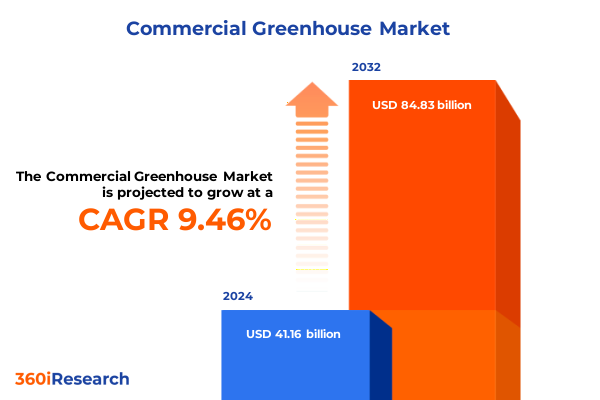

The Commercial Greenhouse Market size was estimated at USD 44.82 billion in 2025 and expected to reach USD 48.82 billion in 2026, at a CAGR of 9.54% to reach USD 84.83 billion by 2032.

Introducing the Pivotal Role of Cutting-Edge Commercial Greenhouse Technologies in Revolutionizing Sustainable Crop Production Worldwide

Global demand for fresh produce has surged as consumer preferences shift toward year-round availability of high-quality fruits and vegetables. Commercial greenhouse systems have emerged as a transformative solution to address this demand through controlled environment agriculture. By leveraging advanced glazing materials and precision climate control, modern facilities can optimize light transmission, temperature, humidity, and carbon dioxide levels to drive higher yields and consistent crop quality. This paradigm shift not only enhances productivity but also aligns with broader sustainability goals by reducing water usage and minimizing land requirements compared to conventional open-field farming.

Within this evolving landscape, greenhouse operators are integrating digital platforms, automated irrigation, and nutrient delivery systems to orchestrate plant growth with unprecedented accuracy. Data-driven insights derived from real-time sensors inform operational decisions and facilitate predictive maintenance of equipment, thereby elevating return on investment and strengthening resilience against climate variability. Moreover, partnerships between technology providers and growers are catalyzing innovation, paving the way for customized solutions that address region-specific challenges. Consequently, this introductory overview underscores the critical factors shaping market adoption and lays the groundwork for deeper exploration.

Examining the Fundamental Shifts in Commercial Greenhouse Ecosystems Driven by Automation, Data Analytics, and Sustainable Practices Across Global Markets

Commercial greenhouse environments are undergoing a profound transformation as industry stakeholders embrace automation, data integration, and sustainability-driven design. Advanced sensor networks now monitor microclimate parameters such as vapour pressure deficit and spectral light quality, while AI-driven control systems adjust ventilation and nutrient delivery in real time. This shift from manual adjustments to autonomous environmental management enhances both crop uniformity and resource efficiency, accelerating decision cycles and mitigating human error.

Simultaneously, emphasis on energy optimization has prompted growers to adopt integrated renewable solutions. Heat recovery exchangers capture waste thermal energy, and solar-assisted systems offset electrical loads, reducing reliance on fossil fuels and lowering operational expenses. Water recirculation and closed-loop irrigation approaches further curtail consumption and minimize discharge, aligning greenhouse operations with circular economy principles.

Emerging business models illustrate the growing complexity of the greenhouse landscape. Vertical integration between seed suppliers, system manufacturers, and end-market distributors is becoming more common, enabling seamless coordination along the supply chain. Collaborative research ventures with academic institutions are generating novel crop varieties tailored for controlled production. As a result, established and disruptive players alike are redefining competitive dynamics, driving a new era of precision agriculture that balances scalability with sustainability.

Assessing the Industry-Wide Impact of Recent United States Tariff Measures on Commercial Greenhouse Operations and Supply Chain Dynamics in 2025

In 2025, the imposition of new tariff measures by the United States has significantly altered cost structures for greenhouse construction and operation. Duties on imported steel framing, specialized glazing panels, and polymer films have increased capital expenditure estimates, compelling developers to reassess sourcing strategies. As raw material prices climbed, many operators faced compressed margins, prompting accelerated negotiations with domestic fabricators and alternative suppliers to mitigate the financial burden.

The cascading impact of these tariffs extends beyond construction budgets. Equipment manufacturers, encountering higher input costs, have passed through price adjustments for climate control units, automated conveyors, and sensor assemblies. This ripple effect has influenced procurement timelines, with some projects deferring expansion plans until economic conditions stabilize or tariff exclusions are obtained. Conversely, the situation has stimulated growth in regional manufacturing hubs, where local producers scale capacity to serve greenhouse demand, enhancing supply chain resilience.

Looking ahead, growers are exploring multi-year contracting and consortium-based purchasing to secure favorable terms. Policy advocacy efforts aim to attain exemptions for specialized agricultural imports, underscoring the critical role of controlled environment farming in national food security agendas. In this context, understanding tariff implications is essential for stakeholders devising investment roadmaps and navigating a dynamically shifting regulatory landscape.

Unveiling Critical Market Segmentation Dimensions That Illuminate Structure, Crop Preferences, Cultivation Systems, Energy Sources, and End-Use Applications

The commercial greenhouse market can be dissected by structure design, with traditional glass houses still commanding premium segments due to superior light diffusion and thermal retention. Polyhouses offer cost-effective alternatives in emerging regions, delivering adequate climate control with lower capital requirements. Shade houses serve specialized applications, protecting ornamental and delicate crops against solar stress, while tunnel houses provide seasonal flexibility for rapid deployment and scalability.

Crop cultivation trends reveal a clear bifurcation between high-value ornamentals and staple vegetables. The flower segment, encompassing cut varieties prized for uniform bloom cycles and potted flowers optimized for aesthetic appeal, drives significant revenue in metropolitan markets. Fruit cultivation spans berries, prized for antioxidant-rich profiles, alongside citrus and tropical varieties that address consumer demand for exotic produce. Herbs bifurcate into culinary applications, supplying fresh flavor enhancers, and medicinal categories, supporting nutraceutical markets. Indoor ornamental plants are flourishing as biophilic design gains traction, whereas outdoor ornamentals lend seasonal diversity. Vegetable production splits into fruit vegetables such as tomatoes and peppers, leafy greens like lettuce and spinach, and root vegetables offering dietary carbohydrates.

Cultivation systems range from aeroponic installations enabling high-density vertical stacking to aquaponic frameworks combining fish production with hydroponic grow beds. Hydroponic systems remain the predominant choice due to operational familiarity, while soil-based methods persist in traditional operations. Energy sourcing strategies reflect a commitment to sustainability: biomass heating leverages agricultural waste and wood chips, electric heating incorporates heat pump and resistive technologies, gas heating utilizes natural gas and propane, and solar heating integrates photovoltaic panels with thermal collectors. End-use is segmented between commercial farming enterprises, educational and demonstration facilities, research and development centers, and retail outlets showcasing end-product diversity. Altogether, these segmentation dimensions illuminate nuanced decision criteria guiding investment and operational strategies.

This comprehensive research report categorizes the Commercial Greenhouse market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Structure Type

- Crop Type

- System Type

- Energy Source

- End-Use

Highlighting Regional Dynamics Shaping Commercial Greenhouse Adoption Trends Across the Americas, EMEA, and Asia-Pacific Markets

Different regions display distinct trajectories for greenhouse adoption driven by climatic, economic, and policy variables. In the Americas, the United States and Canada lead the charge with well-established greenhouse clusters focused on automation and advanced climate control. Government incentives for water-efficient agriculture and robust financing options have catalyzed facility modernization, while the influence of local food movements has elevated demand for regionally produced, high-quality produce.

Europe, the Middle East, and Africa present a more heterogeneous landscape. Western European nations emphasize stringent energy efficiency standards, investing heavily in renewable integration and energy recovery systems. In contrast, Middle Eastern stakeholders exploit abundant solar resources to power large-scale greenhouse complexes, transforming arid lands into productive agricultural hubs. Meanwhile, nascent markets in Africa are beginning to explore controlled environment solutions, spurred by concerns over food security and technological transfer from established regions.

Asia-Pacific registers the fastest growth rates, underpinned by population expansion and shifting dietary preferences. China’s investments in automated greenhouse parks and India’s pilot projects for high-yield tomato and cucumber production exemplify this trend. Japan’s integration of vertical farms with urban infrastructure highlights the region’s appetite for high-tech cultivation. Across these markets, supportive policies, access to capital, and technology transfer agreements continue to drive widespread adoption and foster competitive differentiation.

This comprehensive research report examines key regions that drive the evolution of the Commercial Greenhouse market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Movements and Technological Innovations by Leading Commercial Greenhouse Players Steering Industry Competitiveness

Market leadership is defined by companies that blend advanced engineering with comprehensive service portfolios. Key players have prioritized modular greenhouse designs, enabling rapid scaling and streamlined maintenance. By integrating proprietary climate management platforms, these organizations offer turnkey solutions that reduce time to productivity and simplify operational workflows. Strategic acquisitions have broadened their technological scope, incorporating automation specialists and data analytics providers to deliver holistic systems.

Innovative mid-tier organizations focus on niche application areas such as vertical farming and aquaponics, forging partnerships with research institutions to validate novel crop varieties and system configurations. Their agility in customizing solutions for specialized conditions, such as urban rooftops or remote research stations, has garnered attention from both commercial growers and public-sector initiatives aiming to enhance food security.

Startups are also disrupting legacy models by introducing AI-enabled crop modeling, blockchain-based supply chain traceability, and sustainable material innovations for greenhouse construction. Collaboration networks among these emerging enterprises and established equipment manufacturers are accelerating knowledge exchange and reducing barriers to market entry. Collectively, these strategic movements underscore an industry poised for rapid evolution and differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Greenhouse market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agra Tech, Inc.

- Argus Control Systems Limited

- ATLAS MANUFACTURING, INC.

- BC Greenhouse Builders Ltd.

- Beijing Kingpeng International Hi-Tech Corporation

- Ceres Greenhouse Solutions

- Certhon Build B.V.

- DeCloet Greenhouse Manufacturing Ltd.

- Europrogress

- FarmTek

- Gibraltar Industries, Inc.

- Growers Supply, Inc.

- Heliospectra AB

- Hort Americas

- Hummert International

- IGreen Industries Limited

- Keder Greenhouse Ltd.

- Logiqs B.V.

- Luiten Greenhouses BV

- LumiGrow, Inc.

- Nobutec B.V.

- Noonty Greenhouse Co., Ltd.

- Omni Structures International

- Poly-Tex, Inc.

- Prospiant, Inc.

- Qingzhou Xinhe Greenhouse Horticulture Co., Ltd.

- Richel Group

- Stuppy Greenhouse

- The Glasshouse Company Pty Ltd.

- The International Greenhouse Contractors LLC

Proposing Comprehensive Strategic Recommendations Empowering Commercial Greenhouse Leaders to Capitalize on Emerging Opportunities and Mitigate Operational Risks

Organizations should prioritize the deployment of advanced sensor networks and predictive analytics platforms to optimize environmental controls and nutrient delivery, thereby enhancing crop consistency and reducing resource consumption. By integrating AI-driven decision support tools with automated actuation, operators can proactively address potential system inefficiencies and minimize downtime.

To counteract tariff-induced supply chain disruptions, agribusinesses are advised to diversify their procurement strategies. Establishing partnerships with domestic component manufacturers and exploring multi-source agreements will shield projects from regulatory volatility. Concurrently, constructing consortium-based purchasing arrangements can unlock volume discounts and long-term stability in input pricing.

Sustainability imperatives demand that greenhouse leaders adopt renewable energy integration, such as solar-assisted heating and biomass boilers leveraging agricultural residues. Investing in water recirculation and closed-loop irrigation systems will not only conserve precious resources but also demonstrate environmental stewardship to stakeholders and regulators.

Collaboration with academic and research institutions can accelerate innovation in cultivar development, biosecurity protocols, and system design. Joint pilot programs and demonstration facilities serve as proving grounds for emerging technologies, fostering stakeholder engagement and de-risking large-scale deployments.

Finally, cultivating a skilled workforce through targeted training and certification programs is essential. By equipping personnel with expertise in smart farming technologies and sustainable practices, companies can maintain operational excellence and adapt swiftly to evolving market demands.

Detailing the Rigorous Research Methodology Employed to Ensure Accurate Insights into Commercial Greenhouse Market Trends and Segmentation

This analysis employed a multi-pronged research approach to ensure comprehensive coverage and data integrity. Primary research involved in-depth interviews with greenhouse operators, system integrators, policy makers, and agritech innovators to capture firsthand insights into operational challenges and adoption drivers. These qualitative inputs provided the foundation for identifying thematic trends and strategic priorities across stakeholder segments.

Secondary research encompassed an extensive review of industry journals, white papers, technical specifications, and government publications. Trade association reports and environmental regulation documents were analyzed to contextualize policy impacts and sustainability benchmarks. References to academic studies enriched the understanding of emerging cultivation technologies and their agronomic performance.

Data validation was achieved through triangulation, cross-referencing quantitative inputs against survey responses and manufacturer disclosures. Peer benchmarking sessions with industry experts served as a Delphi panel, refining assumptions and verifying forecast scenarios. Attention to data granularity across segmentation dimensions ensured that insights remain relevant for both enterprise-scale operators and specialized niche players.

Segmentation frameworks were developed iteratively to align structure types, crop categories, cultivation systems, energy sources, and end-use applications with market realities. Regional analysis accounted for climatic factors, regulatory environments, and economic indicators, guaranteeing that the report’s conclusions and recommendations reflect the nuanced conditions influencing greenhouse adoption worldwide.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Greenhouse market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Greenhouse Market, by Structure Type

- Commercial Greenhouse Market, by Crop Type

- Commercial Greenhouse Market, by System Type

- Commercial Greenhouse Market, by Energy Source

- Commercial Greenhouse Market, by End-Use

- Commercial Greenhouse Market, by Region

- Commercial Greenhouse Market, by Group

- Commercial Greenhouse Market, by Country

- United States Commercial Greenhouse Market

- China Commercial Greenhouse Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Distilling Key Findings and Forward-Looking Perspectives That Outline the Strategic Imperatives for Commercial Greenhouse Market Stakeholders

The convergence of automation, digital intelligence, and sustainable energy integration is reshaping the commercial greenhouse landscape, offering growers unprecedented control over production outcomes. Concurrently, regulatory shifts and trade policies, including elevated tariffs on critical materials, underscore the importance of supply chain resilience and strategic sourcing.

Segmentation analysis highlights diverse pathways to value, from high-tech glass structures in developed markets to cost-efficient polyhouses in emerging regions. Regional dynamics further accentuate the need for tailored approaches, whether optimizing energy usage in Europe or deploying solar-augmented systems in arid zones.

Industry leaders and innovators alike must embrace technology partnerships, invest in workforce development, and pursue sustainability imperatives to maintain competitiveness. The insights presented herein offer a clear roadmap for navigating complex market forces and capitalizing on growth opportunities. As controlled environment agriculture evolves, stakeholders that integrate these findings into their strategic planning will be best positioned to deliver consistent quality, drive operational efficiencies, and secure long-term market leadership.

Connect with Associate Director Sales & Marketing Ketan Rohom to Unlock Exclusive Access to the Definitive Commercial Greenhouse Market Intelligence Report

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to unlock exclusive access to the definitive commercial greenhouse market intelligence report. Engaging directly will empower your team with actionable insights tailored to your strategic priorities, allowing rapid integration of advanced cultivation technologies and policy analysis into your planning. Reach out today and secure your competitive edge through a partnership that delivers comprehensive data, expert interpretation, and customized recommendations aligned with the evolving demands of controlled environment agriculture.

- How big is the Commercial Greenhouse Market?

- What is the Commercial Greenhouse Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?