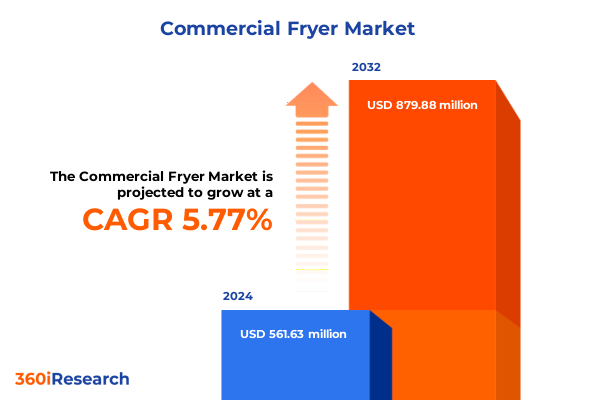

The Commercial Fryer Market size was estimated at USD 593.81 million in 2025 and expected to reach USD 625.76 million in 2026, at a CAGR of 5.77% to reach USD 879.88 million by 2032.

Exploring the Evolution of Commercial Frying Technology and Market Dynamics to Provide Context for Strategic Decision Making in a Competitive Landscape

The commercial fryer market stands at the intersection of evolving consumer preferences, tightening regulatory frameworks, and accelerating technological innovation. In this opening overview, we explore the foundational elements driving demand for high-performance frying equipment across diverse culinary settings. As operators seek to balance consistency, throughput, and energy efficiency, manufacturers and suppliers are compelled to refine product designs to address stringent sanitation standards, rising labor costs, and the imperative of minimizing equipment downtime. Transitioning from traditional high-capacity floor-standing models to more agile countertop and drop-in solutions has introduced new variables in installation, maintenance, and user training, necessitating a comprehensive understanding of operational workflows.

Beyond mere hardware specifications, the broader context encompasses shifting menu trends in quick service and full service restaurants, where menu diversification and the emphasis on health-conscious frying oils have redefined performance expectations. As plant managers and kitchen directors weigh the total cost of ownership, factors such as integrated filtration systems, rapid heat recovery, and digital control interfaces have become critical differentiators. Therefore, this summary sets the stage by uniting market drivers, stakeholder expectations, and competitive forces, offering a unified perspective that informs strategic planning and product innovation in the commercial fryer landscape.

Identifying Pivotal Technological, Operational, and Regulatory Disruptions Reshaping the Commercial Fryer Market’s Competitive and Innovation Trajectory

Recent years have witnessed transformative shifts that are fundamentally reshaping how commercial frying equipment is designed, manufactured, and deployed. Advancements in Internet of Things connectivity have enabled fryers to transmit real-time performance data, facilitating predictive maintenance and remote diagnostics that reduce unplanned downtime. Concurrently, the industry’s pivot toward sustainable practices has spotlighted energy-efficient heating elements and eco-friendly filtration media, responding to both rising utility costs and stringent environmental regulations.

Operationally, the integration of automated oil management and precise temperature controls has elevated consistency in end-product quality, particularly in high-volume settings such as institutional kitchens and quick service restaurants. This trend is complemented by growing demand for modular frying systems that can adapt to fluctuating menu requirements, allowing operators to scale capacity without significant capital expenditure. Regulatory pressures, including water effluent guidelines and emissions standards, have further accelerated innovation, compelling OEMs to engineer closed-loop filtration and grease recovery solutions.

Finally, the proliferation of digital ordering platforms and the intensification of labor shortages have driven a need for user-friendly interfaces and simplified maintenance protocols. As a result, the competitive landscape is increasingly defined by manufacturers that can seamlessly integrate connectivity, sustainability, and automation within their fryer portfolios.

Analyzing the Multifaceted Consequences of United States 2025 Tariff Measures on Commercial Fryer Supply Chains Production Costs and Import Strategies

In 2025, the imposition and extension of United States tariff measures have exerted a pronounced influence on commercial fryer supply chains and pricing structures. The continuation of Section 232 levies on steel and aluminum has elevated raw material costs, directly affecting the fabrication of fryer bodies and oil storage components. Simultaneously, Section 301 duties on certain imports have increased the landed cost of electronic control modules and precision-engineered filtration parts sourced from overseas, compelling original equipment manufacturers to reevaluate their global sourcing strategies.

Consequently, several market players have initiated a dual-pronged response: negotiating long-term domestic supplier agreements to hedge against tariff volatility while pursuing strategic partnerships with nearshore fabricators to mitigate shipping delays and import burdens. These adjustments have not only driven a marginal increase in end-user pricing but have also highlighted the importance of supply chain agility. Operators are now factoring in extended lead times and potential tariff escalations when planning equipment procurement cycles.

Looking ahead, the interplay between federal trade policies and evolving free trade agreements under USMCA also presents both challenges and opportunities. Companies that proactively align their production footprints with tariff-exempt zones stand to gain a competitive edge, whereas those reliant on distant manufacturing hubs may face ongoing margin compression and logistical complexity.

Unearthing Strategic Insights from Diverse Product Fuel Application End User and Sales Channel Segmentations Guiding Market Positioning and Growth

Segment-specific dynamics reveal nuanced pathways to differentiation and growth across the commercial fryer market. In the realm of product types, countertop units have gained traction in space-constrained venues, while drop-in fryers offer seamless integration in custom kitchen layouts; filtered fryers, with their enhanced oil management systems, have become indispensable for high-volume institutional applications, and floor-standing models continue to dominate large-scale operations, whereas split pot configurations address operators’ need for simultaneous multi-product frying.

When examining fuel types, dual fuel systems are emerging as versatile solutions capable of operating on either gas or electric power, granting operators operational flexibility; within electric configurations, single-phase models are favored for lower-volume establishments, while three-phase units deliver the higher output required by restaurants with continuous frying demands, and in gas-powered units, natural gas serves as the default choice for stable utility operations, whereas propane remains integral to mobile food trucks and remote catering services.

Application-driven insights further underscore how cafeterias capitalize on consistent throughput, full service restaurants differentiate offerings through fine dining precision and casual dining volume, hotels and accommodations emphasize equipment reliability during peak occupancy, institutional kitchens prioritize scalability, and quick service restaurants-particularly burger and fried chicken chains-depend on consistency and speed. Evaluating end-user segments reveals that catering services demand portability, food trucks and carts focus on compact electric solutions, hotels and resorts invest in high-capacity floor-standing systems, institutional facilities select rugged durability, and full-service and fast-casual eateries of various formats tailor their choices accordingly. Sales channels likewise shape procurement pathways; aftermarket solutions fulfill spare part needs, direct sales accommodate custom specifications, distributors support regional deployment, and online retail caters to rapid procurement for smaller operators.

This comprehensive research report categorizes the Commercial Fryer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Fuel Type

- Application

- End User

- Distribution Channel

Highlighting Regional Performance Differentiators Across the Americas Europe Middle East & Africa and Asia Pacific to Inform Geographical Strategy

Regional nuances profoundly influence how commercial fryer manufacturers and end users approach procurement, installation, and service. In the Americas, the United States leads with a matured infrastructure that prioritizes energy efficiency certifications and digital integration, while Canada’s market is shaped by stringent safety and environmental standards, and Latin American markets reflect a balance of cost sensitivity and the rapid expansion of quick service restaurant chains.

Across Europe, Middle East & Africa, European buyers rigorously assess life cycle costs, driving demand for premium filtration systems and automation. The Middle East’s hospitality boom has fueled growth in luxury fryer installations, and Africa’s emerging markets, though constrained by import tariffs and infrastructure challenges, are exhibiting early signs of increased interest in compact and mobile frying units.

In Asia-Pacific, China remains a manufacturing hub with a burgeoning domestic consumer base, driving continuous improvements in cost competitiveness and product customization. India’s rapid proliferation of quick service and cloud kitchens is fostering opportunities for mid-range electric and gas fryers, whereas Japan emphasizes precision engineering, energy conservation, and seamless integration with smart kitchen ecosystems, and Australia balances compliance with local energy codes and sustainability goals, resulting in steady demand for high-efficiency models.

This comprehensive research report examines key regions that drive the evolution of the Commercial Fryer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Commercial Fryer Manufacturers and Innovators Shaping the Industry Through Technological Breakthroughs and Strategic Partnerships

Leading manufacturers are leveraging differentiated strategies to capture share and set new performance benchmarks. Established players such as Pitco Frialator are at the forefront of integrating Internet of Things connectivity and energy recovery systems, whereas Henny Penny focuses on multi-cook and automated filtration platforms that reduce labor requirements and optimize oil usage. Frymaster’s affiliation with Linc Global has enabled it to expand its footprint through bundled service packages and cloud-based monitoring solutions.

Other key innovators include Nemco, which has introduced compact and modular fryers tailored to food trucks and small-footprint operations, and Dean Food Equipment, known for its scalable systems that address the specific demands of institutional kitchens and large catering services. In parallel, newer entrants are differentiating through niche offerings such as high-speed air frying technology and AI-driven cooking algorithms, while traditional OEMs are forging strategic alliances with software providers to deliver comprehensive kitchen management suites.

Across the board, mergers and acquisitions remain a pivotal mechanism for achieving vertical integration, enhancing aftermarket service capabilities, and accelerating product development cycles. This dynamic competitive environment underscores the importance of continual investment in research and development and the strategic cultivation of channel partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Fryer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Electrolux

- Ali Group

- American Range

- APW Wyott

- Breville Group Ltd

- Frymaster

- Groupe SEB

- Henny Penny

- Hobart

- Hoshizaki Corp

- Imperial Commercial Cooking Equipment

- Koninklijke Philips N.V.

- Lincat Limited

- Manitowoc Company Inc

- Midea Group

- Newell Brands

- Pitco Frialator

- RATIONAL AG

- SharkNinja Operating LLC

- Southbend

- The Middleby Corporation

- The Vollrath Company

- Vesync Co., Ltd.

- Waring Commercial

Delivering Actionable Strategic Imperatives for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Competitive and Operational Risks

As the commercial fryer market continues to evolve, industry leaders must adopt proactive strategies to maintain competitive advantage and drive sustainable growth. First, prioritizing investments in digital connectivity will enable real-time performance monitoring, predictive maintenance, and enhanced customer support, thereby reducing downtime and reinforcing brand loyalty. Moreover, diversifying supply chain footprints by establishing regional fabrication centers or nearshore partnerships can hedge against future tariff fluctuations and logistical disruptions.

Sustainability imperatives must also be elevated, with a focus on designing energy-efficient heating elements, closed-loop filtration systems, and recyclable materials to meet escalating environmental regulations and corporate responsibility goals. Further, cultivating modular product architectures will empower operators to adjust frying capacity and functionality in response to changing menu profiles without significant capital expenditure.

Equally crucial is the upskilling of technical and service teams to support advanced automation and software platforms. Training initiatives should encompass both installation protocols and data analytics competencies, ensuring that personnel can translate operational metrics into actionable improvements. Lastly, exploring untapped geographies with burgeoning foodservice sectors, such as parts of Latin America and Asia-Pacific, can broaden revenue streams while mitigating reliance on mature markets.

Detailing a Rigorous Research Methodology Combining Primary Interviews Secondary Data Validation and Industry Expert Consultations for Reliable Insights

This analysis is underpinned by a rigorous research methodology designed to deliver authoritative and actionable insights. Primary research comprised in-depth interviews with C-suite executives at leading fryer OEMs, operations managers at high-volume foodservice outlets, and procurement specialists across direct and distributor sales channels. Complementing these discussions, quantitative surveys captured end-user preferences regarding performance attributes, service expectations, and fuel-type choices.

Secondary research drew on a wide array of trade association publications, government statistics on import-export databases, regulatory filings related to tariff measures, and peer-reviewed articles examining energy efficiency and filtration technologies. Data triangulation was employed to validate findings, ensuring consistency between primary inputs and secondary sources. A bottom-up approach was used to cross-verify segment-specific trends, while top-down assessments contextualized broader market and regulatory impacts.

To bolster reliability, preliminary conclusions were subjected to an expert panel review composed of industry analysts, equipment designers, and foodservice consultants, with feedback integrated through iterative validation workshops. This multi-layered approach ensures that the insights presented herein reflect both granular operational realities and overarching strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Fryer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Fryer Market, by Product Type

- Commercial Fryer Market, by Fuel Type

- Commercial Fryer Market, by Application

- Commercial Fryer Market, by End User

- Commercial Fryer Market, by Distribution Channel

- Commercial Fryer Market, by Region

- Commercial Fryer Market, by Group

- Commercial Fryer Market, by Country

- United States Commercial Fryer Market

- China Commercial Fryer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Implications to Provide a Cohesive Perspective on Future Prospects and Challenges in Commercial Fry Equipment

Bringing together the key themes explored across introductory context, transformative trends, tariff impacts, segmentation and regional analyses, company profiling, and strategic recommendations, this summary offers a holistic perspective on the commercial fryer market’s current state and future direction. The convergence of digital connectivity, sustainability mandates, and evolving consumer expectations underscores a pivotal moment for industry stakeholders to redefine product portfolios and service offerings.

Tariff-related cost pressures have highlighted the critical importance of supply chain agility, prompting leading OEMs to localize production and forge nearshore alliances. Meanwhile, nuanced segmentation insights reveal where tailored solutions-whether countertop electric fryers for food trucks or high-capacity filtered units for institutional kitchens-can unlock incremental value. Geographically, differentiated regional drivers emphasize the need for a flexible go-to-market approach that accounts for local regulations, energy codes, and infrastructure readiness.

Ultimately, manufacturers and end users alike stand to benefit from a strategic emphasis on modularity, predictive maintenance, and comprehensive after-sales support. By aligning investment priorities with emerging market opportunities and regulatory landscapes, stakeholders can navigate complexity and sustain competitive advantage in this dynamic sector.

Engage with Associate Director Ketan Rohom to Secure Comprehensive Commercial Fryer Industry Intelligence and Drive Strategic Decision Making

I invite you to engage directly with Associate Director Ketan Rohom to secure access to the comprehensive commercial fryer market research report that will power your strategic initiatives. Through this partnership, you will gain immediate entry to proprietary data on emerging trends, deep-dive analyses of segment performance, and actionable intelligence on regional dynamics that can shape your business roadmap. Ketan Rohom will guide you through tailored insights, ensuring your organization leverages the full spectrum of findings on technological innovation, tariff impacts, and competitive positioning. By connecting with him, you can arrange a customized walkthrough of key deliverables, discuss pricing and licensing options, and explore bespoke consulting engagements to accelerate your decision-making process. Don’t miss the opportunity to equip your leadership team with this indispensable resource; reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch today and transform market uncertainty into your strategic advantage.

- How big is the Commercial Fryer Market?

- What is the Commercial Fryer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?