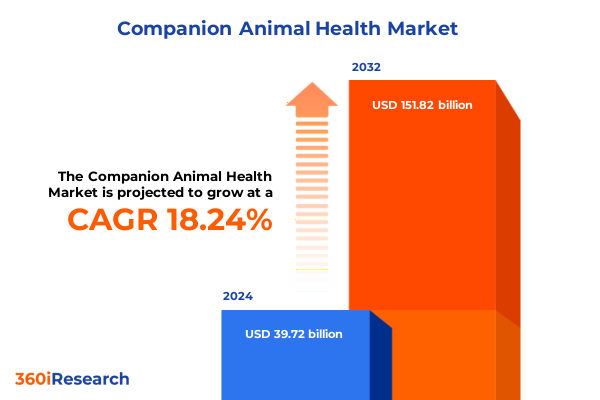

The Companion Animal Health Market size was estimated at USD 47.13 billion in 2025 and expected to reach USD 55.01 billion in 2026, at a CAGR of 18.18% to reach USD 151.82 billion by 2032.

Discovering the Future of Companion Animal Health Through Comprehensive Insights into Market Dynamics and Emerging Opportunities

The companion animal health sector has evolved into a cornerstone of global animal care, driven by rising pet ownership and deepening emotional bonds between owners and their pets. This landscape is characterized by an intensifying focus on preventive care, personalized treatment plans, and premium products aimed at addressing the ever-growing expectations of pet parents. As more households view dogs, cats, and equines as integral family members, demand for advanced diagnostics, tailored nutrition, and innovative pharmaceuticals continues to surge.

Against this backdrop, industry stakeholders must navigate a complex interplay of technological innovation, regulatory frameworks, and shifting consumer behaviors. Understanding these dynamics is crucial to unlocking new avenues for growth and ensuring the delivery of high-quality care across clinical and retail settings. With the pace of market evolution accelerating, this executive summary distills the critical factors shaping companion animal health, offering a strategic lens through which decision-makers can evaluate emerging opportunities and mitigate potential risks.

Navigating Transformative Shifts Reshaping the Companion Animal Health Ecosystem from Technology Innovations to Humanization Trends

Companion animal health is being reshaped by a wave of transformative shifts that transcend traditional veterinary models. The surge in telemedicine adoption exemplifies this change: the global veterinary telemedicine market was valued at USD 620.3 million in 2024 and is projected to expand rapidly as clinics integrate virtual consultations to enhance accessibility and client engagement. This growth is underpinned by robust technological infrastructure in advanced economies, supportive regulatory adjustments that validate remote care under established veterinarian-client-patient relationships, and pet owners’ growing preference for convenient services.

Equally significant is the integration of artificial intelligence into diagnostic workflows. AI-enabled triage tools and imaging analysis platforms are delivering accuracy rates exceeding 90%, freeing up clinician time for complex cases and effectively augmenting workforce capacity amid persistent staff shortages. As these solutions mature, veterinarians can detect subtler disease markers earlier, shifting the paradigm from reactive treatment to proactive wellness maintenance.

Concurrently, the humanization of pets continues to fuel demand for personalized nutrition and supplements. A recent survey revealed that nearly 40% of dog and cat owners are keenly interested in technologies that translate pet behaviors and health metrics into actionable insights, and nutritional supplements for stress, anxiety, and joint support have surged by over 1,700% in the last decade. This focus on holistic well-being is prompting industry players to invest in science-backed formulations and to explore novel delivery formats, from soft chews to AI-driven personalized recommendations. Together, these shifts are redefining value creation in the companion animal health ecosystem and setting new benchmarks for care quality.

Assessing the Cumulative Impact of New US Tariffs on Companion Animal Health Products and Supply Chain Dynamics in 2025

New trade policies enacted in 2025 have introduced significant tariff adjustments that reverberate throughout the companion animal health supply chain. Average U.S. tariff rates have climbed from 2.5% to nearly 27%, the highest level since the early 20th century, directly affecting the importation cost of raw pharmaceutical ingredients, diagnostic instruments, and basic medical supplies. While some critical vaccines and life-saving drugs remain exempt, many essential consumables now carry an additional cost burden that manufacturers and distributors must navigate.

Importers face the immediate impact at the U.S. border, where a 25% levy on tariffed goods is levied regardless of subsequent distribution channels. These added expenses cannot be absorbed indefinitely by distributors operating on thin margins and invariably trickle down to veterinary clinics, potentially forcing price adjustments for routine services and supplies. For companion animal practices, the result may be incremental increases in the cost of preventive products, consumer-facing diagnostics, and therapeutic regimens.

Recognizing these challenges, seven leading pet industry organizations formed a coalition in April 2025 to align advocacy efforts and share best practices for mitigating tariff impacts, including strategic stockpiling, alternative sourcing, and coordinated policy dialogue with federal agencies. As these measures take shape, industry participants must remain vigilant, continuously assessing supplier portfolios and exploring localized manufacturing options to safeguard supply continuity and cost competitiveness.

Unveiling Key Segmentation Insights Revealing How Animal Type, Product Categories, Formulations, and Distribution Channels Drive Market Nuances

The companion animal health market encompasses a mosaic of segments that reveal the breadth of industry specialization and growth potential. When analyzed by animal type, dogs command the lion’s share of attention, reflecting their prevalence in urban and suburban households and their owners’ willingness to invest in premium care. Cats follow closely, with a preference for minimally invasive preventive treatments and nutrition geared toward longevity, while horses occupy a distinct niche driven by high-value performance and leisure sectors.

In the realm of product type, diagnostics span from sophisticated imaging modalities to in vitro assays and real-time monitoring devices, each addressing specific clinical decision-making needs. Nutrition bifurcates into specialized pet foods and targeted supplement regimens, catering to life-stage requirements and condition-specific support. Pharmaceuticals branch into anti-inflammatories, antibiotics, endocrine therapies, pain management solutions, and parasiticides, charting an intricate landscape of treatment protocols.

Formulation preferences further delineate market dynamics: injectable preparations dominate in vaccine delivery and certain long-acting therapies, while oral formulations are preferred for home-administered pharmaceuticals and supplements. Topical applications continue to gain traction for dermatological and parasitological interventions, benefitting from convenience and owner compliance.

Distribution channels illuminate consumer behavior: traditional veterinary clinics remain the cornerstone for professional interventions, even as online retail platforms capture share through subscription models and home delivery. Pet specialty stores blend expertise with curated offerings, while pharmacies extend reach to urban pet parents seeking convenience.

Finally, therapeutic areas such as dermatology, orthopedics, and parasitology highlight the chronic conditions that drive recurrent revenue and foster the development of novel biologics and precision therapies. The interplay of these segments underscores the complexity of the companion animal health market and offers a roadmap for targeted innovation and investment.

This comprehensive research report categorizes the Companion Animal Health market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Product Type

- Formulation

- Distribution Channel

- Therapeutic Area

Exploring Regional Drivers in Americas, Europe Middle East & Africa, and Asia-Pacific to Illuminate Growth Patterns Across Key Markets

Regional dynamics in the companion animal health market vary substantially, reflecting demographic trends, regulatory environments, and economic maturity. In the Americas, advanced pet healthcare infrastructure and strong consumer spending underpin a market that led global veterinary telemedicine with a 41.2% share in 2024, driven by widespread high-speed internet access and cultural prioritization of pet wellness. The U.S. continues to pioneer new care delivery models, while Canada and Brazil show growing private investment in specialized clinics.

Europe, the Middle East & Africa presents a multifaceted picture: Western European nations maintain robust veterinary frameworks and high per capita pet ownership, while emerging markets in the Middle East and Africa are witnessing nascent growth. European veterinary telehealth accounted for USD 166.6 million in 2024, reflecting regulatory support for remote care that is gradually extending across borders and languages. Meanwhile, pet life expectancies are increasing as urbanization and household incomes rise, prompting demand for premium nutrition and chronic disease management.

Asia-Pacific commands attention for its rapid acceleration, with urban pet populations expanding in China, India, Japan, and Australia. The region is forecast to post a 22.5% CAGR through 2030 in telemedicine adoption as smartphone penetration deepens and digital health platforms proliferate. Growing middle-class wealth is driving the shift toward proactive pet care, reflected in the U.S. pet supplement market surpassing USD 2.7 billion in 2024 and signaling analogous growth trajectories in Asia-Pacific markets.

This comprehensive research report examines key regions that drive the evolution of the Companion Animal Health market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Industry Leaders’ Strategic Moves and Competitive Positioning in Diagnostics, Nutrition, Pharmaceuticals, and Distribution Channels

Industry leaders continue to shape the companion animal health narrative through strategic innovation, M&A activity, and investments in R&D. Zoetis, the largest global provider of veterinary pharmaceuticals, reported first-quarter 2025 organic operational revenue growth of 9%, reaffirming its leadership in parasiticides and monoclonal antibody therapies for osteoarthritis in dogs. The company’s updated guidance accounts for enacted tariffs and foreign exchange, underscoring the resilience of its diversified portfolio.

In diagnostics, IDEXX Laboratories delivered fourth-quarter 2024 revenue of USD 954 million, up 6% year-over-year, buoyed by strong recurring revenues from its Companion Animal Group consumables and the rollout of novel instrument platforms such as the inVue Dx cellular analyzer. Its global installed base continues to expand, underpinning a recurring revenue model that enhances predictability and funds ongoing innovation.

Mars Petcare remains a powerhouse in pet nutrition, committing USD 1 billion to enhance digital presence and AI capabilities through 2027. This effort aims to double digital sales by 2030 and accelerate direct-to-consumer engagement, signaling a strategic pivot toward data-driven personalization in pet food and supplement offerings.

Other key players include Elanco, Merck Animal Health, Hill’s Pet Nutrition, and Vetoquinol, each carving out niches in biologics, specialty diets, or regional supply chains. Collaboration across these segments will likely intensify as companies seek to leverage complementary strengths and navigate evolving regulatory and economic landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Companion Animal Health market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blue Buffalo Co., Ltd.

- Boehringer Ingelheim Animal Health

- Ceva Santé Animale

- Covetrus

- Dechra Pharmaceuticals PLC

- Elanco Animal Health Incorporated

- Heska Corporation

- Hill's Pet Nutrition, Inc.

- IDEXX Laboratories, Inc.

- Kindred Biosciences, Inc.

- Mars Petcare Inc.

- Merck Animal Health

- Nestlé Purina PetCare

- Patterson Companies, Inc.

- Royal Canin SAS

- Vetoquinol S.A.

- Virbac SA

- Zoetis Inc.

Crafting Actionable Recommendations to Empower Industry Leaders in Adapting to Market Disruptions and Seizing Growth Opportunities

To thrive amid dynamic market conditions, industry leaders must adopt a multidimensional strategy that balances innovation, resilience, and customer-centricity. First, investing in digital health platforms and telemedicine services will ensure clinics can extend care beyond traditional settings and meet client demand for remote consultations and continuous monitoring. Partnerships with technology providers specializing in AI-driven diagnostics and wearables can accelerate time-to-market and enhance clinical outcomes.

Second, supply chain diversification is paramount in light of tariff uncertainties. Building or expanding regional manufacturing capabilities and exploring alternative raw material sources can reduce exposure to import levies and logistical disruptions. Collaborating with industry coalitions and engaging proactively with policymakers will further strengthen collective advocacy efforts and ensure balanced trade measures.

Third, deepening direct-to-consumer engagement through subscription models, educational digital content, and personalized nutrition recommendations can drive loyalty and higher lifetime value. Leveraging data analytics to understand pet health trends will enable targeted product development and optimized channel strategies.

Finally, fostering cross-sector collaborations-such as co-development agreements between pharmaceutical and diagnostics firms-can expedite the commercialization of integrated care solutions. Embracing sustainability and transparent ingredient sourcing will resonate with environmentally conscious consumers and align with broader corporate ESG objectives.

Detailing a Rigorous Research Methodology Integrating Primary Interviews, Secondary Data, and Analytical Triangulation for Robust Insights

Our analysis integrates a robust research methodology designed to deliver reliable and actionable insights. Secondary research involved an exhaustive review of regulatory filings, industry publications, peer-reviewed journals, and trade association reports to map historical trends and regulatory frameworks. Primary research encompassed in-depth interviews with senior executives, veterinary professionals, and channel partners across major regions, capturing real-time perspectives on market dynamics and unmet needs.

Quantitative data was triangulated against proprietary databases and credible public sources to validate market trajectories and segment growth patterns. A combination of forecasting models and scenario analyses was employed to assess potential impacts of trade policies, technological adoption rates, and demographic shifts. Rigorous data cleaning and cross-validation protocols ensured consistency and minimized bias.

By blending qualitative insights with quantitative rigor, this methodology offers a comprehensive view of the companion animal health ecosystem and supports strategic decision-making with high confidence levels.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Companion Animal Health market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Companion Animal Health Market, by Animal Type

- Companion Animal Health Market, by Product Type

- Companion Animal Health Market, by Formulation

- Companion Animal Health Market, by Distribution Channel

- Companion Animal Health Market, by Therapeutic Area

- Companion Animal Health Market, by Region

- Companion Animal Health Market, by Group

- Companion Animal Health Market, by Country

- United States Companion Animal Health Market

- China Companion Animal Health Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Closing Reflections on the Companion Animal Health Landscape and Strategic Imperatives for Stakeholders in an Evolving Ecosystem

As the companion animal health market continues its rapid evolution, stakeholders must embrace innovation and adaptability to capture growth opportunities. From the transformative rise of telemedicine and AI-enabled diagnostics to the humanization-driven expansion of premium nutrition and pharmaceuticals, the imperative is clear: success hinges on anticipating shifts and responding with agility.

Tariff-induced supply chain disruptions underscore the need for diversified sourcing and proactive policy engagement, while regional nuances demand tailored market strategies. Leading companies are already charting paths forward by investing in digital platforms, forging cross-sector partnerships, and prioritizing consumer-centric offerings.

Looking ahead, positioning within key therapeutic and distribution segments, coupled with robust advocacy and strategic collaborations, will define competitive advantage. By applying the insights and recommendations detailed here, industry participants can navigate uncertainty, align resources with emerging trends, and deliver enhanced care for companion animals globally.

Take the Next Step Today by Engaging with Ketan Rohom to Acquire In-Depth Companion Animal Health Market Research Insights

Are you ready to gain unparalleled insights into the companion animal health market’s intricate dynamics and emerging opportunities? Our comprehensive market research report offers a deep dive into trends, challenges, and growth drivers that impact diagnostics, nutrition, pharmaceuticals, and distribution channels for pets. By partnering with Ketan Rohom, Associate Director of Sales & Marketing, you’ll secure the strategic intelligence needed to make informed investment, product development, and market entry decisions. Reach out today to explore how this in-depth analysis can empower your organization to stay ahead of competitors, anticipate regulatory shifts, and capitalize on evolving consumer preferences. Transform your market understanding into actionable strategies-contact Ketan Rohom now to purchase the definitive companion animal health market research report and turn insights into impact.

- How big is the Companion Animal Health Market?

- What is the Companion Animal Health Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?