cycles. Across distribution channels, the balance between offline relationships with established dealers and the growing momentum of direct-to-customer e-commerce platforms shapes market access, and the choice between electric and solar power sources informs both capital budgets and sustainability pledges. Capacity tiers, ranging from small-scale up to 5 kg per cycle to large-scale above 20 kg, reflect the spectrum of end-user throughput requirements and capital constraints.

This comprehensive research report categorizes the Commercial Food Dehydrators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Power Source

- Capacity

- Application

- End User

- Distribution Channel

Highlighting Regional Nuances in Dehydration Technology Adoption Patterns Across the Americas EMEA and Asia-Pacific Growth Landscapes

Geographic variations in commercial dehydration equipment adoption underscore the interplay of regional market maturity, regulatory environments, and supply chain ecosystems. In the Americas, robust demand from artisanal food producers and farm-to-table restaurants has accelerated uptake of compact shelf and tray dehydrators, with an increasing number of operators embedding these units within on-site production labs. Meanwhile, industrial processors in North America have gravitated towards conveyor belt and drum systems, seeking to maximize throughput under stringent FDA and CFIA regulatory regimes.

In Europe, Middle East, and Africa, stringent energy efficiency directives and renewable energy targets have incentivized investments in solar-integrated and hybrid drying systems. Manufacturers in the region are collaborating closely with energy service companies to deliver turnkey solutions that blend photovoltaic arrays with electric drying capacity, thus ensuring compliance with EU Ecodesign regulations and South African SANS standards. The complex mosaic of EMEA markets, spanning food safety norms and import duties, has also driven a surge in localized manufacturing partnerships to streamline certification and reduce lead times.

Asia-Pacific remains a fertile ground for large-scale dehydration applications, fueled by high throughput requirements in pharmaceutical excipient production and consumer snack development. Rapid modernization of food processing infrastructure in China, India, and Southeast Asia has supported growth of drum dehydrators and vacuum belt systems, while governments in Australia and Japan bolster innovation through grant funding for energy-efficient drying research. As cross-border e-commerce platforms proliferate, OEMs are establishing regional hubs to optimize aftermarket service and spare parts logistics.

This comprehensive research report examines key regions that drive the evolution of the Commercial Food Dehydrators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Movements and Portfolio Diversification Among Leading Global Manufacturers and Innovators in Dehydration Systems

Leading equipment manufacturers are deploying a range of strategic imperatives to fortify their positions within the evolving dehydration technology market. Some incumbents are augmenting their product portfolios with next-generation hybrid systems that marry infrared and microwave energy sources, highlighting a commitment to R&D and patent acquisition. Others are forging alliances with digital platform providers, embedding IoT sensors and cloud-based analytics into their core offerings to unlock predictive maintenance and remote process optimization services.

A number of companies have also prioritized geographic expansion and aftermarket service enhancement, opening regional centers of excellence that deliver training, spare parts, and rapid field support. This dual emphasis on product innovation and service-led differentiation has enabled these players to deepen customer relationships and unlock recurring revenue streams through maintenance contracts and software subscriptions. Strategic acquisitions of specialty component suppliers have further streamlined supply chains and secured preferential access to custom-engineered modules.

Simultaneously, several forward-thinking innovators have embraced sustainability as a core differentiator, launching solar-powered skid-mounted dehydrators and modular systems that can be upcycled for alternate uses. Through participation in cross-industry consortia and standards committees, these companies are helping define best practices for energy performance labeling and end-of-life equipment recycling, reinforcing their credentials among environmentally conscious end-users and regulatory bodies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Food Dehydrators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aroma Housewares Company

- Avantco Equipment Inc.

- Buffalo Appliances LLC

- EcoTech Solutions

- Excalibur Products Inc.

- Foshan Dalle Technology Co. Ltd

- Guangdong IKE Industrial Co. Ltd

- Hamilton Beach Brands Holding Company Inc.

- Ice Make Refrigeration Limited

- Kerone Engineering Solutions Ltd.

- Koolatron Corporation

- LEM Products Holding LLC

- Longbank

- MAAN Global Industries

- Marlen International Inc.

- National Enameling and Stamping Company

- National Presto Industries Inc.

- NutriChef Kitchen LLC

- STX International Inc.

- The Sausage Maker Inc.

- Tribest Corporation

- Vesync Co. Ltd

- Vitality 4 Life Pty Ltd

- Waring Commercial

- Weston Brands LLC

Proposing Actionable Strategies for Industry Leaders to Navigate Regulatory Challenges and Capitalize on Emerging Dehydration Market Opportunities

Industry leaders should prioritize the integration of renewable energy platforms, including solar-assisted drying modules and heat recovery systems, to align with emerging regulatory mandates and corporate sustainability targets. By collaborating with energy service companies and leveraging grant-funding opportunities, manufacturers can offset upfront capital expenditures and strengthen their value propositions. Concurrently, establishing nearshore assembly operations within Mexico and Canada will mitigate the impact of U.S. import duties while enhancing supply chain resilience and reducing lead times.

Moreover, embracing digital transformation through the deployment of IoT-enabled sensors and cloud-based analytics will elevate operational visibility and support data-driven decision making. OEMs and end users alike should invest in predictive maintenance programs that leverage remote diagnostics to minimize downtime and optimize lifecycle costs. In parallel, developing customizable modular platforms will cater to the diverse application requirements spanning fruits and vegetables, herbs and spices, meat and seafood, and pet food segments.

Finally, executives are encouraged to foster strategic partnerships across distribution channels, balancing traditional dealership networks with direct digital sales and aftermarket service portals. This omnichannel approach will broaden market reach and enable more agile responses to shifting end-user preferences. By simultaneously pursuing these initiatives, industry stakeholders can cultivate a sustainable, resilient, and growth-oriented trajectory in the competitive commercial dehydration landscape.

Detailing Rigorous Primary and Secondary Research Methodologies Employed to Deliver Comprehensive Insights Into Dehydration Equipment Markets

This analysis is grounded in a comprehensive research framework that synthesizes primary and secondary data sources to deliver an authoritative market perspective. Primary research included in-depth interviews with C-level executives and plant managers across leading OEMs, distributors, and end-user segments, complemented by structured surveys of food processing and pharmaceutical facilities to validate equipment selection criteria. Secondary research leveraged trade data from U.S. Customs and Tariff schedules, industry publications, and patent filings, along with technical standards from regulatory bodies such as the FDA, EU Ecodesign authorities, and global safety certification organizations.

Quantitative shipment trends were cross-referenced with macroeconomic indicators, energy pricing indices, and tariff schedules to isolate the impact of policy shifts on landed costs. Qualitative insights were triangulated through expert workshops and peer benchmarking sessions, ensuring that emerging best practices and technology adoption patterns were rigorously vetted. Furthermore, regional case studies were developed to illustrate how localized manufacturing partnerships and renewable energy integrations are being operationalized across the Americas, EMEA, and Asia-Pacific.

The methodology emphasizes transparency and traceability, with all assumptions documented and validated through stakeholder reviews. This robust approach ensures that the insights presented here are both current and actionable, providing decision makers with the clarity needed to navigate a complex and rapidly evolving commercial dehydration market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Food Dehydrators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Food Dehydrators Market, by Product Type

- Commercial Food Dehydrators Market, by Power Source

- Commercial Food Dehydrators Market, by Capacity

- Commercial Food Dehydrators Market, by Application

- Commercial Food Dehydrators Market, by End User

- Commercial Food Dehydrators Market, by Distribution Channel

- Commercial Food Dehydrators Market, by Region

- Commercial Food Dehydrators Market, by Group

- Commercial Food Dehydrators Market, by Country

- United States Commercial Food Dehydrators Market

- China Commercial Food Dehydrators Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concluding Perspectives on How Evolving Technologies and Market Forces Are Shaping the Future Trajectory of Commercial Food Dehydration

The commercial dehydration equipment market stands at a pivotal juncture, characterized by rapid technological innovation, evolving regulatory landscapes, and shifting end-user priorities. Advances in hybrid drying modalities and digital control systems are delivering unprecedented gains in efficiency and product quality, while tariff adjustments have prompted a strategic realignment of supply chains and nearshore manufacturing investments. Segmentation analysis has illuminated the diverse requirements across product types, applications, end users, distribution channels, power sources, and capacity tiers, underscoring the importance of tailored solutions to meet distinct operational objectives.

Regional insights reveal a mosaic of adoption patterns, with the Americas embracing modular deployments for artisanal and industrial scale alike, EMEA driving energy-efficient sustainable architectures, and Asia-Pacific prioritizing high-throughput, regulated pharmaceutical processing. Leading manufacturers are responding through portfolio diversification, digital service expansions, and sustainability-driven product launches. To remain at the forefront, stakeholders must harness actionable strategies that integrate renewable energy technologies, digital transformation initiatives, and localized manufacturing models.

Ultimately, the confluence of these market forces offers significant opportunities for organizations that can adapt swiftly, innovate purpose-driven solutions, and forge strategic partnerships. By leveraging the insights within this report, industry leaders will be well positioned to navigate uncertainty, optimize operational performance, and chart a path toward sustained growth in the dynamic commercial dehydration landscape.

Connect with Associate Director Ketan Rohom to Secure Comprehensive Market Intelligence That Drives Strategic Decisions in Dehydration Equipment

To gain an unparalleled strategic advantage in the commercial dehydration arena, schedule a personalized consultation with the Associate Director of Sales & Marketing at 360iResearch, Ketan Rohom. By collaborating directly, you will uncover tailored insights and actionable intelligence that resonate with your organization’s unique challenges and ambitions. Ketan’s expertise in synthesizing complex market dynamics into clear, decision-ready recommendations ensures that your investment in research delivers immediate value. Reach out today to discuss bespoke data packages, licensing options, and bespoke workshops that align with your go-to-market strategies. Secure your competitive edge now through a direct conversation with Ketan Rohom and transform your approach to dehydrator technology adoption and market engagement

- How big is the Commercial Food Dehydrators Market?

- What is the Commercial Food Dehydrators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?