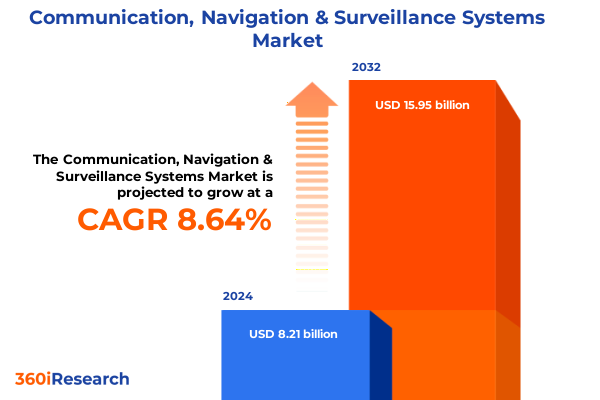

The Communication, Navigation & Surveillance Systems Market size was estimated at USD 8.92 billion in 2025 and expected to reach USD 9.64 billion in 2026, at a CAGR of 8.64% to reach USD 15.95 billion by 2032.

Setting the Stage for a Deep Dive into Cutting-Edge Communication Navigation and Surveillance Systems Driving Industry Transformation and Emerging Aerospace Technologies

The advent of advanced communication, navigation, and surveillance systems has ushered in a new era of operational efficiency, safety, and interoperability across both civil and defense sectors. Recent technological advancements, from the integration of satellite-based augmentation to the proliferation of software-defined radios, have redefined how aircraft, ground stations, and unmanned aerial vehicles communicate, determine position, and monitor airspace. Against this backdrop, stakeholders face mounting pressure to adopt resilient architectures that can seamlessly integrate emerging technologies while meeting stringent regulatory requirements and ensuring uninterrupted service continuity.

As industry actors grapple with evolving security threats, increasingly congested airspace, and the imperative to decarbonize operations, the imperative for a holistic understanding of technical, commercial, and geopolitical drivers has never been greater. This executive summary synthesizes critical insights into the fundamental trends reshaping the market, examines the ripple effects of new trade measures, and delineates actionable strategies for capturing untapped opportunities. By establishing a clear analytical framework and spotlighting the most consequential shifts, readers will be equipped to navigate complexity, anticipate future disruptions, and chart a deliberate path toward sustainable growth.

Exploring How Digitalization Autonomy Satellite Mega Constellations and Next Generation Connectivity Seamlessly Converge to Transform the CNS Solutions Landscape Worldwide

Digital transformation has become the cornerstone of innovation within communication, navigation, and surveillance domains, driving the deployment of network-centric operations that leverage real-time data exchange and advanced analytics. The convergence of cloud-native architectures with edge-computing capabilities is enabling system integrators to deliver scalable, software-defined solutions that adapt to evolving mission profiles. Moreover, the emergence of autonomous platforms-from remotely piloted air systems to self-guided logistics drones-has placed unprecedented demands on connectivity frameworks, requiring ultra-reliable, low-latency links and resilient mesh networks.

In parallel, the dramatic expansion of low Earth orbit and medium Earth orbit satellite constellations is catalyzing a paradigm shift in global reach. These constellations now offer comprehensive, near-continuous coverage that supports high-throughput data services and precision timing essential for next-generation navigation and surveillance applications. At the same time, 5G and emerging 6G terrestrial networks are converging with satellite links to create hybrid topologies that enhance throughput, reduce latency, and provide differentiated service levels. Underpinning these shifts is a growing emphasis on cybersecurity hardening and spectrum management, as operators seek to safeguard critical infrastructure against sophisticated electronic warfare and jamming threats while optimizing scarce frequency resources.

Unpacking the Comprehensive Economic Regulatory and Strategic Reverberations of the 2025 United States Tariffs on Communication Navigation and Surveillance Equipment Supply Chains

The introduction of updated tariffs on imported aerospace and defense components in early 2025 has introduced new complexities for procurement teams, system architects, and project planners. While the measures aim to incentivize domestic manufacturing, they have also contributed to higher landed costs for key subsystems such as high-frequency radios, inertial navigation modules, and radar altimeter components. Consequently, original equipment manufacturers and end users are recalibrating supplier networks, exploring nearshoring options, and renegotiating long-term agreements to mitigate margin erosion.

Furthermore, compliance requirements associated with the new tariff classifications have increased administrative overhead and elongated lead times, prompting program managers to prioritize modular design principles and dual-sourcing strategies. As a result, innovation cycles are increasingly being driven by supply chain resilience considerations, with a focus on interchangeable line-replaceable units and open system architectures that facilitate component substitution. In addition, the broader ecosystem is witnessing strategic partnerships between domestic electronics fabricators and established aerospace integrators, aimed at localizing production and sustaining critical technology pipelines.

Dissecting Product Platform Application and End User Segmentation to Uncover Granular Insights into the Evolution of CNS Equipment Market Dynamics

A nuanced view of the market reveals that segmentation by product type exposes divergent growth trajectories. Communication equipment, spanning data link technologies, high-frequency radios, satellite communications, and very high-frequency radios, continues to evolve under the pressure of bandwidth-intensive applications and interoperability mandates. Within satellite communications, the competitive dynamics among Inmarsat, Iridium, and VSAT systems underscore the race to deliver lower latency and higher reliability in both civil and defense deployments. Simultaneously, navigation equipment-comprising global navigation satellite system receivers, inertial navigation systems, and radar altimeters-has become more sophisticated, with multi-constellation GNSS receivers supporting BeiDou, Galileo, GLONASS, and GPS signals to enhance positioning accuracy and signal availability.

In the surveillance domain, the proliferation of automatic dependent surveillance systems, including ADS-B In and ADS-B Out, is reshaping air traffic management protocols. Complementary technologies such as multilateration, primary radar, and secondary radar continue to play critical roles in maintaining robust situational awareness. When examining platforms, airborne assets ranging from commercial airliners to tactical UAVs interface with ground stations and satellite platforms in layered architectures optimized for latency, coverage, and redundancy. Cross-cutting applications-from air traffic management to commercial aviation, military communications, and unmanned aerial operations-further highlight the interconnected nature of system requirements. Ultimately, end users in civil aviation, general aviation, and military segments demand tailored solutions that balance operational reliability, cost efficiency, and compliance with evolving regulatory standards.

This comprehensive research report categorizes the Communication, Navigation & Surveillance Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Platform

- Application

- End User

Revealing Distinctive Growth Drivers Competitive Factors and Strategic Imperatives Across the Americas EMEA and Asia-Pacific Regions in CNS Technologies

Geographic analysis illustrates that the Americas region remains a pivotal market, driven by significant modernization initiatives in air traffic management and defense communications. The United States Federal Aviation Administration’s NextGen program continues to penetrate regional airports, while carriers across North and South America adopt satellite-based augmentation services to enhance operational resilience. In addition, Latin American nations are incrementally investing in ground station infrastructure to support domestic LEO satellite applications, positioning the region as a growing hub for cross-border data relay services.

Across Europe, the Middle East, and Africa, a tapestry of regulatory frameworks and investment priorities shapes market dynamics. European nations are advancing the Single European Sky ATM Research initiative and deepening partnerships with commercial satellite providers to bolster continental connectivity. In the Middle East, visionary airport expansion projects and national satellite mandates are fueling demand for integrated CNS platforms, while several African states are establishing airspace modernization roadmaps that leverage affordable, modular radar and navigation solutions. Meanwhile, Asia-Pacific continues to set the pace for innovation, with China further enhancing its BeiDou augmentation services, India expanding IRNSS coverage, and Southeast Asian operators embracing hybrid satcom-terrestrial networks to accommodate burgeoning passenger traffic and unmanned systems operations.

This comprehensive research report examines key regions that drive the evolution of the Communication, Navigation & Surveillance Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leadership Agility and Strategic Collaborations among Key Aerospace and Defense Corporations Propelling Innovation in Communication Navigation and Surveillance Systems

A closer examination of leading system integrators and component suppliers reveals a landscape characterized by strategic alliances, targeted M&A activity, and focused R&D investments. Established aerospace conglomerates are collaborating with specialized electronics firms to co-develop open architecture radios and next-generation navigation sensors. These partnerships are complemented by joint ventures with technology startups that bring advanced software-defined and machine-learning capabilities into legacy platforms.

At the same time, several players are leveraging aftermarket service models to differentiate their offerings, bundling predictive maintenance, software updates, and cybersecurity patches under performance-based contracts. This shift toward lifecycle support underscores a broader industry transition from point-product sales to solution-oriented engagements. Moreover, investment capital continues to flow toward disruptive entrants that are integrating edge-computing, artificial intelligence, and satellite mesh networking in novel configurations, challenging incumbents to accelerate their own innovation pipelines and refine go-to-market strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Communication, Navigation & Surveillance Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- BAE Systems plc

- Cobham Limited

- Collins Aerospace

- Elbit Systems Ltd

- Garmin Ltd

- General Dynamics Corporation

- Hensoldt AG

- Honeywell International Inc

- Indra Sistemas S.A.

- Iridium Satellite LLC

- Kratos Defense & Security Solutions Inc

- L3Harris Technologies Inc

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Rohde & Schwarz GmbH & Co. KG

- Saab AB

- Safran SA

- Siemens AG

- SITA

- Thales Group

- The Boeing Company

- Viasat Inc

Translating Market Intelligence into Strategic Action with Clear Roadmaps for Operational Excellence and Competitive Leadership in the CNS Sector

Industry leaders should prioritize architecting modular, open systems that enable rapid integration of new sensors, waveforms, and algorithmic capabilities. By adopting standards-based interfaces and fostering interoperability across multi-vendor ecosystems, organizations can reduce integration risk and accelerate deployment timelines. Concurrently, establishing supply chain diversification programs that include dual sourcing, nearshoring, and strategic inventory buffering will safeguard against geopolitical disruptions and tariff impacts.

Furthermore, companies must invest in robust cybersecurity frameworks that encompass both the operational technology and information technology domains. Embedding security-by-design principles into new platforms, conducting continuous penetration testing, and collaborating with regulatory bodies on threat intelligence sharing will strengthen overall system resilience. Finally, cultivating a high-performance culture through skills development, cross-disciplinary training, and collaborative R&D partnerships will ensure that teams remain at the forefront of technological innovation and capable of executing complex modernization initiatives.

Outlining a Rigorous Multi-Source Analytical Framework Integrating Primary Research Secondary Data and Expert Validation for CNS Market Insights

This analysis draws upon a rigorous, multi-tiered research framework that integrates qualitative and quantitative inputs. Primary research was conducted through in-depth interviews with OEM executives, airline network planners, defense procurement officers, and regulatory agency representatives to capture firsthand perspectives on emerging requirements and decision criteria. Simultaneously, secondary data sources-including industry publications, technical white papers, and government filings-were systematically reviewed to contextualize market dynamics and validate evolving technology roadmaps.

Data triangulation techniques were employed to reconcile discrepancies between public disclosures and interview insights, bolstering the credibility of key findings. The research team utilized a bottom-up approach to map component-level developments to system-level implications, while an expert advisory panel provided validation through iterative feedback sessions. Finally, thematic analysis of candidate technologies and strategic initiatives enabled the derivation of actionable recommendations tailored to specific stakeholder segments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Communication, Navigation & Surveillance Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Communication, Navigation & Surveillance Systems Market, by Product Type

- Communication, Navigation & Surveillance Systems Market, by Platform

- Communication, Navigation & Surveillance Systems Market, by Application

- Communication, Navigation & Surveillance Systems Market, by End User

- Communication, Navigation & Surveillance Systems Market, by Region

- Communication, Navigation & Surveillance Systems Market, by Group

- Communication, Navigation & Surveillance Systems Market, by Country

- United States Communication, Navigation & Surveillance Systems Market

- China Communication, Navigation & Surveillance Systems Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Critical Findings and Strategic Imperatives to Chart a Cohesive Path Forward for Stakeholders in the Communication Navigation and Surveillance Domain

Collectively, the insights within this executive summary illuminate a rapidly evolving ecosystem where technological innovation, regulatory shifts, and geopolitical dynamics intersect. The synthesis of segmentation analysis, regional trends, and company strategies underscores the imperative for organizations to adopt agile, interoperable architectures and resilient supply chains. As digital transformation and autonomy continue to accelerate, stakeholders who proactively align their investment priorities with emerging connectivity paradigms will secure competitive advantage.

In closing, the alignment of strategic vision with rigorous operational planning will define success in the communication, navigation, and surveillance domain. By leveraging the detailed insights and recommendations presented here, decision-makers can anticipate market disruptions, capitalize on growth inflection points, and chart a sustainable course toward long-term technological leadership.

Engage with Associate Director Sales and Marketing Ketan Rohom to Secure Comprehensive Market Intelligence and Drive Strategic Growth Opportunities Today

Take the next step toward harnessing in-depth insights and unlocking strategic growth in communication, navigation, and surveillance systems by connecting with Associate Director, Sales & Marketing Ketan Rohom. You will gain tailored guidance on how this comprehensive research can inform critical decisions, mitigate emerging risks, and position your organization at the forefront of aerospace and defense innovation. Reach out today to learn more about licensing options, custom data packages, and executive advisory services designed for forward-thinking leaders ready to accelerate their competitive edge

- How big is the Communication, Navigation & Surveillance Systems Market?

- What is the Communication, Navigation & Surveillance Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?