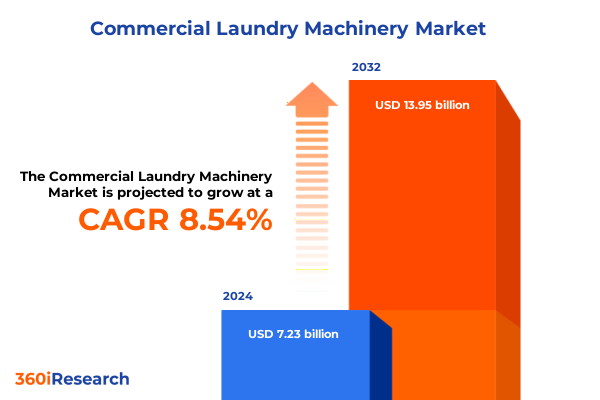

The Commercial Laundry Machinery Market size was estimated at USD 7.82 billion in 2025 and expected to reach USD 8.47 billion in 2026, at a CAGR of 8.60% to reach USD 13.95 billion by 2032.

Unveiling the Dynamics of Commercial Laundry Machinery in 2025: Insights into Market Evolution, Technological Advancements, and Operational Efficiency Trends

Commercial laundry machinery has evolved into a critical pillar of operational efficiency for sectors ranging from hospitality to healthcare and industrial laundries. As global demand for high-performance equipment intensifies, providers must navigate an intricate landscape shaped by technological innovation, sustainability mandates, and shifting consumer expectations. Against this backdrop, stakeholders seek clarity on the forces driving machine design, process automation, and service delivery models.

Over the past year, the integration of connectivity features has accelerated, enabling real-time monitoring and remote diagnostics that preemptively address equipment malfunctions. Simultaneously, growing regulatory emphasis on water conservation and energy use compels manufacturers to optimize performance without sacrificing throughput. In addition, the rising prominence of on-demand and subscription-based service offerings challenges traditional sales frameworks, prompting a reevaluation of revenue models.

In this dynamic environment, decision-makers require a comprehensive introduction to emerging technologies and market enablers. This section lays the groundwork for understanding how digital transformation, sustainability objectives, and evolving customer requirements converge to shape the next generation of commercial laundry solutions.

Exploring the Transformational Forces Shaping the Commercial Laundry Sector Through Digital Innovation, Sustainability, and Automation Breakthroughs

The commercial laundry sector is undergoing transformative shifts driven by a convergence of digital innovation, sustainability imperatives, and advanced automation. Smart systems embedded with IoT capabilities now provide granular data on machine health, usage patterns, and performance metrics, allowing operators to schedule predictive maintenance and reduce downtime significantly. These insights also enable dynamic resource management, optimizing water and detergent use through AI-powered dosing algorithms that respond to real-time load conditions.

Concurrently, regulatory frameworks and environmental stewardship initiatives are fostering the adoption of energy-efficient models that comply with stringent standards. Closed-loop water recycling systems are increasingly common, recapturing and purifying wash water to minimize consumption and lower operational costs. Heat pump drying technologies further reduce energy use by recirculating heated air, aligning with carbon reduction targets and offering a competitive differentiator for eco-conscious operators.

Moreover, the rise of modular machine architectures and scalable configurations supports flexible facility design. Facilities can now tailor layouts to fluctuating demand, deploying folding machines, ironers, or specialized finishing equipment in response to seasonal or segment-specific requirements. As automation extends to robotic sorting and handling systems, labor-intensive tasks are being streamlined, enhancing throughput and lowering total cost of ownership. Together, these developments constitute a fundamental recalibration of how commercial laundry operations are designed, managed, and monetized.

Analyzing the Cumulative Effect of United States Tariff Policies in 2025 on Commercial Laundry Equipment Costs Supply Chains and Strategic Sourcing

Tariff regimes in the United States continue to exert a profound influence on the commercial laundry equipment supply chain. As of mid-2025, machines with a dry linen capacity exceeding 10 kilograms are subject to a general Most-Favored Nation duty rate of 1%, a significant reduction following the expiry of safeguard measures on large residential washers in January 2021. While the base rate appears modest, equipment sourced from China often faces additional duties under U.S. trade law, effectively raising the landed cost. In many cases, importers anticipating Section 301 tariffs incur an extra 25% levy on top of standard duties, with eligible machinery sometimes petitioning for temporary exclusions to mitigate these costs.

Parts and accessories for laundry machines, classified under HTS subheading 8450.90, carry a general duty of 2.6%. For components originating in China, additional Section 301 obligations apply-currently amounting to 7.5% on top of the base rate-resulting in a combined duty burden of over 10%. This structure incentivizes manufacturers and distributors to reassess their sourcing strategies, either shifting procurement to tariff-exempt origins or increasing local content to benefit from free-trade agreements and special tariff waiver programs.

The cumulative impact of these duties manifests in higher equipment acquisition costs, elongated lead times due to documentation and compliance requirements, and heightened pressure on end-user budgets. In response, industry players are exploring near-shoring for subassemblies, forging joint ventures with domestic fabricators, and negotiating supplier agreements that share tariff exposure. Ultimately, these adaptive strategies are reshaping global supply networks, compelling stakeholders to balance cost, quality, and regulatory complexity.

Illuminating Key Segmentation Perspectives Across Product Types Load Capacities Operational Modes Sales Channels and End User Verticals Driving Market Nuances

Diving into product type segmentation reveals a diverse landscape of equipment categories each tailored to specific operational requirements. Dryers stand as a cornerstone of any facility, yet extractors and finishing equipment are gaining prominence for their role in accelerating throughput. Folding machines and ironers complement these core assets, while the bifurcation of washing machines into front-loading and top-loading designs addresses varied preferences for gentler fabric handling or higher throughput. These distinctions enable providers to align technology with load profiles and end-user priorities without compromising on reliability.

Load capacity further refines purchasing decisions, differentiating between large, medium, and small installations. Large capacity systems drive efficiency in high-volume settings such as industrial laundries, whereas small and medium capacity models provide flexibility for customer segments like hotels or on-site healthcare facilities. The mode of operation spans fully automatic cycles that minimize labor touchpoints to semi-automatic configurations that afford operators manual control over specific process stages, thereby tailoring solutions to workforce skill levels and process complexity.

Sales channels underscore the evolution of procurement methodologies. Offline transactions through equipment distributors continue to serve traditional buyers, offering hands-on demonstrations and responsive service agreements. Meanwhile, online sales via manufacturer websites and third-party e-commerce platforms are swiftly gaining traction, simplifying order placement and enabling transparent price comparisons.

Finally, market demand is shaped by end-user verticals: healthcare facilities prioritize hygiene-focused protocols and barrier washers, hotels and resorts demand equipment capable of handling linens and uniforms with consistent performance, industrial laundries emphasize maximum uptime and throughput, and laundromats value cost-effective, intuitive machines that drive customer satisfaction. Together, these segmentation insights inform targeted product development and refined go-to-market approaches.

This comprehensive research report categorizes the Commercial Laundry Machinery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Load Capacity

- Mode of Operation

- Sales Channel

- End User

Dissecting Regional Market Dynamics in the Americas Europe Middle East Africa and Asia-Pacific to Reveal Commercial Laundry Equipment Adoption Patterns

Regional dynamics in the Americas showcase a mature market with established infrastructure and ongoing investments in retrofits to meet stricter environmental regulations. In North America, energy efficiency standards and water conservation mandates effectively accelerate replacements of legacy equipment, while Latin American markets exhibit growth opportunities fueled by expanding hospitality and industrial sectors. Proximity to key manufacturing hubs further enables near-shoring strategies and enhances after-sales support networks.

The Europe, Middle East & Africa region presents a mosaic of regulatory frameworks and adoption rates. Western Europe leads in sustainable equipment uptake, driven by incentive schemes that offset initial capital expenditures and by corporate ESG targets. In contrast, emerging EMEA markets balance affordability with performance, often favoring modular systems that can be upgraded as budgets and demand allow. Service excellence and financing options become critical differentiators in these diverse environments.

Asia-Pacific offers a contrasting narrative, with rapid urbanization and hospitality growth underpinning strong demand for both new installations and machinery upgrades. Key manufacturing centers in East Asia not only supply regional needs but also export innovations worldwide. Southeast Asian markets are catching up in smart technology adoption, supported by government programs that encourage industrial digitalization. Together, these regional distinctives shape supply chain strategies and inform priorities for localized product customization.

This comprehensive research report examines key regions that drive the evolution of the Commercial Laundry Machinery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Commercial Laundry Machinery Manufacturers and Technology Innovators Steering the Industry’s Competitive Landscape and Future Directions

Market leadership in commercial laundry machinery hinges on a blend of technological innovation, service excellence, and global reach. Alliance Laundry Systems continues to set benchmarks with its AI-powered load sensing technology integrated into new washer lines, delivering water savings of up to 25 liters per cycle and significant detergent optimization. Electrolux leverages advanced heat pump dryer platforms, reducing energy consumption by approximately 35% compared to conventional systems and expanding its footprint in hospitality and healthcare segments.

German manufacturer Miele differentiates through its proprietary IoT-enabled predictive maintenance platform that has reduced unplanned downtime by 18% in pilot installations, strengthening its value proposition for high-availability operations. Meanwhile, Jensen Group addresses stringent hygiene requirements with barrier washer solutions designed for hospital laundries, offering thermal disinfection cycles that meet updated industry standards. Kannegiesser focuses on modular system architectures, enabling urban facilities to maximize throughput in constrained footprints, whereas Girbau’s emphasis on reliability and low maintenance resonates powerfully in the self-service laundromat channel.

Collectively, these players drive competitive intensity through continuous product enhancements, strategic partnerships, and global service networks, raising the bar for performance, durability, and lifecycle value.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Laundry Machinery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alliance Laundry Systems LLC

- Asko Appliances AB

- BÖWE Textile Cleaning GmbH

- DANUBE INTERNATIONAL SARL.

- Dexter Apache Holdings, Inc.

- EDRO Corporation

- Electrolux Professional Singapore Pte Ltd

- Fagor Professional

- G.A. Braun, Inc.

- Girbau S.A.

- Herbert Kannegiesser GmbH

- Image Laundry Systems

- JENSEN-GROUP

- LG Electronics, Inc.

- Miele, Incorporated

- Onnera Group

- Pellerin Milnor Corporation

- Primus CE s.r.o.

- Robert Bosch GmbH

- Sailstar

- Shanghai Sailstar Machinery Group Co. Ltd.

- Stefab Limited

- Tosen Machinery Corporation.

- Welco Garment Machinery Pvt. Ltd

- Whirlpool Corporation

Formulating Actionable Strategic Recommendations for Industry Leaders to Navigate Market Complexity Capitalize on Innovation and Strengthen Competitive Positioning

Industry leaders must prioritize the integration of smart technologies to transition from reactive to predictive maintenance frameworks, thereby reducing downtime and enhancing service reliability. By forging partnerships with AI and IoT specialists, companies can embed advanced analytics into their equipment, unlocking new revenue streams through data-as-a-service offerings. Furthermore, investing in modular machine designs allows operators to scale capacity in response to demand fluctuations without incurring full replacement costs.

Sustainability should guide product roadmaps and marketing messages. Leaders can secure competitive advantages by strengthening their sustainability credentials through eco-certifications, offering water reclamation retrofits, and promoting energy-efficient models tied to measurable cost savings. At the same time, collaborative engagements with government agencies can align equipment specifications with evolving regulatory mandates, smoothing compliance pathways for end users.

Tariff optimization remains a critical lever for margin protection. Supply chain executives should pursue diversified sourcing strategies, exploring tariff exemption processes for qualifying imports and expanding local manufacturing capabilities. Simultaneously, embracing digital sales channels and refining financing options can enhance market penetration, particularly in emerging regions where online procurement and subscription-based models resonate strongly. Together, these actions will equip industry leaders to navigate complexity and sustain profitable growth.

Detailing a Robust Research Methodology Combining Qualitative Stakeholder Interviews and Quantitative Data Analysis for Market Intelligence Integrity

This research employs a multi-faceted methodology combining primary and secondary data sources to ensure comprehensive market intelligence. Primary insights derive from structured interviews and surveys with key stakeholders across equipment manufacturers, distributors, and end-user segments, providing qualitative context on purchasing criteria and operational priorities. These interactions are supplemented by site visits and direct machine performance evaluations to validate feature claims and reliability metrics.

Secondary research encompasses a thorough review of regulatory filings, tariff schedules, and industry publications, enabling an accurate assessment of trade policy impacts and compliance requirements. Proprietary databases and trade associations contribute granular data on technology adoption rates, while patent filings and press releases inform competitive benchmarking.

Analytical frameworks applied include segmentation analysis to identify demand drivers by product type and end-user vertical, as well as regional modeling that accounts for macroeconomic indicators, infrastructure maturity, and regulatory stringency. Quality assurance protocols ensure data integrity through cross-verification of multiple sources, while scenario-based modeling explores potential market responses to emerging trends and policy shifts. Together, these methodological pillars deliver robust, actionable insights for stakeholders seeking to navigate the commercial laundry machinery landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Laundry Machinery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Laundry Machinery Market, by Product Type

- Commercial Laundry Machinery Market, by Load Capacity

- Commercial Laundry Machinery Market, by Mode of Operation

- Commercial Laundry Machinery Market, by Sales Channel

- Commercial Laundry Machinery Market, by End User

- Commercial Laundry Machinery Market, by Region

- Commercial Laundry Machinery Market, by Group

- Commercial Laundry Machinery Market, by Country

- United States Commercial Laundry Machinery Market

- China Commercial Laundry Machinery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Drawing Conclusive Insights from Market Trends Regulatory Impacts and Technological Advancements to Chart a Clear Path Forward for Stakeholders

In conclusion, commercial laundry machinery is at the nexus of transformative trends encompassing digitalization, sustainability, and supply chain realignments. The integration of AI-driven predictive maintenance and IoT monitoring tools empowers operators to achieve unprecedented uptime and resource efficiency. Concurrently, environmental imperatives drive the adoption of energy-optimized and water-recycling systems, while tariff structures and regulatory frameworks shape procurement strategies and manufacturing footprints.

Segmentation analysis underscores the importance of tailoring equipment solutions to specific product types, load capacities, modes of operation, and end-user requirements, ensuring that value propositions resonate with distinct buyer profiles. Regional insights reveal varied adoption curves and regulatory landscapes, calling for localized go-to-market plans and service models. The competitive arena is defined by a cohort of established global players and emerging innovators that continuously push the envelope on machine performance, modularity, and lifecycle service offerings.

By synthesizing these findings, stakeholders can chart clear pathways to optimize their equipment portfolios, refine sourcing approaches, and harness technological breakthroughs. This comprehensive perspective facilitates informed decision-making that aligns with strategic objectives, operational constraints, and emerging market opportunities in the evolving commercial laundry domain.

Engage with Associate Director Ketan Rohom to Access the Comprehensive Commercial Laundry Machinery Report and Empower Your Strategic Decisions Today

Ready to elevate your strategic planning with in-depth market insights, Ketan Rohom invites you to engage directly and secure the complete commercial laundry machinery report. Benefit from a tailored walkthrough of actionable data, segmentation analysis, regional deep dives, and competitor profiling to inform your investment and operational decisions. Don’t miss the opportunity to leverage this comprehensive resource to optimize sourcing strategies, anticipate regulatory shifts, and harness emerging technologies. Connect with Ketan Rohom (Associate Director, Sales & Marketing) today to discuss pricing, customized research add-ons, and volume license options that suit your organizational needs. Empower your team with definitive market intelligence and take decisive action now.

- How big is the Commercial Laundry Machinery Market?

- What is the Commercial Laundry Machinery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?