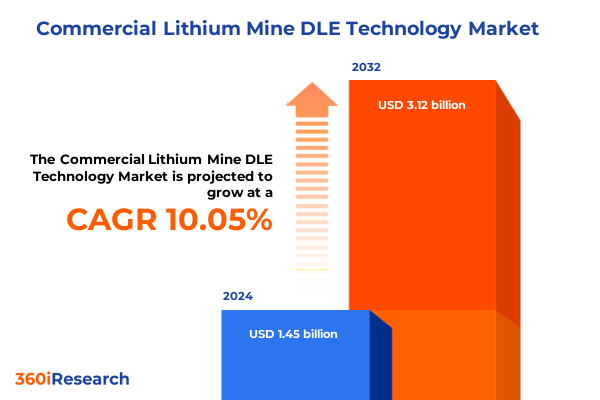

The Commercial Lithium Mine DLE Technology Market size was estimated at USD 1.54 billion in 2025 and expected to reach USD 1.71 billion in 2026, at a CAGR of 10.52% to reach USD 3.12 billion by 2032.

Unveiling Direct Lithium Extraction’s Transformative Potential in Commercial Lithium Mining to Secure Domestic Critical Mineral Supply Chains

The advent of direct lithium extraction represents a paradigm shift in how lithium resources are harnessed, addressing both environmental imperatives and supply chain vulnerabilities. Unlike traditional evaporation pond methods that rely on lengthy processing cycles and extensive land use, DLE leverages advanced chemical and physical processes to isolate lithium directly from brine in a fraction of the time. This rapid approach not only reduces water consumption but also significantly diminishes the ecological footprint associated with lithium production. As the U.S. grapples with strategic dependency on foreign lithium sources, domestic projects in regions such as Arkansas’s Smackover Formation have demonstrated the potential to fulfill local demand while fostering energy security and economic development.

Navigating the Transformative Shifts Redefining the Commercial Lithium Extraction Landscape from Brine to Battery-Ready Materials

The landscape of lithium extraction is experiencing transformative shifts driven by technological advancements, evolving regulatory frameworks, and strategic geopolitical realignment. On the technology front, innovation in ion exchange, adsorption, membrane separation, and solvent extraction techniques has accelerated commercialization readiness, yielding faster recovery rates and improved selectivity even in brines with high impurity levels. Concurrently, policy initiatives at both federal and state levels are incentivizing onshore development through grants, tax credits, and streamlined permitting, thereby amplifying investment activity. Geopolitically, market participants are diversifying resource portfolios to mitigate concentration risks, as global players seek to balance supply chains previously dominated by a handful of refining hubs. These intersecting trends underscore a new era in which commercial viability is increasingly contingent upon integrated strategies that combine cutting-edge technology with robust policy support and diversified resource sourcing.

Assessing the Cumulative Impact of 2025 U.S. Trade Tariffs on Lithium Extraction and Battery Supply Chains Amid Policy Shifts

Throughout 2025, U.S. trade policy has introduced a layered array of tariffs that collectively influence the economics of lithium extraction and downstream battery production. Under recent policy changes, lithium-ion EV batteries and key battery components saw tariff rates rise from 7.5% to 25%, while non-EV battery products will follow suit by 2026. Natural graphite and permanent magnets transitioned from zero to 25% tariffs, and a broader universal import tax introduced in April 2025 applies a 10% duty on all goods except critical minerals, preserving exemptions for lithium and its raw materials. The cumulative effect of these measures has been to fortify domestic manufacturing incentives while simultaneously raising import costs for finished battery products. Consequently, stakeholders are recalibrating supply chains: raw lithium is increasingly sourced domestically to capitalize on tariff exemptions, while value-added processing and cell assembly are being repatriated to avoid punitive duties. These dynamics reaffirm the strategic importance of integrated DLE operations that can deliver battery-grade material within the U.S. without incurring layered tariff burdens.

Decoding Key Market Segmentation Across Products, Applications, Technologies, and End Users Driving Lithium DLE Adoption

Analyzing market segmentation through the lenses of product, application, technology, and end user reveals nuanced adoption patterns and value creation opportunities. Within product categories, lithium carbonate remains a staple for traditional cathode manufacturing, lithium chloride is gaining traction for modular DLE systems with rapid cycle capabilities, and lithium hydroxide is prioritized where high-purity requirements intersect with aggressive performance targets. Application-driven demand shows electric vehicles leading investment in high-throughput extraction systems, grid energy storage catalyzing mid-scale deployments that emphasize cost efficiency, and portable electronics sustaining niche deployments that prioritize compact, modular processing units. Technological segmentation highlights adsorption workflows-spanning activated alumina beds to advanced metal-organic frameworks-as versatile platforms for low-impurity brines, while ion exchange resins, both strong acid and strong base variants, address variable brine compositions with high selectivity. Membrane separation techniques, including nanofiltration and reverse osmosis, offer scalable thin-film modules, and solvent extraction chemistries based on organophosphate or versatic acid ligands enable fine-tuned purification. End users span battery manufacturers-ranging from established lithium-ion producers to emerging solid-state developers-and chemical companies, from industrial chemical giants to specialty firms seeking to integrate battery material streams into broader value chains.

This comprehensive research report categorizes the Commercial Lithium Mine DLE Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Application

- End User

Comparative Regional Analysis Highlighting Strategic Opportunities for DLE Adoption in the Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in shaping the trajectory of direct lithium extraction, with each geographic market presenting distinct resource characteristics and policy environments. In the Americas, significant brine formations in the United States and Latin America benefit from supportive legislative frameworks, enabling rapid pilot programs that leverage existing oilfield infrastructure. Meanwhile, Europe, the Middle East & Africa are consolidating diverse brine and hard-rock projects, underpinned by rigorous environmental standards and renewable energy integration mandates that reinforce DLE’s ESG credentials. Asia-Pacific stands as the largest consumption hub, driven by a mature battery manufacturing ecosystem and aggressive electrification targets, yet faces raw material security pressures that are spurring local exploratory ventures. Within these regions, collaborative consortia-formed between governments, producers, and technology developers-are accelerating pilot deployments, optimizing resource throughput, and fostering knowledge transfer to ensure scalable operations that align with regional strategic imperatives.

This comprehensive research report examines key regions that drive the evolution of the Commercial Lithium Mine DLE Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Future of Direct Lithium Extraction Technology

An elite cohort of innovators and established energy conglomerates is steering the evolution of commercial DLE technologies. Major oil and gas incumbents have repurposed subsurface expertise to advance brine-based extraction, while mining majors leverage global asset portfolios to deploy modular DLE plants at scale. Simultaneously, agile technology startups are pushing the boundaries of sorbent and membrane chemistries, securing strategic partnerships with engineering firms to navigate pilot-to-commercial transitions. Collaboration between automotive OEMs and DLE specialists is forging offtake agreements that underwrite capital-intensive demonstrations, and alliances with renewable energy providers are optimizing power inputs to reduce operational carbon footprints. This multifaceted landscape underscores a convergence of competencies-ranging from geological modeling and chemical engineering to digital process control-that is essential for commercial success. Investors and strategic partners are closely tracking pre-commercial performance metrics, technology readiness assessments, and joint venture announcements to identify high-conviction opportunities in the competitive DLE ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Lithium Mine DLE Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albemarle Corporation

- Contemporary Amperex Technology Co., Limited

- Cornish Lithium Plc

- E3 Lithium Ltd.

- ElectraLith Pty Ltd

- Energy Exploration Technologies, Inc.

- Equinor ASA

- Ganfeng Lithium Co., Ltd.

- International Battery Metals, Inc.

- KMX Technologies, Inc.

- Lilac Solutions Limited

- Occidental Petroleum Corporation

- Pure Energy Minerals Ltd.

- Rio Tinto plc

- Schlumberger Limited

- Standard Lithium Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Summit Nanotech Inc.

- Tetra Technologies, Inc.

- Vulcan Energy Resources Limited

Strategic Imperatives for Industry Leaders to Accelerate Commercial Viability and Sustainable Growth in Lithium DLE

To navigate the complexities of commercial DLE implementation, industry leaders should prioritize rigorous pilot validation that integrates site-specific brine profiling with tailored process flowsheets, thereby minimizing scale-up risks. It is advisable to cultivate cross-sector partnerships that align technology developers with offtake customers and regulatory bodies early in the project lifecycle, ensuring seamless permitting and demand-side commitments. Allocating dedicated R&D funds toward advanced sorbent materials and next-generation membrane platforms will bolster recovery efficiencies and cycle durability. Moreover, integrating renewable energy sources and closed-loop water management systems can significantly enhance ESG performance, attracting premium financing and stakeholder support. Finally, adopting a modular, phased deployment strategy can accelerate time-to-first-commercial-lithium while preserving optionality for technology upgrades as new chemistries and digital control solutions emerge.

Comprehensive Research Methodology Ensuring Rigorous Analysis of Commercial DLE Technologies and Market Dynamics

Our analysis synthesizes both primary and secondary research methodologies to deliver robust insights into the commercial DLE landscape. Primary research involved in-depth interviews with industry veterans, technology providers, and leading battery manufacturers to capture firsthand perspectives on operational challenges and scalability thresholds. Secondary data collection encompassed technical white papers, peer-reviewed journals, regulatory filings, and patent analyses to validate process innovations and competitive positioning. We employed a triangulation approach to cross-verify data points, leveraging multiple sources to mitigate bias and ensure factual integrity. Additionally, technology readiness levels were assessed through detailed case studies of pilot projects, and strategic frameworks such as SWOT analysis and Porter’s Five Forces were applied to interrogate market dynamics. This methodological rigor underpins our comprehensive evaluation of DLE technologies, segmentation landscapes, and competitive imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Lithium Mine DLE Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Lithium Mine DLE Technology Market, by Product

- Commercial Lithium Mine DLE Technology Market, by Technology

- Commercial Lithium Mine DLE Technology Market, by Application

- Commercial Lithium Mine DLE Technology Market, by End User

- Commercial Lithium Mine DLE Technology Market, by Region

- Commercial Lithium Mine DLE Technology Market, by Group

- Commercial Lithium Mine DLE Technology Market, by Country

- United States Commercial Lithium Mine DLE Technology Market

- China Commercial Lithium Mine DLE Technology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesis of Direct Lithium Extraction Insights Consolidating the Path Forward for Sustainable Domestic Lithium Production

Direct lithium extraction stands at the nexus of technological ingenuity and strategic resource management, offering a pathway to sustainable, high-purity lithium production that aligns with global decarbonization objectives. As DLE projects advance from pilot to commercial scale, the interplay of innovation, regulatory support, and strategic partnerships will determine which stakeholders secure market leadership. The aggregated insights presented herein emphasize the importance of site-specific technology selection, cross-sector collaboration, and adaptive deployment strategies to navigate evolving tariff regimes and regional policy landscapes. Ultimately, the successful commercialization of DLE will not only bolster domestic supply chains but also catalyze new avenues for value creation across the battery ecosystem, affirming the technology’s role as a cornerstone of next-generation lithium production.

Drive Strategic Decisions with a Detailed Commercial Lithium Mine DLE Technology Report Available Through Ketan Rohom’s Expert Guidance

For in-depth insights and to secure a competitive advantage in the evolving direct lithium extraction market, reach out to Ketan Rohom. As Associate Director of Sales & Marketing, he can guide you through comprehensive market intelligence, tailored to inform strategic decision-making and accelerate your access to critical data. Engage with Ketan to explore bespoke research packages and unlock the full value of the commercial lithium mine DLE technology report. Elevate your strategic planning today by partnering with an expert who understands the intricacies of lithium extraction dynamics and can drive actionable outcomes for your organization.

- How big is the Commercial Lithium Mine DLE Technology Market?

- What is the Commercial Lithium Mine DLE Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?