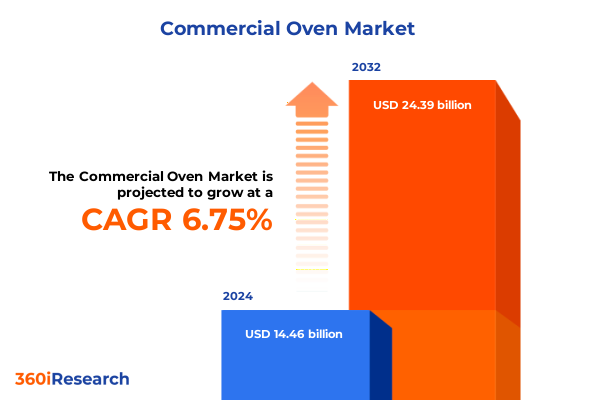

The Commercial Oven Market size was estimated at USD 15.38 billion in 2025 and expected to reach USD 16.36 billion in 2026, at a CAGR of 6.81% to reach USD 24.39 billion by 2032.

Exploring the Crucial Role of Commercial Ovens in Revolutionizing Foodservice Operations, Industrial Production, and Emerging Culinary Technologies

The commercial oven market stands at the intersection of culinary innovation, operational efficiency, and industrial performance. As foodservice operators, large-scale manufacturers, and hospitality providers strive to elevate quality while controlling costs, the selection and deployment of ovens have become strategic imperatives. In response to evolving consumer preferences and sustainability mandates, manufacturers are integrating digital control systems, energy-saving features, and modular designs into their offerings, enabling buyers to tailor configurations to specific production requirements.

This report opens by contextualizing the vital role that commercial ovens play across diverse applications, from high-volume bakery lines to specialty restaurant kitchens. Against a backdrop of globalization and supply chain pressures, stakeholders are increasingly prioritizing equipment that delivers consistency, minimizes downtime, and supports remote diagnostics. Moreover, tighter regulatory scrutiny on emissions and energy consumption has heightened the demand for appliances that align with ESG commitments without compromising throughput.

By framing these dynamics, the introduction sets the stage for a deeper exploration of the forces reshaping the industry. It underscores why equipment selection decisions now extend beyond simple functionality, encompassing total cost of ownership, integration with smart kitchen ecosystems, and resilience against trade policy headwinds.

How Digital Innovations, Sustainability Initiatives, and Evolving Culinary Trends Are Redefining the Commercial Oven Industry Landscape and Competitive Dynamics

Technological breakthroughs are redefining the commercial oven space, ushering in an era where connectivity, precision, and adaptability converge. Advanced sensor arrays and IoT-enabled controls have become standard features, empowering operators to monitor temperature profiles in real time and adjust cooking cycles remotely. Coupled with AI-driven data analytics, these innovations enable predictive maintenance that minimizes unplanned downtime, while also optimizing energy consumption through adaptive power modulation.

Concurrent shifts in consumer behavior are amplifying these trends. Demand for artisanal offerings and on-demand meal services has pushed kitchens to adopt ovens capable of multi-mode cooking, seamlessly alternating between convection, steam, and impingement. At the same time, sustainability considerations have driven suppliers to explore alternative heating technologies, such as infrared and induction, which promise faster recovery times and lower environmental footprints. Manufacturers are responding by launching hybrid platforms that integrate conventional heating elements with renewable energy compatibility, thus future-proofing installations.

These transformative shifts are not occurring in isolation. Partnerships between equipment producers, software developers, and service providers are proliferating, fostering ecosystems that deliver end-to-end capabilities-from cloud-based recipe libraries to automated cleaning sequences. As a result, the competitive landscape is intensifying, with legacy suppliers and disruptive entrants alike racing to capture share through differentiated solutions that address ever-more stringent operational and regulatory requirements.

Assessing the Comprehensive Economic and Operational Effects of 2025 United States Steel and Aluminum Tariffs on Commercial Oven Supply and Pricing

The introduction of heightened tariffs on steel and aluminum imports in 2025 has exerted profound pressure on commercial oven supply chains and pricing dynamics. Effective March 12, a 25% Section 232 tariff was reinstated on steel and aluminum commodities and subsequently escalated to 50% on June 23, targeting the metal content in appliances including cooking stoves, ranges, and ovens. This levy is assessed strictly on the proportion of steel or aluminum present in each unit, yet its impact extends to material sourcing, manufacturing overheads, and ultimately, end-user pricing.

Manufacturers have reported that this tariff expansion has driven immediate cost increases, prompting some to adjust list prices in mid-2025 ahead of seasonal procurement cycles. Historical precedents, such as the 2018 washing machine tariffs, illustrate how importers often pass higher duties onto buyers, contributing to inflationary pressures in foodservice operations. In parallel, industry participants faced with lingering stockpiles of pre-duty imports have engaged in accelerated purchasing to hedge against further rate hikes, temporarily buffering some of the cost transmission.

Over the longer term, the cumulative effect has encouraged a strategic pivot toward domestic production and alternative alloy sourcing. Several leading manufacturers have explored localized steel partnerships and cast iron substitutes to mitigate exposure, while also negotiating with suppliers for favorable pricing tiers. Despite these adjustments, analysts warn that middle-market operators may continue to confront elevated capital expenditures for oven acquisitions through 2025, emphasizing the importance of proactive tariff management and scenario planning.

In-Depth Analysis of Commercial Oven Market Segmentation Revealing Divergent Growth Drivers Across Key Product, Power, Size, End-User, and Distribution Categories

In examining the market through the lens of product category, convection ovens continue to command attention for their even heat distribution and efficiency in batch cooking, while combination ovens-offering steam and dry heat modes-have secured a premium position among operators seeking versatility. Conveyor ovens, engineered for high-throughput cooking lines, underscore the automation trend, whereas deck ovens maintain a loyal following in artisanal baking and pizza applications due to their direct-fired heat and customizable deck surfaces.

Power source segmentation reveals a clear dichotomy: electric-powered ovens gain footholds in urban centers where infrastructure supports high-energy draw and facilitates integration with renewable electricity, yet gas-powered units persist in regions with established natural gas networks, prized for rapid heat response and operational cost advantages. Regarding footprint, countertop and stackable designs address the space constraints of smaller outlets, whereas full-size configurations remain indispensable for large-scale production facilities.

End-user patterns highlight a bifurcation between food production facilities that prioritize throughput and standardized cooking profiles, and food service outlets such as hotels and restaurants, which demand aesthetic design and multi-functionality to support diverse menus. Distribution channels have likewise evolved; while traditional offline sales through dealerships and authorized distributors remain foundational for equipment installation services, online procurement platforms are gaining traction by streamlining the purchasing process and offering broader access to installation and maintenance contracts.

This comprehensive research report categorizes the Commercial Oven market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Category

- Power Source

- Size

- End-User

- Distribution Channel

Regional Dynamics Shaping the Commercial Oven Market Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Regions and Their Unique Drivers

The Americas region continues to leverage its mature foodservice infrastructure and strong domestic manufacturing capabilities, resulting in demand for high-capacity conveyor and combination ovens that support large-scale bakery and processing operations. Innovative financing models and equipment-as-a-service offerings further incentivize adoption across mid-market operators, while ongoing investments in kitchen automation sustain growth momentum in major metropolitan centers.

In Europe, Middle East & Africa, diverse regulatory environments and wide-ranging culinary traditions drive heterogeneity in product preferences-from deck ovens favored by artisanal bakeries in Western Europe to gas-powered units prevalent in the Middle East. Stricter emissions standards in the EU have accelerated the uptake of electric and hybrid heating technologies, with manufacturers tailoring solutions to comply with energy efficiency directives and support local content mandates.

Asia-Pacific demonstrates rapid modernizing of foodservice chains and industrial processing facilities, particularly in urbanized markets where rising consumer incomes spur demand for premium dining experiences. Here, multi-functional combi ovens with digital connectivity are gaining ground, while localized production hubs in China and Southeast Asia enhance supply chain resilience. Government incentives for manufacturing excellence and renewable energy integration further influence procurement decisions, underscoring the importance of regional customization in product development.

This comprehensive research report examines key regions that drive the evolution of the Commercial Oven market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Positioning, Innovation Pipelines, and Competitive Strategies of Leading Commercial Oven Manufacturers and Solution Providers

Leading equipment suppliers have intensified investments in R&D to secure competitive differentiation. Middleby Corporation and Welbilt, Inc. focus on modular designs and IoT platforms that facilitate remote monitoring and data-driven maintenance, enabling end users to minimize downtime and optimize energy consumption. Rational AG continues to pioneer multi-sensor combi oven technologies that automate cooking cycles for consistent food quality, while Ali Group’s diverse brand portfolio spans convection, conveyor, and high-speed microwave ovens designed to meet global performance standards.

Specialized manufacturers such as MKN and Henny Penny emphasize premium engineering and user-centric interfaces, catering to the demands of upscale hospitality and institutional kitchens. At the same time, Electrolux AB and Alto-Shaam, Inc. invest in sustainable heating innovations to align their product roadmaps with stringent environmental regulations. Meanwhile, niche players like Blodgett Oven Company sustain their market presence by offering heritage brands and customizable configurations valued by artisanal bakers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Oven market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ali Holding S.r.l.

- Alto-Shaam Inc.

- Breville Group Limited

- China Ashine

- Electrolux Group

- General Electric Company

- Guangdong Galanz Enterprises Co., Ltd.

- Henny Penny Corporation

- Hobart Corporation

- LG Electronics Inc.

- MECATHERM SAS

- Middleby Corporation

- Midea Group

- Orchard Ovens

- Panasonic Corporation

- Prática Klimaquip SA

- RATIONAL AG

- Sammic, S.A.

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Toshiba Corporation

- UNOX SpA

- Vulcan by ITW Food Equipment Group LLC

- Welbilt, Inc.

- Whirlpool Corporation

Proactive Strategies and Tactical Recommendations for Industry Leaders to Navigate Market Disruptions, Regulatory Challenges, and Innovation Imperatives in Commercial Ovens

To navigate tariff volatility and input cost pressures, industry leaders should establish diversified raw material supply agreements that balance domestic sourcing with strategic imports, thereby creating flexibility against sudden duty adjustments. Investing in advanced manufacturing capabilities, including metal additive processes and modular assembly lines, will further reduce dependence on high-cost materials and enable rapid product customization.

Stakeholders must also prioritize the integration of digital service models, such as subscription-based maintenance and performance analytics, which can generate recurring revenue streams and deepen customer engagement. By leveraging predictive maintenance algorithms and real-time diagnostics, equipment providers can preempt service disruptions and demonstrate tangible ROI to buyers.

Additionally, aligning product development roadmaps with sustainability frameworks-focusing on energy recovery systems, waste heat utilization, and low-emission heating technologies-will position companies to benefit from green procurement incentives and emerging carbon compliance requirements. Cross-industry collaborations with software developers and renewable energy firms can accelerate these initiatives and strengthen competitive moats.

Transparent Research Methodology Combining Primary Expert Interviews, Secondary Data Analysis, and Robust Validation to Ensure Unbiased Commercial Oven Market Insights

This study employs a mixed-methods research framework, integrating primary interviews with senior executives, product managers, and channel partners to capture firsthand perspectives on technology adoption, tariff impacts, and evolving buyer preferences. Discussions were conducted across North America, EMEA, and Asia-Pacific, ensuring diverse insights reflective of regional distinctions.

Secondary research sources include trade association publications, regulatory filings related to Section 232 steel and aluminum tariffs, and corporate financial disclosures to validate market drivers and competitive positioning. Proprietary data from supply chain audits and distribution channel analyses further informed segmentation and regional breakdowns.

Data triangulation techniques were applied to corroborate findings, while qualitative insights were tested through scenario modeling to anticipate potential industry shifts. Rigorous peer review by an external panel of industry experts ensured unbiased conclusions and actionable recommendations aligned with real-world business imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Oven market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Oven Market, by Product Category

- Commercial Oven Market, by Power Source

- Commercial Oven Market, by Size

- Commercial Oven Market, by End-User

- Commercial Oven Market, by Distribution Channel

- Commercial Oven Market, by Region

- Commercial Oven Market, by Group

- Commercial Oven Market, by Country

- United States Commercial Oven Market

- China Commercial Oven Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Insights Emphasizing the Critical Opportunities and Imperatives for Stakeholders in the Evolving Commercial Oven Industry Landscape

As the commercial oven industry pivots toward digitalization, sustainability, and resilience against trade policy shocks, stakeholders must remain agile in addressing operational, technological, and regulatory disruptions. The confluence of evolving culinary trends, advanced heating technologies, and tariff-related cost dynamics underscores the need for data-driven decision-making and strategic partnerships.

By embracing modular design principles, diversifying supply chains, and leveraging IoT-enabled service models, equipment providers and end users alike can unlock new efficiencies and revenue streams. Meanwhile, adherence to environmental standards and proactive tariff management will safeguard competitiveness in an increasingly complex global market.

Ultimately, success will hinge on the ability to integrate innovation with pragmatic operational practices, ensuring that commercial ovens not only meet current performance expectations but also adapt to emerging demands in the years ahead.

Empower Your Business Decisions with Comprehensive Commercial Oven Market Intelligence—Connect with Ketan Rohom to Unlock the Full Report

For those seeking a competitive edge in the commercial oven sector, comprehensive market intelligence is essential. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to gain immediate access to the full report that delivers actionable insights and strategic guidance. He will guide you through tailored solutions designed to optimize your investment decisions, navigate regulatory complexities, and leverage emerging trends. Reach out today to transform your operational planning with precision data and expert analysis.

- How big is the Commercial Oven Market?

- What is the Commercial Oven Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?