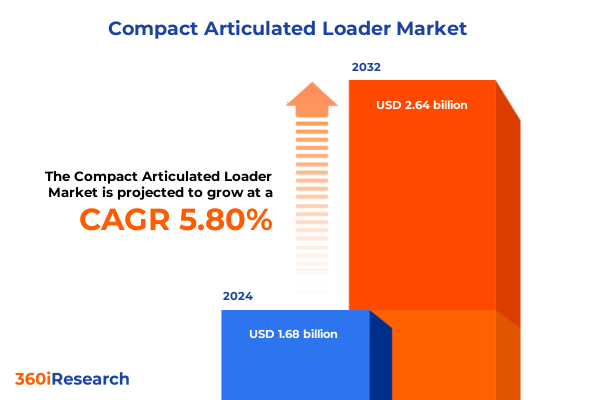

The Compact Articulated Loader Market size was estimated at USD 1.77 billion in 2025 and expected to reach USD 1.87 billion in 2026, at a CAGR of 5.84% to reach USD 2.64 billion by 2032.

Introducing the transformative role of compact articulated loaders as versatile, efficient, and sustainable assets reshaping construction and allied industries

Compact articulated loaders represent a specialized category of compact construction equipment that combine an articulated joint with a telescopic boom to perform a variety of material handling tasks in restricted and challenging environments. Their unique design enables them to navigate narrow pathways, minimize ground disturbance, and achieve precise dump heights, making them particularly suited for urban construction, landscaping, and site maintenance applications. The telescopic boom on models such as the Vermeer ATX850 extends to an impressive 117.3 inches of hinge pin height, offering both reach and rated operating capacity that rival larger machines without the footprint of a traditional loader. Additionally, the articulation mechanism allows operators to make tight turns without disrupting sensitive turf or built environments, reducing both fuel consumption and tire wear compared to non-articulated counterparts.

The adoption of compact articulated loaders has been driven by several converging factors. Public infrastructure investment, fueled by federal programs focused on road, bridge, and urban redevelopment projects, has increased demand for versatile machines that can operate effectively in confined urban corridors and traffic-sensitive zones. At the same time, environmental regulations and corporate sustainability goals are accelerating the shift toward electric and hybrid-powered equipment, as demonstrated by leading manufacturers launching zero-emission models that meet stringent noise and emissions standards. Moreover, the emergence of smart city initiatives is amplifying the need for compact, telematics-enabled machinery capable of integrating with digital asset management systems to optimize operational efficiency and resource allocation across municipal services and commercial developments.

Consequently, industry stakeholders are re-evaluating fleet compositions, prioritizing machines that offer multi-functionality, ease of transport, and rapid deployment. By leveraging the compact articulated loader’s balance of power, reach, and maneuverability, contractors and service providers can enhance productivity, reduce total cost of ownership, and adapt to increasingly complex worksite requirements.

Emerging technological advancements and sustainability trends that are redefining performance benchmarks for compact articulated loaders in evolving operations

Technological innovation is redefining the capabilities of compact articulated loaders, ushering in a new era of performance and sustainability. The integration of electrified drivetrains, telematics, and advanced control systems is elevating these machines from simple material handlers to intelligent worksite solutions. Electric and hybrid models now offer zero-emission operation ideal for indoor or noise-sensitive environments while delivering torque and responsiveness that match or exceed diesel-powered units. Meanwhile, on-board sensors and connectivity platforms enable real-time monitoring of machine health, predictive maintenance alerts, and remote diagnostics, reducing downtime and extending component life cycles.

Automation is another critical shift transforming the landscape. Semi-autonomous functions-including automated bucket leveling, joystick-guided grading assistance, and collision avoidance systems-are increasingly standard on premium models. These capabilities not only improve precision and safety but also lower operator fatigue and training requirements, enabling less experienced personnel to achieve professional-grade results. In parallel, modular attachment systems are proliferating, allowing a single articulated loader to perform tasks previously reserved for specialized equipment, from trenching and drilling to pallet handling.

Environmental stewardship remains at the forefront of industry evolution. Manufacturers are committing to ambitious decarbonization targets, with some pledging up to a 50% reduction in CO₂ emissions by 2030 through product electrification and sustainable manufacturing practices. Partnerships with technology providers and component specialists are accelerating the development of next-generation battery, ultracapacitor, and hydrogen fuel cell prototypes that promise extended runtime and rapid recharging. As regulatory bodies enforce stricter emissions and noise limits, these advancements position electric and hybrid articulated loaders as both compliant and cost-efficient alternatives to their diesel predecessors.

Assessing how recent US tariff measures have compounded production costs and supply chain dynamics for compact articulated loaders

Recent adjustments to United States tariff policies have introduced a series of cost pressures and logistical complexities for compact articulated loader manufacturers and their suppliers. Components such as hydraulic pumps, specialized steel alloys, and electronic control modules-many of which originate from trans-Pacific and European sources-have faced additional duties of up to 25%, directly inflating the input costs for domestic assembly plants and overseas contract manufacturers. These incremental expenses have prompted many producers to renegotiate supplier contracts and revisit global sourcing strategies in order to preserve margin integrity and maintain price competitiveness in an increasingly cost-sensitive procurement environment.

Tariff-induced freight disruptions have further strained supply chains, with container backlogs and shipping surcharges increasing trans-oceanic transit fees by nearly 30% over pre-tariff levels. In response, industry leaders are accelerating dual-sourcing and regionalization efforts, identifying alternative component suppliers in Southeast Asia and Mexico to diversify risk and mitigate delivery delays. Simultaneously, several major equipment vendors are advancing reshoring initiatives-expanding machining capabilities, forging partnerships with domestic specialty metal producers, and investing in localized production facilities-to reduce import dependency and achieve greater control over lead times.

The cumulative impact of these tariff dynamics extends beyond operational costs to influence research and development investment. With a larger portion of working capital allocated toward managing supply chain volatility, smaller manufacturers in particular are experiencing constraints on R&D budgets, potentially delaying the rollout of advanced features like autonomous operation, next-generation powertrains, and smart attachments. Conversely, larger organizations with deeper balance sheets are capitalizing on government incentives for domestic manufacturing to fast-track facility expansions and secure long-term cost advantages, setting the stage for a more regionally integrated production model in the midterm.

Uncovering critical segmentation perspectives across engine types, operational capacities, power ratings and end-user applications driving loader utilization

The compact articulated loader market is systematically analyzed across multiple dimensions to capture the full spectrum of user requirements and technological capabilities. When viewed through the lens of engine type, the industry is distinguished by traditional diesel-powered models valued for their established performance and refueling infrastructure, alongside electric-powered variants gaining traction for their zero-emission operation and reduced noise profiles, and hybrid platforms that blend the efficiency benefits of electrification with the extended runtime of internal combustion systems.

A separate typology considers the fundamental design configuration: track-based articulated loaders that deliver superior traction and stability on steep or uneven terrain, contrasted with wheel-based units prized for their rapid travel speeds and minimal ground scuffing in urban and industrial settings. Engine power segmentation further refines the offering into sub-25 HP machines ideally suited for sensitive landscaping tasks, midrange loaders with 25–50 HP that balance portability and capability, and above-50 HP platforms engineered for heavy material handling and continuous site operations.

Lifting capacity serves as another critical axis, encompassing compact units capable of handling loads up to 1,000 pounds in confined spaces, mid-tier loaders rated for 1,000–2,000 pounds that support most general construction and agricultural tasks, and high-capacity models exceeding 2,000 pounds for demanding industrial, mining, and large-scale infrastructure applications. Equally important is the diversity of end-user applications: agricultural operators rely on articulated loaders for barn cleanup and feed handling, while construction and infrastructure firms deploy them across commercial projects, residential site preparation, and urban infrastructure maintenance; forestry professionals utilize dedicated attachments for site clearing and timber handling; industrial and warehousing facilities employ loaders for loading/unloading, material handling, and pallet transport; mining and quarrying sites leverage high-capacity machines for stockpile management; and municipal services integrate these loaders into park and recreational area maintenance, roadside repairs, and snow removal operations.

Finally, the sales channel dimension distinguishes between offline distribution networks-comprising dealership showrooms, rental houses, and field sales representatives-and the growing prominence of online platforms that facilitate direct-to-user transactions, digital quoting tools, and subscription-based access models. This multi-faceted segmentation framework ensures that stakeholders can pinpoint the precise combination of powertrain, mobility, lifting capability, and service delivery that aligns with their specific operational goals.

This comprehensive research report categorizes the Compact Articulated Loader market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Engine Type

- Type

- Engine Power

- Lifting Capacity

- End-User

- Sales Channel

Exploring diverse regional dynamics and distinctive growth patterns shaping the compact articulated loader market across the Americas, EMEA and Asia-Pacific

Regional market dynamics exhibit distinct characteristics influenced by infrastructure priorities, regulatory frameworks, and economic growth trajectories. In the Americas, robust public and private investment in road upgrades, urban redevelopment, and agricultural mechanization has fueled demand for midsized articulated loaders that balance travel speed and versatility. North American fleet operators, in particular, are accelerating the replacement of aging equipment with electric and hybrid units to align with state-level incentives and corporate decarbonization targets.

Within Europe, the Middle East, and Africa, stringently enforced emissions regulations and a high concentration of urban heritage sites have elevated the importance of low-emission, low-noise machinery. Compact articulated loaders are thus being adopted for indoor municipal tasks, tunnel maintenance, and historic structure preservation. Simultaneously, the EMEA region’s diverse terrain-from arid construction zones in the Gulf to rugged job sites in sub-Saharan Africa-drives the selection of track-based configurations and high-capacity powertrains.

Asia-Pacific markets reflect a dual focus on rapid infrastructure expansion and agricultural modernization. Southeast Asian governments are prioritizing rural road networks and smart-city projects, resulting in increased usage of versatile loaders at highway construction sites and mixed-use developments. In Australia and New Zealand, mining and forestry applications dominate, leading to demand for high-lift-capacity articulated loaders equipped with reinforced chassis and heavy-duty hydraulic systems. Across the region, digital sales channels are gaining prominence as end users seek transparent pricing and turnkey rental solutions to support project-based procurement strategies.

This comprehensive research report examines key regions that drive the evolution of the Compact Articulated Loader market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic maneuvers and innovation trajectories of industry-leading manufacturers shaping the compact articulated loader competitive landscape

Industry-leading manufacturers have pursued a range of strategic initiatives to strengthen their position within the compact articulated loader landscape. Long-established equipment producers leverage expansive dealer networks and full-service solutions to deliver comprehensive lifecycle support, encompassing financing, maintenance contracts, and telematics integration platforms. These companies are simultaneously investing in electric and hybrid architecture, collaborating with battery and power electronics specialists to integrate modular energy storage systems that enhance uptime and reduce total cost of ownership.

Emerging challengers are differentiating through nimble product development cycles and targeted regional partnerships. By forging alliances with local component suppliers, these agile firms can mitigate tariff exposure and accelerate time-to-market for models tailored to specific geo-climatic conditions. Their customer-centric approach often emphasizes digital configuration tools, cloud-based remote monitoring services, and pay-per-use rental options that appeal to smaller contractors and municipal agencies exploring capex-light procurement.

Across the competitive spectrum, innovation is centered on expanding attachment portfolios-ranging from multipurpose tool carriers to specialized grapples and trenchers-that transform a single articulated loader into a multi-functional asset. Strategic collaborations with implement manufacturers and aftermarket accessory providers are driving rapid expansion of certified attachment ecosystems, enabling end users to optimize machine utilization across an array of applications without sacrificing performance or warranty coverage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Compact Articulated Loader market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alamo Group Inc.

- Avant Tecno Oy

- Bobcat Company

- Cast Group S.R.L.

- Caterpillar Inc.

- CNH Industrial N.V.

- Deere & Company

- Hitachi Construction Machinery Co., Ltd.

- J C Bamford Excavators Ltd.

- Komatsu Europe International N.V.

- KUBOTA Corporation

- Liebherr Group

- Manitou Group

- MECALAC France SAS by Fayat Group

- MultiOne S.r.l.

- Schäffer Maschinenfabrik GmbH

- SHERPA mini-loaders B.V.

- Takeuchi Mfg. Co. Ltd.

- Tobroco-Giant

- Vermeer Corporation

- Volvo Group

- Wacker Neuson Group

- XCMG Group

- Yanmar Holdings Co., Ltd.

- YUFAN Machinery

Strategic action plan outlining practical recommendations for industry leaders to capitalize on innovation, sustainability, and market agility

Industry leaders must adopt a multi-pronged strategy to capitalize on emerging opportunities and mitigate operational challenges. First, accelerating the integration of electric and hybrid powertrains will not only ensure compliance with forthcoming emissions regulations but also unlock access to government incentives and carbon credit revenues. By conducting pilot deployments in urban infrastructure and indoor rental segments, decision-makers can refine charging strategies and quantify efficiency gains before full-scale fleet replacement.

Second, diversifying supply chain footprints through regional dual-sourcing and nearshoring partnerships will bolster resilience against tariff volatility and logistics bottlenecks. Establishing contingency agreements with secondary suppliers in North America and Southeast Asia can safeguard production continuity during periods of geopolitical tension or shipping disruptions. Concurrently, investing in in-house machining and assembly capabilities can reduce exposure to import duties and shorten lead times for critical components.

Third, enhancing customer value propositions through digital services and outcome-based business models will differentiate offerings in a crowded marketplace. Deploying telematics-driven maintenance platforms, predictive analytics tools, and subscription-based access to equipment can deepen client engagement and generate recurring revenue streams. Finally, cultivating an agile innovation pipeline-rooted in close collaboration with industry partners and end users-will facilitate rapid introduction of new attachments, automation features, and sustainability enhancements that align with evolving worksite requirements.

Elaborating the rigorous research methodology and analytical framework employed to deliver comprehensive insights into compact articulated loader dynamics

This analysis is underpinned by a robust research methodology that combines qualitative and quantitative techniques to ensure comprehensive coverage and accuracy. Primary research involved in-depth interviews with key decision-makers across manufacturing, distribution, and end-user organizations, providing insights into product development roadmaps, procurement criteria, and service expectations. These conversations were complemented by extensive consultations with industry associations, regulatory bodies, and technology partners to contextualize emerging trends in sustainability, automation, and trade policy.

Secondary research encompassed a systematic review of technical literature, trade publications, corporate disclosures, and government filings to validate product specifications, regulatory impacts, and tariff frameworks. Supply chain mapping tools were employed to trace component origins and quantify duty exposures, while competitive benchmarking analyses leveraged publicly available financial reports and dealer network data to assess strategic positioning across major equipment vendors. Finally, a structured segmentation framework was applied to categorize equipment offerings by engine type, mobility configuration, power rating, lifting capacity, end-use application, and sales channel, ensuring that the multifaceted nature of compact articulated loaders is accurately represented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Compact Articulated Loader market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Compact Articulated Loader Market, by Engine Type

- Compact Articulated Loader Market, by Type

- Compact Articulated Loader Market, by Engine Power

- Compact Articulated Loader Market, by Lifting Capacity

- Compact Articulated Loader Market, by End-User

- Compact Articulated Loader Market, by Sales Channel

- Compact Articulated Loader Market, by Region

- Compact Articulated Loader Market, by Group

- Compact Articulated Loader Market, by Country

- United States Compact Articulated Loader Market

- China Compact Articulated Loader Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarizing pivotal insights and emphasizing the strategic importance of compact articulated loaders for future-proofed operational excellence

This comprehensive examination underscores the strategic importance of compact articulated loaders as versatile, high-performance assets tailored to the nuanced demands of modern worksites. By balancing power, precision, and portability, these machines are driving efficiency gains across a spectrum of applications ranging from urban infrastructure maintenance to forestry and mining operations. The convergence of electrification, automation, and digital connectivity is further elevating the value proposition, enabling end users to achieve superior productivity while advancing environmental objectives.

At the same time, evolving trade policies and tariff adjustments have introduced cost pressures that require proactive supply chain management and localized production strategies. Stakeholders who anticipate these challenges and pivot toward resilient sourcing models will be better positioned to preserve margin integrity and sustain innovation investment. Meanwhile, segmentation insights reveal clear pathways for optimizing fleet configurations according to engine type, mobility, power, capacity, and end-user requirements.

Ultimately, organizations that integrate these insights into their strategic planning-leveraging electric powertrains, digital services, and agile manufacturing frameworks-will secure a competitive edge and chart a course toward long-term operational excellence in the compact articulated loader sector.

Connect directly with Ketan Rohom to secure your market research report and unlock strategic growth opportunities in the compact articulated loader sector

Don't miss the opportunity to leverage comprehensive insights tailored to your strategic objectives and operational challenges. By connecting directly with Ketan Rohom, Associate Director of Sales & Marketing, you can secure access to the definitive market research report designed to empower your decision-making and drive sustainable growth in the compact articulated loader sector. Reach out today to explore customized packages, gain deeper intelligence on competitive dynamics, and position your organization at the forefront of innovation and efficiency in this rapidly evolving industry

- How big is the Compact Articulated Loader Market?

- What is the Compact Articulated Loader Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?