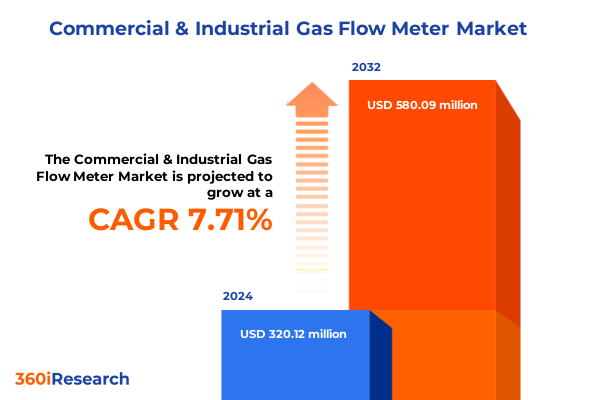

The Commercial & Industrial Gas Flow Meter Market size was estimated at USD 342.05 million in 2025 and expected to reach USD 369.05 million in 2026, at a CAGR of 7.83% to reach USD 580.09 million by 2032.

Introduction to Commercial & Industrial Gas Flow Meters: Understanding Their Critical Role in Modern Operations and Process Optimization

Gas flow meters serve as the cornerstone of efficient process control within commercial and industrial operations, providing critical data that underpins safety, productivity, and regulatory compliance. These instruments measure the volumetric or mass flow rate of gases traversing pipelines and systems, enabling operators to optimize energy consumption, detect leaks, and ensure accurate billing in utility applications. With industries ranging from oil and gas to pharmaceuticals relying on precise flow measurement, the role of advanced metering solutions has grown more prominent as companies pursue improvements in operational efficiency and sustainability.

Emerging demands for real-time monitoring and tighter process control have pushed manufacturers to innovate beyond traditional mechanical designs. Today’s leading gas flow meters incorporate digital sensors, onboard diagnostics, and network connectivity to deliver actionable insights directly to control systems and cloud platforms. As a result, operations teams can anticipate maintenance needs, adjust process parameters on the fly, and maintain continuous compliance with evolving environmental and safety regulations. This introduction sets the stage for a deeper exploration of the key trends, tariff impacts, and strategic opportunities shaping the future of the gas flow meter market.

Examining Key Transformations Reshaping the Commercial & Industrial Gas Flow Meter Landscape and Driving Technology Adoption Across Industries

The commercial and industrial gas flow meter landscape is undergoing transformative shifts driven by the convergence of digitalization, sustainability goals, and evolving regulatory frameworks. Modern process plants are replacing legacy mechanical meters with smart, sensor-driven alternatives that offer greater accuracy and advanced analytics capabilities. As digital transformation initiatives accelerate, flow meters have evolved from isolated instruments to integral components of Industry 4.0 ecosystems, feeding high-fidelity data into analytics engines that optimize energy use and reduce emissions.

Concurrently, end users are demanding more from their metering solutions, with a focus on reduced footprint, lower maintenance requirements, and compatibility with a wider array of gas compositions. Manufacturers have responded by introducing modular designs and multi-parameter sensors capable of handling varying flow conditions and complex mixtures. Furthermore, advancements in additive manufacturing and materials science have enabled the development of corrosion-resistant sensor elements tailored for harsh industrial environments. Amid these technological changes, strategic partnerships between device makers and software providers have emerged, creating comprehensive service offerings that bundle metering hardware, cloud-based analytics, and predictive maintenance capabilities.

Assessing How Recent United States Tariff Measures in 2025 Are Impacting Commercial & Industrial Gas Flow Meter Manufacturing Costs and Supply Chains

In early 2025, the United States implemented a new set of tariffs targeting imported industrial equipment components, including sensor modules and specialized alloys widely used in gas flow meter manufacturing. These measures have introduced material cost pressures for meter producers who source critical elements such as stainless steel tubing and semiconductor-based transducers from overseas suppliers. As a direct consequence, original equipment manufacturers have adjusted their procurement strategies, with some accelerating localization efforts and others seeking alternative supply partners in regions unaffected by the levies.

The supply chain disruptions induced by the tariffs have also influenced pricing dynamics throughout the value chain. System integrators and end users have begun factoring in elevated costs during procurement cycles, leading to lengthened negotiation timelines and more frequent requests for total cost of ownership evaluations. Looking beyond the immediate price increases, these trade policies may prompt a reconfiguration of manufacturing footprints, encouraging greater vertical integration and reshoring initiatives to mitigate future tariff exposure. In turn, technology providers may intensify investments in domestic production capacities and collaborative R&D to safeguard against similar policy shifts.

Uncovering Strategic Insights from Diverse Segmentation Dimensions Spanning Technology, End Use Industry, Meter Type, Phase, and Configuration Dynamics

A nuanced understanding of market segmentation reveals the differential adoption rates and growth trajectories within the gas flow meter sector. When considering technology, Coriolis meters-offering direct mass flow measurement and high accuracy-continue to gain traction in custody transfer and high-value process control applications, with dual flow tube variants favored for their enhanced precision while single flow tube designs meet cost-sensitive requirements. Meanwhile, differential pressure meters retain a strong presence in pipeline monitoring, with orifice and Venturi types serving established infrastructures and wedge elements becoming preferred in applications demanding reduced maintenance. Magnetic meters excel where conductive gases are prevalent, with insertion styles dominating retrofits and full bore configurations used in new installations. Ultrasonic meters have advanced in both Doppler and transit time formats, leveraging clamp-on modules for minimal process interruption and in line units where long-term stability is paramount. Vortex and turbine meters supplement these categories, particularly in midstream gas distribution networks seeking balance between capital cost and performance.

End use industry dynamics further shape market behavior. The oil and gas sector continues to drive demand through upstream exploration measurement, midstream pipeline balancing, and downstream custody transfer; concurrently, the petrochemical and chemical industries adopt flow meters to regulate feedstock blends in both basic and specialty chemical production. In food and beverage, breweries, dairies, and soft drink plants leverage thermal and Coriolis technologies for product consistency, while power generation facilities, from nuclear to renewables, require high-reliability meters to track fuel consumption and emissions reporting. Water and wastewater treatment operations also deploy robust ultrasonic and magnetic solutions across municipal and industrial sites. Phase considerations underscore distinct meter selection: dry gas applications prioritize high-accuracy technologies such as Coriolis and ultrasonic transit time, whereas wet gas conditions often necessitate DP or vortex instruments with phase compensation features. Configuration plays a pivotal role as well, with fixed installations dominating continuous monitoring and portable units empowering maintenance teams to validate performance or troubleshoot anomalies on demand.

This comprehensive research report categorizes the Commercial & Industrial Gas Flow Meter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Meter Type

- Phase

- Configuration

- End Use Industry

Exploring Regional Market Nuances and Growth Drivers Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Zones

Across the Americas, the market benefits from extensive pipeline networks and mature regulatory frameworks that incentivize metering accuracy and environmental compliance. North America’s shale gas boom has propelled demand for high-performance mass flow solutions in both field and downstream applications, while Latin American energy diversification programs spur investments in municipal gas distribution and power generation measurement systems. Transitioning to Europe, Middle East & Africa, stringent emissions targets and safety standards have elevated the adoption of smart flow meters that integrate leak detection and remote diagnostics. Key oil and gas corridors in the Middle East continue to rely on proven DP and vortex technologies but are incrementally shifting toward digital meters as part of national initiatives to modernize infrastructure.

In Asia-Pacific, rapid industrialization across China, India, Southeast Asia, and Oceania creates significant demand for both new installations and retrofit projects. The region’s power generation sector, including thermal, nuclear, and renewable plants, stands out as a primary driver of advanced metering solutions. Additionally, the burgeoning chemical and petrochemical industries in the Asia-Pacific realm require precise flow measurement for process optimization and safety compliance. Across all regions, regional policy landscapes and infrastructure maturity levels directly influence technology preferences and procurement models, shaping tailored deployment strategies for international and local metering providers.

This comprehensive research report examines key regions that drive the evolution of the Commercial & Industrial Gas Flow Meter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Players Driving Innovation, Partnerships, and Competitive Dynamics in the Commercial & Industrial Gas Flow Meter Market

Leading players in the gas flow meter market are distinguished by their ability to integrate advanced sensor technologies, digital platforms, and comprehensive service offerings. One major instrumentation provider has broadened its portfolio through strategic acquisitions and an expanded channel network, enabling localized support in emerging markets. Another global automation giant has leveraged its control system expertise to deliver turnkey metering solutions that seamlessly integrate with distributed control systems and SCADA networks. Meanwhile, a prominent European manufacturer emphasizes modular meter designs that streamline maintenance and calibration, complemented by digital twin capabilities for lifecycle management.

Collaborations between meter producers and cloud analytics vendors are also on the rise, creating subscription-based models that bundle hardware, software, and predictive maintenance services. In parallel, several independent specialists have carved out niches in clamp-on ultrasonic meters and industry-specific configurations for oil & gas and power generation applications. Across this competitive landscape, companies are investing in next-generation sensor materials, AI-driven diagnostics, and global service footprints to differentiate their offerings and meet evolving end user requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial & Industrial Gas Flow Meter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Apator SA

- Azbil Corporation

- Badger Meter, Inc.

- Emerson Electric Co.

- Endress+Hauser Group Services AG

- Fluid Components International LLC

- Honeywell International Inc.

- Itron, Inc.

- Keyence Corporation

- Krohne Messtechnik GmbH

- Mikrom GmbH

- Parker-Hannifin Corporation

- Ritter GmbH

- Schneider Electric SE

- SICK AG

- Siemens AG

- Sierra Instruments, Inc.

- Spirax Sarco Engineering plc

- Yokogawa Electric Corporation

Delivering Actionable Strategies and Forward-Looking Guidance to Empower Industry Leaders in Navigating the Gas Flow Meter Market's Future Challenges

Industry leaders should prioritize the development of digital metering platforms that offer end-to-end visibility, enabling predictive maintenance and real-time process optimization. By integrating IoT connectivity and open API frameworks, device manufacturers can foster an ecosystem of third-party analytics and application providers, expanding the value proposition for end users. In tandem, supply chain resilience must be reinforced through diversified supplier networks and strategic inventory buffers; this approach will mitigate the impact of geopolitical uncertainties and tariff fluctuations on component availability and production lead times.

Furthermore, companies should cultivate partnerships with regulatory bodies and industry associations to influence evolving standards and ensure new technologies gain timely approvals. Emphasizing modular design principles will facilitate easier upgrades and retrofits, reducing downtime and total cost of ownership for customers. Finally, investing in end user training and certification programs will accelerate technology adoption by equipping operators and engineers with the skills needed to maximize meter performance, interpret complex data outputs, and maintain compliance with rigorous safety requirements.

Outlining a Rigorous Mixed-Method Research Framework Combining Primary and Secondary Sources for Comprehensive Gas Flow Meter Analysis

This research leverages a mixed-method approach, commencing with a comprehensive secondary review of industry publications, technical standards, trade journals, and regulatory filings to establish foundational market context. Secondary insights are supplemented by primary interviews conducted with senior executives at meter manufacturers, system integrators, and end user companies, providing direct perspectives on technology adoption drivers and procurement dynamics.

Quantitative data collection involved a structured survey of procurement managers and process engineers across key end use industries, ensuring broad representation of regional and application-specific nuances. Collected data underwent a multi-stage validation process, including cross-referencing with public company disclosures and supplier shipment data. Finally, findings were synthesized through data triangulation techniques, corroborating qualitative insights with quantitative metrics to deliver robust, actionable conclusions and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial & Industrial Gas Flow Meter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial & Industrial Gas Flow Meter Market, by Technology

- Commercial & Industrial Gas Flow Meter Market, by Meter Type

- Commercial & Industrial Gas Flow Meter Market, by Phase

- Commercial & Industrial Gas Flow Meter Market, by Configuration

- Commercial & Industrial Gas Flow Meter Market, by End Use Industry

- Commercial & Industrial Gas Flow Meter Market, by Region

- Commercial & Industrial Gas Flow Meter Market, by Group

- Commercial & Industrial Gas Flow Meter Market, by Country

- United States Commercial & Industrial Gas Flow Meter Market

- China Commercial & Industrial Gas Flow Meter Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Summarizing Key Insights and Reinforcing the Strategic Importance of Advanced Gas Flow Meter Technologies for Operational Excellence

The expansive review of commercial and industrial gas flow meters underscores their indispensable role in optimizing operational efficiency, ensuring regulatory compliance, and advancing sustainability objectives across diverse industries. Technological advancements and strategic partnerships are reshaping the market, driving broader adoption of smart metering solutions that deliver enhanced accuracy, remote diagnostics, and predictive maintenance capabilities.

Navigating the evolving tariff landscape will require agile supply chain strategies and targeted localization of production to sustain cost competitiveness. Meanwhile, granular segmentation analysis highlights differentiated use cases across technology types, industries, and deployment configurations, enabling manufacturers to tailor their offerings precisely. Finally, regional insights reveal that infrastructure maturity and policy frameworks are pivotal in shaping demand patterns, underscoring the need for customized market entry and expansion plans. These collective insights form the basis for informed decision-making, arming stakeholders with the clarity necessary to harness emerging opportunities and mitigate potential risks in the dynamic gas flow meter market.

Connect with Associate Director Ketan Rohom to Secure Comprehensive Commercial & Industrial Gas Flow Meter Market Research and Elevate Your Strategic Decisions

We appreciate your interest in this comprehensive analysis of the commercial and industrial gas flow meter market. To access the full report, including in-depth data, detailed charts, and further insights, please connect with Associate Director Ketan Rohom. His expertise in sales and marketing will guide you through tailored solutions to address your organization’s specific needs and strategic objectives. Reach out today to secure your copy and empower your decision-makers with the critical intelligence required to navigate the evolving gas flow meter landscape and achieve sustained operational excellence.

- How big is the Commercial & Industrial Gas Flow Meter Market?

- What is the Commercial & Industrial Gas Flow Meter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?