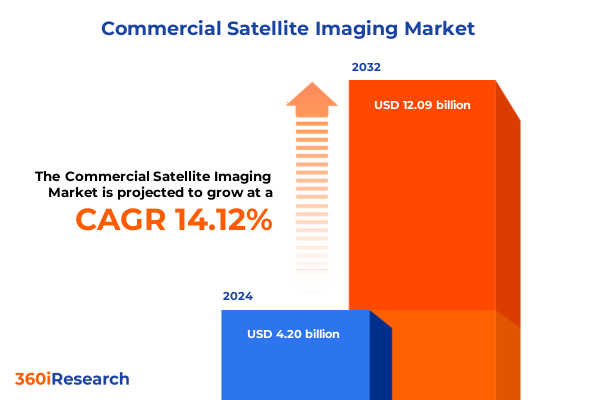

The Commercial Satellite Imaging Market size was estimated at USD 4.74 billion in 2025 and expected to reach USD 5.35 billion in 2026, at a CAGR of 14.31% to reach USD 12.09 billion by 2032.

Elevating Earth Observation Capabilities Through Advanced Commercial Satellite Imaging to Empower Decision Makers Across Industries and Accelerate Innovation

Elevating Earth Observation Capabilities Through Advanced Commercial Satellite Imaging to Empower Decision Makers Across Industries and Accelerate Innovation

Commercial satellite imaging has evolved into a cornerstone of modern decision-making, driving transformative outcomes across agriculture, environmental monitoring, defense, and infrastructure management. As the convergence of high-resolution sensors, expanded constellation architectures, and more affordable launch options continues, organizations are increasingly leveraging geospatial intelligence to optimize operations, mitigate risks, and uncover new revenue streams. The proliferation of private-sector imagery providers has disrupted traditional models, democratizing access to data that was once the exclusive domain of government agencies.

Against this backdrop, the demand for actionable insights derived from optical, hyperspectral, and radar imaging platforms has intensified. Stakeholders now require end-to-end solutions that extend beyond raw imagery, encompassing analytics, machine learning algorithms, and seamless integration with cloud-based processing environments. This executive summary introduces the fundamental drivers shaping the commercial satellite imaging landscape, outlines emerging challenges and opportunities, and establishes the strategic context for in-depth exploration of technology shifts, policy impacts, segmentation nuances, regional demand patterns, and actionable recommendations for industry leaders.

Disruptive Technological Advancements and Data Democratization Reshape Commercial Satellite Imaging to Unlock Horizons for Industry and Research Applications

Disruptive Technological Advancements and Data Democratization Reshape Commercial Satellite Imaging to Unlock Horizons for Industry and Research Applications

Over the past decade, the commercial satellite imaging landscape has been transformed by miniaturized sensors, more agile launch capabilities, and breakthroughs in on-board processing. High-performance computing at the edge now enables satellites to process data in real time, reducing latency and enabling near-instantaneous intelligence. Cloud-native architectures and open APIs have further democratized access, allowing developers and end users to build customized applications that harness vast archives of imagery alongside live feeds.

In parallel, advances in artificial intelligence and machine learning are unlocking new possibilities for automated feature extraction, change detection, and predictive analytics. These tools allow non-technical stakeholders to generate insights from complex datasets without deep expertise, while also enabling satellite operators to optimize collection schedules and calibrate sensors for maximum efficacy. As the ecosystem matures, collaboration among technology providers, analytics firms, and end-user communities will be critical to sustaining innovation and maximizing the value of geospatial intelligence.

Escalating United States Trade Tariffs in 2025 Trigger Strategic Reallocations and Supply Chain Adaptations in Commercial Satellite Imaging Ecosystem

Escalating United States Trade Tariffs in 2025 Trigger Strategic Reallocations and Supply Chain Adaptations in Commercial Satellite Imaging Ecosystem

The introduction of expanded trade tariffs by the United States government in early 2025 has prompted satellite manufacturers and service providers to reevaluate supplier relationships and component sourcing. As import duties on critical satellites subsystems and high-precision optics rose, many operators were compelled to diversify their supply chains, shifting production toward domestic vendors or tariff-exempt trading partners. This reconfiguration has introduced both challenges-in the form of initial cost escalations and lead-time constraints-and long-term opportunities through strengthened local alliances.

Moreover, providers of synthetic aperture radar and hyperspectral imaging payloads have accelerated their partnerships with academic institutions and defense laboratories to secure alternative processing hardware that mitigates tariff exposure. While these adaptations have preserved mission schedules, they have also underscored the importance of strategic procurement and risk management in a landscape shaped by shifting trade policies. Industry stakeholders now recognize the value of flexible sourcing strategies and ongoing compliance monitoring to ensure resilience against future regulatory changes.

Holistic Segmentation Framework Illuminates Modality Variations Resolution Classes Orbit Dynamics and Diverse Application Excellence in Satellite Imaging

Holistic Segmentation Framework Illuminates Modality Variations Resolution Classes Orbit Dynamics and Diverse Application Excellence in Satellite Imaging

Commercial satellite imagery is organized by the type of sensor modality, encompassing hyperspectral systems that capture both shortwave infrared and visible near-infrared bands, optical platforms differentiated into multispectral and panchromatic sensors, and synthetic aperture radar instruments operating in C-band, L-band, and X-band frequencies. Each modality addresses unique use cases, from precision agriculture’s spectral analysis to all-weather surveillance facilitated by radar penetrative capabilities. Such a nuanced breakdown of imaging technologies enables stakeholders to match sensor characteristics with their operational requirements, ensuring optimal data accuracy and revisit frequencies.

Further segmentation by spatial resolution class highlights the trade-offs between high-resolution imagery necessary for detailed facility mapping, medium-resolution data suited to land-cover classification, and low-resolution products designed for large-area monitoring. Orbit classification deepens this understanding, differentiating geostationary platforms from medium earth orbit relays and low earth orbit constellations-particularly those in inclined and sun-synchronous trajectories-thereby illuminating variations in revisit cycles and swath widths. Application-oriented segmentation spans critical domains such as agriculture, where crop health monitoring, irrigation management, and yield prediction benefit from spectral insights; defense operations, which depend on border security assessments, intelligence-surveillance-reconnaissance missions, and missile tracking; and environmental monitoring, encompassing climate change studies, deforestation surveillance, and pollution tracking.

This comprehensive research report categorizes the Commercial Satellite Imaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Imaging Modality

- Resolution Class

- Orbit Class

- Application Area

Regional Demand Divergence Reveals Distinct Priorities and Collaborative Opportunities across Americas Europe Middle East Africa and Asia Pacific Markets

Regional Demand Divergence Reveals Distinct Priorities and Collaborative Opportunities across Americas Europe Middle East Africa and Asia Pacific Markets

In the Americas, end users emphasize high-resolution optical and radar imagery to support precision farming, oil and gas exploration, and border security initiatives. Major agricultural operations leverage near-real-time spectral data to optimize irrigation scheduling and yield forecasts, while energy companies rely on synthetic aperture radar to detect infrastructure anomalies in remote regions. Conversely, in Europe, the Middle East, and Africa, demand has grown for environmental monitoring and infrastructure assessment, driven by regulatory mandates to track carbon emissions and maintain critical transport networks.

Asia Pacific stakeholders display unique priorities, with some governments investing heavily in earth observation for coastal risk mitigation amid rising sea levels and tropical cyclone monitoring. Simultaneously, private enterprises across the region pursue satellite-enabled resource mapping and maritime surveillance to enhance supply chain visibility. Despite these divergent needs, cross-regional collaborations are emerging, underpinned by shared interests in climate resilience, disaster response, and sustainable development.

This comprehensive research report examines key regions that drive the evolution of the Commercial Satellite Imaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players Drive Innovation Through Strategic Partnerships Technology Development and Differentiated Service Offerings in Satellite Imaging Space

Leading Industry Players Drive Innovation Through Strategic Partnerships Technology Development and Differentiated Service Offerings in Satellite Imaging Space

A small cohort of organizations has established themselves as frontrunners by scaling constellation deployments and fostering alliances with analytics and cloud service providers. These leaders have prioritized research and development around microsatellite platforms, enabling faster launch cadences and lower per‐unit costs. Partnerships with semiconductor firms have also yielded custom sensor designs, improving spectral fidelity and onboard processing power. Such collaborations underscore the industry’s shift toward ecosystem models, where imaging companies focus on core competencies while leveraging external expertise for data analysis and distribution.

At the same time, several innovators have differentiated their offerings by integrating artificial intelligence pipelines that deliver automated feature recognition, anomaly detection, and predictive insights directly through user interfaces. By coupling service-level agreements with end-to-end solutions-from tasking requests to analytics outputs-these organizations have created stickier product portfolios, effectively raising the barrier to entry for emerging competitors. Through ongoing investments in cloud infrastructure and geoportals, they continue to expand the accessibility and utility of geospatial intelligence for a broadening array of customers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Satellite Imaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Bhuvan Indian Geo-Platform

- BlackSky Global LLC

- Capella Space Corp.

- EOS Data Analytics, Inc.

- ICEYE Oyj

- ImageSat International

- L3Harris Technologies, Inc.

- Maxar Technologies Inc.

- MDA Ltd.

- Planet Labs PBC

- Satellogic Inc.

- SI Imaging Services Co., Ltd.

- Telespazio Group

Strategic Roadmap Outlining Actionable Steps for Stakeholders to Enhance Competitive Position Accelerate Innovation and Strengthen Operational Resilience

Strategic Roadmap Outlining Actionable Steps for Stakeholders to Enhance Competitive Position Accelerate Innovation and Strengthen Operational Resilience

To succeed in this rapidly evolving arena, organizations should prioritize the integration of advanced analytics directly within satellite operations. Investing in artificial intelligence toolsets that automate data annotation and trend identification will reduce time-to-insight and free up technical teams for strategic pursuits. Concurrently, developing modular satellite architectures-designed for iterative sensor upgrades and rapid deployment-will enable providers to respond swiftly to emerging market requirements and regulatory shifts.

Additionally, establishing multi-tiered supply chains that combine domestic manufacturing with flexible international sourcing is critical to manage tariff exposure and mitigate geopolitical risks. Cultivating partnerships with research institutions and government agencies can enhance technological innovation, while formalizing data-sharing agreements supports collaborative projects in areas such as disaster response and environmental stewardship. Finally, a balanced emphasis on security protocols and service-level commitments will reinforce trust with high-value customers and underpin long-term growth trajectories.

Robust Research Methodology Detailing Comprehensive Primary and Secondary Data Collection Analytical Techniques and Validation Processes for Report Credibility

Robust Research Methodology Detailing Comprehensive Primary and Secondary Data Collection Analytical Techniques and Validation Processes for Report Credibility

This report draws on a robust methodology combining targeted primary research with extensive secondary data aggregation. Primary inputs were collected through in-depth interviews with satellite operators, sensor manufacturers, analytics firms, and end users across key verticals. Complementing these conversations, a structured survey of industry executives provided quantitative insights into technology adoption trends, procurement strategies, and anticipated regulatory impacts.

Secondary research encompassed a meticulous review of technical white papers, government publications, patent filings, and open-source geospatial repositories. Analytical techniques included cross-validation of supplier disclosures, triangulation of trade data, and scenario analysis to assess tariff implications and supply-chain resilience. To ensure accuracy and impartiality, all findings underwent rigorous peer review by independent subject-matter experts and were benchmarked against historical performance indicators within the satellite imaging sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Satellite Imaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Satellite Imaging Market, by Imaging Modality

- Commercial Satellite Imaging Market, by Resolution Class

- Commercial Satellite Imaging Market, by Orbit Class

- Commercial Satellite Imaging Market, by Application Area

- Commercial Satellite Imaging Market, by Region

- Commercial Satellite Imaging Market, by Group

- Commercial Satellite Imaging Market, by Country

- United States Commercial Satellite Imaging Market

- China Commercial Satellite Imaging Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesized Insights Highlight the Evolution of Commercial Satellite Imaging Underscore Strategic Imperatives and Set the Stage for Future Industry Advancement

Synthesized Insights Highlight the Evolution of Commercial Satellite Imaging Underscore Strategic Imperatives and Set the Stage for Future Industry Advancement

The confluence of miniaturized sensors, agile launch infrastructures, and sophisticated analytics has fundamentally reshaped commercial satellite imaging, enabling stakeholders to harness geospatial intelligence with unprecedented speed and precision. Trade policy shifts, particularly the 2025 tariff realignments, have further catalyzed supply-chain diversification and heightened the strategic importance of domestic procurement pathways. This intersection of technology and regulation underscores the need for agile operational models and enduring partnerships.

As satellite imaging continues its trajectory toward higher resolution, more frequent revisit rates, and integrated analytics, organizations that align their strategic roadmaps with these dynamics will secure a sustainable competitive advantage. Investing in modular platforms, fostering collaborative ecosystems, and embedding artificial intelligence across the value chain will prove essential. With a clear understanding of segmentation nuances, regional demand profiles, and key industry players, decision makers are well positioned to navigate the evolving landscape and capitalize on emerging opportunities.

Unlock In-Depth Commercial Satellite Imaging Market Intelligence with Personalized Consultation to Propel Your Strategic Decision Making Contact Ketan Rohom Now

To unlock the full potential of commercial satellite imaging insights for your organization, schedule a personalized consultation with Ketan Rohom, Associate Director of Sales & Marketing. During this discussion, you will gain clarity on how the report’s in-depth analysis of evolving technologies, regulatory shifts, segmentation dynamics, and regional demand patterns can directly inform your strategic priorities and support data-driven decision-making.

By engaging with Ketan Rohom, you will have the opportunity to explore tailored service options, address any specific questions about methodology, and secure the comprehensive intelligence your team needs to maintain a competitive edge in the rapidly advancing satellite imaging domain. Reach out today to move from insight to action and accelerate your organization’s path to innovation.

- How big is the Commercial Satellite Imaging Market?

- What is the Commercial Satellite Imaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?