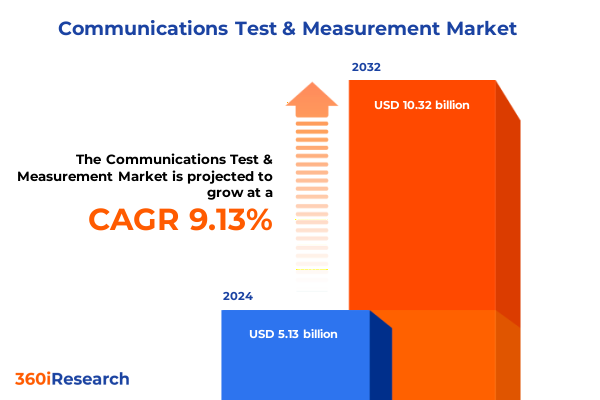

The Communications Test & Measurement Market size was estimated at USD 5.56 billion in 2025 and expected to reach USD 6.03 billion in 2026, at a CAGR of 9.22% to reach USD 10.32 billion by 2032.

Comprehensive Introduction to the Communications Test and Measurement Landscape Highlighting Core Drivers Technological Foundations and Market Potential

Communications test and measurement technologies stand at the heart of ensuring reliability, performance, and quality across the rapidly evolving telecommunications landscape. As next-generation networks deploy at unprecedented scale, the capabilities of test instruments and analytic software become foundational for service providers, equipment manufacturers, and enterprises alike. This summary offers a holistic perspective on how core drivers such as 5G proliferation, virtualization, and software-defined networking are reshaping the expectations placed on testing frameworks and measurement protocols in both development and operational contexts.

Drawing on extensive secondary research and targeted expert interviews, this introduction delineates the strategic imperatives that stakeholders must embrace to maintain competitive advantage. By presenting an integrated view of hardware, software, and service offerings, it sets the stage for deeper analysis into technology shifts, regulatory impacts, and regional variations. The subsequent sections build upon this foundation by examining transformative trends, tariff influences, and granular segmentation insights, progressively guiding readers toward actionable strategic recommendations.

The intersection of advancing edge computing, increased spectrum utilization, and the transition toward cloud-native test environments underscores the complexity that market participants face. This introduction therefore not only contextualizes the current state of the industry but also highlights emergent opportunities for innovation and partnership. By weaving together perspectives on artificial intelligence-enabled analytics, the surge in IoT connectivity, and the demands of ultra-low-latency use cases, it equips readers with a cohesive understanding of the market forces at play

Identification of Transformative Technological Shifts and Market Forces Redefining Communications Test and Measurement Requirements and Competitive Dynamics

The communications test and measurement sector is undergoing transformative shifts driven by a convergence of emerging technologies and evolving network architectures. Virtualization and cloud-based orchestration have enabled the creation of digital twins and remote test laboratories, significantly reducing time to insight and enabling iterative testing cycles. At the same time, the rise of open RAN and software-defined radio access networks is demanding new tools capable of validating interoperability across multi-vendor ecosystems. Edge computing and network slicing are introducing novel performance parameters that require granular measurement capabilities to guarantee service level agreements in highly dynamic, distributed environments.

Artificial intelligence and machine learning have further accelerated these shifts by automating root-cause analysis and enabling predictive maintenance models. Automated test suites powered by AI reduce manual intervention and accelerate defect detection, allowing continuous integration and continuous deployment pipelines to thrive. The ongoing evolution toward mmWave spectrum utilization, with an eye on future 6G deployments, is placing fresh demands on signal characterization, propagation modeling, and high-throughput data acquisition.

These market forces are redefining competitive dynamics, pushing vendors to innovate across both hardware and software domains. Companies that can integrate intelligent analytics, flexible test orchestration, and scalable infrastructure into cohesive solutions will gain a decisive edge as networks become more complex and performance thresholds more stringent

Comprehensive Assessment of United States Tariff Measures Enacted in 2025 and Their Compounding Impact on Communications Test and Measurement Supply Chains

In 2025, a series of tariff measures introduced by the United States government have compounded supply chain complexities for communications test and measurement equipment. Section 301 duties on select electronic components, enacted to address unfair trade practices, have led to import levies on critical semiconductors and specialized instrumentation modules. Simultaneously, Section 232 tariffs on steel and aluminum inputs continue to elevate material costs, affecting the fabrication of rack-mount chassis and mechanical fixtures integral to test hardware. The cumulative result is an escalation in production expenses and longer lead times for key system elements.

These duties have ripple effects throughout the value chain, driving original equipment manufacturers to seek alternative suppliers in tariff-exempt regions or invest in localized assembly operations. Component shortages exacerbated by increased duty burdens have prompted service providers and test labs to revise procurement strategies, often prioritizing modular architectures that can accommodate multiple supplier pathways. As a consequence, inventory management has become more complex, with safety stocks expanding to hedge against potential tariff escalations or further regulatory actions.

Operationally, calibration and maintenance providers are also feeling the strain of delayed shipments and higher replacement costs. In response, many testing organizations are exploring expanded field service capabilities and increased collaboration with domestic contract manufacturers. By strategically diversifying sourcing channels and renegotiating supply agreements, companies are working to mitigate the financial impact of tariff pressures while maintaining rigorous quality and performance benchmarks

Strategic Segmentation Analysis Unveiling How Offerings Technologies Environments Distribution Channels and End Users Shape Market Opportunities

An analysis of market offerings reveals a clear tripartite structure comprising hardware platforms, specialized software suites, and a broad spectrum of services. Hardware remains the backbone of signal generation, analysis, and emulation, while software solutions add layers of automation, data visualization, and remote orchestration. Services, spanning consulting engagements, maintenance and support contracts, and fully managed solutions, are increasingly leveraged to optimize lifecycle value and reduce total cost of ownership.

From a technology standpoint, the market can be delineated into optical, wired, and wireless domains. Optical test solutions address both long-haul networks requiring high power and sensitivity as well as short-reach links in data center and enterprise environments. Wired test technologies focus on Ethernet and power over Ethernet signaling, ensuring integrity in physical layer deployments. The wireless segment is dominated by the rapid rollout of 5G infrastructure alongside legacy LTE networks, demanding robust protocols for RF characterization, beamforming validation, and mobile device interoperability.

Testing environments further segment into field applications-where on-site diagnostics and network assurance take precedence-and controlled laboratory settings that support both in-house and third-party validation workflows. Distribution channels cover direct sales relationships, OEM distributor partnerships with value-added resellers, and growing online procurement platforms. Finally, end users span cloud service providers building hyperscale infrastructure, large enterprises modernizing private networks, government and defense agencies requiring secure communications, and telecommunications service providers deploying next-generation access networks

This comprehensive research report categorizes the Communications Test & Measurement market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Technology

- Test Environment

- Distribution Channel

- End User

Holistic Regional Insights Highlighting Market Drivers Competitive Landscape and Growth Potential within the Americas EMEA Region and the AsiaPacific Spectrum

Across the Americas, robust investments in network modernization and the rapid deployment of 5G infrastructure are driving heightened demand for advanced test and measurement solutions. Major service providers in North America are collaborating with equipment vendors to develop tailored test protocols that validate network resilience under peak traffic conditions. Meanwhile, in Latin America, increasing private partnership models and spectrum auctions have accelerated the modernization of legacy fixed-line systems, prompting regional test labs to adopt versatile instrumentation capable of supporting mixed-technology environments.

In the EMEA region, regulatory frameworks emphasizing interoperability and cybersecurity are shaping procurement strategies. European operators are integrating private LTE and emerging Open RAN trials, requiring flexible testbench architectures that can adapt to multi-vendor deployments. In the Middle East and Africa, government-backed digital transformation initiatives are nurturing demand for portable, ruggedized testing tools that facilitate rapid network rollout in challenging terrains and urban centers alike.

The Asia Pacific arena remains characterized by expansive manufacturing ecosystems and aggressive network rollout plans, particularly in markets such as China, India, and Southeast Asia. Local suppliers are scaling capabilities to support high-volume production of both hardware and software platforms, while regional service providers are focused on quality-of-service validation for emerging IoT and mission-critical communications use cases. Cross-border collaboration on standardization and joint innovation programs continues to reinforce the region’s role as a global center for test and measurement R&D

This comprehensive research report examines key regions that drive the evolution of the Communications Test & Measurement market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Competitive Company Profiles and Strategic Movements Shaping the Industry Footprint Driving Innovation in Test and Measurement Solutions

Leading instrumentation vendors are investing heavily in research and development to broaden their capabilities across both wired and wireless domains. One global provider has established open software frameworks that streamline remote orchestration and third-party integrations, enhancing flexibility for end users. Another major player, renowned for its handheld and portable analyzers, is focusing on miniaturization and ease of use to support field engineers conducting on-site network troubleshooting.

A specialist in optical test suites continues to expand its portfolio by incorporating high-precision coherent detection modules and real-time analytics platforms, enabling datacenter operators to validate short-reach fiber connectivity with minimal downtime. Concurrently, a traditional RF measurement leader is forging alliances with chipset manufacturers to develop turnkey solutions for millimeter-wave propagation assessment, targeting emerging 6G proof-of-concept deployments.

In addition, an established network assurance provider has enhanced its cyber resilience testing offerings, integrating threat emulation capabilities within its performance validation workflows. Finally, a purveyor of emulation and automation software is reinforcing its cloud-native testing environments, empowering customers to leverage containerized test functions and elastic resource allocation. Collectively, these strategic movements highlight an industry pivot toward modular architectures, software-centric analytics, and collaborative innovation models

This comprehensive research report delivers an in-depth overview of the principal market players in the Communications Test & Measurement market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accuver by Innowireless

- Anritsu Corporation

- Calnex Solutions PLC

- Cisco Systems, Inc.

- COMIT Corporation System

- Emerson Electric Co.

- EXFO Inc.

- Fortive Corporation

- Hammer by Infovista SAS

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Keysight Technologies

- Kyrio, Inc. by CableLabs

- Liverage Technology Inc.

- Logic Fruit Technologies Private Limited

- Luna Innovations Incorporated

- MACOM Technology Solutions Inc.

- NetScout Systems, Inc.

- OMICRON electronics GmbH

- Qualitest International Inc.

- Rohde & Schwarz

- Spirent Communications PLC

- Tempo Communications, Inc.

- TEOCO Corporation

- Texas Instruments Incorporated

- thinkRF Corp.

- VeEX Inc.

- VIAVI Solutions Inc.

- Yokogawa Electric Corporation

Actionable Strategic Recommendations Guiding Industry Leaders to Capitalize on Emerging Trends Optimize Operations and Enhance Competitive Positioning

Industry leaders should pursue deeper collaboration within open ecosystem consortia to influence test interface standards and accelerate interoperability across multi-vendor environments. By contributing to shared frameworks and reference implementations, companies can reduce integration complexity for service providers while positioning themselves as thought leaders in defining the industry’s technical roadmap.

Given the impact of recent tariff measures, organizations must refine their supply chain strategies by diversifying component sourcing and exploring nearshore manufacturing partnerships. Establishing strategic alliances with regional contract manufacturers will help mitigate duty exposure, enhance supply resilience, and shorten lead times for critical hardware components. Simultaneously, service providers can leverage managed services offerings to offset capital expenditure pressures and shift toward operational expenditure models.

To fully capitalize on data driven insights, vendors should integrate advanced analytics and machine learning modules within their test suites, enabling real-time anomaly detection and predictive maintenance across distributed network assets. Expanding cloud-native testing environments and offering flexible consumption models will empower customers to tailor deployments according to workload demands, improving scalability and reducing upfront investments.

Finally, enterprises and test laboratories are encouraged to invest in workforce upskilling programs focused on automation and virtualization. Cultivating in-house expertise in orchestrating large-scale automated test networks will accelerate time to market for new services and foster greater agility in responding to dynamic performance requirements

Robust Research Methodology Detailing Data Collection Approaches Analytical Frameworks and Validation Processes Underpinning Market Insights

This analysis employs a rigorous methodology that begins with comprehensive secondary research, including technical white papers, industry publications, regulatory filings, and patent databases. Publicly available financial statements and corporate disclosures were scrutinized to identify strategic investments, R&D trajectories, and partnership networks. Historical market data and policy announcements were reviewed to construct a context for the evolution of tariff frameworks and regional deployment strategies.

Complementing this foundation, primary research was conducted through in-depth interviews with senior stakeholders spanning equipment vendors, network operators, test laboratories, and government agencies. These conversations provided qualitative insights into purchase decision criteria, emerging use cases, and technology adoption hurdles. Additionally, targeted surveys of field engineers and lab managers captured sentiment on tool usability, feature gaps, and service expectations.

Data validation was achieved through triangulation, cross-referencing quantitative findings with expert commentary and independent third-party analyses. A series of workshops and peer reviews were convened to challenge assumptions and ensure clarity of interpretation. Quality control protocols were applied to verify data integrity and minimize bias throughout the research lifecycle.

Finally, the report’s analytical framework integrates segmentation analysis, PEST evaluations of regulatory and economic drivers, and SWOT assessments for key players. This multi-dimensional approach underpins the actionable insights presented, ensuring that strategic recommendations are grounded in empirically validated observations

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Communications Test & Measurement market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Communications Test & Measurement Market, by Offering

- Communications Test & Measurement Market, by Technology

- Communications Test & Measurement Market, by Test Environment

- Communications Test & Measurement Market, by Distribution Channel

- Communications Test & Measurement Market, by End User

- Communications Test & Measurement Market, by Region

- Communications Test & Measurement Market, by Group

- Communications Test & Measurement Market, by Country

- United States Communications Test & Measurement Market

- China Communications Test & Measurement Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Conclusion Summarizing Key Insights Strategic Imperatives and ForwardLooking Perspectives for Stakeholders in the Communications Test and Measurement Arena

This executive summary has distilled the core dynamics reshaping the communications test and measurement arena, from the automation and intelligence inherent in next-generation networks to the tangible effects of tariff policies on supply chains. Segmentation analysis has highlighted diverse requirements across hardware, software, and service domains, while regional perspectives have underscored the influence of regulatory environments and infrastructure investment patterns.

Strategic imperatives emerging from this analysis call for ecosystem collaboration, flexible supply chain configurations, and the infusion of advanced analytics into testing workflows. Organizations that align their R&D investments with open standards and pursue flexible delivery models will be best positioned to navigate volatility and capitalize on growth opportunities.

Looking ahead, the industry is poised for further innovation as 6G research intensifies and edge computing architectures mature. Stakeholders who maintain a proactive approach to technology integration, tariff mitigation, and cross-functional talent development will secure leadership positions. Ultimately, the ability to translate complex performance data into actionable insights will distinguish market winners in this dynamic landscape

Direct Engagement with Associate Director of Sales and Marketing to Unveil Exclusive Research and Secure the Full Market Analysis Report

Direct engagement with Ketan Rohom, Associate Director of Sales & Marketing, offers an unparalleled opportunity to explore the comprehensive findings of this analysis and secure a competitive edge. With deep expertise in articulating market dynamics and translating complex data into strategic imperatives, Ketan is poised to guide you through customized insights tailored to your unique business challenges and growth aspirations.

By partnering directly with Ketan, stakeholders gain expedited access to in-depth research modules covering technological trajectories, tariff implications, regional differentiators, and segmentation nuances. Reach out to initiate an informed discussion on how this report can empower your organization to navigate evolving market conditions, optimize investment decisions, and unlock new opportunities within the communications test and measurement ecosystem

- How big is the Communications Test & Measurement Market?

- What is the Communications Test & Measurement Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?