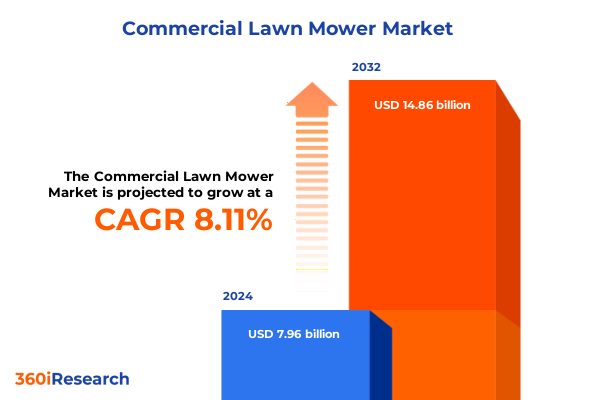

The Commercial Lawn Mower Market size was estimated at USD 8.58 billion in 2025 and expected to reach USD 9.25 billion in 2026, at a CAGR of 8.16% to reach USD 14.86 billion by 2032.

Unveiling the Strategic Imperatives and Market Dynamics Shaping Commercial Lawn Mower Adoption in Professional Landscaping and Maintenance

The commercial lawn mower industry has undergone profound evolution as professional landscaping and maintenance enterprises strive to meet escalating demands for efficiency, reliability, and environmental stewardship. This report opens by contextualizing the market within the broader turf care ecosystem, highlighting how rising awareness of sustainable practices and the intensification of urban greenery projects have elevated the requirements for heavy-duty mowing equipment. By framing the competitive landscape alongside critical macroeconomic drivers such as labor cost pressures and municipal investments in public spaces, this introduction lays the groundwork for a nuanced exploration of emerging opportunities and strategic imperatives.

Transitioning from a broad overview to a focused lens, it underscores the importance of technology integration-from automated guidance systems to real-time performance analytics-and examines how these advancements are redefining maintenance protocols and service delivery. Readers will gain clarity on why understanding shifting buyer priorities, regulatory stipulations on noise and emissions, and the interplay of global supply chains is essential to formulating resilient business strategies. This introduction sets the stage for a deep dive into the market’s transformative shifts, tariff impacts, segmentation insights, and region-specific dynamics, ensuring that executives are equipped with a comprehensive vantage point from the outset.

How Technological Innovations and Sustainability Imperatives Are Redefining the Commercial Lawn Mower Ecosystem for Market Leaders

The commercial lawn mower landscape has been reshaped by a confluence of technological breakthroughs and intensifying sustainability mandates that are compelling manufacturers and end users alike to adopt new paradigms. Electric propulsion and advanced battery chemistries have challenged the dominance of traditional internal combustion engines, ushering in quieter, emission-free operation that aligns with increasingly strict environmental regulations. Concurrently, the adoption of robotic mowing platforms is accelerating as artificial intelligence and sensor fusion technologies mature, enabling fully autonomous turf maintenance that reduces labor dependencies and enhances precision.

Beyond propulsion and automation, digital connectivity has emerged as a transformative force, enabling fleet managers to monitor equipment performance, schedule predictive maintenance, and optimize asset utilization through cloud-based platforms. This shift toward the Internet of Things has not only driven operational efficiencies but also spawned novel service models, such as pay-per-acre mowing and outcome-based contracts, which recalibrate traditional procurement and ownership frameworks. As stakeholder expectations pivot toward integrated, data-driven solutions, the imperative for agility and innovation in product development and after-sales support has never been more pronounced.

Assessing the Strategic Ramifications of 2025 United States Tariff Measures on the Commercial Lawn Mower Industry Supply Chains and Costs

In 2025, newly enacted United States tariffs on imported engine components and battery modules have exerted multifaceted effects on the commercial lawn mower industry’s cost structure and supply chain resilience. Manufacturers that rely on global sourcing have experienced material cost escalations, driving them to evaluate alternative procurement strategies, renegotiate supplier contracts, and consider near-shoring critical component fabrication. The cumulative impact of these trade measures has also catalyzed a reassessment of product portfolios, as price sensitivity among end users-particularly cost-conscious municipalities and small-to-medium landscaping services-has intensified.

To mitigate tariff-driven inflation, several OEMs have accelerated vertical integration initiatives, securing ownership stakes or long-term agreements with key battery and engine suppliers. Others have invested in engineering efforts to redesign modules for domestic production or to qualify alternative powertrain options that circumvent tariff thresholds. These strategic responses underscore the industry’s adaptability in the face of evolving policy landscapes and illustrate how proactive supply chain reconfiguration can safeguard margins while preserving competitiveness in price-sensitive segments.

Illuminating Core Market Segments and Product Preferences Driving Commercial Lawn Mower Demand Across Diverse End User Profiles

Deepening our comprehension of market drivers requires a granular understanding of the core product and powertrain variations that define buyer preferences. Commercial operators gravitate toward zero-turn mowers for expansive parks and sports fields due to their superior maneuverability; within this segment, both sit-on and stand-on configurations address diverse terrain and operator comfort requirements. Riding mowers, spanning garden tractors to lawn tractors, continue to appeal to service providers managing mixed-use estates where versatility and durability command premium value. Walk-behind mowers-available in push and self-propelled variants-satisfy niche applications such as tight perimeters and intricate landscape features, while hover mowers find specialized use in sloped regions where ground-conformity is critical. Robotic mowers, differentiated into commercial and residential models, are disrupting the maintenance paradigm with their programmable routines and low-noise footprints, resonating with customers who prioritize labor efficiency and environmental sensibility.

Complementing product distinctions, the source of power emerges as a defining factor in purchase decisions. Battery-powered models, encompassing lead-acid and advanced lithium-ion chemistries, are gaining traction for their zero-emission operation, although they demand robust charging infrastructure and battery management protocols. Diesel variants, whether naturally aspirated or turbocharged, sustain their stronghold in high-output scenarios where runtime endurance and torque delivery are paramount. Gasoline engines, optimized for either two-stroke or four-stroke cycles, balance acquisition cost and performance, making them a versatile choice for mid-range applications. Hybrid platforms, integrating both diesel-electric and gas-electric technologies, present compelling value propositions by blending fuel efficiency with extended operational windows, catering to operators who require both power and economy.

The end user landscape further nuances market dynamics, with commercial landscaping firms driving volume demand while educational institutions and sports facility managers emphasize safety, noise abatement, and compliance with campus regulations. Municipal governments allocate expenditures across parks and recreation as well as public works departments, each with distinct procurement cycles and maintenance objectives. Golf course operators-whether public or private-often collaborate closely with OEMs to customize mower fleets that preserve turf health and deliver consistent performance across fairways and greens. This multifaceted segmentation insight informs product roadmap prioritization and targeted go-to-market strategies, ensuring alignment with the unique drivers influencing each customer cohort.

This comprehensive research report categorizes the Commercial Lawn Mower market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Power Source

- Engine Type

- Blade Type

- End User

- Distribution Channel

Comparative Analysis of Regional Demand Drivers and Adoption Trends for Commercial Lawn Mowers Across Key Global Markets

Examining the commercial lawn mower market through a geographic lens reveals stark contrasts in technology adoption, regulatory environments, and service requirements. In the Americas, a mature maintenance services sector and robust rental networks have accelerated uptake of zero-emission solutions, particularly in urban centers with stringent noise ordinances. Regional OEMs are leveraging domestic manufacturing footprints to shorten lead times and capitalize on near-shoring advantages, responding swiftly to shifts in municipal procurement policies and private contract demand.

Across Europe, Middle East, and Africa, regulatory frameworks emphasizing carbon reduction and water conservation have incentivized the switch to battery-operated and robotic platforms. OEMs in Western Europe are pioneering modular product designs that facilitate rapid customization, while emerging markets in the Middle East and Africa prioritize engine robustness and fuel resilience due to challenging operating conditions. These divergent focal points underscore the necessity for adaptable product families that can be calibrated to local standards and performance expectations.

In the Asia-Pacific region, the confluence of rapid urbanization and expanding recreational infrastructure has stoked demand for high-capacity ride-on mowers and hybrid powertrains. Manufacturers are forging partnerships with local distributors to navigate complex regulatory landscapes and bolster after‐sales service networks. Meanwhile, the region’s growing emphasis on smart city initiatives has elevated interest in connected maintenance solutions and autonomous mowing fleets, positioning Asia-Pacific as both a manufacturing hub and a dynamic growth frontier.

This comprehensive research report examines key regions that drive the evolution of the Commercial Lawn Mower market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers and Strategic Alliances Shaping Competitive Dynamics in the Commercial Lawn Mower Sector

Competitive dynamics in the commercial lawn mower sector are shaped by a blend of legacy OEMs, emerging technology innovators, and strategic partnerships. Established manufacturers are fortifying their market positions by expanding electrification roadmaps and offering comprehensive service agreements that include remote diagnostics and predictive maintenance. Meanwhile, specialized technology firms are entering the fray with user-friendly robotic platforms and AI-driven fleet management software, prompting incumbents to forge alliances or pursue targeted acquisitions to integrate advanced capabilities.

Cross-industry collaborations are also redefining the competitive landscape. Engine specialists are aligning with battery system providers to co-develop hybrid powertrains that meet rigorous performance standards, while mapping and sensor technology companies partner with mower manufacturers to create precision-guidance packages. These synergistic initiatives not only accelerate time-to-market for next-generation products but also enable OEMs to differentiate through holistic solutions that extend beyond mere hardware.

As a result, the lines between pure equipment suppliers and full-service solution providers are blurring. Key players are investing in digital platforms that bundle equipment rental, usage analytics, and outcome-based contracting, reflecting a broader shift toward integrated service ecosystems. This evolving competitive paradigm underscores the importance of agility, R&D investment, and customer-centric business models for organizations seeking to maintain leadership in an increasingly crowded marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Lawn Mower market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGCO Corporation

- AL-KO Geräte GmbH

- Andreas Stihl Pvt Ltd.

- AriensCo

- Bad Boy Mowers

- Bobcat Company by Doosan Group

- Briggs & Stratton, LLC

- EGO POWER

- Einhell Germany AG

- Greenworks North America, LLC

- Honda Motor Co., Ltd.

- Husqvarna AB

- iRobot Corporation

- Jacobsen by Textron Inc.

- John Deere Group

- Kubota Corporation

- Lastec LLC

- Makita Corporation

- Mamibot Manufacturing USA

- Masport Industries Limited

- Positec Tool Corporation

- Robert Bosch GmbH

- SCAG Power Equipment

- Stanley Black & Decker, Inc.

- Stiga S.p.A.

- Swisher Inc.

- The Toro Company

- Yamabiko Corporation

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Operational Challenges in the Commercial Lawn Mower Market

In response to evolving market demands and external pressures, industry leaders must adopt a multi-pronged strategic approach to sustain growth and build resilience. First, accelerating investment in modular battery and hybrid powertrain platforms will future-proof product portfolios against tightening emissions regulations and volatile fuel prices. By establishing robust partnerships with technology suppliers early in the development cycle, OEMs can secure preferential access to cutting-edge components and co-create differentiated offerings that resonate with eco-conscious customers.

Second, diversifying supply chains and exploring near-shoring or on-shoring options for critical components will mitigate tariff exposure and reduce lead times. Manufacturers should conduct comprehensive supplier risk assessments, implement dual-sourcing strategies, and explore local assembly arrangements to enhance operational agility. Third, deepening after-sales engagement through predictive maintenance services and outcome-based contracting can unlock new revenue streams while fostering long-term customer loyalty. Deploying cloud-enabled diagnostics platforms and training distributor networks to leverage real-time performance data will underpin these value-added offerings.

Finally, cultivating strategic partnerships with commercial landscaping services, educational institutions, and government agencies can yield co-innovation opportunities and early adoption pathways for novel technologies. By engaging in targeted pilot programs and offering tailored financing options, equipment providers can accelerate market acceptance of advanced mower platforms and establish themselves as trusted advisors. This combination of product innovation, operational excellence, and collaborative engagement forms the blueprint for sustained success in a dynamic market environment.

Comprehensive Research Framework Integrating Qualitative Interviews and Quantitative Analysis for Robust Commercial Lawn Mower Market Insights

This report leverages a rigorous mixed‐methods research framework to ensure the integrity and relevance of its insights. Secondary research involved a thorough review of public regulatory filings, environmental standards documentation, patent databases, trade associations publications, and specialist periodicals covering landscaping equipment trends. This foundational desk research established the structural context and informed the development of detailed interview guides.

Primary research comprised 30 in‐depth interviews with senior executives from leading OEMs, component suppliers, maintenance service providers, and large‐scale end users, including municipal parks departments and elite golf course operators. These conversations focused on procurement processes, technology adoption roadmaps, and strategic imperatives, enabling the triangulation of perspectives across the value chain. Quantitative validation was achieved through structured surveys with over 200 decision-makers in landscaping firms and facility management organizations, ensuring statistical robustness and cross-segment representativeness.

Data synthesis and analysis employed advanced analytical tools to identify patterns, correlations, and emerging themes, with iterative feedback loops to refine key findings. Quality assurance measures, including inter-review and consistency checks, were conducted at each stage to uphold methodological rigor. This combination of qualitative depth and quantitative breadth underpins the report’s strategic recommendations and forward-looking insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Lawn Mower market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Lawn Mower Market, by Product Type

- Commercial Lawn Mower Market, by Power Source

- Commercial Lawn Mower Market, by Engine Type

- Commercial Lawn Mower Market, by Blade Type

- Commercial Lawn Mower Market, by End User

- Commercial Lawn Mower Market, by Distribution Channel

- Commercial Lawn Mower Market, by Region

- Commercial Lawn Mower Market, by Group

- Commercial Lawn Mower Market, by Country

- United States Commercial Lawn Mower Market

- China Commercial Lawn Mower Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Synthesis of Critical Insights and Strategic Imperatives Guiding the Future Trajectory of the Commercial Lawn Mower Landscape

Synthesizing the critical insights reveals that the commercial lawn mower industry is at a pivotal juncture, where technological innovation, policy dynamics, and nuanced customer requirements converge to shape the competitive playing field. The acceleration of electrification and automation underscores a broader shift toward service-oriented business models, while regional variations in regulatory and operational contexts demand tailored approaches to product development and market entry.

Moreover, the 2025 tariff landscape has underscored the value of supply chain agility and the strategic necessity of localizing component production. Simultaneously, the granular segmentation analysis highlights the importance of aligning product features and powertrain options with the distinct use cases and performance parameters that define buyer decisions across each end-user category. As legacy OEMs, technology disruptors, and service providers navigate an increasingly complex ecosystem, the ability to forge strategic partnerships and cultivate after-sales engagement will differentiate market leaders from followers.

In this environment, organizations that adopt a holistic approach-integrating advanced propulsion platforms, data-driven service models, and resilient supply chain architectures-will be best positioned to capture value. By leveraging the insights presented across these sections, executives can formulate strategies that address immediate operational challenges while laying the foundation for sustained innovation and market growth.

Accelerate Market Leadership with Expert Guidance from Our Sales & Marketing Specialist to Secure the Commercial Lawn Mower Report

Unlock unparalleled insights and actionable strategies tailored to your organization’s objectives by securing the comprehensive commercial lawn mower market research report from our team. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore customized licensing options, volume discounts, and detailed deliverables that align with your strategic roadmap. This collaboration will empower you with the granular market intelligence and expert advisory needed to outpace competitors, optimize your product portfolio, and make data-driven investments. Don’t miss this opportunity to translate in-depth analysis into measurable business growth; connect with our sales and marketing leadership today to initiate the process and access the full depth of research findings.

- How big is the Commercial Lawn Mower Market?

- What is the Commercial Lawn Mower Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?