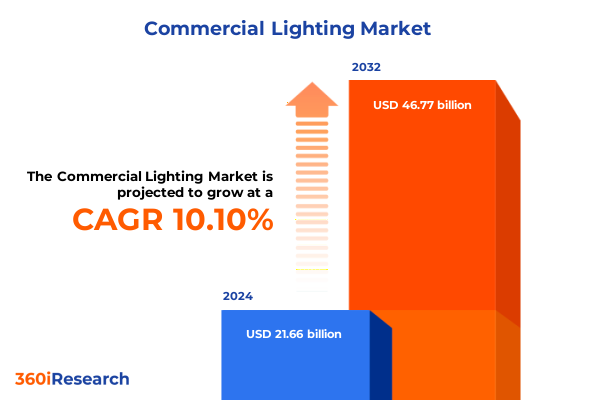

The Commercial Lighting Market size was estimated at USD 23.77 billion in 2025 and expected to reach USD 26.09 billion in 2026, at a CAGR of 10.15% to reach USD 46.77 billion by 2032.

Shaping the Future of Commercial Lighting Through Dynamic Stakeholder Engagement, Regulatory Alignment, and Technological Innovation

Commercial lighting has transcended its foundational role of basic illumination to become an integral driver of energy efficiency, occupant well-being, and operational excellence across multiple industry verticals. Technological breakthroughs in light-emitting diodes, networked controls, and adaptive lighting systems have redefined what lighting solutions can achieve, offering unprecedented opportunities to reduce costs, enhance safety, and support sustainability agendas. Simultaneously, tightening regulatory frameworks around energy consumption and carbon footprints have elevated commercial lighting to a strategic imperative for facility managers and C-suite leaders alike.

As organizations worldwide accelerate their digital transformation journeys, lighting infrastructures are evolving into platforms for data collection and analytics, enabling smarter building management through integrated sensors and wireless connectivity. This intersection of hardware innovation and software intelligence underscores the critical need for stakeholders to understand the multifaceted drivers reshaping the market. Building on these core dynamics, the ensuing analysis delves into transformative shifts, policy impacts, segmentation nuances, and region-specific insights that together chart the future trajectory of commercial lighting.

Unveiling the Pivotal Shifts Redefining Commercial Lighting with Smart Controls, Energy Efficiency, and Sustainability Imperatives

In recent years, the commercial lighting sector has undergone sweeping transformations propelled by three converging forces: the rapid decline in LED system costs, the proliferation of smart building ecosystems, and growing environmental mandates. Once‐dominant fluorescent and HID technologies have ceded market presence to high‐efficacy LEDs, while the integration of digital controls has enabled customizable, data-driven lighting strategies that optimize energy use and maintenance schedules. Meanwhile, end‐users are demanding that lighting infrastructures serve dual purposes as occupant comfort enhancers and operational intelligence hubs, effectively redefining service expectations across the value chain.

Transitioning from legacy solutions to adaptive, IoT-enabled lighting platforms has required new competencies in systems integration, cybersecurity, and data analytics. At the same time, procurement and specification processes have shifted from transactional fixtures and lamp orders to holistic lighting ecosystems encompassing hardware, software, and managed services. This evolution reflects a broader industry reorientation toward service-based models, with manufacturers, distributors, and integrators collaborating to deliver end-to-end solutions that drive sustainability targets and deliver quantifiable return on investment.

Assessing the Far-Reaching Effects of Recent United States Tariffs on Commercial Lighting Supply Chains and Cost Structures in 2025

The imposition of additional duties on imported lighting components and fixtures in early 2025 has reverberated across the commercial lighting supply chain, elevating raw materials and finished product costs for many end-users. Manufacturers reliant on offshore production have faced margin compression and navigated complex customs compliance requirements, while distributors have restructured pricing strategies to mitigate near-term cost increases. As a result, many stakeholders have accelerated efforts to localize manufacturing footprints and establish strategic inventory buffers to maintain service continuity.

Longer term, the tariff landscape has incentivized innovation in product design and materials sourcing to offset duty‐induced price escalations. Companies are exploring alternative alloys, polymer composites, and modular assembly approaches to reduce dependency on high‐tariff imports. In parallel, a growing emphasis on vendor diversification and nearshoring has realigned procurement strategies toward domestic or regional suppliers capable of delivering on shorter lead times and predictable cost structures. This strategic rebalancing underscores how policy shifts can catalyze resilience and foster new competitive advantages within the commercial lighting ecosystem.

Analyzing Market Segmentation Trends Across Products, Technologies, Installations, Applications, End-Use Scenarios, and Distribution Channels in Commercial Lighting

Diverse product offerings underscore the commercial lighting market’s complexity, where fixtures ranging from recessed downlights to high-bay luminaires coexist with specialized troffers and wall-pack solutions, all complemented by an array of lamp types tailored to specific performance metrics. Parallel to this product spectrum, technology adoption spans conventional fluorescent and HID systems while LEDs continue their ascendancy, driven by superior efficacy and longer operating lifespans. Installation preferences further segment the landscape, with new construction projects prioritizing integrated smart lighting platforms even as retrofit initiatives target rapid payback through LED upgrades and networked controls.

Applications vary widely across architectural and hospitality environments seeking both aesthetic appeal and guest comfort, educational and healthcare facilities demanding precise visual conditions, office spaces optimizing worker productivity, and outdoor deployments in parking lots or street corridors emphasizing safety and durability. End-use contexts bifurcate into indoor settings requiring tailored beam distributions and color temperatures, and outdoor scenarios where environmental ruggedness and energy efficiency are paramount. Meanwhile, distribution pathways have diversified beyond traditional direct‐sales and distributor networks to include online channels that cater to rapid procurement cycles and provide digital tools for specification and installation support.

This comprehensive research report categorizes the Commercial Lighting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Installation Type

- Application

- End-use

- Distribution Channel

Exploring Regional Market Dynamics and Growth Patterns Across Americas, Europe Middle East Africa, and Asia-Pacific Commercial Lighting Sectors

In the Americas, regulatory incentives such as energy rebates and stringent building codes have propelled LED retrofits and incentivized the adoption of sophisticated control systems for both new and existing facilities. Stakeholders in North America particularly have shown a strong propensity toward integrated lighting as a service models, recognizing the dual benefits of off-balance-sheet financing and guaranteed performance outcomes. Latin American markets are increasingly investing in infrastructure modernization, driven by urbanization and smart city pilots that leverage lighting networks for public safety and data analytics.

Across Europe, the Middle East, and Africa, ambitious carbon reduction targets and EU eco-design regulations have created fertile ground for advanced lighting solutions that deliver both compliance and operational savings. In many GCC countries, large-scale developments are integrating intelligent lighting as part of smart campus and smart city initiatives. Elsewhere in Africa, electrification projects and solar-powered lighting continue to advance economic development goals while prompting manufacturers to innovate for robustness and low-maintenance in challenging environments.

The Asia-Pacific region remains a critical growth engine, as rapid urban expansion in China, India, and Southeast Asia drives demand for scalable lighting platforms in commercial and public infrastructure. Digital transformation initiatives across major APAC economies are catalyzing interest in connected lighting networks that support occupant analytics, indoor positioning, and facility management, positioning the region at the leading edge of the next generation of lighting innovation.

This comprehensive research report examines key regions that drive the evolution of the Commercial Lighting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Competitive Strategies and Innovation Trajectories of Leading Players in the Global Commercial Lighting Ecosystem

Leading commercial lighting companies are advancing comprehensive strategies to capture value across hardware, software, and services. A prominent global pioneer has leveraged its heritage in incandescent and fluorescent systems to build a robust LED portfolio augmented by cloud-based asset management and analytics platforms. This firm has further solidified its leadership through strategic acquisitions in the connected lighting space, enhancing its end-to-end ecosystem capabilities.

A North American industry stalwart has diversified its offerings by integrating human-centric lighting research into product development, emphasizing circadian-rhythm-supportive spectra and dynamic controls. This organization’s robust channel network and customized engineering services have bolstered its presence in large-scale commercial and institutional projects. Meanwhile, a major European player renowned for precision optics and specialized luminaires continues to expand its footprint in high-end architectural and retail segments, underpinned by partnerships with leading design firms.

Regional champions and emerging entrants alike are differentiating through circular economy initiatives, including fixture recycling programs and take-back schemes, to address sustainability mandates. Across the competitive landscape, collaboration with technology providers and system integrators is becoming a critical success factor, enabling manufacturers to deliver seamless implementation and recurring revenue models that align with evolving customer expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Lighting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Acuity Brands, Inc.

- Eaton Corporation plc

- Fagerhult Group AB

- Hubbell Incorporated

- Legrand S.A.

- NVC Lighting Technology Co., Ltd.

- OSRAM Licht AG

- Panasonic Holdings Corporation

- Schneider Electric SE

- Signify N.V.

- Zumtobel Group AG

Driving Business Success with Actionable Strategies for Supply Chain Resilience, Digital Transformation, and Customer Engagement in Lighting

Industry leaders should prioritize the integration of advanced lighting controls with building management systems to unlock operational efficiencies and real-time performance insights. By embedding sensors and leveraging data analytics, organizations can transition from fixed scheduling to occupancy- and daylight-responsive lighting schemes that optimize energy use without compromising occupant comfort. Furthermore, establishing strategic partnerships with technology integrators will streamline deployment and accelerate time-to-value while mitigating cybersecurity risks associated with connected devices.

To counter persistent supply chain disruptions and tariff pressures, businesses must diversify supplier bases and evaluate nearshoring opportunities that offer greater cost predictability and lead-time reliability. Simultaneously, investing in modular design principles and standardizing components across product lines can simplify manufacturing processes and foster economies of scale. On the go-to-market front, companies should develop service-based offerings-such as performance-based lighting contracts-that align incentives with end-user outcomes, unlocking recurring revenue streams and strengthening customer loyalty.

Detailing Robust Research Methodologies Employed for Generating Accurate Commercial Lighting Market Insights and Analysis

Our research framework combines extensive primary interviews with C-level executives, facility managers, and procurement specialists, alongside rigorous secondary analysis of technical whitepapers, regulatory filings, and industry publications. This hybrid approach ensures that insights reflect both frontline operational realities and broader market trends. Data triangulation techniques cross-validate quantitative findings with qualitative perspectives, offering a robust foundation for strategic recommendations.

In addition, we employ scenario planning to assess the potential impact of regulatory shifts, technological breakthroughs, and geo-economic factors on market evolution. Expert panels comprising lighting designers, energy consultants, and systems integrators provide iterative feedback loops that refine assumptions and address emerging uncertainties. This methodological rigor ensures transparent, replicable outcomes that stakeholders can confidently leverage in investment appraisals, product roadmaps, and policy advocacy efforts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Lighting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Lighting Market, by Product Type

- Commercial Lighting Market, by Technology

- Commercial Lighting Market, by Installation Type

- Commercial Lighting Market, by Application

- Commercial Lighting Market, by End-use

- Commercial Lighting Market, by Distribution Channel

- Commercial Lighting Market, by Region

- Commercial Lighting Market, by Group

- Commercial Lighting Market, by Country

- United States Commercial Lighting Market

- China Commercial Lighting Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Summarizing Core Insights and Strategic Imperatives to Navigate the Evolving Commercial Lighting Marketplace Effectively

As the commercial lighting industry continues its shift toward digital, service-oriented, and sustainability-driven models, stakeholders must adapt to multifaceted market pressures and emerging opportunities. The convergence of LED innovation, smart controls, and regulatory incentives creates a dynamic environment where speed to market and strategic agility are paramount. Simultaneously, tariff-induced supply chain realignments underscore the importance of resilient procurement strategies and modular product architectures.

Decision-makers equipped with granular segmentation insights and region-specific intelligence will be best positioned to capitalize on growth pockets while mitigating downside risks. By aligning competitive positioning with emerging end-user demands for human-centric and data-powered lighting solutions, companies can forge long-term partnerships and capture recurring revenue streams. Ultimately, navigating this complex landscape requires a clear understanding of core market drivers, rigorous methodological underpinnings, and decisive action plans that prioritize innovation, efficiency, and sustainability.

Seize Strategic Intelligence on Commercial Lighting Markets Today—Connect with Ketan Rohom to Secure Your Definitive Research Report

To gain comprehensive clarity on emerging commercial lighting trends and secure the competitive edge in a rapidly evolving market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, who can guide you through the full breadth of our in-depth research offering. Our team stands ready to provide tailored briefings, detailed sample chapters, and bespoke consultancy support that align with your strategic objectives and operational priorities. Engage with an expert liaison to discuss customized data packages, licensing options, and enterprise-wide access models designed to empower your organization’s decision-making and investment roadmaps. Seize this opportunity to transform industry insights into actionable plans that will shape your lighting strategies for years to come.

- How big is the Commercial Lighting Market?

- What is the Commercial Lighting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?